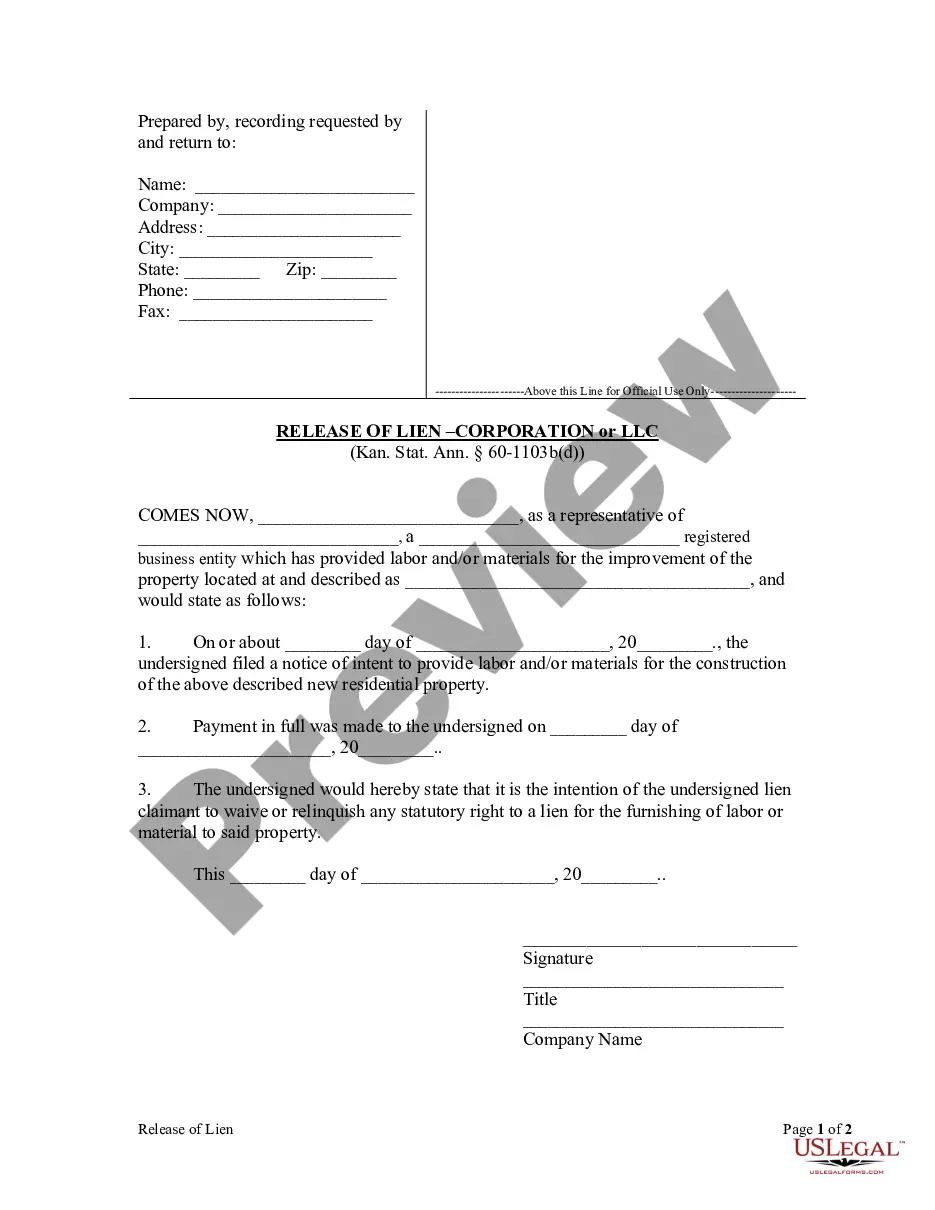

This form is used to release a lien after payment in full.

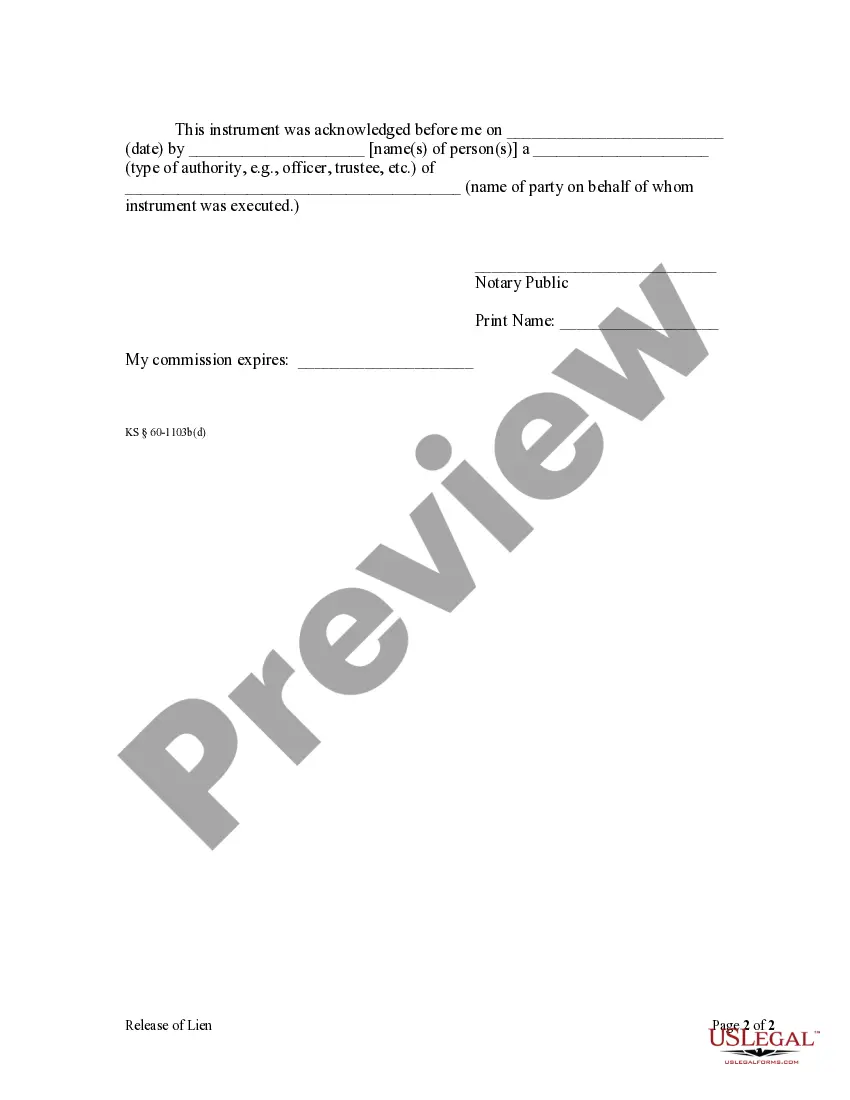

Olathe Kansas Release of Lien by Corporation or LLC: Understanding the Process In Olathe, Kansas, a Release of Lien by Corporation or Limited Liability Company (LLC) is an essential legal document used to release a previously filed lien against a property. This document is crucial for corporations and LCS engaged in construction, remodeling, or any similar business activities that involve placing liens on properties as a means of securing payment. The Release of Lien document is filed with the appropriate government agency responsible for recording property records in Johnson County, Kansas. It serves as proof that the lien holder (the corporation or LLC) has received full payment for the services or materials provided and guarantees the removal of any claim on the property. Different Types of Olathe Kansas Release of Lien by Corporation or LLC: 1. Mechanic's Lien Release: This type of release is commonly used when a corporation or LLC has placed a mechanic's lien on a property due to unpaid services or materials provided for construction, repairs, or improvements. Once the lien holder receives payment in full, they file a Mechanic's Lien Release to formally release the lien from the property. 2. Construction Lien Release: When a corporation or LLC is involved in construction projects, they may file a construction lien against the property to secure payment. A Construction Lien Release is necessary to release the lien once payment has been received, ensuring that the property owner's title remains clear and unencumbered. 3. Material Supplier Lien Release: If a corporation or LLC supplies materials for a construction project, they may file a lien against the property until payment is made. A Material Supplier Lien Release is filed to release the lien after receiving full payment, confirming that the corporation or LLC no longer has any claim on the property. 4. Contractual Lien Release: In certain cases, a corporation or LLC may have a lien on a property due to a contractual agreement with the property owner. A Contractual Lien Release outlines the terms and conditions agreed upon by both parties and is filed to release the lien upon fulfillment of the agreed-upon obligations or payment terms. It's important for corporations and LCS to ensure the accuracy and validity of their lien releases. By filing the appropriate release of lien documents with the proper authorities in Olathe, Kansas, businesses can protect their rights while maintaining transparent and lawful practices. Note: This is a fictional description and does not constitute legal advice. It is advisable to consult an attorney or legal professional for accurate information regarding the specific processes and requirements of the Olathe Kansas Release of Lien by Corporation or LLC.Olathe Kansas Release of Lien by Corporation or LLC: Understanding the Process In Olathe, Kansas, a Release of Lien by Corporation or Limited Liability Company (LLC) is an essential legal document used to release a previously filed lien against a property. This document is crucial for corporations and LCS engaged in construction, remodeling, or any similar business activities that involve placing liens on properties as a means of securing payment. The Release of Lien document is filed with the appropriate government agency responsible for recording property records in Johnson County, Kansas. It serves as proof that the lien holder (the corporation or LLC) has received full payment for the services or materials provided and guarantees the removal of any claim on the property. Different Types of Olathe Kansas Release of Lien by Corporation or LLC: 1. Mechanic's Lien Release: This type of release is commonly used when a corporation or LLC has placed a mechanic's lien on a property due to unpaid services or materials provided for construction, repairs, or improvements. Once the lien holder receives payment in full, they file a Mechanic's Lien Release to formally release the lien from the property. 2. Construction Lien Release: When a corporation or LLC is involved in construction projects, they may file a construction lien against the property to secure payment. A Construction Lien Release is necessary to release the lien once payment has been received, ensuring that the property owner's title remains clear and unencumbered. 3. Material Supplier Lien Release: If a corporation or LLC supplies materials for a construction project, they may file a lien against the property until payment is made. A Material Supplier Lien Release is filed to release the lien after receiving full payment, confirming that the corporation or LLC no longer has any claim on the property. 4. Contractual Lien Release: In certain cases, a corporation or LLC may have a lien on a property due to a contractual agreement with the property owner. A Contractual Lien Release outlines the terms and conditions agreed upon by both parties and is filed to release the lien upon fulfillment of the agreed-upon obligations or payment terms. It's important for corporations and LCS to ensure the accuracy and validity of their lien releases. By filing the appropriate release of lien documents with the proper authorities in Olathe, Kansas, businesses can protect their rights while maintaining transparent and lawful practices. Note: This is a fictional description and does not constitute legal advice. It is advisable to consult an attorney or legal professional for accurate information regarding the specific processes and requirements of the Olathe Kansas Release of Lien by Corporation or LLC.