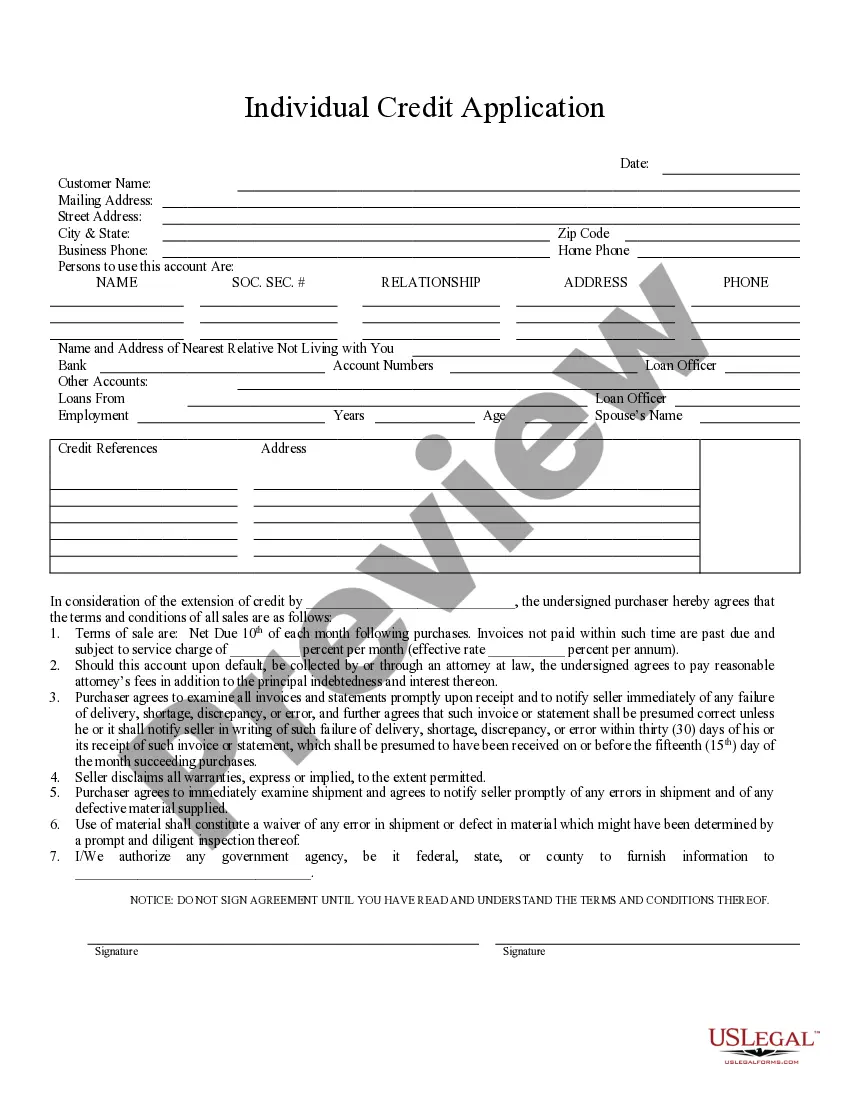

The Wichita Kansas Individual Credit Application is an essential document used by individuals in Wichita, Kansas, to apply for credit from various financial institutions or lenders. This application provides a thorough understanding of the applicant's financial background, credit history, and overall financial stability. The Wichita Kansas Individual Credit Application typically requires individuals to provide personal information such as their full name, contact details including address and phone number, social security number, and date of birth. Additionally, applicants are asked to provide details about their current employment, including employer name, job position, and income details. Moreover, this application requests information about the applicant's current and previous financial obligations, including outstanding loans, credit card debts, or any other financial liabilities. The purpose of collecting this data is to assess the applicant's ability to handle additional credit and to determine their creditworthiness. Furthermore, the Wichita Kansas Individual Credit Application often includes sections to disclose details about the applicant's assets, such as their savings account balances, investments, real estate properties, and vehicles owned. These assets help financial institutions evaluate the applicant's overall financial strength and capacity to repay the borrowed funds. Additionally, the Wichita Kansas Individual Credit Application may include sections to disclose any legal judgments, bankruptcies, or foreclosures that the applicant has faced in the past. This information helps lenders assess the applicant's credit history and enables them to make an informed decision regarding the individual's creditworthiness. Different types of Wichita Kansas Individual Credit Applications may exist based on the specific financial institution or lender. For example, some lenders may offer specific credit applications for personal loans, auto loans, mortgage loans, or credit cards. Each type of credit application may have slightly different requirements and sections tailored to the particular type of credit being sought. In conclusion, the Wichita Kansas Individual Credit Application serves as a comprehensive tool for residents of Wichita, Kansas, seeking credit from financial institutions or lenders. By providing detailed personal, financial, and employment information, individuals can demonstrate their creditworthiness and increase their chances of obtaining the desired credit.

Wichita Kansas Individual Credit Application

Description

How to fill out Wichita Kansas Individual Credit Application?

Do you need a trustworthy and inexpensive legal forms supplier to get the Wichita Kansas Individual Credit Application? US Legal Forms is your go-to option.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Wichita Kansas Individual Credit Application conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is good for.

- Start the search over if the form isn’t suitable for your legal situation.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Wichita Kansas Individual Credit Application in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online once and for all.