Topeka Kansas Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Kansas Quitclaim Deed From Husband And Wife To LLC?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our helpful website with a vast array of templates simplifies the process of discovering and acquiring nearly any document sample you might need.

You can download, fill out, and certify the Topeka Kansas Quitclaim Deed from Spouses to LLC in mere minutes instead of spending hours online searching for the appropriate template.

Using our assortment is a wise approach to enhance the security of your form submissions. Our experienced lawyers routinely review all documents to ensure that the templates are applicable for a specific area and compliant with current laws and regulations.

US Legal Forms is one of the largest and most trustworthy template repositories online.

Our team is always eager to assist you in any legal matter, even if it’s simply downloading the Topeka Kansas Quitclaim Deed from Spouses to LLC.

- Discover the form you require.

- Ensure that it is the correct form: confirm its title and description, and utilize the Preview feature when applicable. Otherwise, use the Search bar to locate the necessary one.

- Initiate the saving process. Select Buy Now and choose the pricing plan that best meets your needs. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Choose the format to acquire the Topeka Kansas Quitclaim Deed from Spouses to LLC and edit and finalize, or sign it as per your needs.

Form popularity

FAQ

While you do not necessarily need a lawyer to transfer a deed, consulting one can be beneficial. A lawyer can help ensure you use the correct forms, such as a Topeka Kansas Quitclaim Deed from Husband and Wife to LLC. They can also guide you through the process, helping you avoid common pitfalls. If you feel uncertain, seeking professional advice may provide peace of mind.

Many people choose to put their property in an LLC to protect their personal assets from liabilities related to the property. An LLC also allows for easier transfer of ownership through a Topeka Kansas Quitclaim Deed from Husband and Wife to LLC, making estate planning simpler. Additionally, it can provide potential tax benefits and greater privacy compared to individual ownership.

One disadvantage of putting a property in an LLC is the potential for increased complexity in managing the asset. An LLC can introduce additional paperwork, tax implications, and ongoing compliance requirements. Also, lenders might require personal guarantees, which could offset some of the liability protections. It's important to weigh these factors before using a Topeka Kansas Quitclaim Deed from Husband and Wife to LLC.

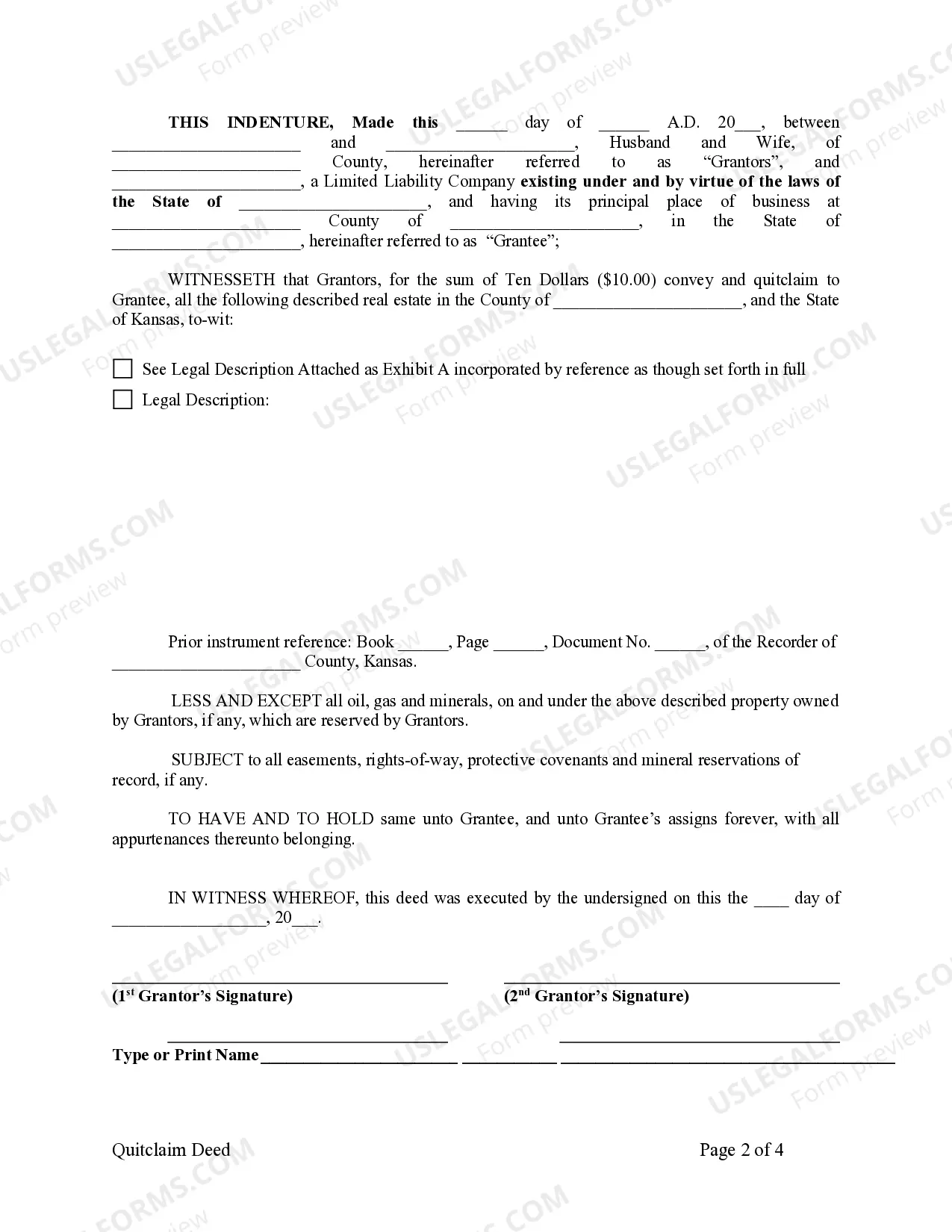

To transfer a deed of house to an LLC, you can use a Topeka Kansas Quitclaim Deed from Husband and Wife to LLC. Start by contacting your local county office to obtain the necessary forms. Next, complete the forms accurately, providing all required information about the property and the LLC. Finally, submit the deed to the county office along with any applicable fees.

The best type of deed for a married couple often depends on their specific situation and goals. While quitclaim deeds are popular for their simplicity, they may not offer as much protection as other deeds, like warranty deeds, which provide guarantees about the property. In Topeka, Kansas, choosing a quitclaim deed from husband and wife to LLC may be beneficial for transferring ownership while minimizing complications. Always consider consulting a professional to determine the most suitable option for your needs.

A quitclaim deed for a married couple allows both partners to transfer their shared interest in property to another person or entity, such as an LLC. This deed type is crucial in managing property after situations like divorce or estate planning. In Topeka, Kansas, utilizing a quitclaim deed from husband and wife to LLC can enhance asset protection and facilitate business ownership transitions. This approach ensures that both partners can jointly maintain control over the property.

People often use a quitclaim deed to transfer property ownership without complex legal procedures. In Topeka, Kansas, a quitclaim deed from a husband and wife to an LLC provides a straightforward way to move real estate into a business structure. This process can simplify estate planning and protect personal assets. Thus, many opt for the convenience and efficiency of this deed type.

A buyer receiving a quitclaim deed may face significant risks due to the lack of warranties. A Topeka Kansas Quitclaim Deed from Husband and Wife to LLC does not guarantee that the seller holds clear title to the property, meaning the buyer could inherit hidden liabilities. This uncertainty can lead to future disputes or costs, making it crucial for buyers to obtain title insurance for added protection. Always consider your options carefully when dealing with quitclaim deeds.

Transferring a deed to an LLC involves a few straightforward steps. First, you need to create the appropriate documentation, such as a Topeka Kansas Quitclaim Deed from Husband and Wife to LLC, to reflect the transfer. Next, you will sign and notarize this deed before filing it with your local county recorder's office. This process ensures that the LLC becomes the legal owner of the property.

Typically, both parties benefit when a quitclaim deed is used. The grantor relinquishes ownership rights without complex legal implications, while the grantee gains access to property. Specifically, in scenarios like a Topeka Kansas Quitclaim Deed from Husband and Wife to LLC, the benefit lies in straightforward transfer and title clarity. However, it’s crucial to understand that quitclaim deeds lack guarantees of a clear title.