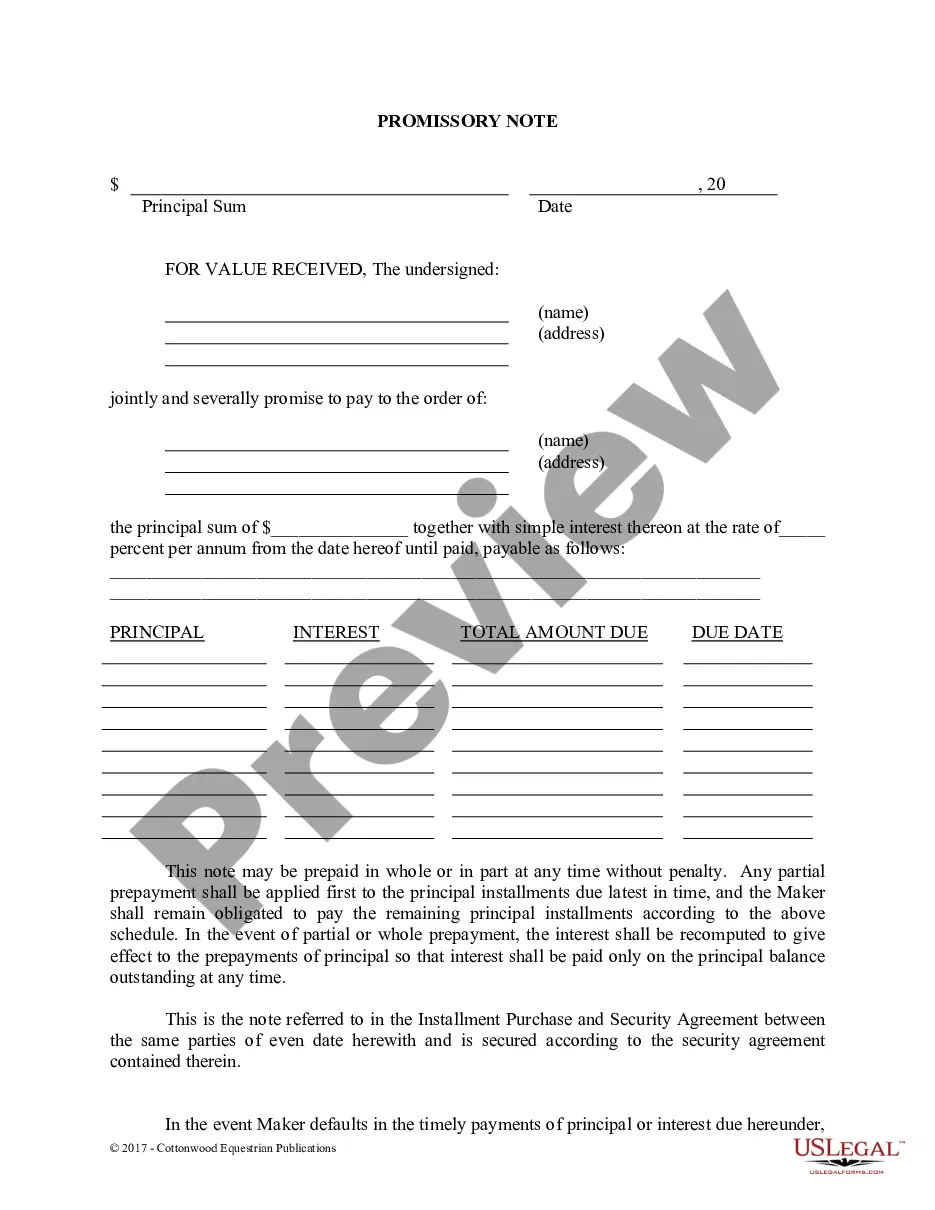

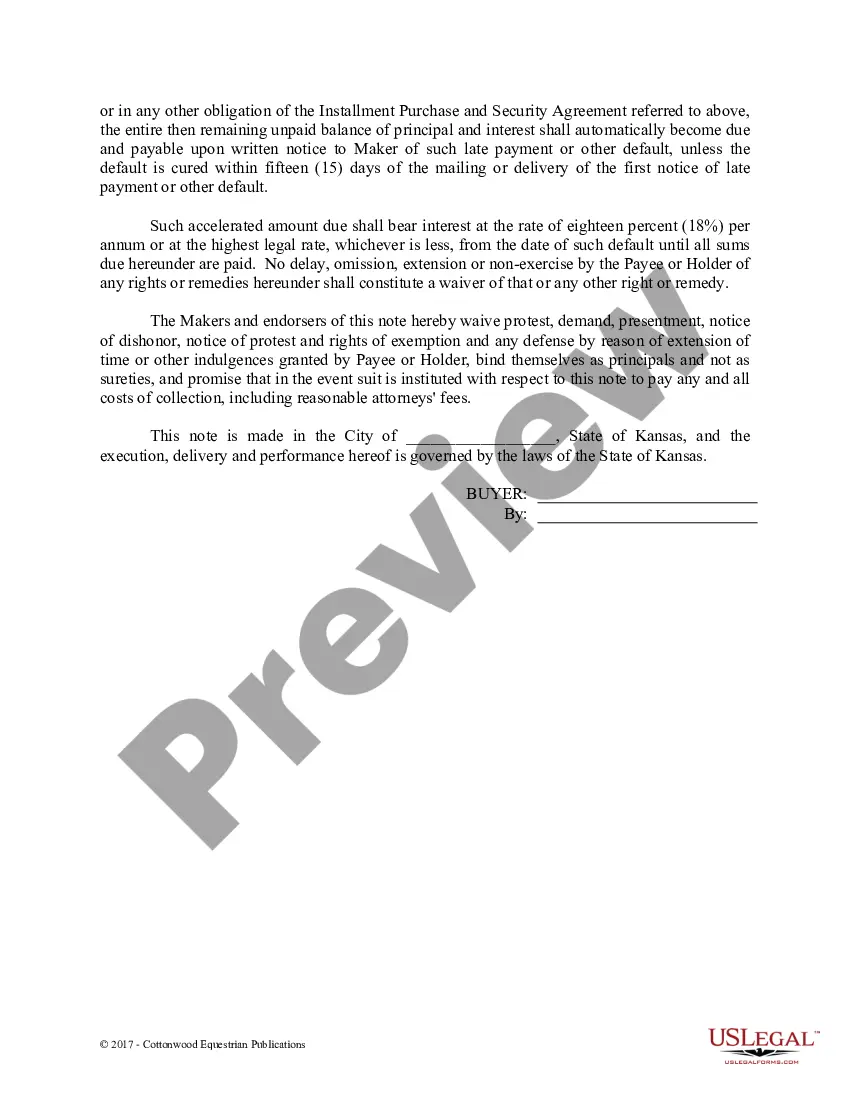

Wichita Kansas Promissory Note — Horse Equine Forms: A Comprehensive Overview A Wichita Kansas Promissory Note — Horse Equine Form is a legally binding document that outlines the terms and conditions of a loan agreement between parties involved in the horse equine industry. These forms serve as written evidence of a loan, detailing the amount borrowed, repayment terms, and any additional agreements or clauses. Promissory notes are an essential component of financial transactions in the horse equine industry, protecting the rights and responsibilities of the lender and the borrower. Wichita Kansas Promissory Note — Horse Equine Forms ensure a clear understanding between the parties and provide security for both parties involved in the loan arrangement. There are several types of Wichita Kansas Promissory Note — Horse Equine Forms, each catering to specific circumstances within the industry: 1. Simple Promissory Note: This type of Promissory Note form is used for straightforward loan agreements without any specific collateral or security involved. It outlines the loan amount, repayment terms, interest rate (if applicable), and any late payment penalties. 2. Secured Promissory Note: In cases where collateral is involved, such as a horse, farm equipment, or land, a Secured Promissory Note is utilized. This type of form contains provisions outlining the details of the collateral, including its value, condition, and any necessary insurance requirements. 3. Installment Promissory Note: When a loan is to be repaid in regular installments over a specific period, an Installment Promissory Note is used. This form details the loan amount, repayment schedule (monthly, quarterly, or annually), interest rate, and any penalties for late payments. 4. Balloon Promissory Note: A Balloon Promissory Note outlines a repayment plan with low monthly installments over an extended period, concluding with a large "balloon" payment at the end of the term. This type of Promissory Note is often used in cases where the borrower expects to have significant funds available in the future. 5. Demand Promissory Note: A Demand Promissory Note allows the lender to demand immediate repayment of the loan balance at any time, without giving prior notice or adhering to a specific timeline. This type of note provides maximum flexibility for the lender and is typically used in situations where the parties have a well-established relationship or the borrower has inconsistent finances. Whichever type of Wichita Kansas Promissory Note — Horse Equine Form is utilized, it is crucial to consult with a legal professional familiar with equine laws to ensure compliance with state regulations and to protect the interests of all parties involved. These forms serve as vital documentation within the horse equine industry, promoting transparency, clarity, and accountability in financial transactions.

Wichita Kansas Promissory Note - Horse Equine Forms

Description

How to fill out Wichita Kansas Promissory Note - Horse Equine Forms?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we apply for attorney services that, as a rule, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Wichita Kansas Promissory Note - Horse Equine Forms or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Wichita Kansas Promissory Note - Horse Equine Forms complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Wichita Kansas Promissory Note - Horse Equine Forms would work for your case, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!