A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Topeka Kansas Guaranty or Guarantee of Payment of Rent

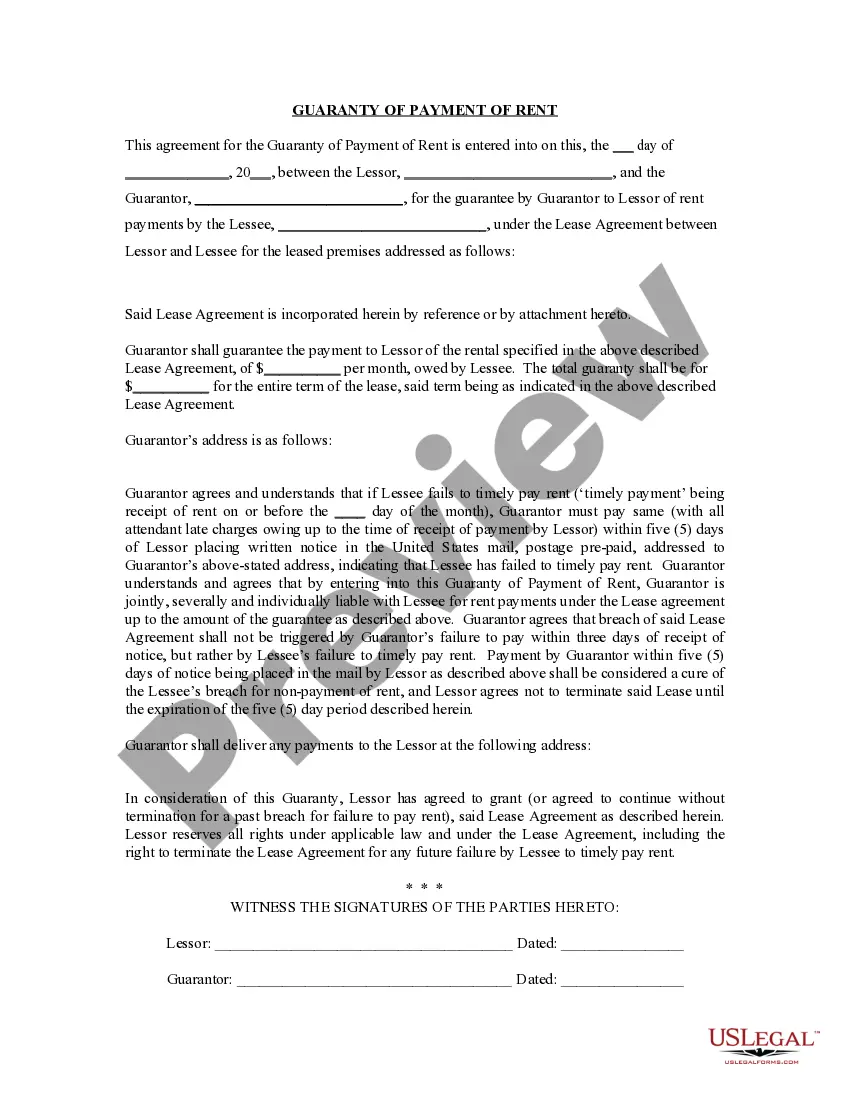

Description

How to fill out Kansas Guaranty Or Guarantee Of Payment Of Rent?

If you have utilized our service previously, sign in to your account and store the Topeka Kansas Guaranty or Guarantee of Payment of Rent on your device by clicking the Download button. Ensure your subscription is current. If not, renew it according to your payment plan.

Should this be your initial interaction with our service, follow these easy steps to obtain your file.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or professional requirements!

- Ensure you’ve found a suitable document. Review the description and utilize the Preview feature, if available, to verify if it aligns with your requirements. If it doesn’t meet your criteria, utilize the Search tab above to locate the correct one.

- Purchase the template. Press the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete a transaction. Employ your credit card information or the PayPal option to finalize the purchase.

- Obtain your Topeka Kansas Guaranty or Guarantee of Payment of Rent. Choose the file format for your document and save it to your device.

- Complete your template. Print it out or make use of professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To fill out a rental verification form, start by providing your personal information, including your name, address, and contact details. Next, include information about your rental history and payment patterns, such as previous landlords' names and their contact information. This process assures landlords in Topeka, Kansas, of your reliability as a tenant and showcases your commitment to upholding rental agreements.

The purpose of a letter of guarantee is to offer a clear commitment regarding financial obligations, such as rent payments. This document protects landlords by ensuring they will receive the rent due on time, even if the tenant encounters unforeseen challenges. In Topeka, Kansas, having a reliable letter of guarantee can ease concerns for property owners and foster positive tenant relationships.

The purpose of a guarantee is to provide assurance to a party that obligations will be met, particularly in financial agreements. In the context of renting, a guarantee ensures that the landlord receives rent payments without delay or default. This structure builds trust and helps facilitate smoother rental agreements in Topeka, Kansas, especially for new tenants.

Normal wear and tear refers to the expected decline in a rental property's condition over time, such as minor scuffs on walls or worn carpet. In Topeka, Kansas, understanding what constitutes normal wear and tear is essential to protect your security deposit. Items that are damaged beyond this scope could lead to disputes under the Guaranty or Guarantee of Payment of Rent. To clarify your rights, US Legal Forms offers helpful guidelines and resources for tenants.

You can file a complaint against your landlord in several places in Kansas, including local housing authorities and the attorney general's office. Understanding the terms of the Topeka Kansas Guaranty or Guarantee of Payment of Rent can strengthen your case. It is crucial to gather evidence of your complaint for a successful resolution. For assistance, consider using US Legal Forms, which can guide you in preparing the necessary documentation to file your complaint.

Yes, you can withhold rent for necessary repairs in Kansas, but you must follow specific procedures. Under the Guaranty or Guarantee of Payment of Rent concept, tenants can address significant repair issues that affect their living conditions. However, you should document your requests and the landlord's response. For a clear understanding of your rights, US Legal Forms provides resources to help navigate this situation.

If you don't inform your landlord about your move, you may face penalties. In Topeka, Kansas, a lack of notice can lead to continued rent obligations under the Guaranty or Guarantee of Payment of Rent. It's essential to communicate clearly with your landlord to avoid potential legal issues. For tailored advice, consider exploring US Legal Forms for documentation that helps you effectively notify your landlord.

The claims process for rent guarantee insurance typically begins with notifying the insurance provider of the tenant's default. In Topeka, Kansas, documentation such as the lease agreement and payment records is often required. After the initial review, the insurance company will guide you through the next steps for payment. This process can help landlords recover lost rent and maintain their investment.

Whether you need a lease guarantor can depend on your financial history and the requirements of the landlord. If you have a strong credit score and stable income, you might not need one. However, in Topeka, Kansas, having a lease guarantor can enhance your chances of securing a rental, especially if you’re a first-time renter or have recently changed jobs. It can be a beneficial option to strengthen your rental application.

A lease guaranty is an assurance provided by a third party to cover rental payments if the tenant defaults. In Topeka, Kansas, this agreement is crucial for landlords, especially when they deal with first-time renters or those with uncertain financial backgrounds. The lease guaranty acts as a safety net, ensuring landlords can collect rent even if the tenant runs into financial trouble. This tool is critical for managing rental properties effectively.