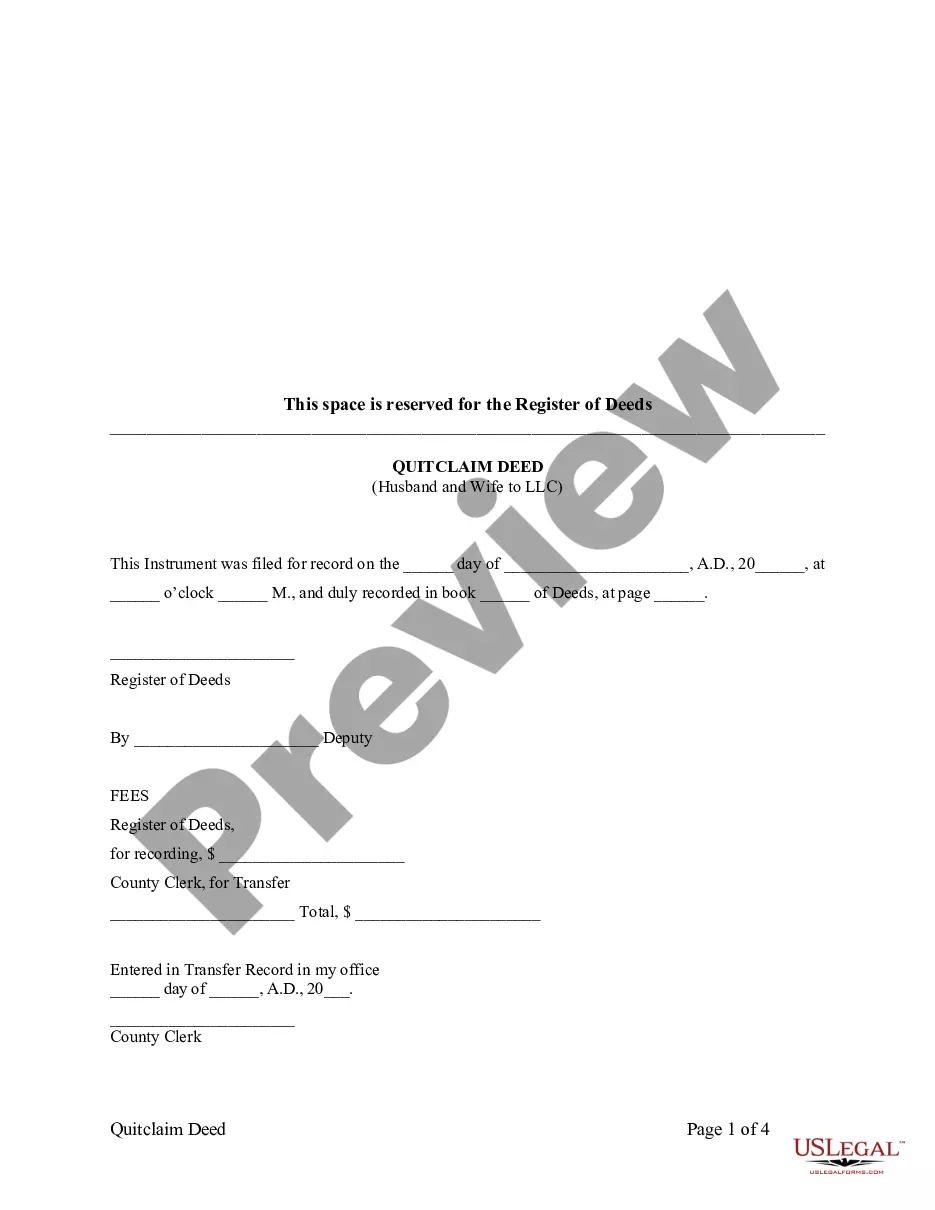

Wichita Kansas Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Wichita Kansas Quitclaim Deed From Husband And Wife To LLC?

If you have previously made use of our service, Log In to your account and store the Wichita Kansas Quitclaim Deed from Husband and Wife to LLC on your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it in line with your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You will have ongoing access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Confirm that you’ve found an appropriate document. Browse the description and use the Preview option, if present, to verify it satisfies your needs. If it does not suit you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Establish an account and complete a payment. Provide your credit card information or choose the PayPal option to finalize the purchase.

- Acquire your Wichita Kansas Quitclaim Deed from Husband and Wife to LLC. Select the file format of your document and save it to your device.

- Complete your form. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

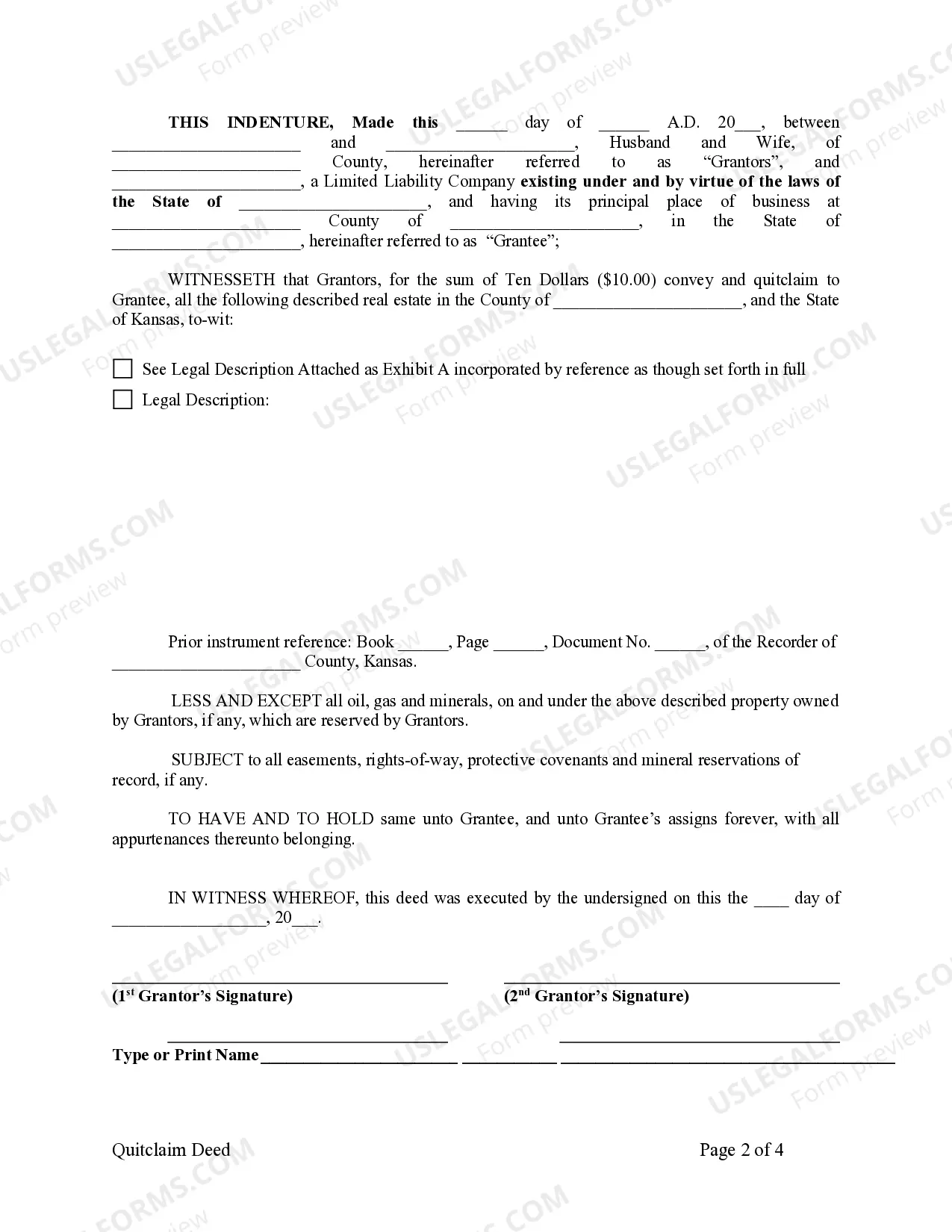

A Kansas quitclaim deed is a legal document used to convey real estate in Kansas, which grants whatever rights to the property the seller (or grantor) has in the property but does not guarantee those rights.

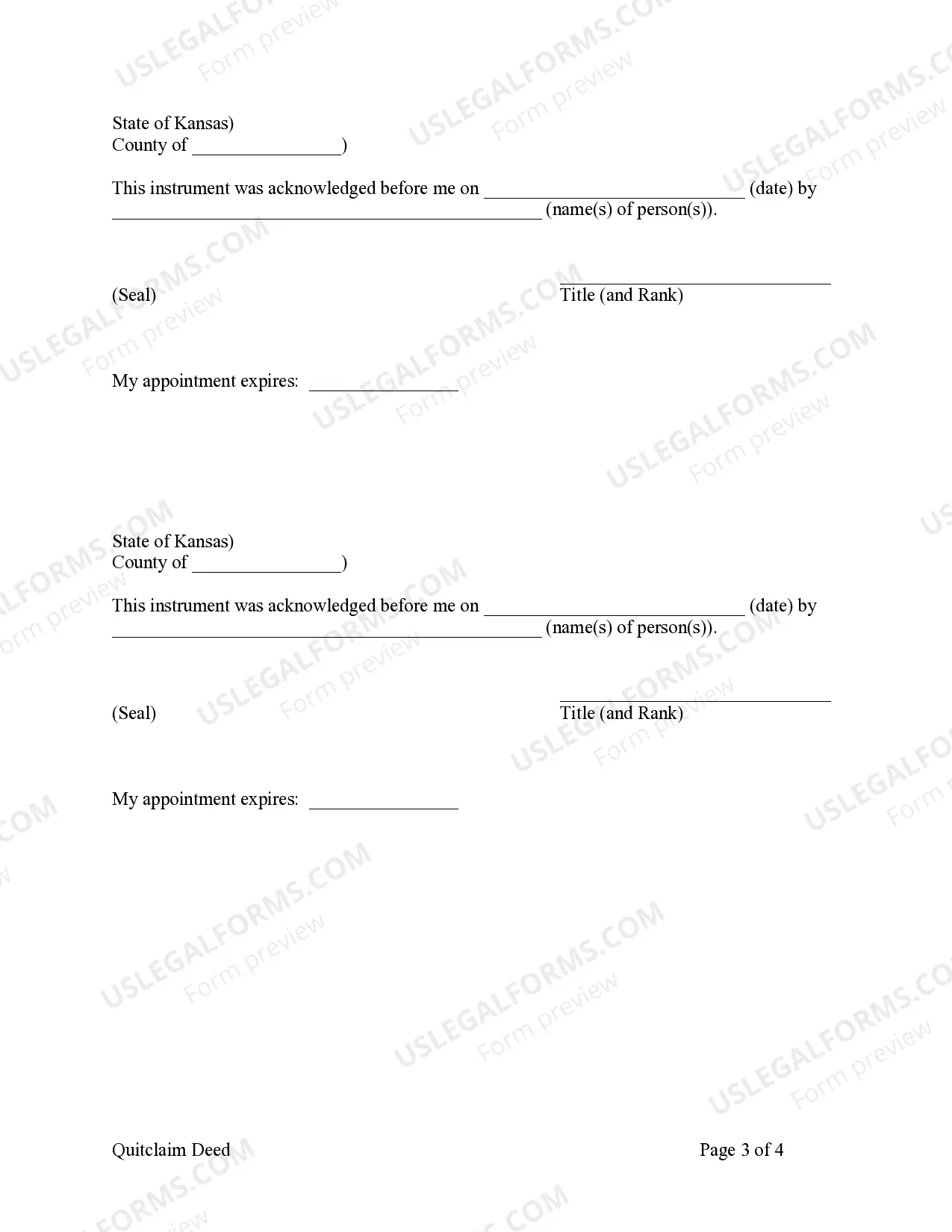

The deed must be signed by the grantor and acknowledged by an individual authorized to take acknowledgements. All signatures must be original. Record the completed gift deed with the Register of Deeds in the county where the subject property is located.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

Recording ? A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) ? A quitclaim deed is required to be authorized with a notary public present.

Under Kansas law, there are two main ways to transfer real property outside the probate process: by joint tenancy or a transfer-on-death deed. Since real estate transfers and estate planning are complicated areas of law, you should consult with an attorney for more specific information before proceeding.

A Kansas quitclaim deed form transfers whatever right the current owner holds?if any?with no warranty of title. The person signing the deed does not promise that the title is clear or that the signer owns a valid interest in the real estate.

The current owner and any co-owners?if the property is co-owned and the deed transfers more than one co-owner's rights?must sign the deed, and a notary must complete the acknowledgment block. The owner's spouse may also need to consent to the transfer by signing the deed.

(a) An interest in real estate may be titled in transfer-on-death, TOD, form by recording a deed signed by the record owner of such interest, designating a grantee beneficiary or beneficiaries of the interest. Such deed shall transfer ownership of such interest upon the death of the owner.

Step 1. Determine and prepare the needed requirements for a title transfer. Deed of Conveyance.Photocopies of valid IDs of all signatories in the deed.The Notary Public's official receipt for the deed's notarization. Certified True Copy of the Title (3 copies)Certified True Copy of the latest Tax Declaration.