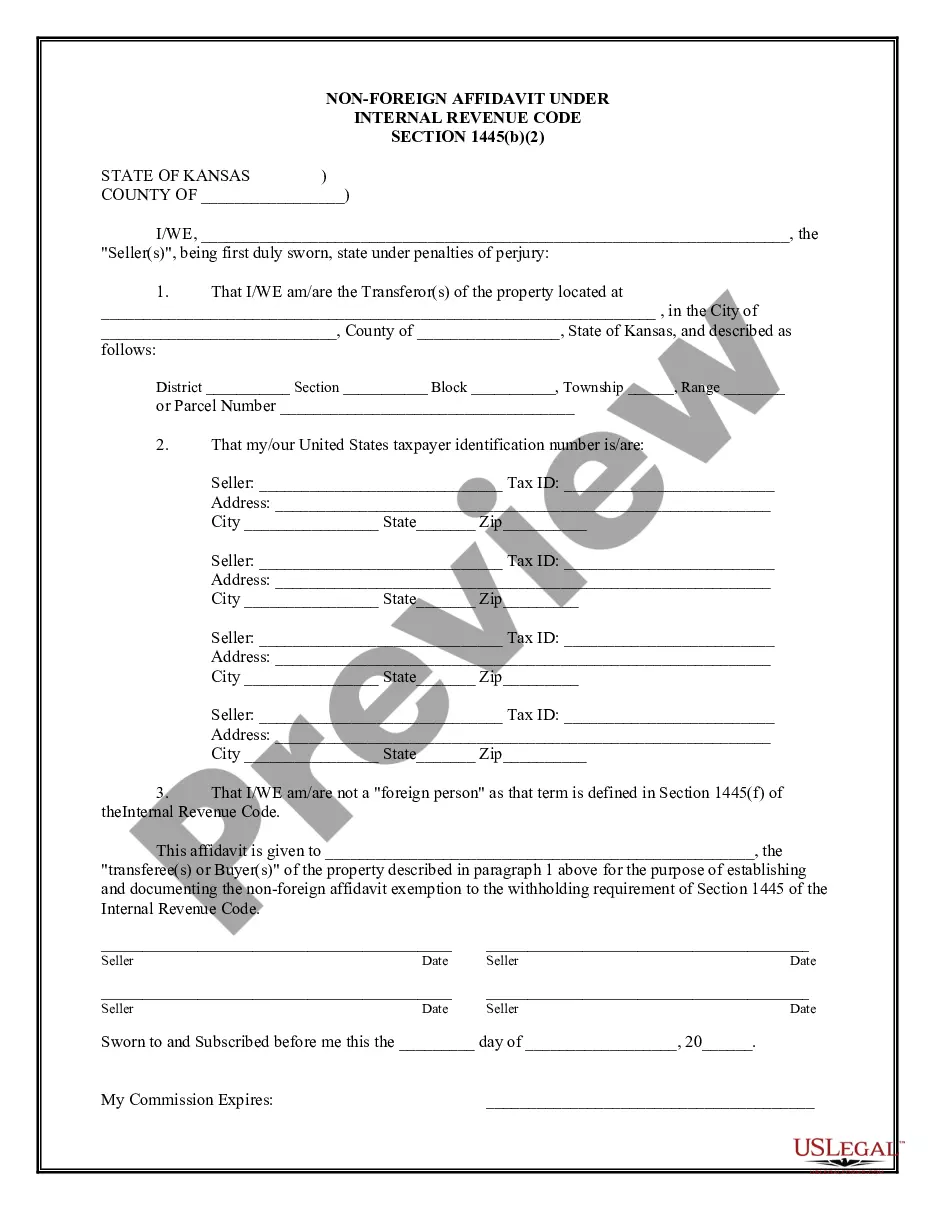

The Overland Park Kansas Non-Foreign Affidavit Under IRC 1445 is a critical document used in real estate transactions. This affidavit is specifically related to the Internal Revenue Code (IRC) section 1445, which deals with the withholding of tax on dispositions of U.S. real property interests by foreign individuals or entities. This detailed description will provide insights into the purpose, key components, and different types (if applicable) of the Overland Park Kansas Non-Foreign Affidavit Under IRC 1445. The main purpose of the Overland Park Kansas Non-Foreign Affidavit Under IRC 1445 is to certify that the seller of a U.S. real property interest is not a foreign person. The IRC 1445 requires the buyer (transferee) or the buyer's agent to withhold a specific percentage of the total sale price and remit it to the Internal Revenue Service (IRS) if the seller is a foreign individual or entity. However, if the seller can provide a valid Non-Foreign Affidavit, the withholding requirement is waived. The affidavit typically contains several crucial components. Firstly, it includes the names and contact information of the seller and buyer, along with their taxpayer identification numbers. The affidavit also requires the seller to provide proof of U.S. citizenship or legal residency, such as a social security number or an Individual Taxpayer Identification Number (ITIN). Additionally, the affidavit may contain a statement affirming the seller's knowledge and understanding of the penalties for filing a false affidavit. In some cases, there may not be different types of Overland Park Kansas Non-Foreign Affidavits Under IRC 1445 as the purpose of the affidavit remains consistent across transactions. However, it's worth mentioning that the affidavit may vary slightly based on specific requirements or guidelines set by the local jurisdiction or the involved parties. It is crucial to ensure compliance with any additional documentation or instructions provided by the real estate professionals or legal experts involved in the transaction. To conclude, the Overland Park Kansas Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions. Its primary purpose is to certify that the seller is not a foreign person, thereby exempting the buyer from the withholding tax requirements. By providing accurate information and completing this affidavit, individuals or entities involved in property transactions can ensure compliance with the IRC 1445 regulations and facilitate a smooth process.

Overland Park Kansas Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Overland Park Kansas Non-Foreign Affidavit Under IRC 1445?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person without any legal education to draft such papers cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Overland Park Kansas Non-Foreign Affidavit Under IRC 1445 or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Overland Park Kansas Non-Foreign Affidavit Under IRC 1445 in minutes using our trustworthy platform. In case you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, if you are a novice to our library, make sure to follow these steps prior to obtaining the Overland Park Kansas Non-Foreign Affidavit Under IRC 1445:

- Ensure the form you have chosen is suitable for your location considering that the regulations of one state or county do not work for another state or county.

- Review the document and read a brief description (if available) of cases the paper can be used for.

- In case the one you selected doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and pick the subscription option that suits you the best.

- with your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Overland Park Kansas Non-Foreign Affidavit Under IRC 1445 once the payment is done.

You’re good to go! Now you can proceed to print the document or complete it online. If you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.