Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Kansas Quitclaim Deed From Husband And Wife To LLC?

Regardless of your societal or professional rank, completing legal documents is an unfortunate requirement in today's society.

Too frequently, it’s nearly impossible for an individual without legal training to generate this kind of documentation from scratch, primarily due to the intricate terminology and legal subtleties they contain.

This is where US Legal Forms can come to the rescue.

Verify that the form you’ve located is appropriate for your jurisdiction, as the rules of one state or county do not apply to another.

Preview the document and review any brief description (if available) of situations for which the paper can be utilized.

- Our platform offers an extensive repository of over 85,000 ready-to-use, state-specific documents suitable for nearly any legal matter.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who wish to conserve time using our DIY forms.

- Whether you need the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC or any other form that is recognized in your area, with US Legal Forms, everything is readily accessible.

- Here’s how you can quickly obtain the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC using our reliable service.

- If you are a returning customer, simply Log In to your account to access the necessary form.

- However, if you’re new to our collection, make sure to follow these instructions before acquiring the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC.

Form popularity

FAQ

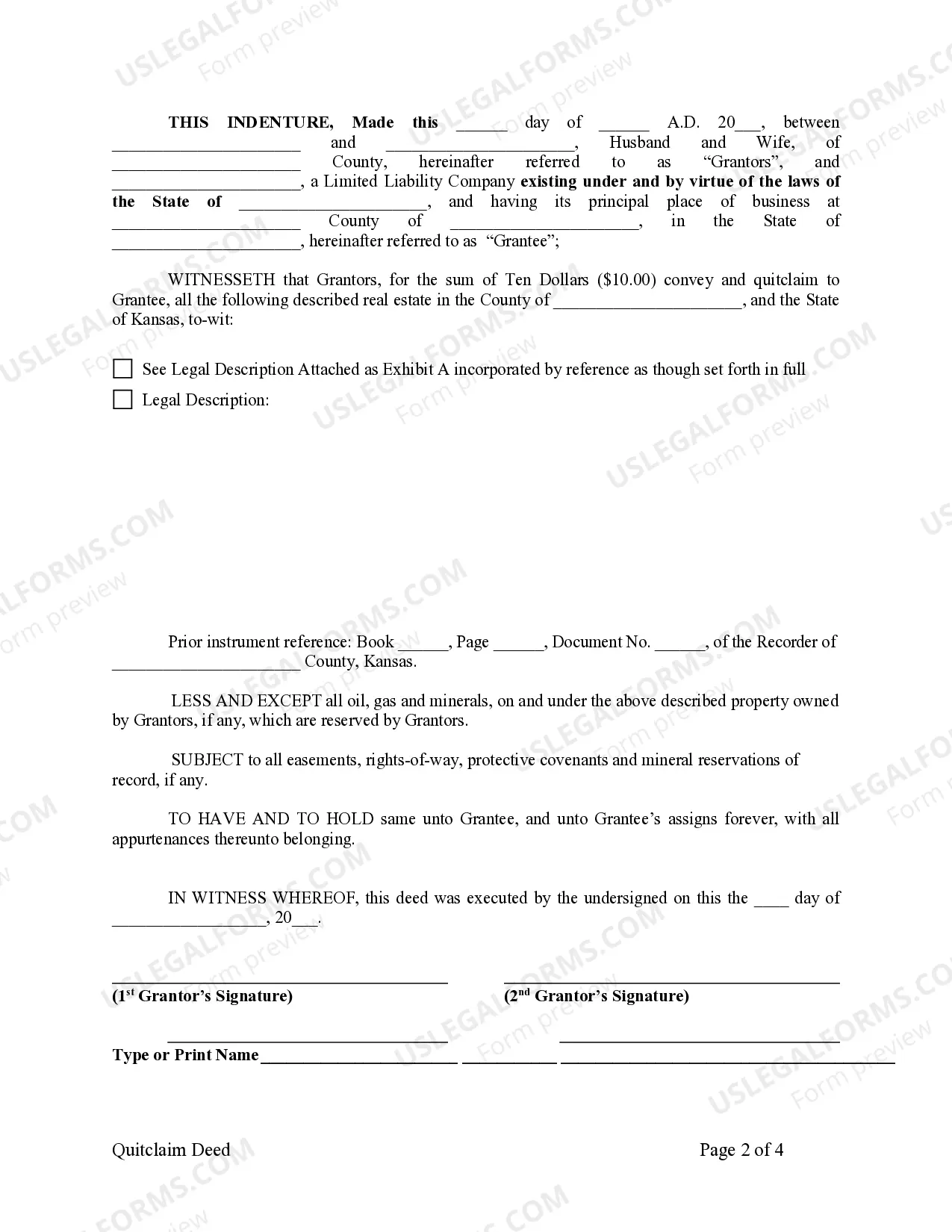

Filing a quitclaim deed in Kansas involves several steps. First, create the deed, ensuring it includes necessary information such as property description and parties involved, specifically for the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC. After notarization, submit the deed to your county's Register of Deeds. This process protects your ownership rights and provides public notification of the transfer.

To file a quitclaim deed in Kansas, you need to prepare the deed with all relevant details, including the names of the grantors and grantees. Once the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC is drafted, take it to a notary public for acknowledgment. After signing, you should file the deed with the Register of Deeds in your local county to officially record the transaction.

The fastest way to transfer a deed is through a quitclaim deed. This method allows for quick transfers, perfect for cases such as the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC. By preparing the deed correctly and filing it promptly, you can swiftly complete the transfer process without lengthy legal procedures.

Filing a quitclaim deed in Kansas involves a few simple steps. After creating the deed, you need to sign it in the presence of a notary and then take it to the appropriate county office. This is part of the process for the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC, ensuring that the transfer of ownership is recorded in public records.

To obtain a quitclaim deed in Kansas, you can draft one yourself or utilize services like uslegalforms, which provide templates tailored for the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC. The document should include the property description and the names of the parties involved. After completion, ensure it is signed and filed with the local county office for it to be valid.

Transferring a deed in Kansas can be efficiently done using a quitclaim deed. This legal instrument allows you to transfer property rights swiftly, suited for transferring ownership, like in the Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC context. Ensure both parties sign the deed and file it with the county to complete the transfer process.

To add a name to a deed in Kansas, you would typically utilize a quitclaim deed. This document enables you to transfer property interests to someone else, such as in an Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC situation. It involves drafting the deed, signing it, and then filing it with the appropriate county office to make the addition official.

A quitclaim deed primarily benefits those involved in a property transfer, especially in situations like Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC. This process allows couples to easily convey property interests to their LLC, ensuring flexibility in managing their assets. It's often favorable for family members, business partners, and those wanting to simplify ownership arrangements.

The most common use of a quitclaim deed is transferring property among family members, such as when a husband and wife want to transfer real estate to an LLC. This deed is frequently utilized to simplify property transactions without the complexities associated with warranties. For example, an Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC allows for easy management and clarity in ownership. Using such a deed can streamline the process, especially in familial situations.

A quitclaim deed transfers ownership rights without warranties. Essentially, when you file an Overland Park Kansas Quitclaim Deed from Husband and Wife to LLC, it allows the specified party to receive whatever interest the grantors have in the property. This type of deed is often used among family members or in transactions involving LLCs, making it a straightforward option for transferring property. Keep in mind that this deed does not provide guarantees about the property’s title.