Wichita Kansas Dissolution Package to Dissolve Corporation

Description

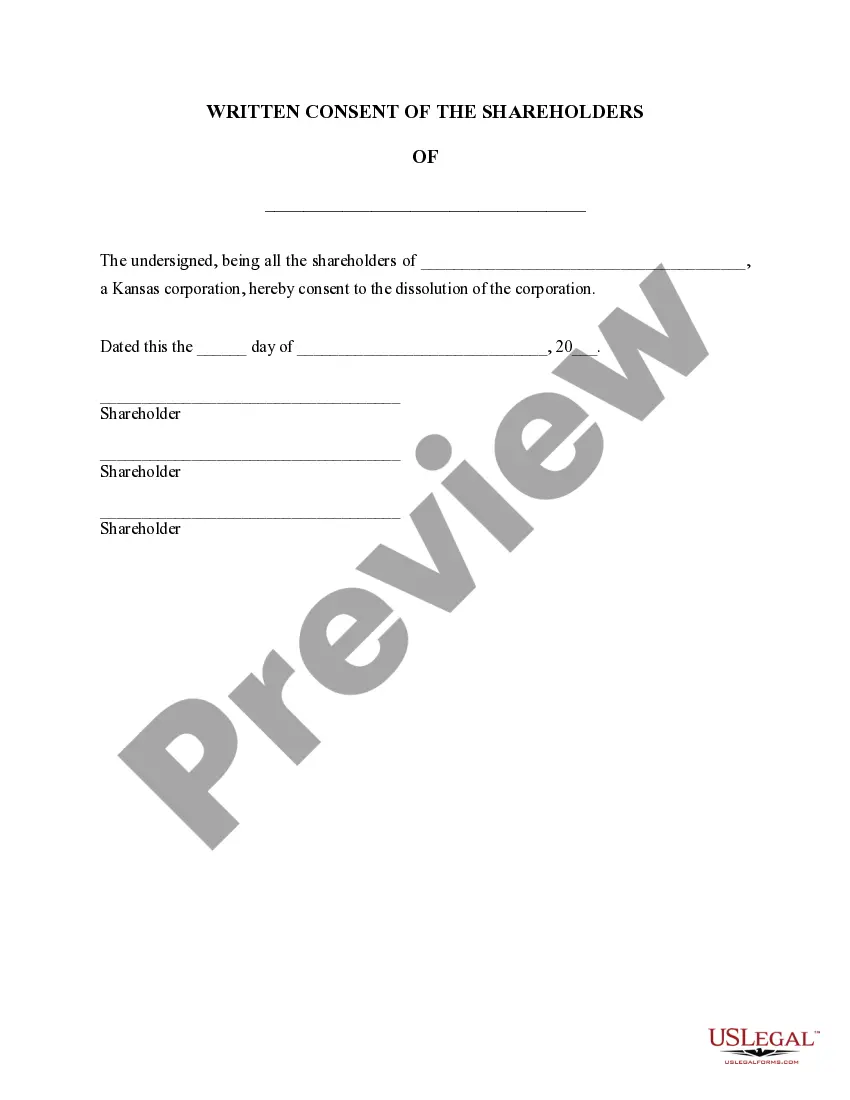

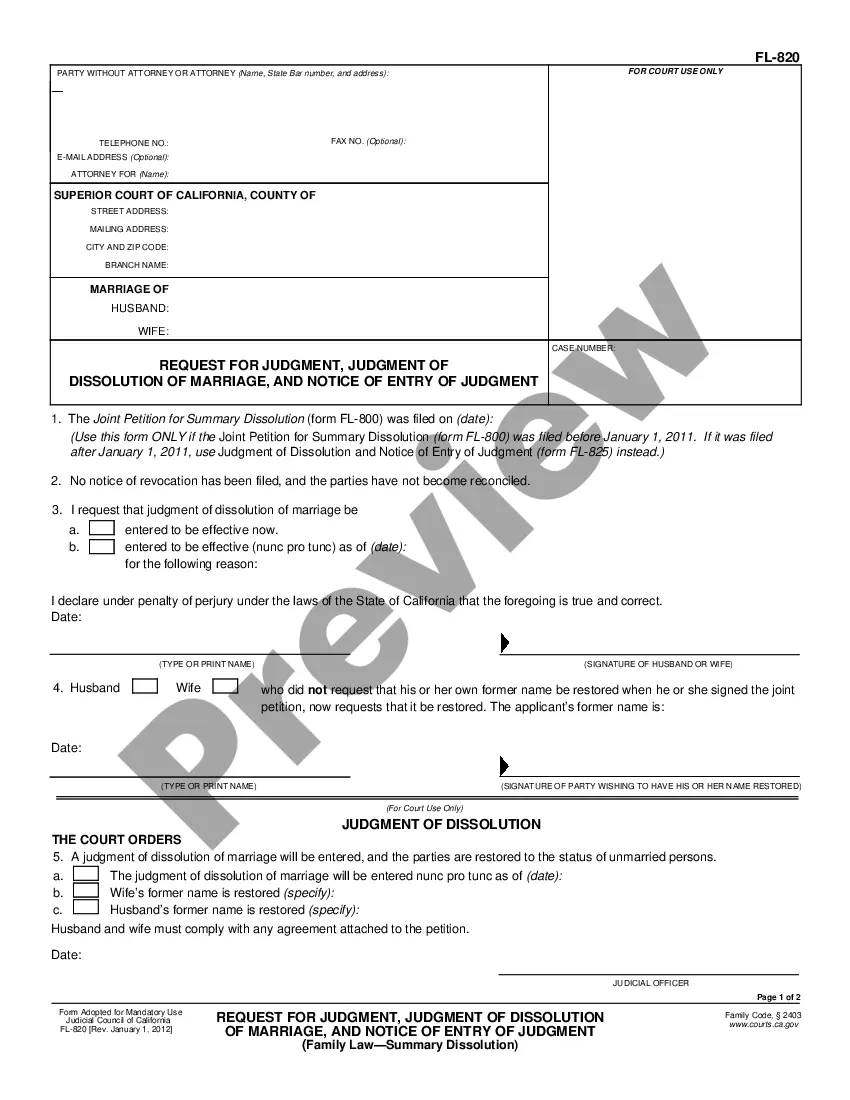

How to fill out Kansas Dissolution Package To Dissolve Corporation?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our advantageous website, featuring a vast selection of templates, simplifies the process of locating and obtaining almost any document sample you require.

You can download, complete, and validate the Wichita Kansas Dissolution Package to Terminate Corporation in just a few minutes instead of spending hours online searching for a suitable template.

Using our repository is a fantastic approach to enhance the security of your document submission.

If you haven’t created an account yet, follow the steps outlined below.

Feel free to utilize our form catalog and make your document experience as hassle-free as possible!

- Our knowledgeable attorneys consistently review all the documents to ensure that the templates are applicable to specific jurisdictions and comply with the latest laws and regulations.

- How can you acquire the Wichita Kansas Dissolution Package to Terminate Corporation.

- If you possess a subscription, simply Log In to your account.

- The Download option will show up on every document you view.

- Moreover, you can access all your previously saved files in the My documents section.

Form popularity

FAQ

Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more owners and more assets.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

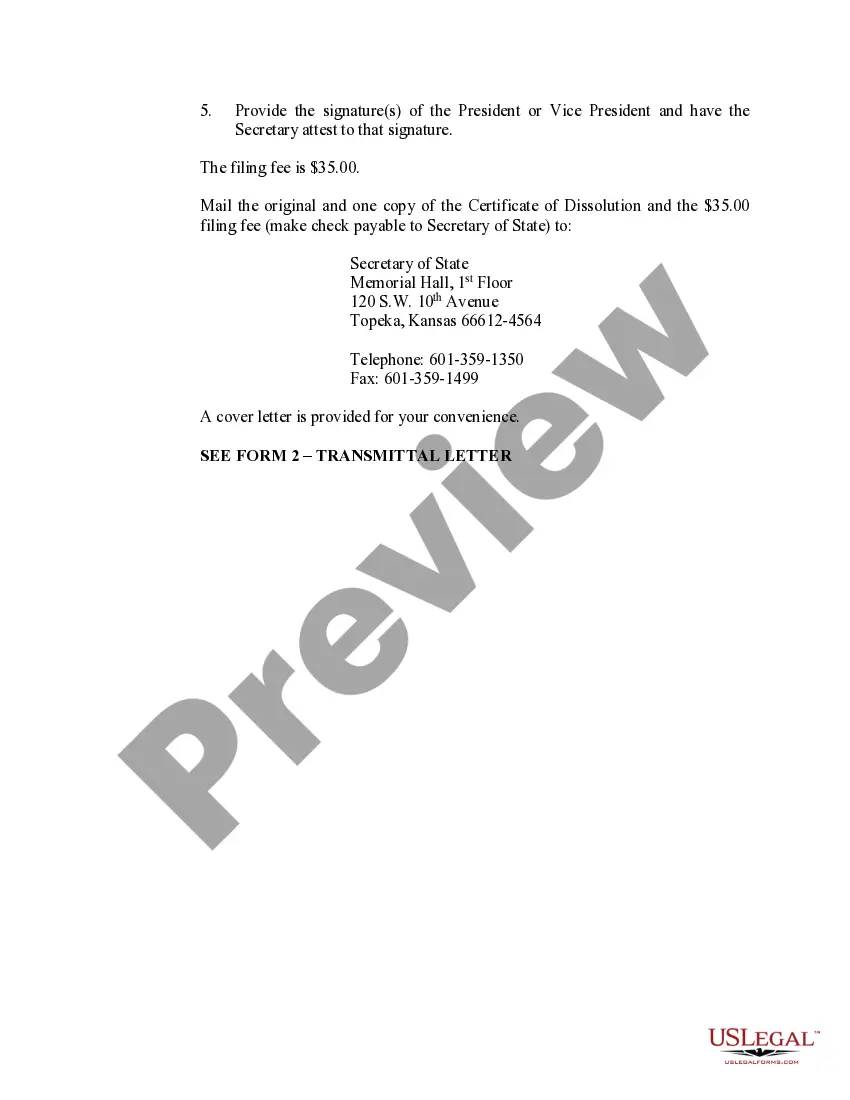

What to do when closing a business: Complete the Notice of Business Closure (CR-108) Return the completed form to: Kansas Department of Revenue, 915 SW Harrison Street, Topeka, KS 66625-9000 or FAX to 785-291-3614. Include information on the date the business was closed. Make sure all tax filings are current.

The Official Receiver attempts to sell the assets of the company and then uses the funds raised to pay back lenders a proportion of the original amount of money they gave as credit. The authorities may also sell assets to meet any outstanding tax liabilities.

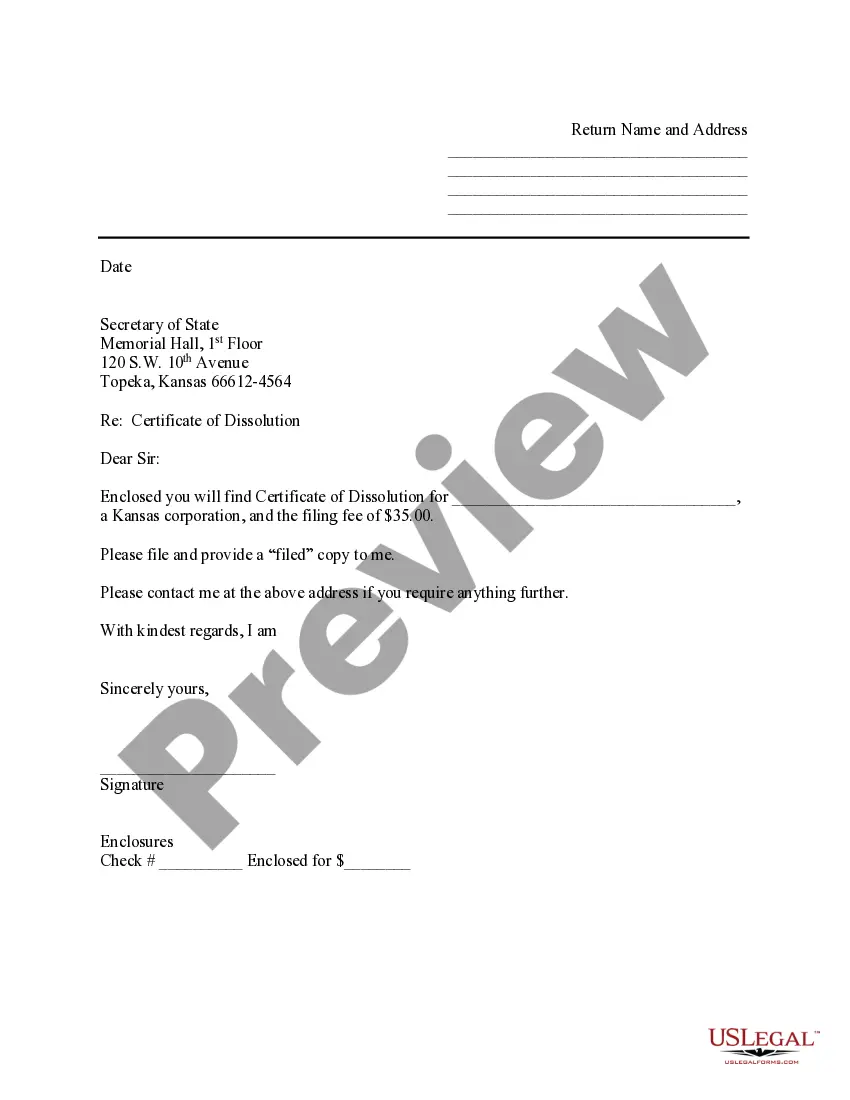

Dissolution of a Corporation is the termination of a corporation, either a) voluntarily by resolution, paying debts, distributing assets, and filing dissolution documents with the Secretary of State; or b) by state suspension for not paying corporate taxes or some other action of the government.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

Dissolving a company is a formal way of closing it. Dissolution refers to the process of 'striking off' (removing) a company from the Companies House register. It can be the most straightforward way of shutting a company down once its directors have decided it should no longer trade.

A corporation can be dissolved only when its property has been distributed and its liabilities have been discharged.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.