A Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real property from a married couple to a corporation. This type of deed ensures that the property title is completely and unconditionally transferred without any warranties or guarantees regarding the property's condition or title history. The Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation serves as a formal agreement between the transferring parties, indicating their intent to transfer ownership rights from themselves to the corporation. It specifies the legal names of the husband and wife, as well as the name of the corporation involved. Additionally, the deed includes a detailed description of the property being transferred, such as the address, parcel number, and legal description. By executing a quitclaim deed, the husband and wife effectively relinquish any rights or interest they have in the property, and simultaneously grant them to the corporation. It's essential to note that this type of deed does not provide any warranties or guarantees to the corporation regarding the validity of the title or condition of the property. Hence, it's crucial for the corporation to conduct its due diligence and thoroughly investigate the property before accepting the transfer. There are a few variations of the Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation, depending on specific circumstances or requirements. These include: 1. Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation with Consideration: A Quitclaim deed with consideration involves a monetary transaction between the husband and wife and the corporation. This type of deed may be used when the corporation pays the couple a certain amount of money for the property. 2. Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation without Consideration: In cases where there is no exchange of monetary value, a quitclaim deed without consideration is used. This may occur when the husband and wife transfer the property to the corporation as a gift or as part of a business transaction. 3. Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation with Reservation of Rights: This type of quitclaim deed allows the husband and wife to retain certain rights even after the transfer to the corporation. Common reservations may include the right to use a portion of the property or live in a specific area of the property for a specified period. It is important to consult with a qualified attorney or legal advisor to ensure compliance with all local laws and regulations regarding the specific type of Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation applicable to your situation.

Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation

Category:

State:

Kansas

City:

Topeka

Control #:

KS-08-77

Format:

Word;

Rich Text

Instant download

Description

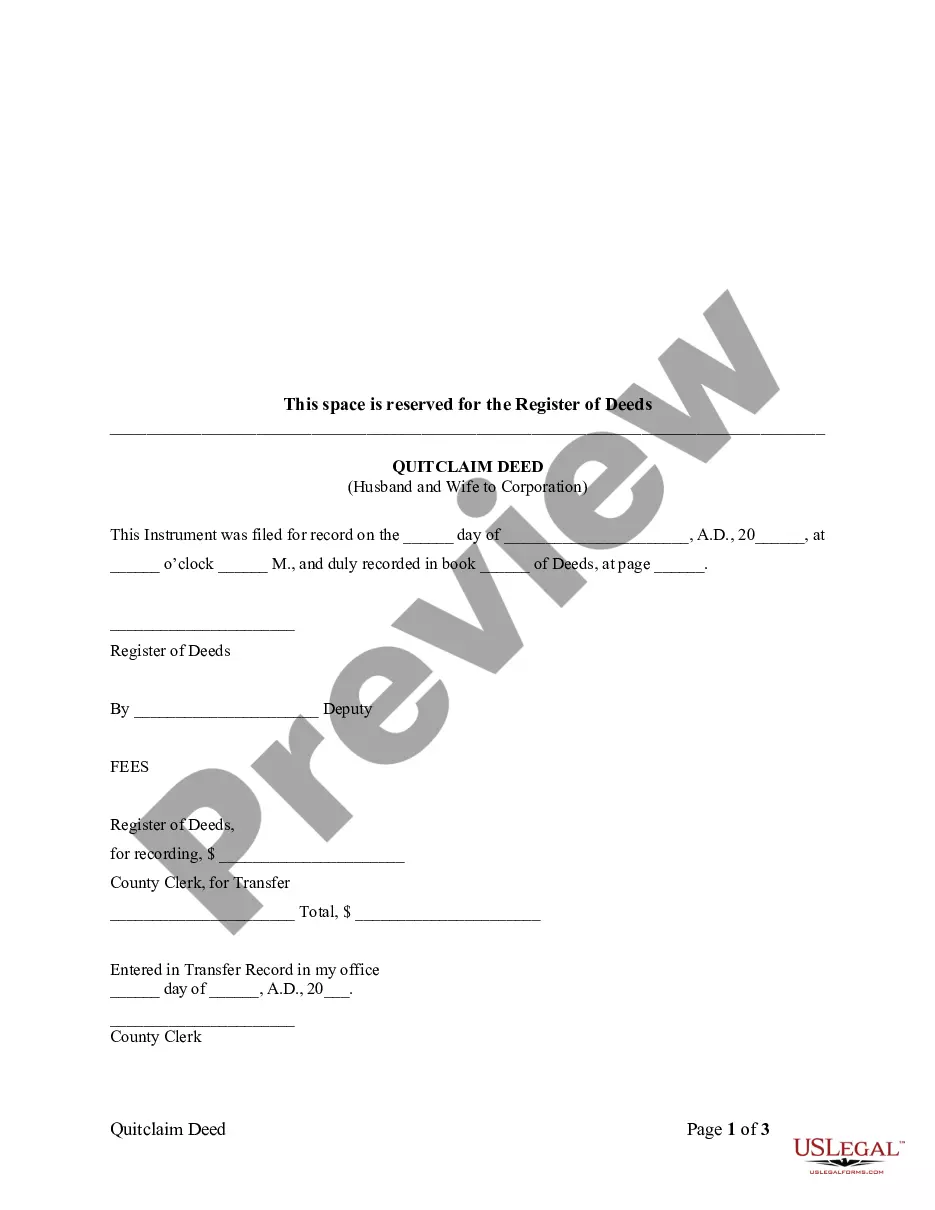

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real property from a married couple to a corporation. This type of deed ensures that the property title is completely and unconditionally transferred without any warranties or guarantees regarding the property's condition or title history. The Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation serves as a formal agreement between the transferring parties, indicating their intent to transfer ownership rights from themselves to the corporation. It specifies the legal names of the husband and wife, as well as the name of the corporation involved. Additionally, the deed includes a detailed description of the property being transferred, such as the address, parcel number, and legal description. By executing a quitclaim deed, the husband and wife effectively relinquish any rights or interest they have in the property, and simultaneously grant them to the corporation. It's essential to note that this type of deed does not provide any warranties or guarantees to the corporation regarding the validity of the title or condition of the property. Hence, it's crucial for the corporation to conduct its due diligence and thoroughly investigate the property before accepting the transfer. There are a few variations of the Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation, depending on specific circumstances or requirements. These include: 1. Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation with Consideration: A Quitclaim deed with consideration involves a monetary transaction between the husband and wife and the corporation. This type of deed may be used when the corporation pays the couple a certain amount of money for the property. 2. Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation without Consideration: In cases where there is no exchange of monetary value, a quitclaim deed without consideration is used. This may occur when the husband and wife transfer the property to the corporation as a gift or as part of a business transaction. 3. Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation with Reservation of Rights: This type of quitclaim deed allows the husband and wife to retain certain rights even after the transfer to the corporation. Common reservations may include the right to use a portion of the property or live in a specific area of the property for a specified period. It is important to consult with a qualified attorney or legal advisor to ensure compliance with all local laws and regulations regarding the specific type of Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation applicable to your situation.

Free preview

How to fill out Topeka Kansas Quitclaim Deed From Husband And Wife To Corporation?

If you’ve already utilized our service before, log in to your account and download the Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Topeka Kansas Quitclaim Deed from Husband and Wife to Corporation. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!