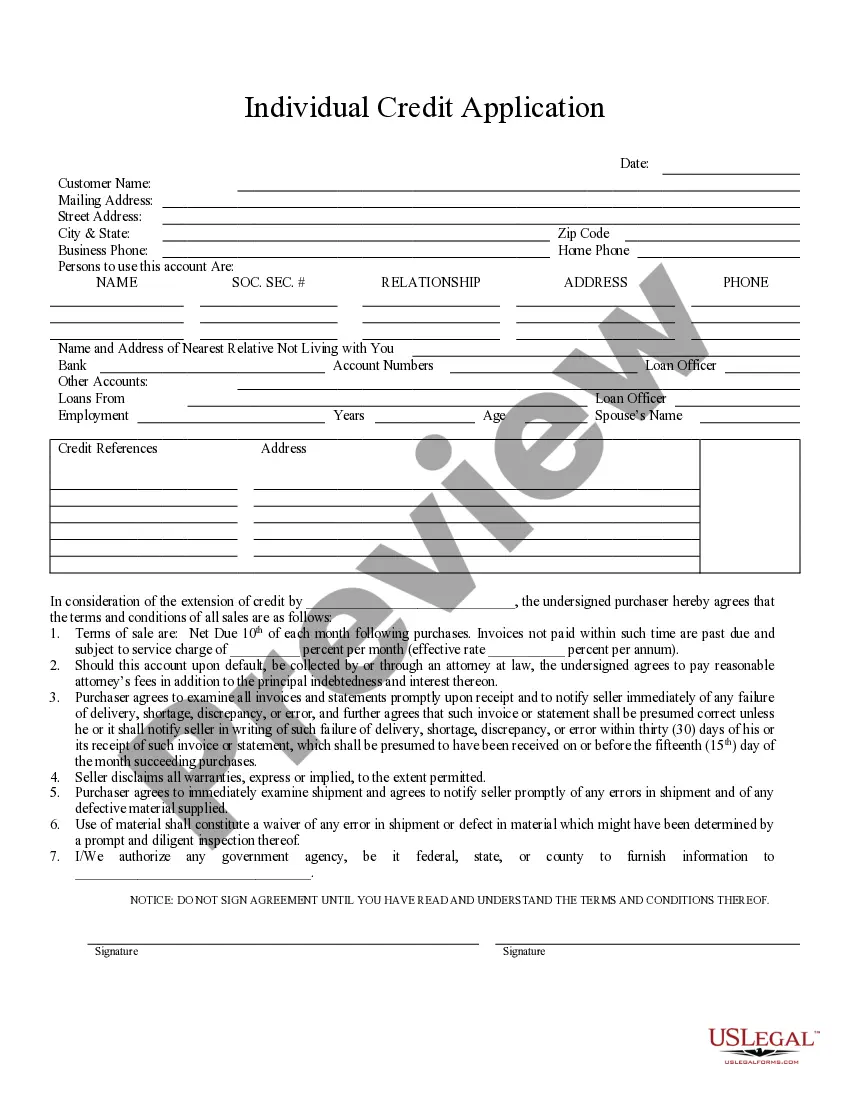

Topeka Kansas Individual Credit Application is a comprehensive document designed for individuals seeking credit opportunities in Topeka, Kansas. Whether it's applying for a loan, a credit card, or any other form of credit, this application is tailored to cater to the needs of the local community. The Topeka Kansas Individual Credit Application collects vital information to assess an applicant's creditworthiness and determine their eligibility for various credit options. Key Details: 1. Personal Information: The applicant is required to provide their full name, date of birth, contact details (address, phone number, and email), social security number, and identification details. 2. Employment Details: This section includes information about the applicant's current and previous employment, such as the name of the employer, job title, duration of employment, and income details. 3. Financial Information: Individuals are asked to disclose their current assets, such as bank accounts, stocks, properties, or any other investments they possess. Additionally, the applicant must disclose their liabilities, including outstanding loans, mortgages, credit card debts, or any other financial obligations. 4. Credit History: This section requires detailed information about the applicant's past and current credit accounts, such as credit cards, loans, mortgages, bankruptcies, or any relevant financial events. It helps financial institutions assess an applicant's creditworthiness and payment history. 5. References: The applicant is requested to provide references such as friends, family members, or acquaintances who can vouch for their character and reliability. Types of Topeka Kansas Individual Credit Applications: 1. Topeka Kansas Personal Loan Application: This application is specifically designed for individuals seeking personal loans for various purposes, such as debt consolidation, home improvements, education, or medical expenses. 2. Topeka Kansas Credit Card Application: This application is tailored for individuals looking to obtain a credit card offered by banks or financial institutions in Topeka, Kansas. It collects essential information needed to assess an applicant's creditworthiness and determine the appropriate credit limit. 3. Topeka Kansas Mortgage Application: This type of application is utilized by individuals planning to purchase a home or refinance their existing mortgage. It gathers relevant financial and personal information necessary to evaluate the applicant's eligibility for a mortgage loan and determine the terms and conditions. 4. Topeka Kansas Auto Loan Application: This application is specifically designed for individuals seeking financing options to purchase a new or used vehicle in Topeka, Kansas. It collects vital information about the applicant's income, employment, and credit history to determine their eligibility for an auto loan. Submitting a Topeka Kansas Individual Credit Application provides individuals with the opportunity to access credit and financial resources that can support their personal and professional goals. It is crucial to provide accurate and truthful information on the application to ensure a smooth evaluation process and increase the chances of credit approval.

Topeka Kansas Individual Credit Application

Description

How to fill out Topeka Kansas Individual Credit Application?

If you are looking for a relevant form template, it’s extremely hard to choose a more convenient service than the US Legal Forms website – one of the most extensive libraries on the web. Here you can find a huge number of templates for business and personal purposes by types and regions, or keywords. Using our high-quality search feature, getting the most recent Topeka Kansas Individual Credit Application is as easy as 1-2-3. Furthermore, the relevance of each record is proved by a group of professional attorneys that on a regular basis check the templates on our platform and update them in accordance with the latest state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Topeka Kansas Individual Credit Application is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have chosen the form you need. Look at its description and use the Preview function (if available) to explore its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to discover the proper document.

- Confirm your selection. Choose the Buy now option. Next, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Select the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Topeka Kansas Individual Credit Application.

Every single form you add to your user profile does not have an expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to receive an additional copy for enhancing or creating a hard copy, you may come back and download it once more anytime.

Make use of the US Legal Forms professional collection to get access to the Topeka Kansas Individual Credit Application you were seeking and a huge number of other professional and state-specific templates on one platform!