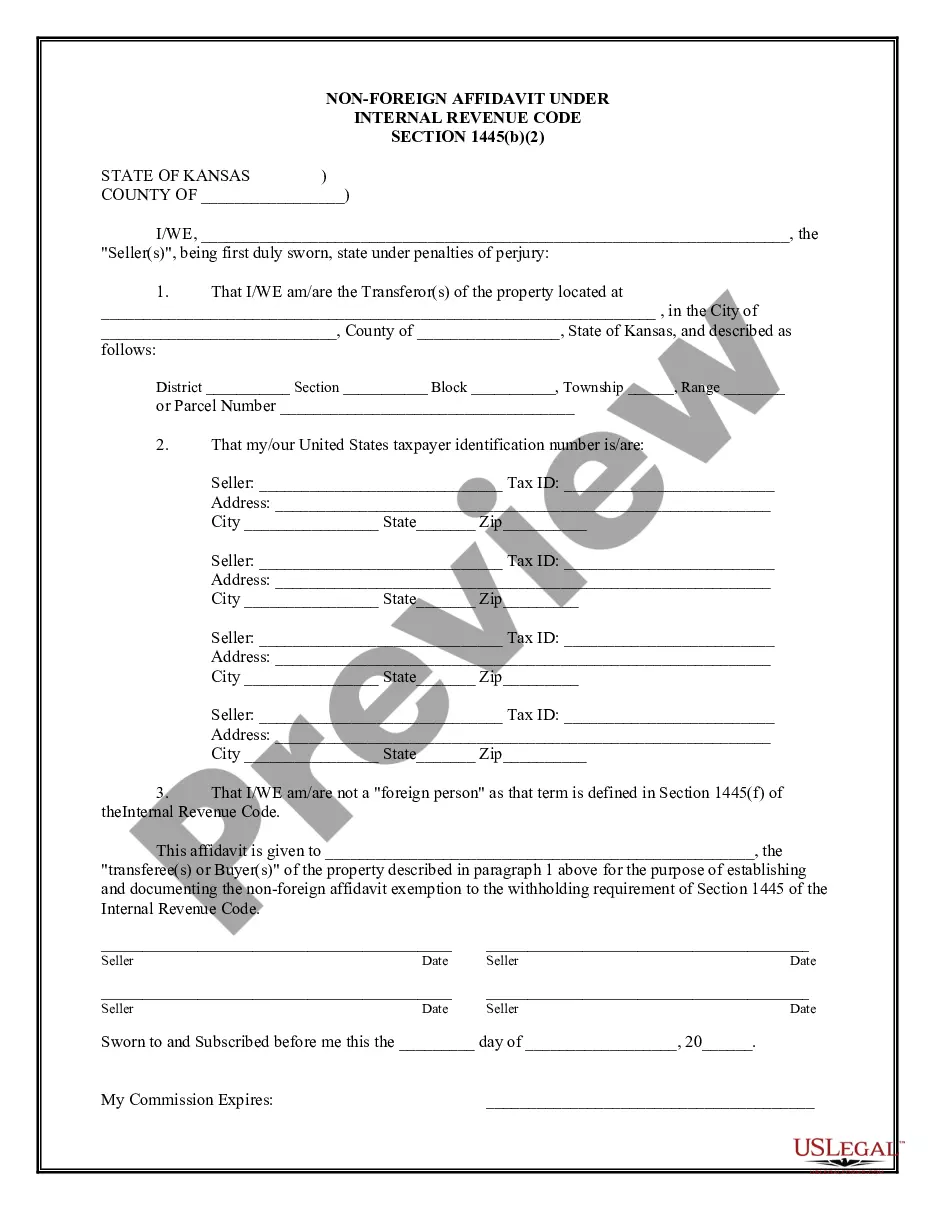

The Olathe Kansas Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Service (IRS) for certain real estate transactions involving non-U.S. persons in Olathe, Kansas. This affidavit serves as proof that the seller of the property is not a foreign person, thus exempting the buyer from withholding taxes under Section 1445 of the Internal Revenue Code. The Non-Foreign Affidavit Under IRC 1445 is essential to ensure compliance with U.S. tax laws and prevent any potential tax liabilities for the buyer. By obtaining this document, the buyer ensures that the transfer of real estate property from a non-U.S. person does not require the mandatory withholding of taxes when the property is sold. There are two main types of Olathe Kansas Non-Foreign Affidavit Under IRC 1445: 1. Non-Foreign Affidavit Under IRC 1445 for Individual Sellers: This affidavit is used when the seller of the property is an individual who is not a foreign person, as defined by the IRS. The individual seller must complete the affidavit by providing their personal details, including their name, address, social security number or taxpayer identification number, and confirm their U.S. citizenship or resident status. 2. Non-Foreign Affidavit Under IRC 1445 for Corporate/Entity Sellers: This affidavit applies to transactions involving corporate or entity sellers that are not classified as foreign persons. In this case, the authorized representative of the corporation or entity completes the affidavit on behalf of the entity. The representative must provide the entity's information, including its name, address, employer identification number (EIN), and assert that it is not a foreign entity. To complete the Olathe Kansas Non-Foreign Affidavit Under IRC 1445, sellers must gather all the required information and accurately fill out the document. It is crucial to ensure the affidavit is signed and dated by the seller or the authorized representative of the entity, certifying the accuracy of the provided information. The completed document should accompany the real estate transaction paperwork and be submitted to the relevant parties involved, including the buyer, title company, and IRS, as necessary. In summary, the Olathe Kansas Non-Foreign Affidavit Under IRC 1445 verifies the seller's status as a non-foreign person, exempting the buyer from withholding taxes on real estate transactions. Whether completed by individual sellers or corporate/entity sellers, this affidavit serves as a crucial compliance document in Olathe, Kansas real estate transactions involving non-U.S. persons.

Olathe Kansas Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Olathe Kansas Non-Foreign Affidavit Under IRC 1445?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone with no law background to draft such paperwork cfrom the ground up, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Olathe Kansas Non-Foreign Affidavit Under IRC 1445 or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Olathe Kansas Non-Foreign Affidavit Under IRC 1445 quickly using our trusted platform. In case you are already an existing customer, you can go ahead and log in to your account to get the appropriate form.

However, in case you are new to our platform, ensure that you follow these steps before downloading the Olathe Kansas Non-Foreign Affidavit Under IRC 1445:

- Be sure the template you have chosen is specific to your area because the rules of one state or area do not work for another state or area.

- Review the document and read a brief description (if available) of cases the document can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start over and search for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Olathe Kansas Non-Foreign Affidavit Under IRC 1445 once the payment is through.

You’re all set! Now you can go ahead and print out the document or fill it out online. If you have any problems locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.