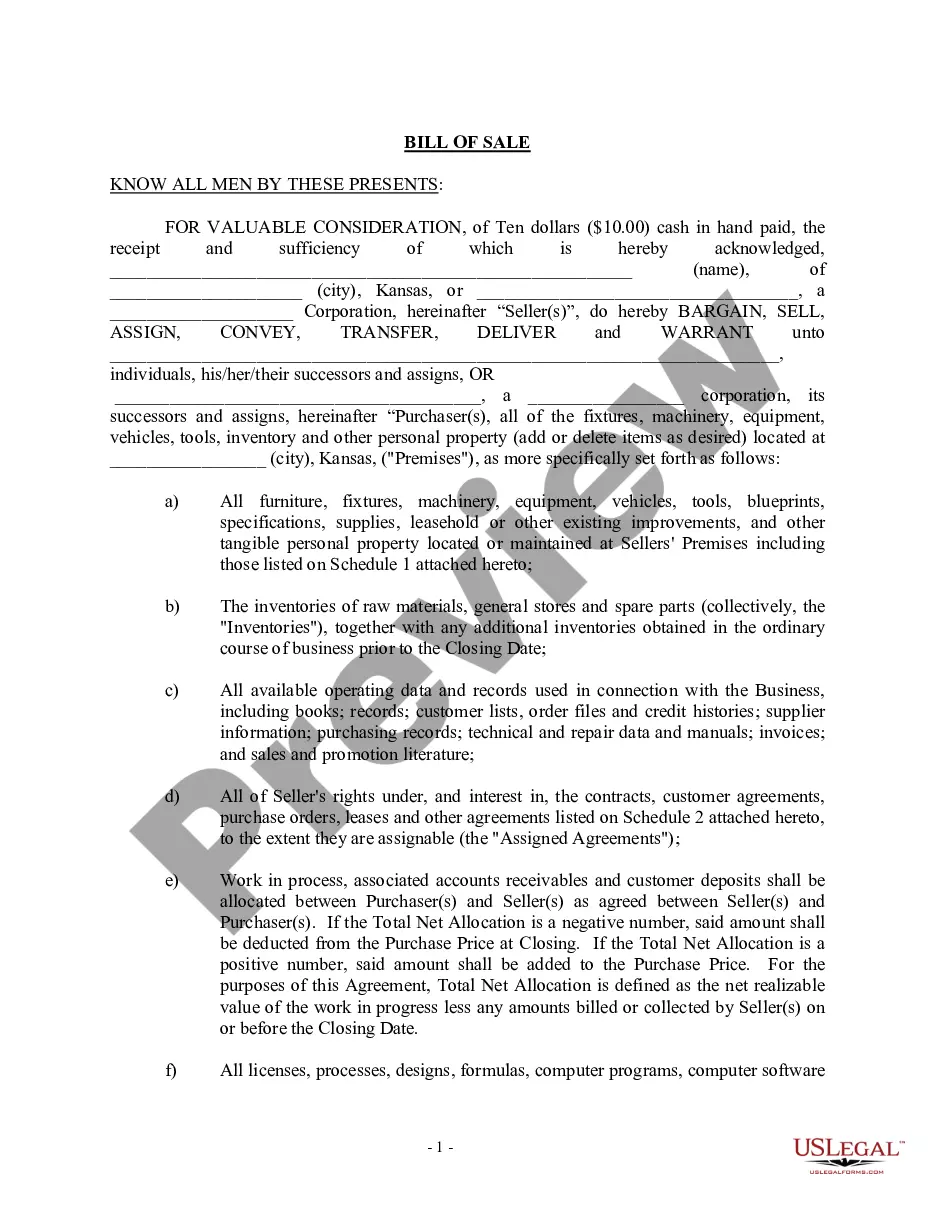

Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

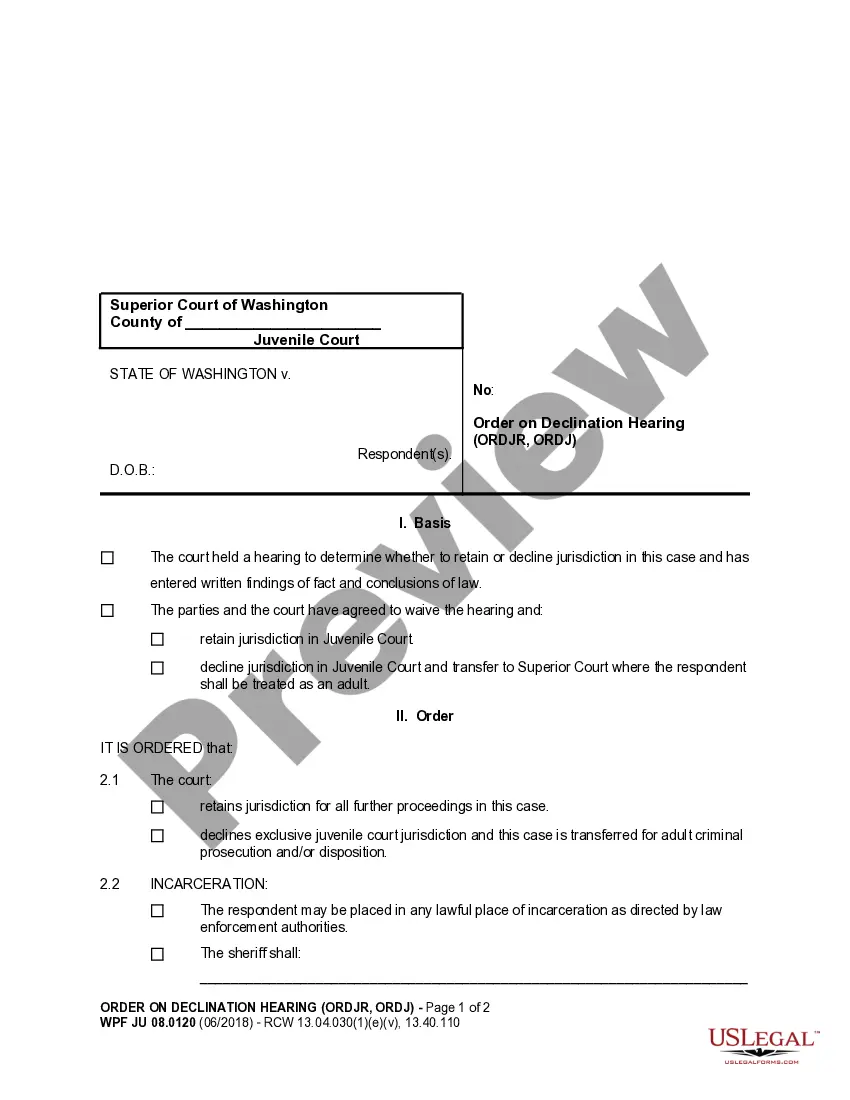

How to fill out Kansas Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Finding authenticated templates tailored to your local statutes can be daunting unless you utilize the US Legal Forms repository.

It’s a digital archive of over 85,000 legal forms catering to both personal and professional needs as well as various real-world situations.

All the documents are appropriately categorized by field of application and jurisdictional areas, so retrieving the Topeka Kansas Bill of Sale related to the Sale of Business by Individual or Corporate Seller becomes as swift and straightforward as ABC.

Maintaining documentation organized and compliant with legal standards is critically important. Take advantage of the US Legal Forms library to always have crucial document templates readily available for any requirements!

- Examine the Preview mode and form summary.

- Ensure you’ve selected the accurate one that fulfills your requirements and entirely aligns with your local jurisdiction mandates.

- Look for an alternative template, if necessary.

- Once you notice any discrepancies, utilize the Search tab above to locate the correct one. If it meets your needs, proceed to the following stage.

- Purchase the document.

Form popularity

FAQ

To sell a car privately in Kansas, you need the vehicle title, a completed bill of sale, and a valid form of identification. You should also gather any maintenance records, which can increase buyer confidence. As you prepare your sale, consider referencing a Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to keep your transaction organized and legally sound.

In Kansas, a bill of sale does not need to be notarized to be legal, but notarization can add an extra layer of security. It verifies that both parties agree to the terms and provides a dated record of the transaction. If you prefer the assurance that comes with notarization, consider using a Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, which can be easily customized for notarization.

Filling out a title when selling a car in Kansas involves signing the title in the area designated for the seller's signature. Make sure to provide the buyer’s name and address. Double-check that the odometer reading is accurate. Completing these steps properly ensures compliance and avoids future disputes, and using a Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can add formality to your sale.

When writing a bill of sale, start by clearly stating the date of the transaction. Next, include the names and addresses of both the buyer and the seller. Be specific about the item you're selling, including its condition and VIN number if it's a vehicle. Finally, sign and date the document to confirm the agreement, and consider using a Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller template for accuracy.

To sell your car privately in Kansas, you need the car's title, a completed bill of sale, and possibly a release of liability form. Ensure that the title is signed over to the buyer, as this proves the transfer of ownership. A Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can serve as an essential way to document the sale, protecting both parties.

Not all Kansas bills of sale require notarization; it depends on the transaction's specifics. However, for additional security, especially when transferring a business, notarizing the Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can provide peace of mind for both parties involved.

Typically, the seller initiates the bill of sale during the transaction process. This document outlines the terms of the sale and protects both parties. In the context of business sales, using a Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller ensures all necessary details are captured.

Yes, a bill of sale can still be valid without notarization in Kansas. As long as both parties agree to the terms and sign the document, it is generally enforceable. For a business sale, consider using a Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller for best practices and clarity in the transaction.

In Kansas, a title does not always require notarization. However, certain circumstances, especially involving business sales, may necessitate additional verification through notarization. A Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller could clarify these requirements when finalizing the transaction.

Yes, having a title does not eliminate the need for a bill of sale in Kansas. A bill of sale serves as proof of the transaction between the buyer and seller. For business sales, you should use a Topeka Kansas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller for proper documentation.