Topeka, Kansas Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children: Explained Living Trusts are legal documents that allow individuals to manage and distribute their assets during their lifetime and after their death. In Topeka, Kansas, specific Living Trust options cater to individuals who are single, divorced, widowed, or widowers with no children. Let's delve into the different types of Living Trusts available in Topeka, Kansas for this specific group: 1. Revocable Living Trust: A Revocable Living Trust grants complete control to the individual setting up the trust (the granter) while they are alive. It provides flexibility to make changes or revoke the trust entirely if circumstances change. A single person, divorced individual, or a widow(er) with no children might opt for a revocable living trust to ensure their assets are protected and distributed according to their wishes. 2. Irrevocable Living Trust: An Irrevocable Living Trust offers more asset protection, as the granter cannot make changes or revoke the trust without consent from the trust's beneficiaries. This type of trust is suitable for individuals who want to protect their assets from potential creditors or ensure efficient long-term care planning. 3. Testamentary Trust: A Testamentary Trust is created through a will after an individual's passing. This trust becomes effective upon death and provides a way to designate how assets should be distributed. It is especially relevant for those without children, as it allows the granter to determine specific beneficiaries, such as other family members, friends, or charitable organizations. 4. Charitable Remainder Trust: For individuals who wish to leave a lasting legacy or support philanthropic causes, a Charitable Remainder Trust can be established. This trust allows the granter to provide income for themselves or a named beneficiary during their lifetime, with the remaining assets going to a charitable organization upon their death. With no children in the picture, this type of trust can make a significant impact in communities and causes within Topeka. 5. Pet Trust: If an individual without children has beloved pets they need to ensure are taken care of after their passing, a Pet Trust can be created. This trust enables the granter to set aside funds and designate a caretaker or provide instructions for the care, support, and welfare of their pets, ensuring they continue to receive proper care and attention. Whether you are single, divorced, or a widow(er) with no children in Topeka, Kansas, having a Living Trust tailored to your specific circumstances can provide peace of mind that your assets will be protected and distributed according to your preferences. Consult with an experienced estate planning attorney who can guide you through the process and help you select the most appropriate Living Trust option for your situation.

Topeka Kansas Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

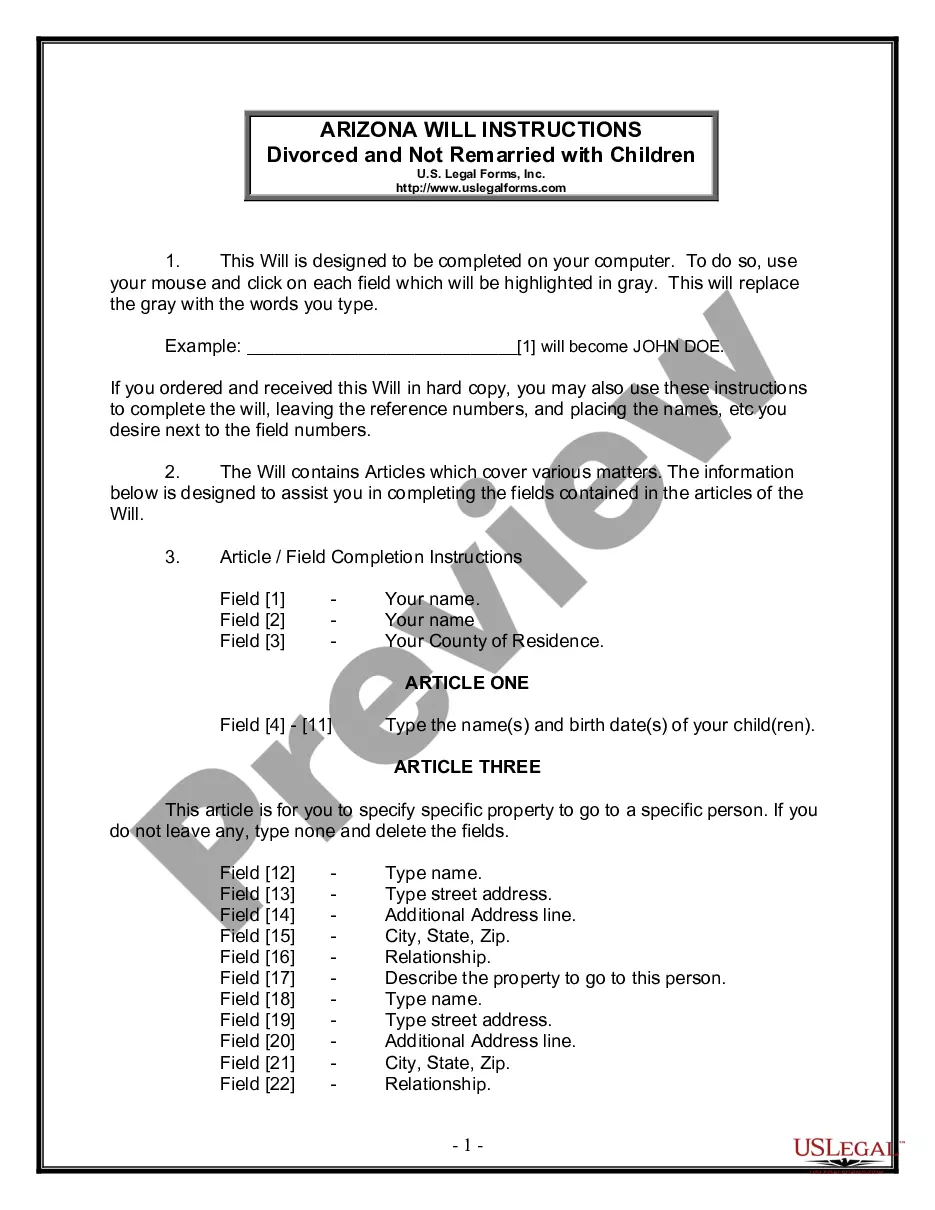

How to fill out Topeka Kansas Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Are you looking for a trustworthy and affordable legal forms provider to buy the Topeka Kansas Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children? US Legal Forms is your go-to option.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of particular state and area.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Topeka Kansas Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is good for.

- Restart the search if the form isn’t good for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Topeka Kansas Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal papers online for good.