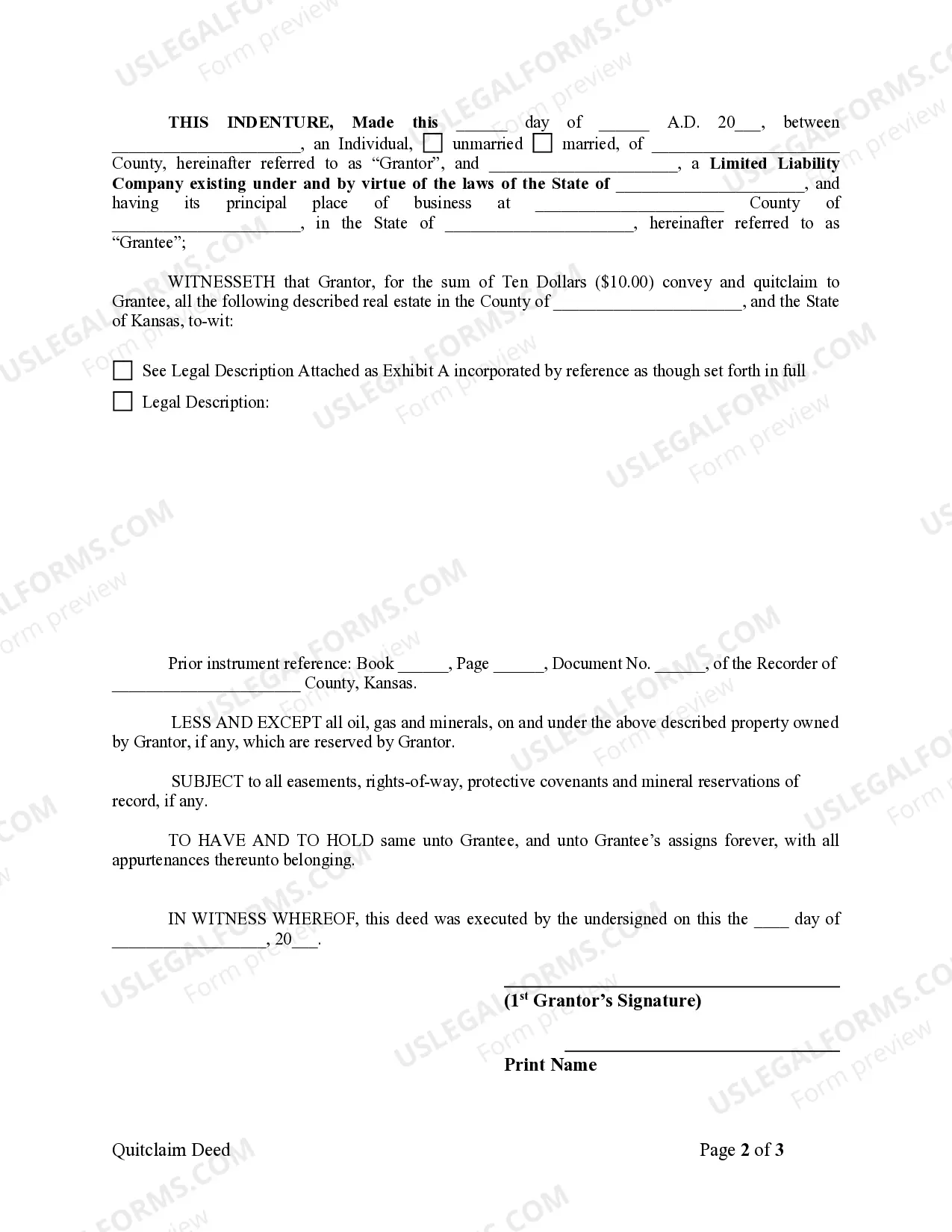

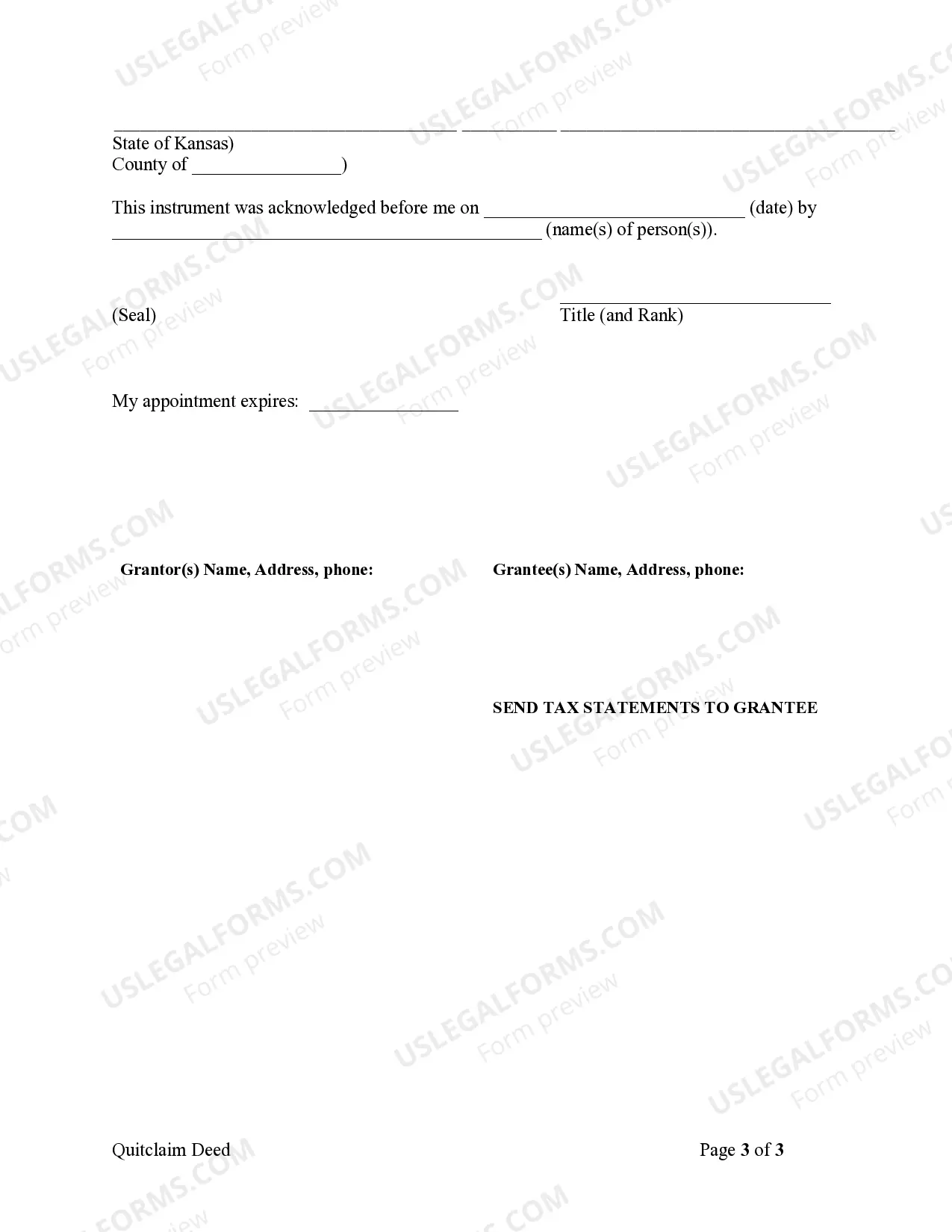

Title: Understanding Olathe Kansas Quitclaim Deed from Individual to LLC Keywords: Olathe Kansas, Quitclaim Deed, Individual, LLC, real estate transfer, types Introduction: In Olathe, Kansas, the process of transferring property ownership from an individual to a Limited Liability Company (LLC) can be achieved through a legal document known as a Quitclaim Deed. This article provides a detailed description of the Olathe Kansas Quitclaim Deed from an Individual to an LLC, including its purpose, process, and potential variations. Purpose of a Quitclaim Deed from Individual to LLC: A Quitclaim Deed serves as a legal instrument in the real estate industry, facilitating the transfer of property ownership from an individual (granter) to an LLC (grantee). This type of transfer is commonly seen when an individual decides to transfer their personal property to their LLC for business or investment purposes. Process of Executing a Quitclaim Deed: 1. Preparation: The individual (granter) or their legal representative prepares the Quitclaim Deed document, ensuring it complies with the specific requirements of Olathe, Kansas. 2. Description of Property: The Quitclaim Deed includes a detailed description of the property being transferred, including its legal description, physical address, and parcel identification number (PIN). 3. Granter and Grantee Information: The names, addresses, and contact details of both the granter (individual) and grantee (LLC) are clearly stated in the document. 4. Clear Intent: The Quitclaim Deed should explicitly express the granter's intention to transfer all their interest and rights to the property to the LLC. It is essential to use clear and unambiguous language to avoid any future disputes. 5. Execution and Notarization: The granter signs the Quitclaim Deed in the presence of a notary public. Notarization is crucial to ensure the document's legality and authenticity. Types of Olathe Kansas Quitclaim Deeds from Individual to LLC: 1. Traditional Quitclaim Deed: This is the standard form used when an individual transfers their personal property, including residential or commercial real estate, to their LLC. It is widely used in Olathe, Kansas, for various purposes. 2. Quitclaim Deed with Consideration: Occasionally, a Quitclaim Deed may involve monetary consideration or payment made from the LLC to the individual granter in exchange for the transfer of ownership rights. This consideration is typically reflected in the document, along with the transfer details. 3. Quitclaim Deed with Restrictive Covenants: In some cases, the individual granter may include specific restrictions or covenants in the Quitclaim Deed to restrict the LLC's use of the property. These restrictions can dictate how the property should be used or limit the LLC's ability to sell, lease, or mortgage the property. Conclusion: When transferring property from an individual to an LLC in Olathe, Kansas, utilizing a Quitclaim Deed is a commonly employed legal mechanism. By following the appropriate steps and ensuring all requirements are met, individuals can effectively transfer ownership rights to their LLC. Understanding the different types of Quitclaim Deeds available and their specific variations can help individuals make informed decisions when engaging in property transfers.

Olathe Kansas Quitclaim Deed from Individual to LLC

Description

How to fill out Kansas Quitclaim Deed From Individual To LLC?

We consistently endeavor to reduce or avert legal complications when handling intricate legal or financial matters.

To achieve this, we enroll in legal services that are often quite expensive.

Nevertheless, not all legal issues are as inherently convoluted.

The majority can be managed independently.

Utilize US Legal Forms whenever you wish to locate and download the Olathe Kansas Quitclaim Deed from Individual to LLC or any other document conveniently and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from testaments and power of attorney to incorporation articles and dissolution petitions.

- Our service empowers you to take control of your legal matters without relying on an attorney.

- We provide access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

Yes, an LLC can gift property to an individual, but this process may involve tax implications. When dealing with property transfers, including gifts, it’s important to document the transfer properly, potentially using an Olathe Kansas Quitclaim Deed from Individual to LLC. Consulting with a tax advisor or attorney can provide clarity on any potential impacts.

To transfer a deed to an LLC, prepare and file an Olathe Kansas Quitclaim Deed from Individual to LLC with your local county office. This document officially changes the property ownership from your name to the LLC’s name. Ensure you meet all legal requirements and seek assistance if needed to avoid mistakes.

While placing your house in an LLC offers liability protection, it can also complicate your mortgage process and estate planning. Additionally, you may face transfer taxes or higher insurance premiums. It's crucial to weigh these factors against your goals before deciding to proceed with an Olathe Kansas Quitclaim Deed from Individual to LLC.

To transfer assets from personal ownership to your LLC, you typically need to execute a quitclaim deed, such as an Olathe Kansas Quitclaim Deed from Individual to LLC. This document allows you to formally convey ownership of the asset. Always keep records of the transfer and consult with professionals to navigate the legal requirements.

Placing your personal assets in an LLC can provide significant protection against personal liabilities. However, consider the pros and cons carefully, as it may impact your taxes and estate planning. Using an Olathe Kansas Quitclaim Deed from Individual to LLC is one way to facilitate this transfer, enhancing your asset protection strategy.

You can transfer personal assets to your LLC through an Olathe Kansas Quitclaim Deed from Individual to LLC. This transfer can clarify ownership and help protect those assets from personal liabilities. It's advisable to consult legal or financial experts before initiating this process to ensure compliance with local laws.

Yes, you can transfer personal funds to your LLC. This process can help you capitalize the business while maintaining clear financial boundaries. However, it's essential to document these transfers properly to ensure that they are recognized as legitimate business transactions.

Many people choose to place their property in an LLC to protect their personal assets from potential lawsuits or creditor claims. By using an Olathe Kansas Quitclaim Deed from Individual to LLC, you can create a clear legal separation between your personal property and the business. This structure may also provide tax benefits, depending on your financial situation.

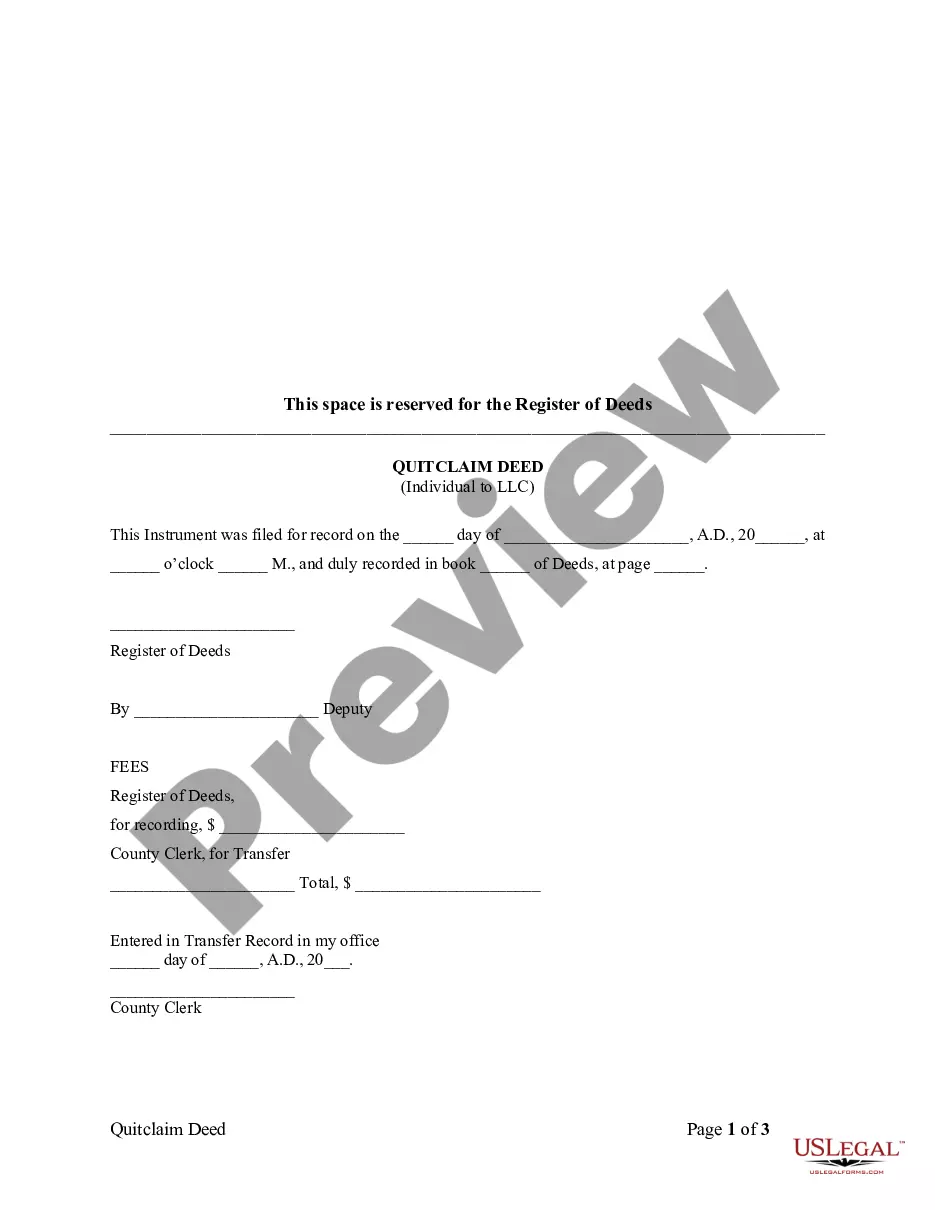

To fill out an Olathe Kansas Quitclaim Deed from Individual to LLC, start by gathering all necessary information about the grantor and grantee. You will need to include the names, addresses, and a legal description of the property being transferred. Ensure that the form is signed by the grantor in front of a notary public, as this is crucial for the document’s legality. Finally, file the completed deed with the appropriate county office to finalize the transfer.

To file an Olathe Kansas quitclaim deed from individual to LLC, you first need to obtain the quit claim deed form, which is often available from local government offices or legal form providers like US Legal Forms. Fill out the form with accurate details, including both the individual's and LLC's information, and then sign it in front of a notary. After notarization, you must submit the completed deed to the county's Register of Deeds office for official recording. This process ensures that your deed is legally enforceable and recognized.