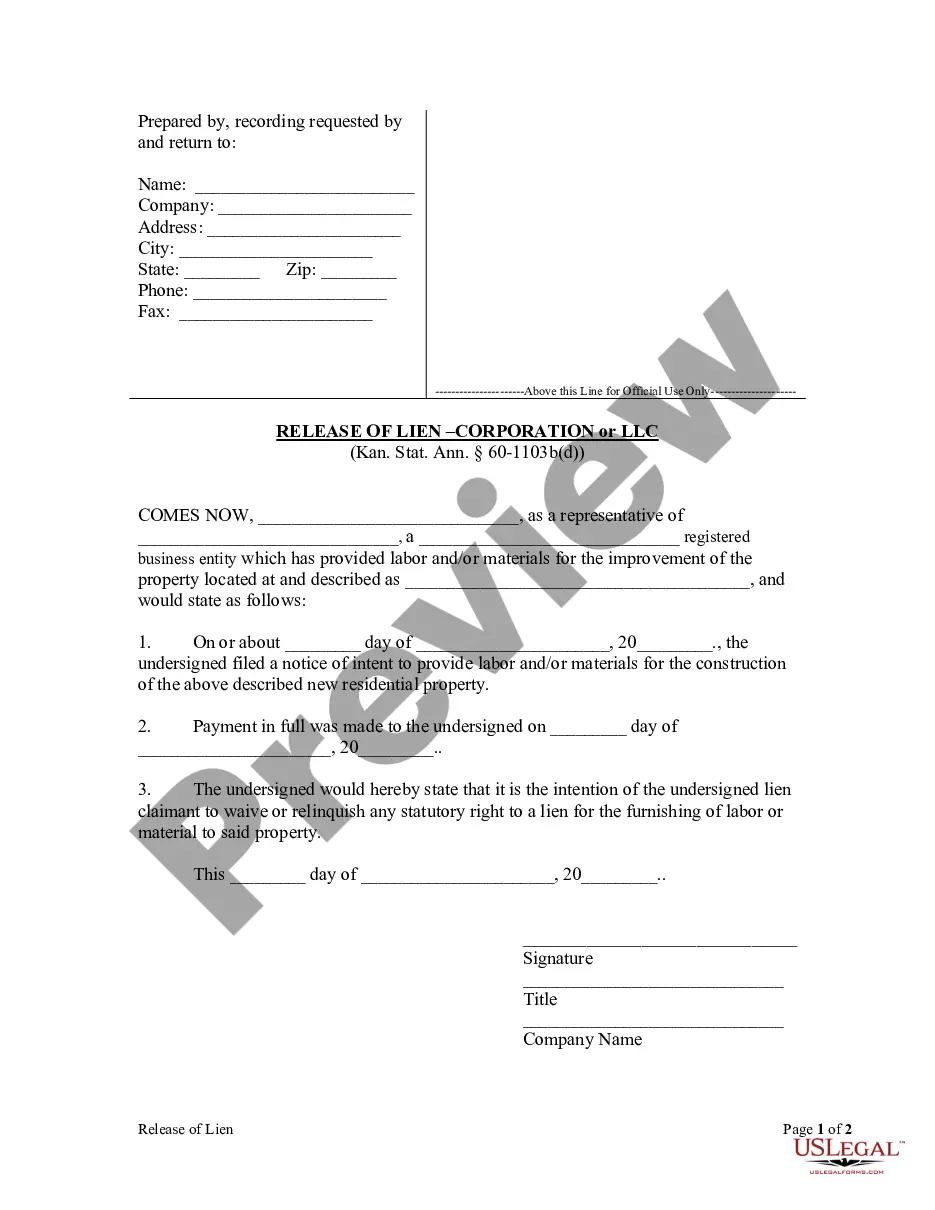

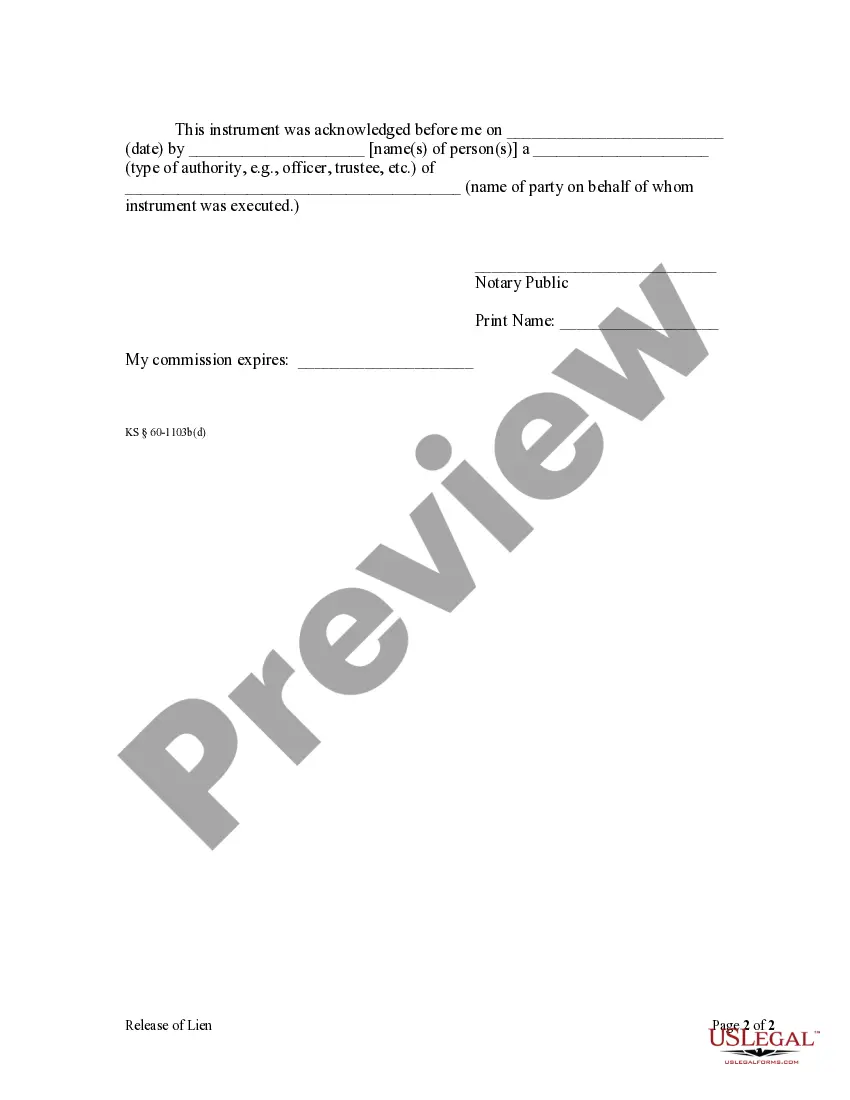

This form is used to release a lien after payment in full.

Wichita Kansas Release of Lien by Corporation or LLC

Description

How to fill out Wichita Kansas Release Of Lien By Corporation Or LLC?

If you are looking for a pertinent document, it’s incredibly challenging to select a superior service than the US Legal Forms website – likely the most comprehensive collections online.

With this collection, you can obtain a vast number of document examples for business and personal objectives categorized by types and locations, or keywords.

Utilizing our enhanced search feature, obtaining the latest Wichita Kansas Release of Lien by Corporation or LLC is as simple as 1-2-3.

Retrieve the document. Choose the file format and store it on your device.

Make modifications. Fill out, edit, print, and sign the acquired Wichita Kansas Release of Lien by Corporation or LLC.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Wichita Kansas Release of Lien by Corporation or LLC is to Log In to your profile and select the Download option.

- If you are accessing US Legal Forms for the first time, simply adhere to the directions provided below.

- Ensure you have located the example you desire. Review its details and utilize the Preview option to verify its content. If it does not meet your requirements, employ the Search feature at the top of the page to identify the suitable document.

- Confirm your choice. Click the Buy now button. Then, select your favored pricing plan and provide information to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Once the first lienholder has been paid off, they may submit their lien release electronically (if they are members of the KS E-Lien system), or by providing it to the owner who will then submit it to the local county treasurer's office or fax it to the Titles and Registrations Bureau at 785-296-2383.

Typically, the clerk offices keep track of the liens recorded against real and personal property in the state. The Kansas Department of Revenue also maintains records of vehicle liens and title information, accessible through the Kansas E-lien system.

Application for a certificate of title and registration must be made through the local county treasurer's office where the vehicle is garaged.

Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

If the lien has been paid off, use the assignment portion of the Lienholder Consent to Transfer Ownership, Form TR-128, attach the lien release in lieu of the lienholder's portion of the consent and go to your local county treasurer's motor vehicle office and make application for title.

How long does a judgment lien last in Kansas? A judgment lien in Kansas will remain attached to the debtor's property (even if the property changes hands) for five years.

Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

If you would like to remove the lien holder's name from the title, you must fill out an application for a reissue title (TR-720B) and bring it, along with your current vehicle registration, title and lien release to any one of the tag offices. The cost is $10.00.

For Titles Being Held Electronically (E-Title) If the title is an e-title and you want to get a 60 day permit, you must have an Electronic Title Sales Agreement, Form TR-39A, a copy of the Seller's Current Registration Receipt and current proof of insurance. A Lien Release is required to get a clear paper title.

If the lien has been paid off, use the assignment portion of the Lienholder Consent to Transfer Ownership, Form TR-128, attach the lien release in lieu of the lienholder's portion of the consent and go to your local county treasurer's motor vehicle office and make application for title.