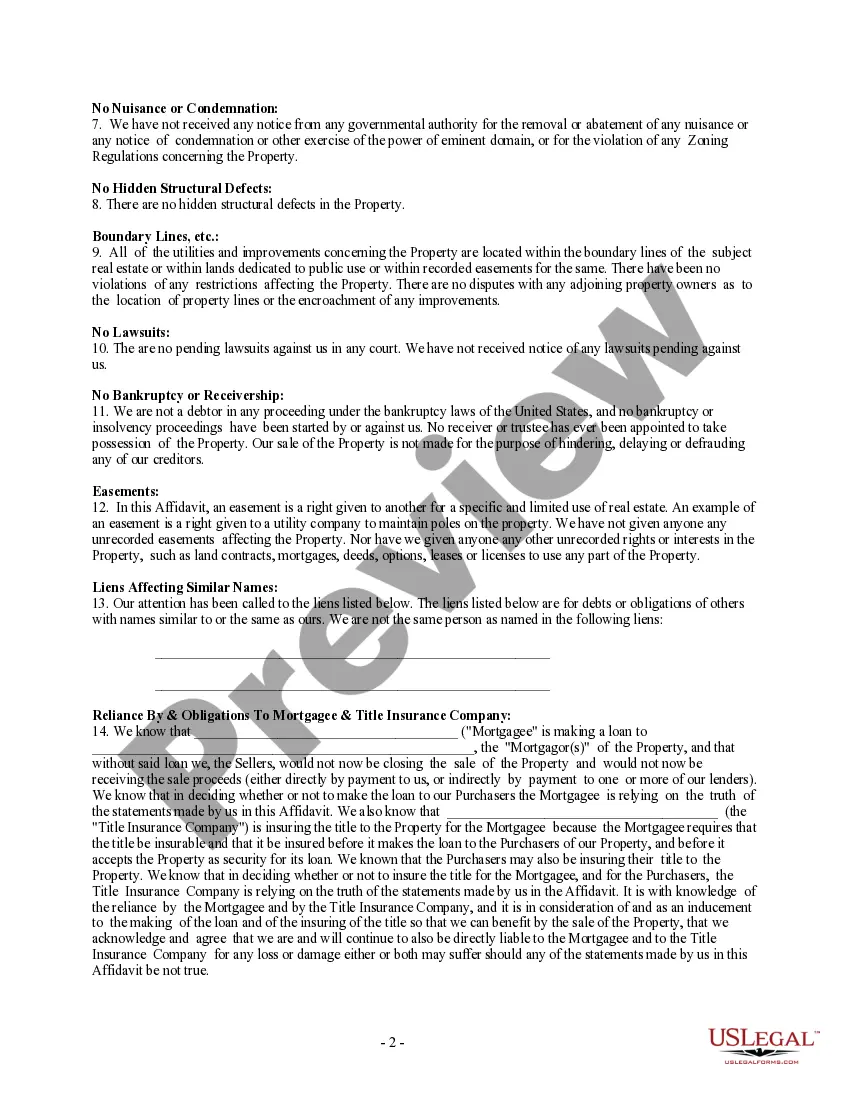

The Wichita Kansas Owner's or Seller's Affidavit of No Liens is a crucial legal document used during real estate transactions to ensure a smooth transfer of property ownership. This affidavit is intended to provide the buyer with assurance that the property being purchased is free from any liens or encumbrances that could impact their legal ownership rights. By filing this affidavit, the seller attests that there are no outstanding debts, mortgages, or other claims against the property. Some relevant keywords associated with the Wichita Kansas Owner's or Seller's Affidavit of No Liens include: 1. Real Estate: The affidavit is primarily used in real estate transactions in Wichita, Kansas, as a means to document the absence of any liens or encumbrances on a property being sold. 2. Affidavit: An affidavit is a sworn written statement, legally binding, where the seller declares specific facts regarding the property's lien status. This document must be signed and witnessed by a notary public. 3. No Liens: The affidavit asserts that no liens or encumbrances exist on the property at the time of sale. This includes any outstanding mortgages, loans, tax liens, or other claims that might affect the buyer's rights. 4. Ownership: The affidavit focuses on the ownership of the property and ensures that the seller has clear ownership rights and authority to transfer the property to the buyer. Types of Wichita Kansas Owner's or Seller's Affidavit of No Liens: 1. General Owner's Affidavit of No Liens: This is the most common type of affidavit used in Wichita, Kansas, where the seller states that they have full legal ownership of the property and that no liens or encumbrances exist on it. 2. Mortgage Lien Release Affidavit: In cases where the property has been previously mortgaged, this affidavit is used to confirm that the seller has paid off the mortgage in full and that no outstanding mortgage liens affect the property. 3. Tax Lien Affidavit: If the property has any pending tax liens, this affidavit specifically addresses the taxes owed, ensuring the buyer is aware of any outstanding obligations and confirming that they will be cleared entirely before the property's transfer. Remember, it is crucial to consult with a legal professional or title company to ensure that the specific affidavit form used conforms to the legal requirements in Wichita, Kansas, and includes any additional clauses relevant to the property's transaction.

Wichita Kansas Owner's or Seller's Affidavit of No Liens

Description

How to fill out Wichita Kansas Owner's Or Seller's Affidavit Of No Liens?

We consistently aim to reduce or avert legal complications when managing intricate law-related or financial matters.

To achieve this, we enlist attorney services that are typically quite costly.

However, not all legal issues are as complicated.

Many of them can be handled by ourselves.

Benefit from US Legal Forms whenever you need to obtain and download the Wichita Kansas Owner's or Seller's Affidavit of No Liens or any other document promptly and securely. Simply Log In to your account and click the Get button next to the document. If you happen to misplace the document, you can always re-download it from the My documents tab.

- US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our library empowers you to manage your affairs independently without resorting to a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

To have your name removed as vehicle owner from the vehicle record after the title has been assigned and delivered to the new owner, a Seller's Notification of Sale, Form TR-216 may be completed and submitted to the Titles and Registrations Bureau along with the required fee listed on the form.

To check the status of title for a vehicle or any relevant information, run a title lookup through Vehicle Title Status Check at the official Kansas Department of Revenue Motor Vehicle website. Enter a VIN, Vehicle Make, Model and Vehicle Year to retrieve title information.

If you have a clear Kansas paper title or lien release from a previous lender in your possession, you will need to surrender it to the lien holder and complete and sign an application for secured title, form TR-720B.

Titles After Loan Payoff If you would like to remove the lien holder's name from the title, you must fill out an application for a reissue title (TR-720B) and bring it, along with your current vehicle registration, title and lien release to any one of the tag offices. The cost is $10.00.

Gather Documents Certificate of Title. Complete the reverse side of the title: Odometer Statement. Complete the odometer disclosure on the back of the title.Release of Liability. Complete the Seller's Notification of Sale (Form TR-216).Bill of Sale. Kansas doesn't require a bill of sale.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

Here are the documents you should have to make your life easier when you come to sell. V5C logbook. Service history. MOT certificate history. Repairs and parts receipts. Remaining car warranty. Number plate retention form (V317) if applicable. Car owner's handbook. Proof of reservation and purchase receipts.

You only need a bill of sale in Kansas if the vehicle being registered is an antique at least 35 years old without a title or the title you have doesn't have a figure listed for the sale amount.

If there is a lien on the title (usually this means the owner owes money on the car), the lienholder must release interest in the vehicle before the car is sold. This can be achieved either by the seller paying off the car or by the lienholder providing a letter of lien release.

You will need to complete the Application for Secured/Duplicate/Reissue Title, form TR-720B that includes the following information: vehicle year, make and identification number, owner's name(s) and the current odometer reading. Include appropriate title fee. The title fee in Kansas is $10.