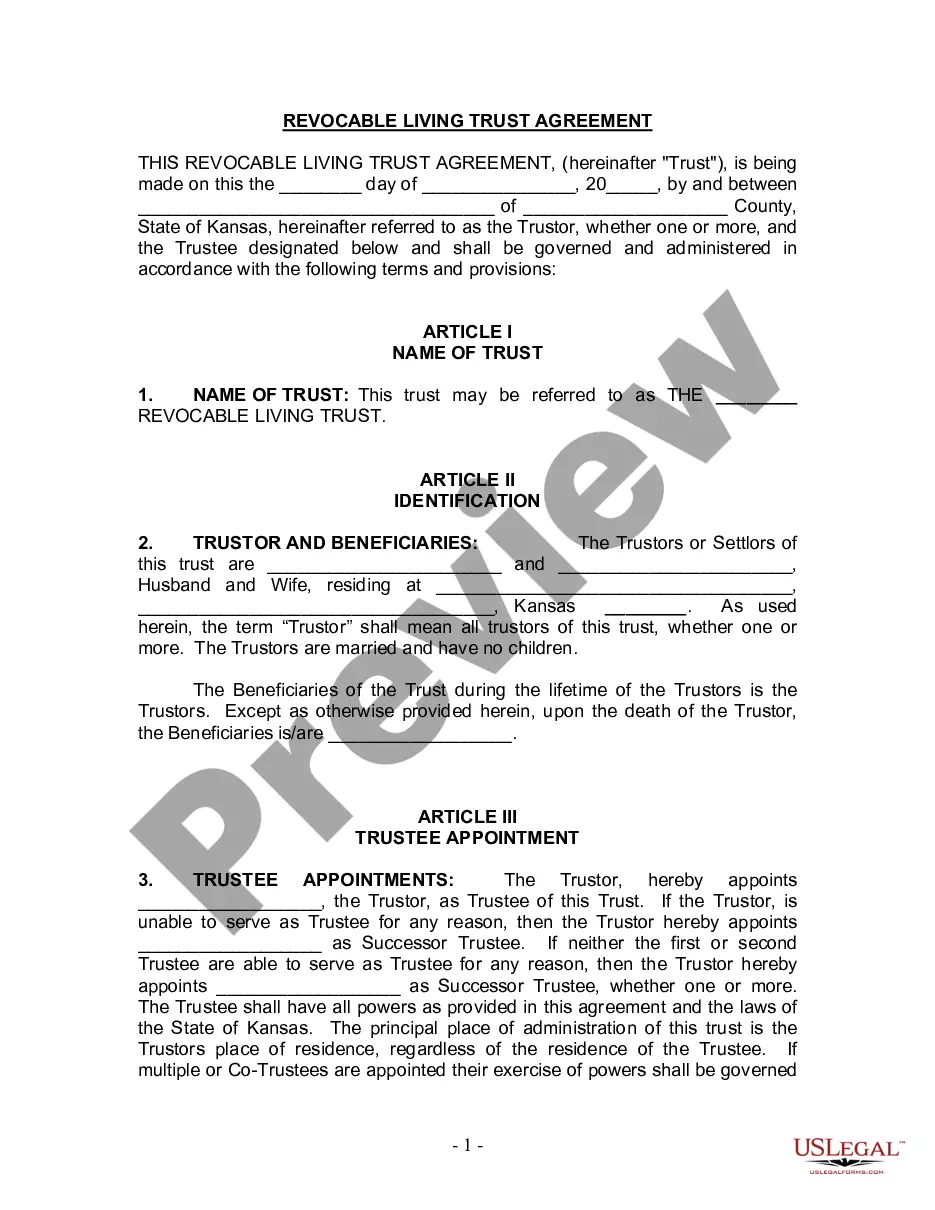

Title: Exploring Overland Park Kansas Living Trust for Husband and Wife with No Children: Types and Benefits Introduction: If you and your spouse reside in Overland Park, Kansas, and have no children, considering a living trust can be a wise estate planning decision. A living trust provides a comprehensive solution for the seamless transfer of assets, privacy, and flexibility in managing your affairs. In this article, we will delve into the intricacies of living trusts tailored specifically for couples in Overland Park, Kansas, with no children. Let's explore the different types of living trusts available and how they can benefit you. 1. Revocable Living Trust: The most common type of living trust for couples without children in Overland Park is a revocable living trust. This trust allows you and your spouse to maintain complete control over your assets while providing an avenue to avoid probate, which can be time-consuming and costly. The key advantage of a revocable living trust is that it can be altered or revoked during your lifetime. 2. Irrevocable Living Trust: Unlike the revocable trust, an irrevocable living trust cannot be altered or revoked once established. Overland Park couples without children might opt for this type of trust to protect and preserve assets from estate taxes, creditor claims, or potential lawsuits. Irrevocable trusts can offer significant tax advantages and asset protection benefits, but it's important to consult an attorney familiar with estate planning laws in Overland Park. 3. Testamentary Trust: While not strictly a living trust, a testamentary trust is created within a will and becomes effective upon the passing of one or both spouses. This trust ensures that your assets are distributed according to your wishes, even if they are no longer physically present. It can include provisions to protect assets, avoid probate, and dictate how funds are used on behalf of the surviving spouse. Benefits of Overland Park Kansas Living Trust for Husband and Wife with No Children: — Avoidance of probate: A living trust enables the seamless and private transfer of assets without the need for probate proceedings, saving time and expenses. — Asset protection: An irrevocable living trust can shield assets from potential lawsuits, creditors, or avoid excessive estate taxes. — Privacy and control: By utilizing a living trust, you can maintain your privacy and retain control over your assets during your lifetime, preventing interference from third parties. — Incapacity planning: Living trusts offer provisions for managing your assets and healthcare decisions if you or your spouse become incapacitated, ensuring your needs are cared for. — Ensuring your legacy: Testamentary trusts within a living trust document allow you to leave a lasting legacy by specifying how your assets will benefit charitable causes or organizations. Conclusion: Overland Park couples without children can significantly benefit from establishing a living trust tailored to their unique circumstances. Whether choosing a revocable or irrevocable living trust, or incorporating a testamentary trust within their estate plan, the advantages of privacy, asset protection, and seamless asset transfer are invaluable for securing one's legacy. Seek legal guidance from an Overland Park attorney specializing in estate planning to ensure your living trust aligns with local laws and your specific goals.

Overland Park Kansas Living Trust for Husband and Wife with No Children

Description

How to fill out Overland Park Kansas Living Trust For Husband And Wife With No Children?

If you’ve previously made use of our service, Log In to your account and download the Overland Park Kansas Living Trust for Husband and Wife without Children to your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to access them again. Utilize the US Legal Forms service to efficiently locate and save any template for your personal or professional requirements!

- Ensure you’ve found a suitable document. Review the description and utilize the Preview option, if available, to verify it fulfills your requirements. If it does not fit your needs, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Set up an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Overland Park Kansas Living Trust for Husband and Wife without Children. Select the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

The most common living trust is the revocable living trust, which allows you to retain control over your assets while planning for their future distribution. Such a trust can effectively address concerns about incapacity and probate. Crafting an Overland Park Kansas Living Trust for Husband and Wife with No Children can be a proactive step towards simplifying your estate planning.

The best type of trust for a married couple typically depends on individual circumstances. Generally, a joint revocable living trust offers simplicity and flexibility for couples. An Overland Park Kansas Living Trust for Husband and Wife with No Children can provide a straightforward approach to managing shared assets while preparing for the future.

The most popular form of marital trust is the Qualified Terminable Interest Property (QTIP) trust. This trust allows a spouse to receive income from the trust assets during their lifetime, while also providing controlled distribution after their death. Choosing an Overland Park Kansas Living Trust for Husband and Wife with No Children can help ensure that you meet both your immediate and long-term estate planning goals.

Setting up a living trust in Kansas involves a few key steps. First, you should identify the assets you wish to include in the trust. Next, create the trust document, which outlines the terms and conditions. Utilizing platforms like uslegalforms can simplify this process, especially for those interested in an Overland Park Kansas Living Trust for Husband and Wife with No Children.

For remarried couples, a revocable living trust is often the most suitable option. This type of trust allows you to manage your assets during your lifetime and direct their distribution after your passing. By establishing an Overland Park Kansas Living Trust for Husband and Wife with No Children, you can efficiently manage your estate while maintaining flexibility over how your assets are handled.

If you are married without children, you may think a trust is unnecessary, but that’s not always the case. An Overland Park Kansas Living Trust for Husband and Wife with No Children can still serve important purposes, such as managing your assets and specifying how they are distributed upon death. It can also protect your spouse by ensuring they have access to resources without legal hurdles. Therefore, having a trust can be a valuable decision even without children.

Having a trust is not a requirement for a marriage, but it can be beneficial. An Overland Park Kansas Living Trust for Husband and Wife with No Children allows couples to manage their assets more effectively and ensures that they can control the distribution of their estate after death. Furthermore, it can help avoid probate, making the process easier for your loved ones. Therefore, while it isn't mandatory, a trust can provide peace of mind.

Yes, you can remain married without establishing a trust. However, it is important to consider how your assets will be managed and transferred in the future. An Overland Park Kansas Living Trust for Husband and Wife with No Children can simplify this process and provide clarity for you and your spouse. Without a trust, you may need to rely on probate, which can be a lengthy and costly process.

The best living trust for a married couple is typically a joint revocable living trust. This type of trust allows both spouses to retain control over the trust assets while they are alive. In the case of death, the surviving spouse can easily manage the assets without the need for probate. For those creating an Overland Park Kansas Living Trust for Husband and Wife with No Children, this structure offers flexibility and ensures the efficient transfer of assets.

A living trust in Kansas serves as a legal arrangement where you transfer ownership of your assets to the trust. This allows you, as the trustee, to manage your assets while you are alive. Upon your passing, the assets in the trust can seamlessly pass to your beneficiaries without going through probate. For couples considering an Overland Park Kansas Living Trust for Husband and Wife with No Children, this process simplifies asset distribution and provides peace of mind.