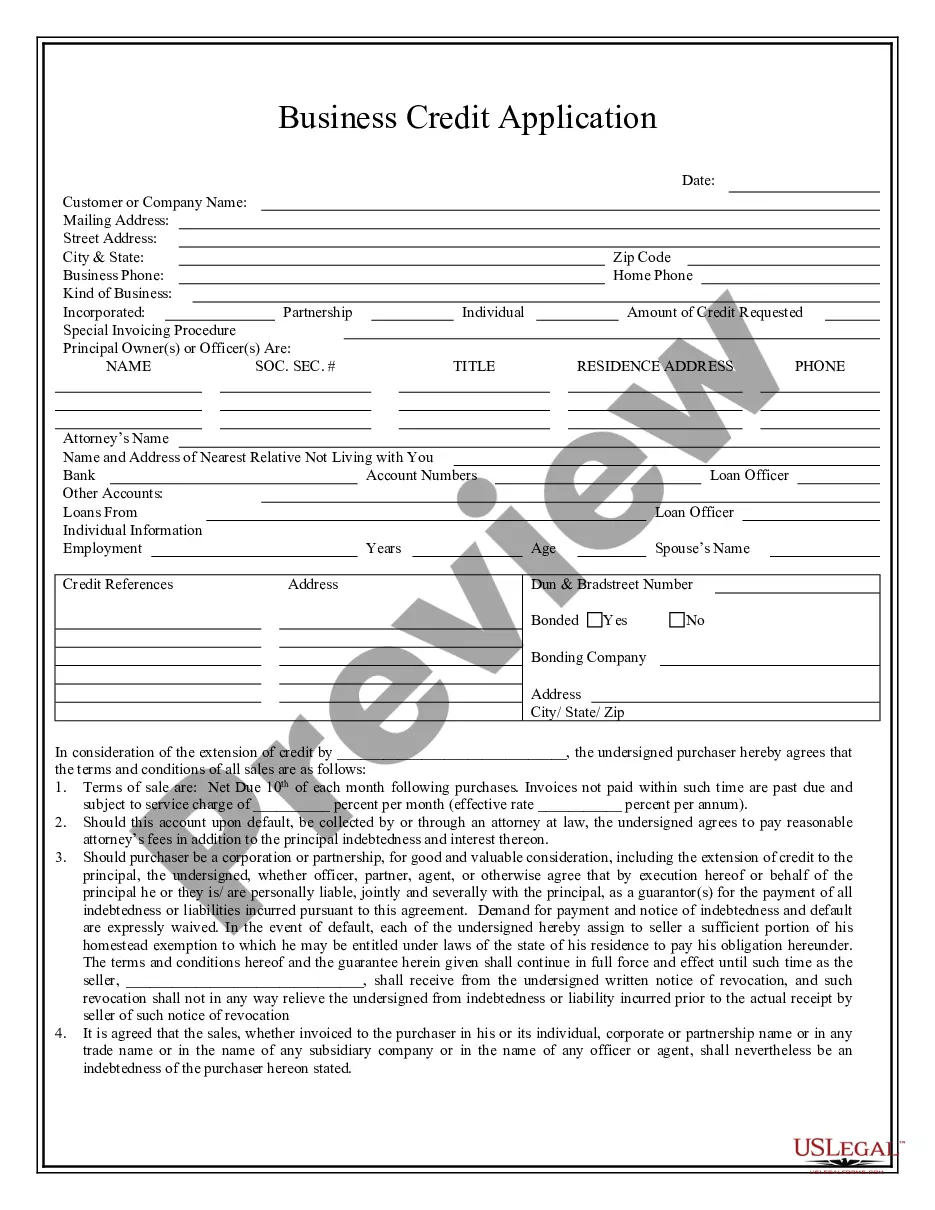

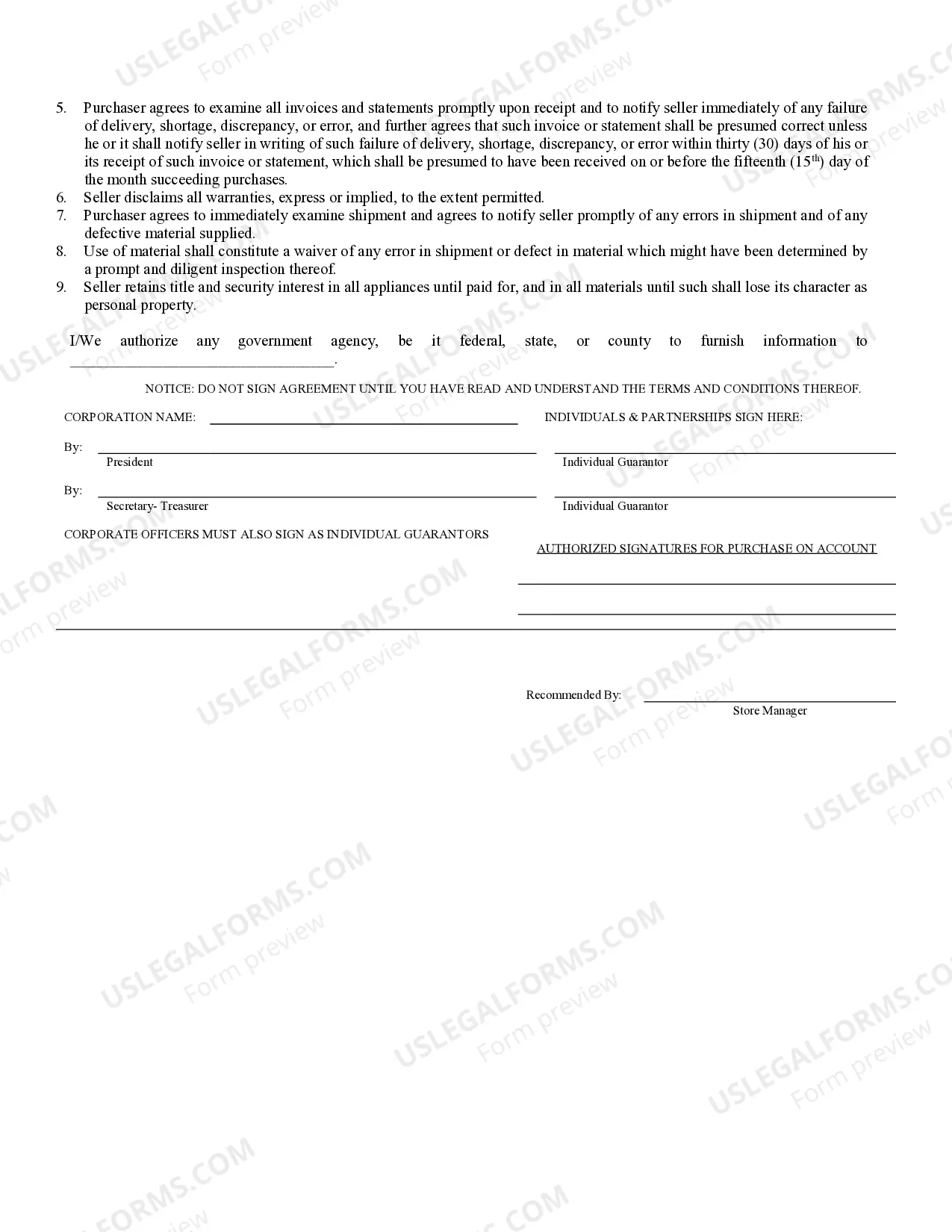

Topeka Kansas Business Credit Application is a comprehensive document that allows businesses in Topeka, Kansas to apply for credit with various financial institutions, lenders, or suppliers. This application serves as a formal request for credit and includes essential information about the business and its financial standing. A well-prepared credit application increases the chances of securing credit and building a strong credit history. Keywords: Topeka Kansas, Business Credit Application, credit, financial institutions, lenders, suppliers, formal request, financial standing, securing credit, credit history. There are several types of Topeka Kansas Business Credit Applications available, depending on the specific needs and requirements of the business. These may include: 1. Small Business Credit Application: Designed for small businesses in Topeka, Kansas seeking credit from local banks or credit unions. This application takes into account the size and nature of the business operations and its financial requirements. 2. Corporate Credit Application: Suitable for larger corporations based in Topeka, Kansas that need substantial credit facilities. This application is more extensive and may require detailed financial statements, business plans, and references to demonstrate the business's capacity to handle substantial credit. 3. Supplier Credit Application: Intended for businesses seeking credit from suppliers in Topeka, Kansas. This application focuses on the business's ability to fulfill payment obligations promptly and efficiently. 4. Government-Backed Credit Application: For businesses in Topeka, Kansas looking to obtain credit through government-backed loan programs, such as Small Business Administration (SBA) loans. This application may require additional documentation and adherence to specific guidelines set by the government agencies involved. 5. Business Line of Credit Application: Suited for businesses in Topeka, Kansas that require a revolving line of credit to manage their ongoing financial needs. This application includes details about the desired credit limit, intended usage, and proposed repayment strategy. When completing a Topeka Kansas Business Credit Application, it is crucial to provide accurate and up-to-date information about the business, its owners, financial records, and any supporting documentation required. This helps lenders and financial institutions make informed decisions about extending credit and ensures a smooth and efficient application process.

Topeka Kansas Business Credit Application

Description

How to fill out Topeka Kansas Business Credit Application?

If you are looking for a legitimate document, it’s challenging to select a more suitable service than the US Legal Forms site – one of the largest online collections.

Here you can discover a vast number of sample documents for business and personal needs categorized by types and states, or keywords.

Utilizing our sophisticated search feature, locating the latest Topeka Kansas Business Credit Application is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Select the format and save it to your device.

- Moreover, the accuracy of every document is validated by a team of professional attorneys who regularly examine the templates on our platform and refresh them in line with the current state and county regulations.

- If you are already familiar with our system and possess an account, all you need to do to retrieve the Topeka Kansas Business Credit Application is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have accessed the document you require. Review its description and utilize the Preview function to verify its content. If it doesn’t meet your requirements, use the Search bar at the top of the page to find the suitable file.

- Confirm your choice. Select the Buy now option. Then, choose your desired subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

By law, businesses must file a DBA either online or at their respective County Recorder's office. A filing is a requirement if a business is to trade under an alternative name from the legal entity in the case of corporations, LLCs, or LLPs ? or the owner's name for sole proprietorships and general partnerships.

How To Set Up a DBA Search your name. Make certain the DBA name you want isn't already being used.Review the naming requirements of your state.Fulfill operating requirements.Register your DBA with the Secretary of State or Local Government Agency.

A. No. State law does not require or permit the registration or filing of DBAs or fictitious names.

Name reservations may be filed online at . Filing a name reservation holds the name for 120 days.

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.

The Kansas Form DL - Articles of Organization is a document that is filed with the Kansas Secretary of State to form an LLC. The fee for filing the Articles of Organization is $160 online and $165 by mail.

The State of Kansas has no formal process for registration of a DBA on the state level, so DBA registration usually occurs on the local or county level. Each county also determines if a DBA filing is required.

How do I register a name? The state of Kansas does not have name registration. A name may be reserved, if available for 120 days and a non-refundable fee of $30. A name that is reserved cannot be used by any other entity to form a business during the 120-day period.

A. Name reservations may be filed online at . Filing a name reservation holds the name for 120 days.