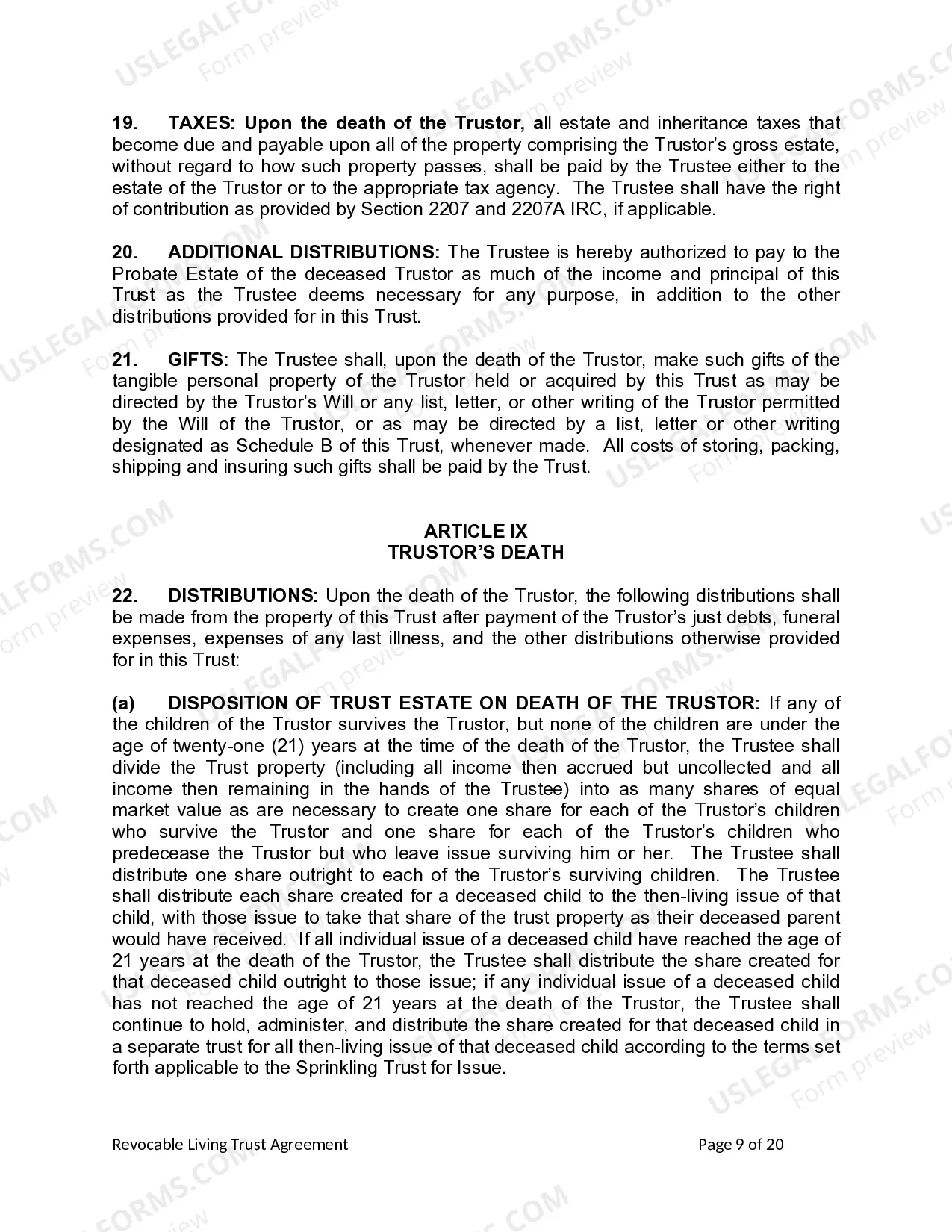

Wichita Kansas Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Wichita Kansas Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

If you have previously utilized our service, Log In to your account and acquire the Wichita Kansas Living Trust for individuals who are Single, Divorced, or a Widow (or Widower) with Children on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it per your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to secure your file.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Leverage the US Legal Forms service to swiftly discover and save any template for your personal or business needs!

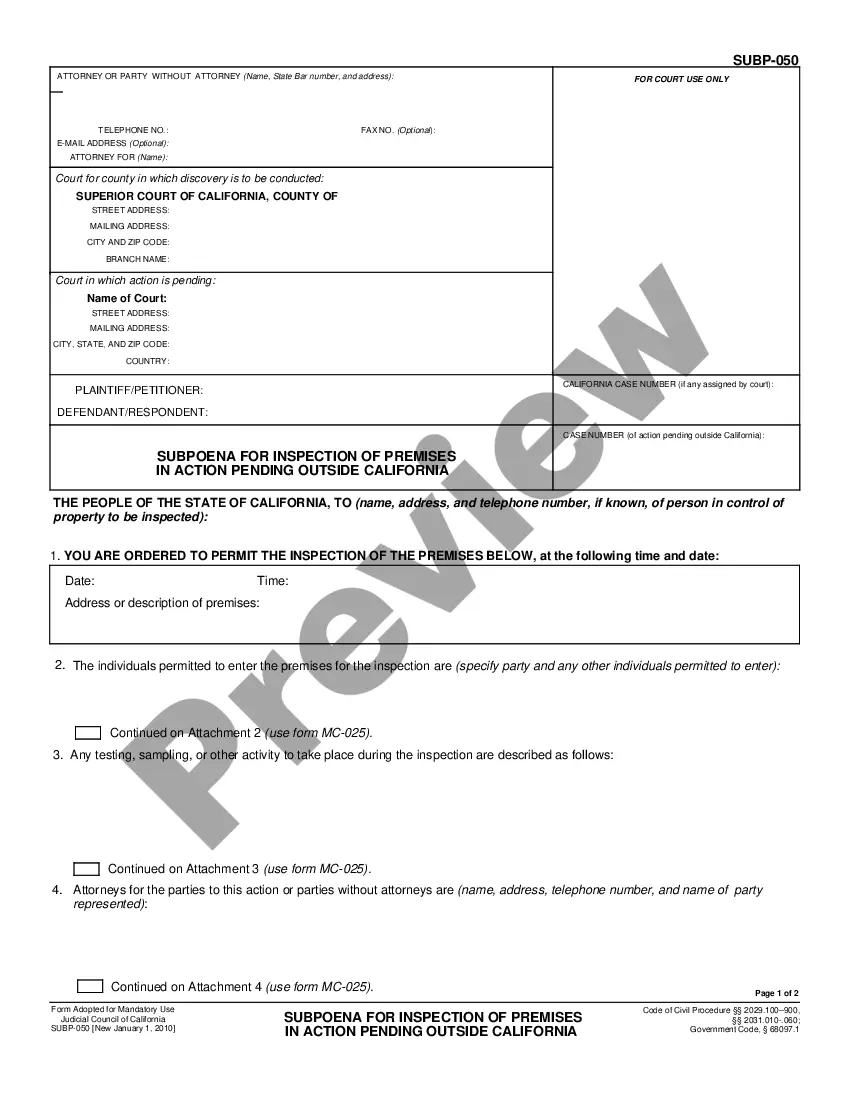

- Ensure you’ve found the correct document. Review the description and utilize the Preview feature, if available, to verify it fulfills your requirements. If it does not meet your needs, use the Search tab above to find the appropriate one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Wichita Kansas Living Trust for individuals who are Single, Divorced, or a Widow (or Widower) with Children. Select the file format for your document and save it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

Living Trusts in Kansas The settlor places assets into the trust and chooses a trustee. The trustee can be anyone, but cannot be the only beneficiary of the trust. Many people name themselves to be trustee and select a successor trustee to manage the trust after death.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

Trust of immovable property. ?No trust in relation to immoveable property is valid unless declared by a non-testamentary instrument in writing signed by the author of the trust or the trustee and registered, or by the will of the author of the trust or of the trustee.

Most living trusts are revocable, meaning they can be changed or deleted during the settlor's life. An irrevocable living trust becomes permanent once it is created. A living trust in Kansas may be created if the settlor lives in Kansas, the trustee lives or works in Kansas, or trust property is located in Kansas.

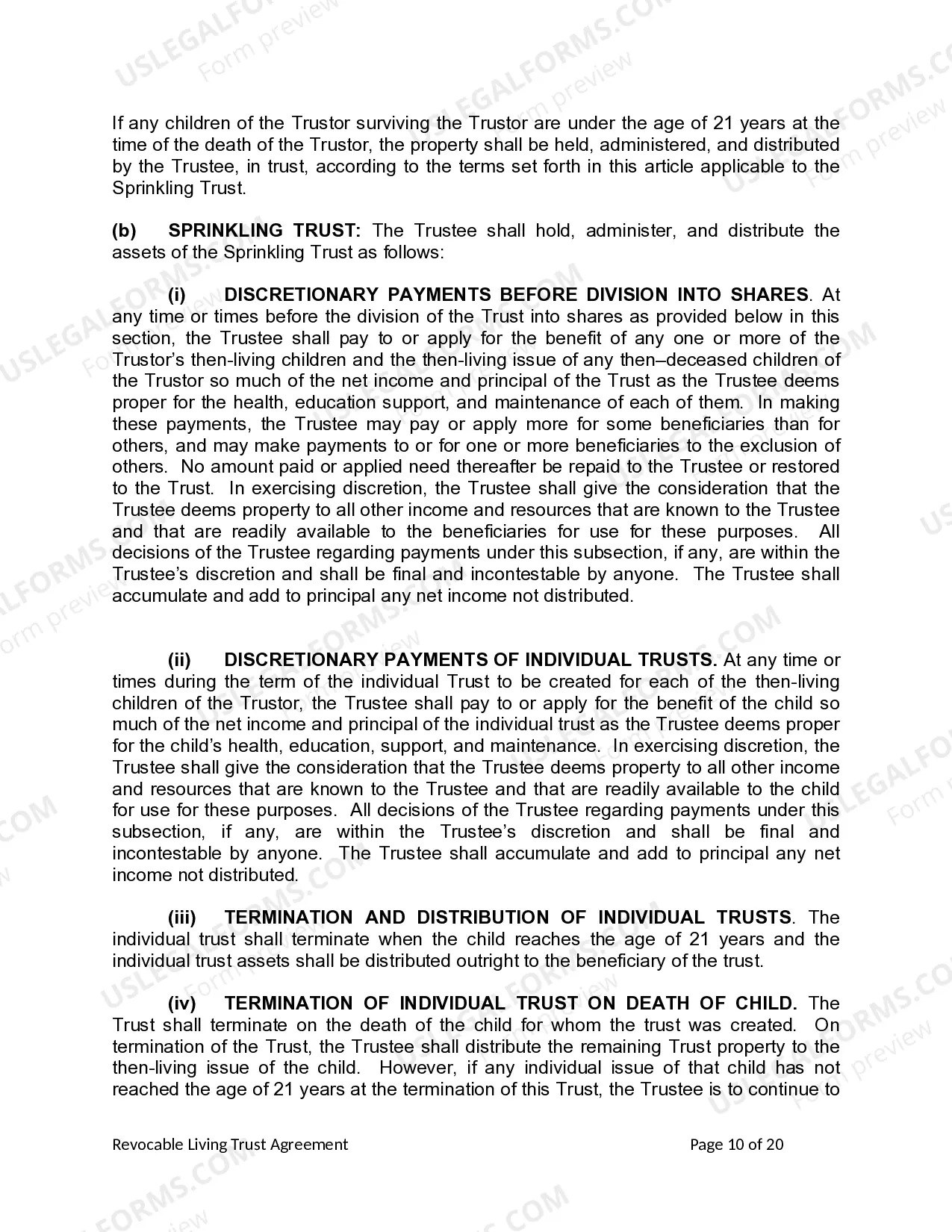

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

Simply put, the primary goal of a will is to distribute your estate, the primary goals of a trust are to distribute your estate, reduce estate taxes and avoid probate whenever possible.

By federal and state law, a trust can remain open for up to 21 years AFTER the death of anyone living at the time the trust was created. The special needs trust remains in effect throughout the person's lifetime.

You can create a living trust through two different ways: you can hire an attorney or you can use an online program. Hiring an attorney will cost you more than $1,000. If you choose to use the DIY approach, you'll spend a few hundred dollars.

Death within 7 years of making a transfer If you die within 7 years of making a transfer into a trust your estate will have to pay Inheritance Tax at the full amount of 40%. This is instead of the reduced amount of 20% which is payable when the payment is made during your lifetime.

Deciding between a Will and a Trust depends on your circumstances; there are pros and cons of each. For example, a Trust can be used to avoid probate and reduce Estate Taxes, whereas a Will cannot.

Interesting Questions

More info

The family also included a sister who died violently at age 34. “I'd been taking the medications for a few weeks because I was afraid that they were going to shut the medication down,” she said in a 2008 press conference. The police never found the body. Police were called to an elder care facility on an apparent suicide at 2 p.m. on July 20, 2011, and an investigation found that the woman, Susanne Piggies, had a long history of violent, erratic, and sometimes suicidal behavior with her children, including her oldest son “who had become involved in an earlier case for which he was sentenced to life imprisonment. Susanne told police that some of her actions were out of frustration, including choking two children and biting another. She had a history of threatening and harming her stepchildren, ages 6 and 30.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.