Title: Topeka Kansas Assignment of Mortgage by Corporate Mortgage Holder: Understanding Types and Process Introduction: In Topeka, Kansas, the Assignment of Mortgage is a vital legal process that occurs when a corporate mortgage holder transfers the ownership rights of a mortgage to another entity. This article aims to provide a detailed description of what the Assignment of Mortgage entails in Topeka, Kansas, while also shedding light on different types of assignments that may occur. Additionally, relevant keywords related to this topic will be incorporated to enhance the content's relevance and searchability. Key Terms/Keywords: — Topeka Kansas Assignmenmortgageag— - Corporate Mortgage Holder — MortgagTransferfe— - Ownership Transfer — Mortgage Assignment Type— - Legal Process — Mortgage Assignment Documen— - Assignee of Mortgage — Assignor of Mortgag— - Mortgage Lien - Recording Office — Real Estate La— - Mortgagee - Mortgagor Description: 1. Purpose of Topeka Kansas Assignment of Mortgage: The Assignment of Mortgage in Topeka, Kansas, is carried out primarily to transfer the legal rights and interests associated with a mortgage from one corporate mortgage holder to another. This process is often initiated due to mergers, acquisitions, or the sale of mortgage loans. 2. Parties Involved: The Assignment of Mortgage involves two main parties — the "Assignor" and the "Assignee." The Assignor, who is the corporate mortgage holder, transfers the mortgage rights to the Assignee, who becomes the new owner of the mortgage. 3. Topeka Kansas Assignment of Mortgage Process: The process typically begins with the drafting of the Assignment of Mortgage document, which outlines the terms and conditions of the transfer. This document must comply with the requirements of Topeka's real estate laws and regulations. Once the document is prepared, it is executed by the Assignor and recorded at the Recording Office. 4. Types of Assignment of Mortgage: a) Full Assignment of Mortgage: In this type, the entire mortgage debt is transferred to the Assignee, including the rights, powers, titles, and obligations associated with it. b) Partial Assignment of Mortgage: Here, only a portion of the mortgage debt is transferred to the Assignee, while the Assignor retains ownership of the remaining debt. 5. Importance of Recording the Assignment: Recording the Assignment of Mortgage is crucial to establish the Assignee's legal ownership of the mortgage and protect their interests. It provides public notice of the transfer and helps prevent multiple claims on the same mortgage. 6. Effects on Mortgagor: The Assignment of Mortgage does not impact the rights and obligations of the mortgage borrower (mortgagor). Their loan terms, interest rates, and repayment obligations generally remain the same, as the only change affects the entity they submit mortgage payments to. Conclusion: Understanding the Topeka Kansas Assignment of Mortgage by Corporate Mortgage Holder is essential for both prospective assignees and assignors. This legal process facilitates the transfer of mortgage ownership, ensuring the rights and obligations associated with the mortgage are appropriately passed on. By familiarizing oneself with the different types and the necessary steps involved, individuals can navigate the Assignment of Mortgage process in Topeka, Kansas, with ease and clarity.

Topeka Kansas Assignment of Mortgage by Corporate Mortgage Holder

State:

Kansas

City:

Topeka

Control #:

KS-121RE

Format:

Word;

Rich Text

Instant download

Description

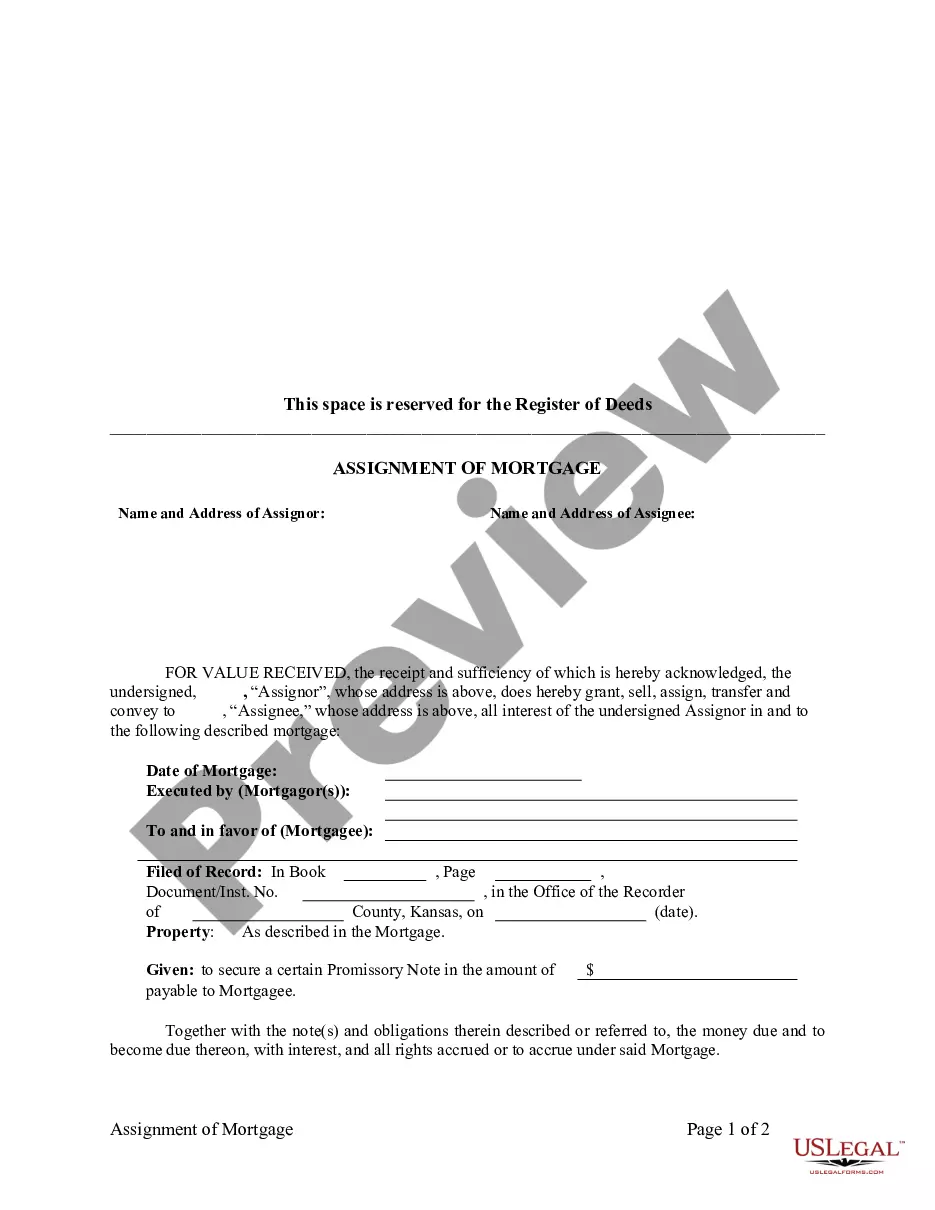

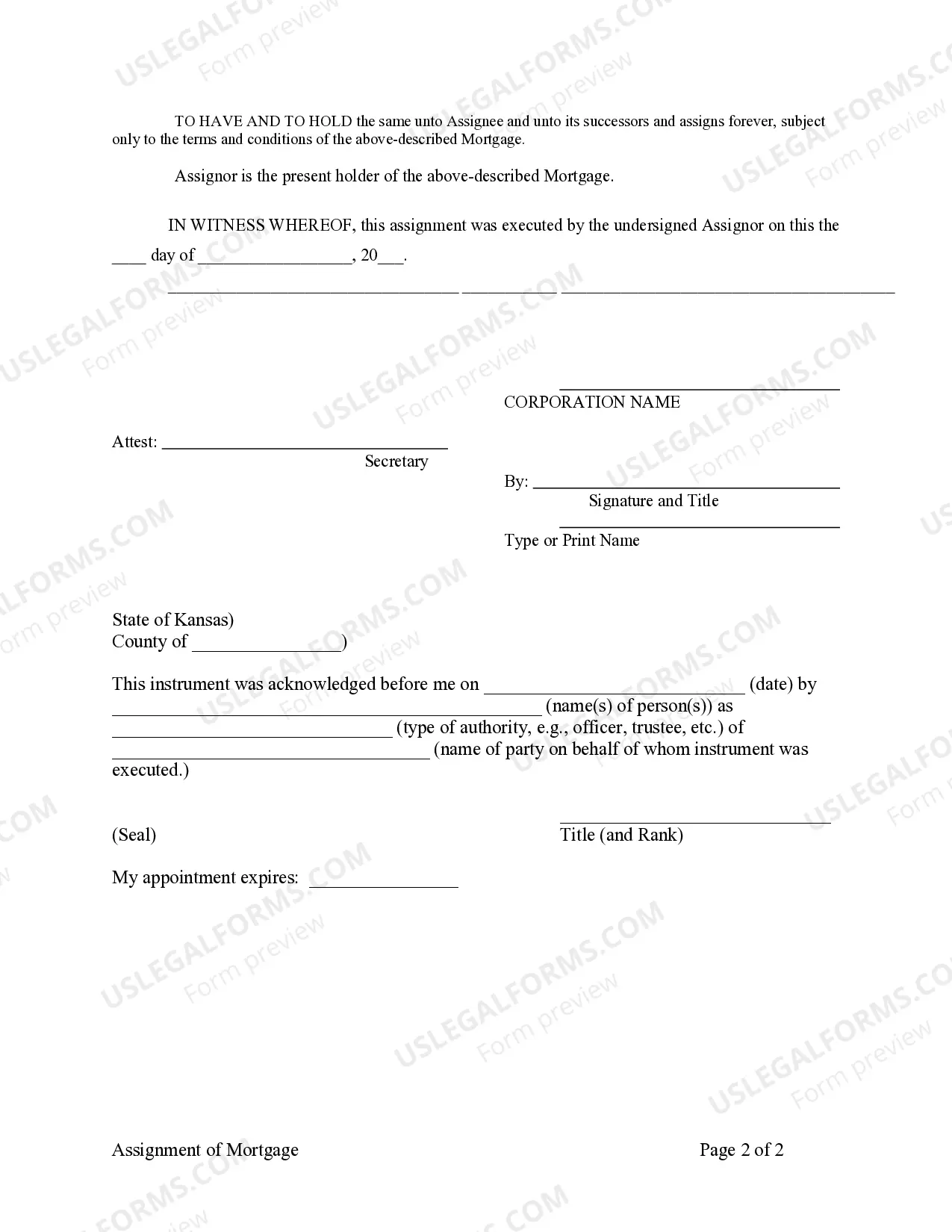

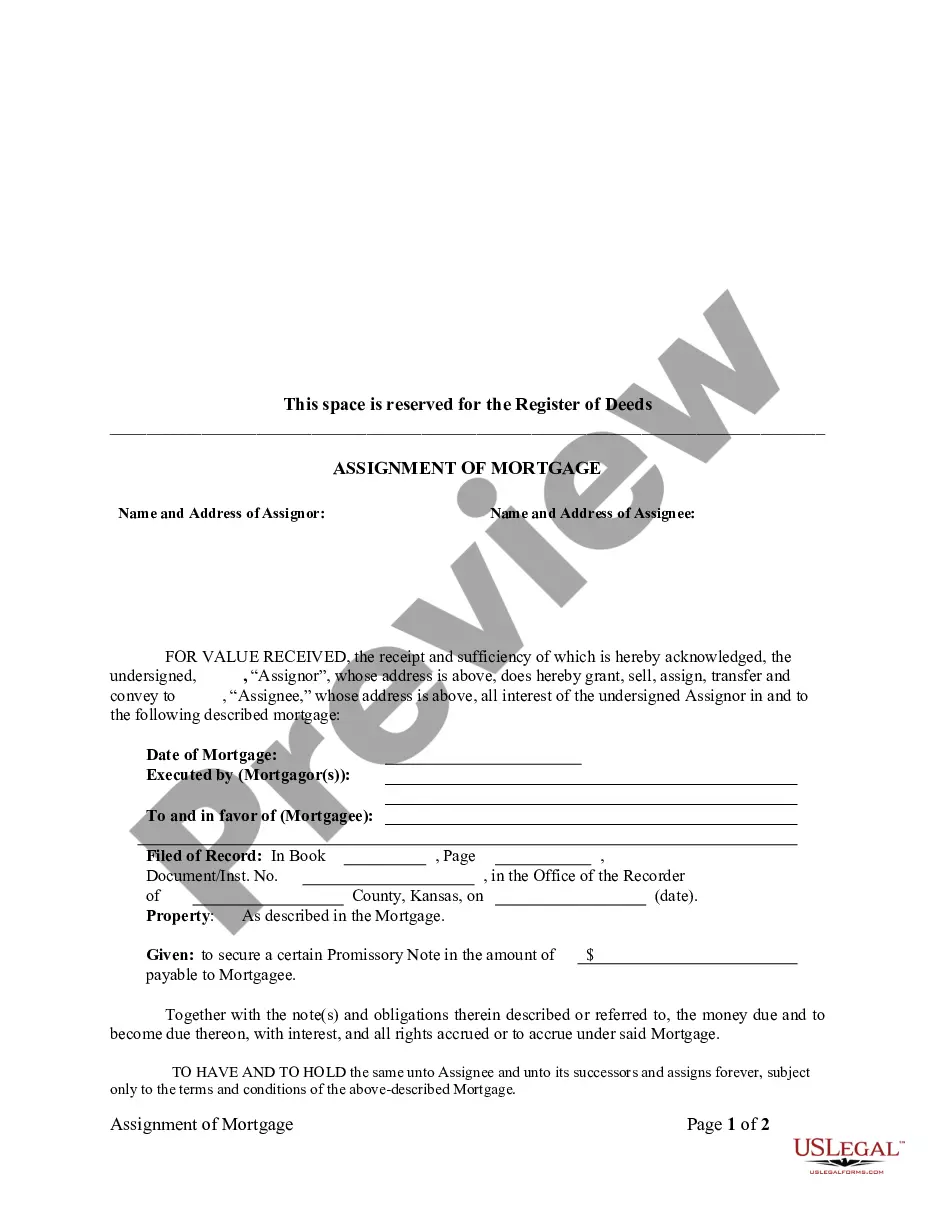

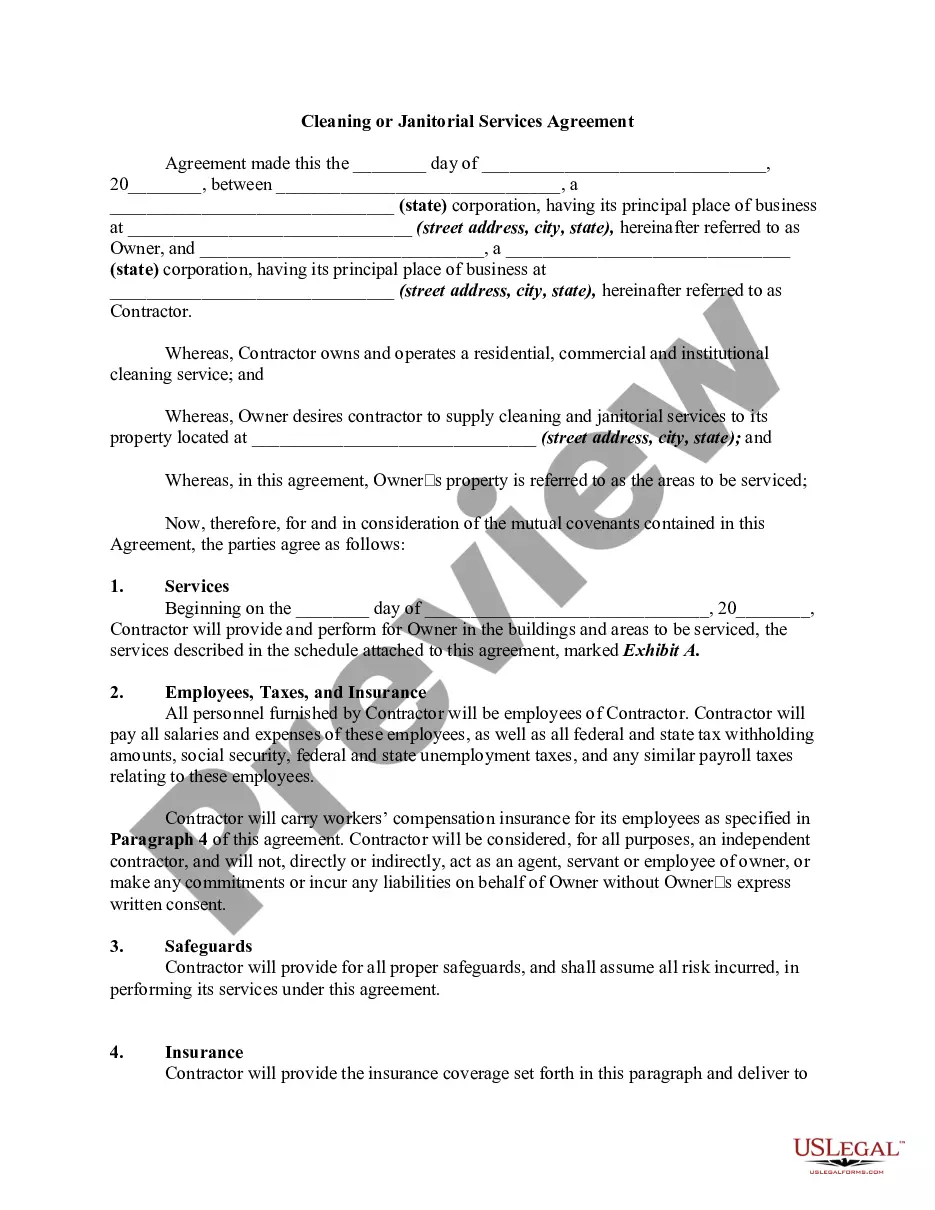

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: Topeka Kansas Assignment of Mortgage by Corporate Mortgage Holder: Understanding Types and Process Introduction: In Topeka, Kansas, the Assignment of Mortgage is a vital legal process that occurs when a corporate mortgage holder transfers the ownership rights of a mortgage to another entity. This article aims to provide a detailed description of what the Assignment of Mortgage entails in Topeka, Kansas, while also shedding light on different types of assignments that may occur. Additionally, relevant keywords related to this topic will be incorporated to enhance the content's relevance and searchability. Key Terms/Keywords: — Topeka Kansas Assignmenmortgageag— - Corporate Mortgage Holder — MortgagTransferfe— - Ownership Transfer — Mortgage Assignment Type— - Legal Process — Mortgage Assignment Documen— - Assignee of Mortgage — Assignor of Mortgag— - Mortgage Lien - Recording Office — Real Estate La— - Mortgagee - Mortgagor Description: 1. Purpose of Topeka Kansas Assignment of Mortgage: The Assignment of Mortgage in Topeka, Kansas, is carried out primarily to transfer the legal rights and interests associated with a mortgage from one corporate mortgage holder to another. This process is often initiated due to mergers, acquisitions, or the sale of mortgage loans. 2. Parties Involved: The Assignment of Mortgage involves two main parties — the "Assignor" and the "Assignee." The Assignor, who is the corporate mortgage holder, transfers the mortgage rights to the Assignee, who becomes the new owner of the mortgage. 3. Topeka Kansas Assignment of Mortgage Process: The process typically begins with the drafting of the Assignment of Mortgage document, which outlines the terms and conditions of the transfer. This document must comply with the requirements of Topeka's real estate laws and regulations. Once the document is prepared, it is executed by the Assignor and recorded at the Recording Office. 4. Types of Assignment of Mortgage: a) Full Assignment of Mortgage: In this type, the entire mortgage debt is transferred to the Assignee, including the rights, powers, titles, and obligations associated with it. b) Partial Assignment of Mortgage: Here, only a portion of the mortgage debt is transferred to the Assignee, while the Assignor retains ownership of the remaining debt. 5. Importance of Recording the Assignment: Recording the Assignment of Mortgage is crucial to establish the Assignee's legal ownership of the mortgage and protect their interests. It provides public notice of the transfer and helps prevent multiple claims on the same mortgage. 6. Effects on Mortgagor: The Assignment of Mortgage does not impact the rights and obligations of the mortgage borrower (mortgagor). Their loan terms, interest rates, and repayment obligations generally remain the same, as the only change affects the entity they submit mortgage payments to. Conclusion: Understanding the Topeka Kansas Assignment of Mortgage by Corporate Mortgage Holder is essential for both prospective assignees and assignors. This legal process facilitates the transfer of mortgage ownership, ensuring the rights and obligations associated with the mortgage are appropriately passed on. By familiarizing oneself with the different types and the necessary steps involved, individuals can navigate the Assignment of Mortgage process in Topeka, Kansas, with ease and clarity.

Free preview

How to fill out Topeka Kansas Assignment Of Mortgage By Corporate Mortgage Holder?

If you’ve already used our service before, log in to your account and download the Topeka Kansas Assignment of Mortgage by Corporate Mortgage Holder on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Topeka Kansas Assignment of Mortgage by Corporate Mortgage Holder. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!