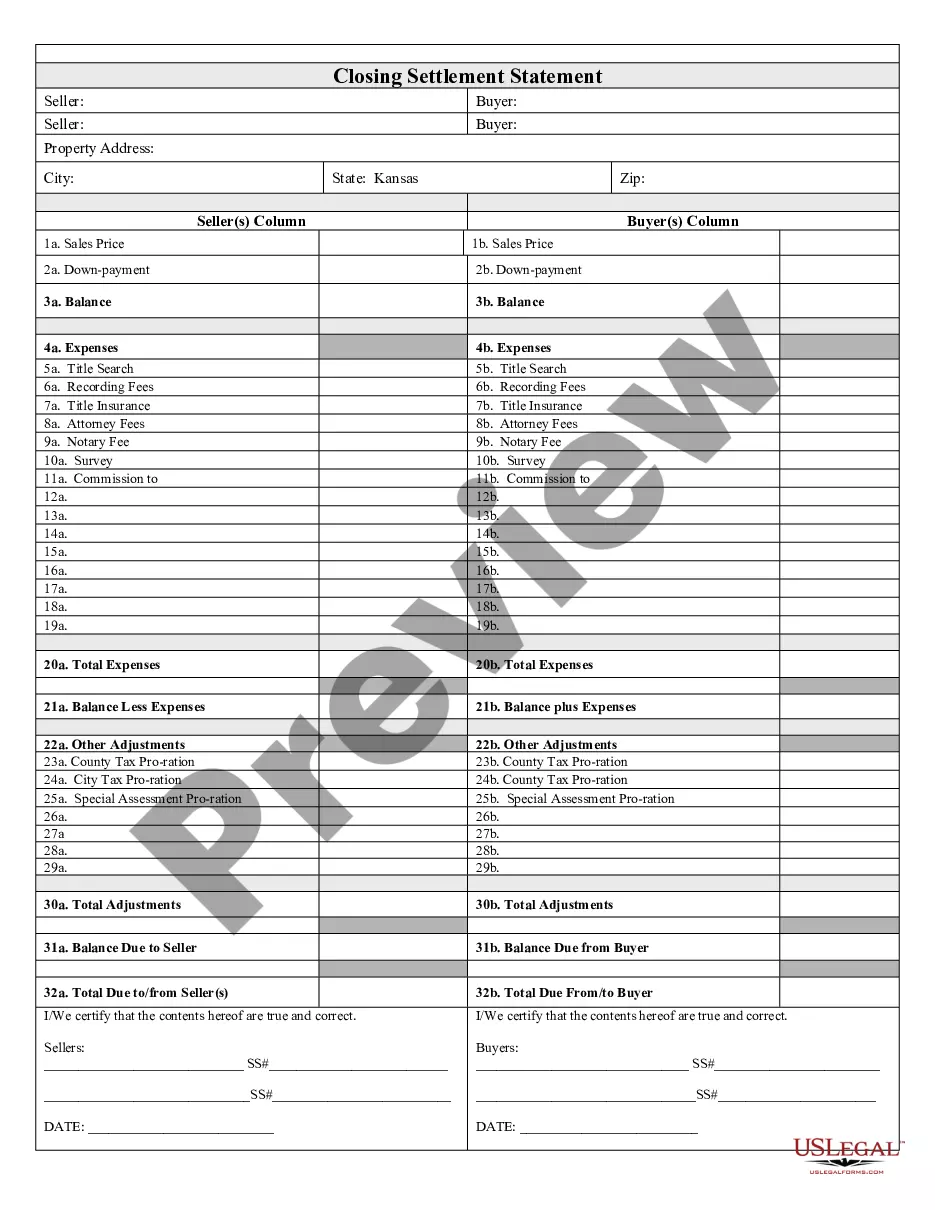

Olathe Kansas Closing Statement

Description

How to fill out Kansas Closing Statement?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our beneficial website, featuring a vast array of documents, simplifies the process of locating and acquiring nearly any document template you need.

You can download, complete, and endorse the Olathe Kansas Closing Statement in just a few minutes rather than spending hours online searching for the suitable template.

Using our collection is a superb method to enhance the security of your document submissions.

If you haven't created an account yet, follow these steps.

Visit the page containing the template you need. Ensure it is the form you intended to find: verify its title and description, and take advantage of the Preview feature if available. Otherwise, utilize the Search option to locate the correct one.

- Our expert attorneys frequently review all documentation to ensure that the forms are suitable for a specific state and adhere to new laws and regulations.

- How can you obtain the Olathe Kansas Closing Statement.

- If you already have an account, simply Log In to your profile.

- The Download button will be visible on all the templates you review.

- Additionally, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

To file a quit claim deed in Kansas, you must first complete the quit claim form correctly, including all necessary names and property information. After obtaining notarization, you should file the document with the county register of deeds where the property is located. A clear understanding of the Olathe Kansas Closing Statement will help you navigate any associated processes effortlessly.

A major disadvantage of a quitclaim deed is that it does not guarantee that the property title is clear. This means you may inherit liens or other claims against the property. Additionally, because the Olathe Kansas Closing Statement may not reflect all liabilities, potential buyers should exercise caution and consider title insurance when acquiring property through this method.

Yes, you can prepare a quit claim deed yourself, but ensure you understand the necessary legal requirements. It is crucial to fill out the form correctly to avoid issues during the filing process. Utilizing an online service like US Legal Forms can simplify this task and provide you with a properly formatted quit claim deed that aligns with the Olathe Kansas Closing Statement.

To file a quit claim deed in Kansas, first, obtain the form from a legal website or local government office. Complete the form with accurate details about the property and the parties involved. After signing the document in front of a notary, you will need to file it with the county register of deeds. Familiarize yourself with the Olathe Kansas Closing Statement to understand the potential implications related to property transfers.

Double Nickel in Olathe has recently attracted attention regarding its closure status. While rumors of its closing surface from time to time, it’s best to check local news or the business's official communications for the latest updates. Understanding local business dynamics can also be relevant when managing your Olathe Kansas Closing Statement, ensuring all transactions are informed by the current business landscape.

As of October 2023, the mayor of Olathe is John Bacon. He has focused on enhancing community services and promoting economic growth in the area. Staying informed about local leadership is important, especially when discussing matters like the Olathe Kansas Closing Statement, which can be affected by local regulations and policies.

Yes, a closing statement and a settlement statement essentially refer to the same document, summarizing the financial aspects of a real estate transaction. Both documents provide transparency about costs, fees, and associated payments. It is important to understand that while terms are interchangeable, the layout or specifics may vary slightly. Utilizing services like US Legal Forms can help clarify the details in your Olathe Kansas Closing Statement.

The final closing statement is provided by the closing agent or attorney after all financial details have been finalized. This statement is crucial as it summarizes the financial transactions of the closing. Review it carefully, as it reflects what you owe, what you have received, and any adjustments made. For a clear understanding, rely on tools from US Legal Forms tailored to detail an Olathe Kansas Closing Statement.

The closing process typically includes buyers, sellers, real estate agents, lenders, and the closing agent or attorney. Each party plays a vital role in ensuring the transaction proceeds smoothly. Communication among these participants is key to addressing any issues that may arise. To facilitate this process, consider consulting US Legal Forms for assistance with Olathe Kansas Closing Statement documentation.

The responsibility of preparing closing documents generally falls on the closing agent or attorney chosen for the transaction. They assemble all necessary paperwork to ensure compliance with local laws and requirements. It’s beneficial to have the right support to avoid missing crucial elements. US Legal Forms offers templates that can aid in creating your Olathe Kansas Closing Statement.