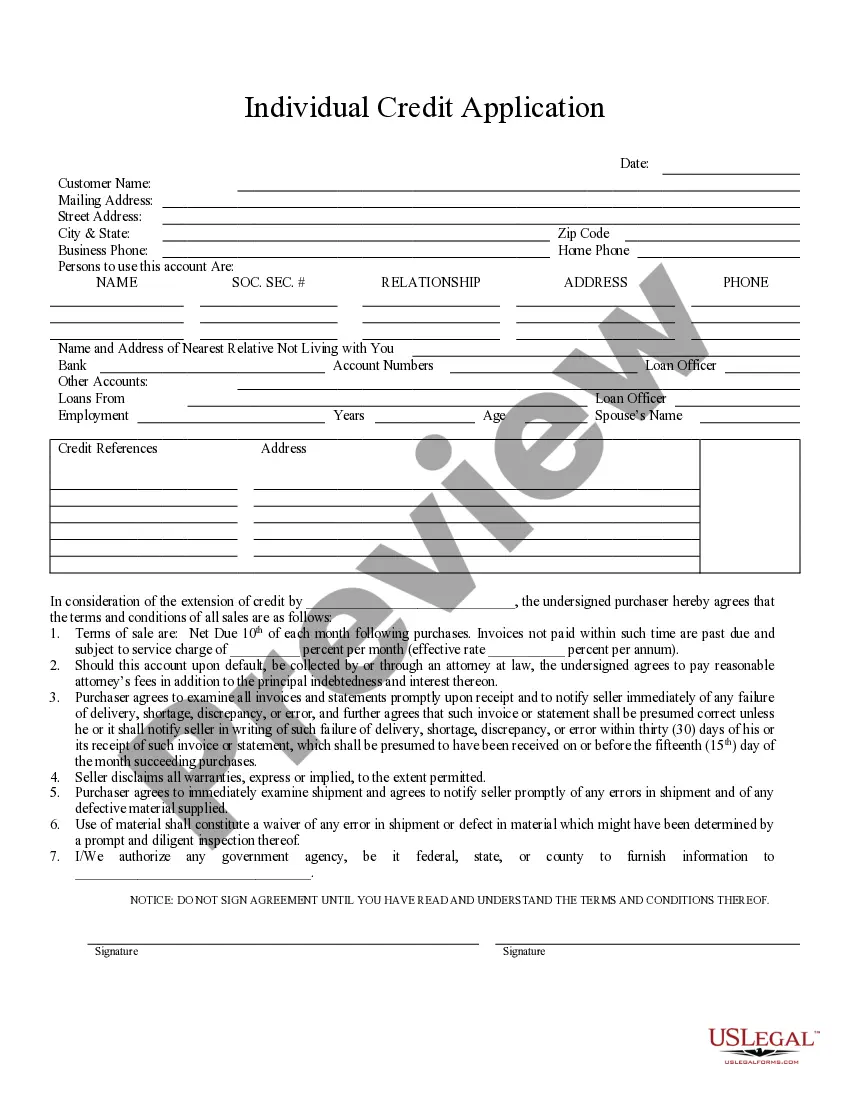

Overland Park Kansas Individual Credit Application is a document used by individuals residing in Overland Park, Kansas, to apply for credit. This detailed application form is essential for individuals looking to obtain credit from financial institutions, banks, credit unions, or other lending organizations located in Overland Park. The Overland Park Kansas Individual Credit Application collects personal, financial, and employment information needed to assess an individual's creditworthiness and determine their eligibility for different types of credit, such as auto loans, personal loans, credit cards, or mortgages. This application form is crucial in helping lenders evaluate an applicant's ability to repay the borrowed funds. The application typically includes fields for personal details, such as name, address, contact information, social security number, and date of birth. Financial aspects such as income, employment information, monthly expenses, and existing debts are also requested. By providing this information, lenders can perform credit checks and calculate an applicant's debt-to-income ratio to evaluate their creditworthiness accurately. Different types of Overland Park Kansas Individual Credit Applications may exist depending on the type of credit individuals are seeking. These credit applications may be specifically tailored for areas such as auto loans or mortgages. For example, an Overland Park Kansas Auto Loan Credit Application will include additional sections related to the vehicle's details, such as make, model, year, and identification number. The Overland Park Kansas Individual Credit Application is designed to protect both the lender and the applicant, ensuring that the lending decision is based on accurate information. It is essential for applicants to provide complete and truthful details to enhance the chances of approval. Lenders rely heavily on this application to determine interest rates, credit limits, and repayment conditions. Submitting an Overland Park Kansas Individual Credit Application permits lenders to assess the applicant's financial stability and creditworthiness, enabling them to make informed decisions. However, it is important to note that approval is not guaranteed; it ultimately depends on the lender's specific criteria and requirements. In conclusion, the Overland Park Kansas Individual Credit Application is a comprehensive document utilized by residents of Overland Park, Kansas, to apply for various types of credit. By completing this application accurately and honestly, individuals increase their chances of obtaining the desired credit product and fulfilling their financial needs.

Overland Park Kansas Individual Credit Application

Description

How to fill out Overland Park Kansas Individual Credit Application?

If you are looking for a valid form, it’s impossible to choose a better platform than the US Legal Forms website – probably the most comprehensive libraries on the internet. Here you can get a huge number of templates for organization and individual purposes by types and regions, or key phrases. With our high-quality search function, getting the newest Overland Park Kansas Individual Credit Application is as elementary as 1-2-3. Additionally, the relevance of every document is confirmed by a team of skilled attorneys that regularly check the templates on our platform and revise them according to the latest state and county requirements.

If you already know about our platform and have a registered account, all you should do to receive the Overland Park Kansas Individual Credit Application is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the form you require. Look at its description and make use of the Preview function (if available) to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to get the appropriate document.

- Confirm your decision. Select the Buy now option. Following that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the file format and download it on your device.

- Make changes. Fill out, modify, print, and sign the obtained Overland Park Kansas Individual Credit Application.

Each and every form you save in your user profile has no expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you need to have an additional version for editing or creating a hard copy, you can come back and save it once more at any moment.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Overland Park Kansas Individual Credit Application you were looking for and a huge number of other professional and state-specific samples on one website!