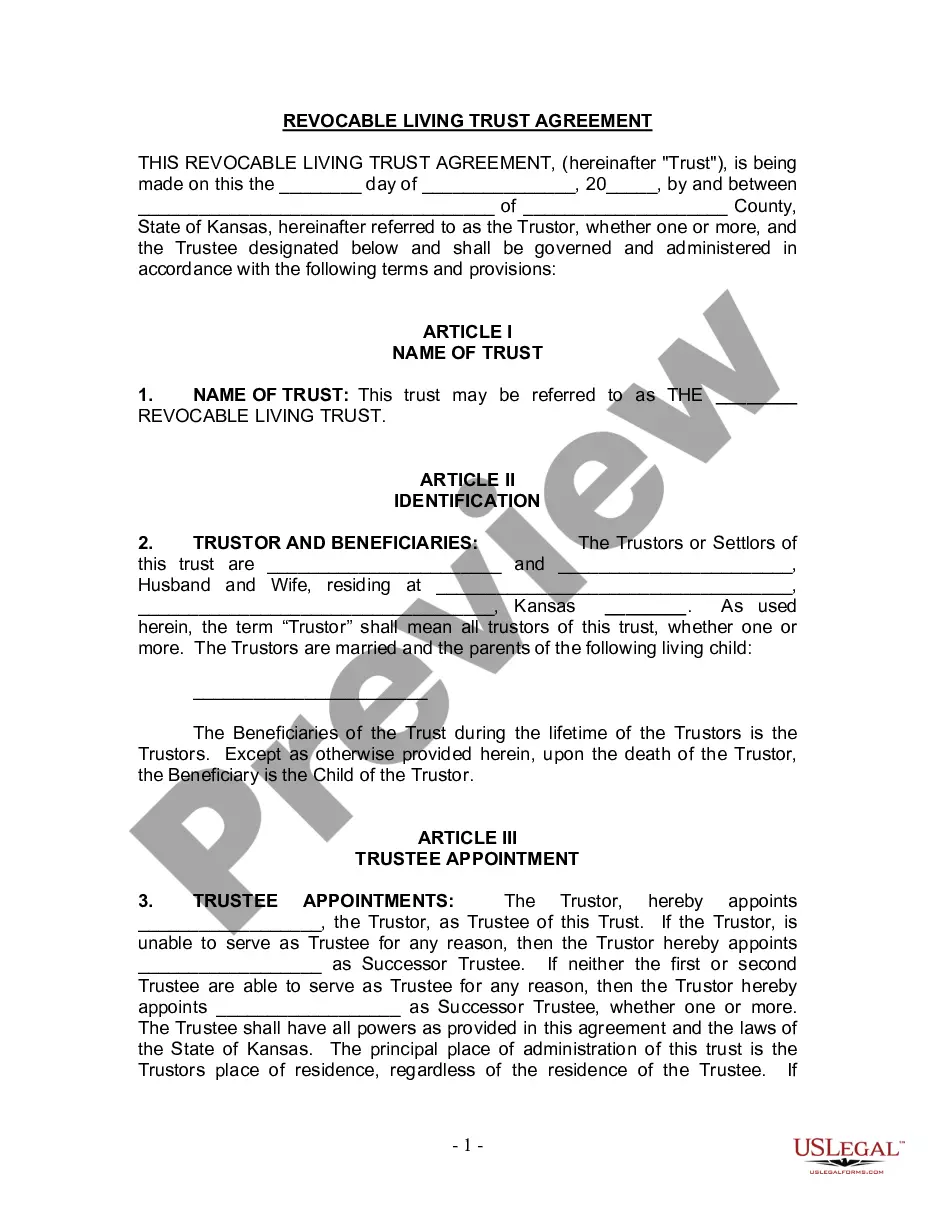

Olathe Kansas Living Trust for Husband and Wife with One Child: A Comprehensive Guide A living trust is a legal document that allows individuals to protect and manage their assets during their lifetime and dictate how those assets are distributed after their passing. In Olathe, Kansas, couples with one child can create a specific type of living trust tailored to their unique family dynamic. Here, we will delve into the details of the Olathe Kansas Living Trust for Husband and Wife with One Child, exploring its benefits, necessary components, and potential variations based on specific considerations. Benefits of an Olathe Kansas Living Trust for Husband and Wife with One Child: — Probate Avoidance: A living trust helps bypass the costly and time-consuming process of probate, ensuring a seamless transfer of assets to the designated beneficiaries. — Privacy: Unlike a will, which becomes public record after probate, a living trust affords privacy and confidentiality to the family's financial affairs. — Incapacity Planning: A living trust incorporates plans for incapacity, ensuring that the assets are properly managed and utilized in case one or both spouses become incapacitated. — Flexibility: The trust can be modified, updated, or revoked during the granter's lifetime, providing adaptability to changing circumstances. Necessary Components of an Olathe Kansas Living Trust for Husband and Wife with One Child: 1. Trust or/Granter: The husband and wife who create the trust and transfer their assets into it. 2. Trustee: The individual or institution chosen to manage and distribute the trust's assets. It is common for the couple to act as co-trustees during their lifetime. 3. Successor Trustee: A designated person or institution who takes over the trustee's responsibilities upon the death or incapacity of the primary trustees. 4. Beneficiaries: The child of the couple, who will inherit the assets in accordance with the terms of the trust. 5. Assets: Real estate, investments, bank accounts, and other valuable possessions to be included in the trust. 6. Trust Terms: The specific instructions regarding the distribution of assets, management of trust, and any special provisions such as educational expenses or charitable contributions. Different Variations of Olathe Kansas Living Trust for Husband and Wife with One Child: 1. Testamentary Trust: This trust is established within a will and comes into effect only after the death of the granters. It allows parents to ensure their child's financial well-being while maintaining control over how and when the assets are distributed. 2. Revocable Living Trust: This form of trust is changeable or revocable during the granters' lifetime. It provides flexibility in managing the assets and can help avoid probate upon the granters' death. 3. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be amended or revoked without the consent of beneficiaries. It may be utilized for tax planning, asset protection, or Medicaid planning purposes. In conclusion, the Olathe Kansas Living Trust for Husband and Wife with One Child offers numerous advantages in terms of probate avoidance, privacy, incapacity planning, and flexibility. By understanding its components and potential variations, couples can make informed decisions to protect their assets and ensure future financial security for their sole child. Seek legal advice from experienced professionals to create a living trust that aligns with your specific and unique family structure and goals.

Olathe Kansas Living Trust for Husband and Wife with One Child

Description

How to fill out Olathe Kansas Living Trust For Husband And Wife With One Child?

If you’ve previously utilized our service, Log In to your account and download the Olathe Kansas Living Trust for Husband and Wife with One Child onto your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have acquired: you can find them in your profile within the My documents section whenever you need to utilize them again. Make the most of the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Verify you’ve located an appropriate document. Review the description and utilize the Preview feature, if available, to confirm it fits your needs. If it doesn’t meet your criteria, use the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and make a payment. Use your credit card information or the PayPal method to finalize the payment.

- Receive your Olathe Kansas Living Trust for Husband and Wife with One Child. Select the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A trust functions as a tool for managing and distributing assets, especially for couples. With the Olathe Kansas Living Trust for Husband and Wife with One Child, both partners can contribute assets and outline how each person’s share will be handled after death. This arrangement can provide for your child effectively while ensuring that both partners' wishes are respected. Consider using uslegalforms to establish a clear and legally binding trust tailored to your family's needs.

Yes, a married couple can indeed have one trust, and the Olathe Kansas Living Trust for Husband and Wife with One Child is designed specifically for this purpose. By having a single trust, both spouses can collectively manage their assets and designate how these will be distributed to their child. This unified approach can reduce administrative costs and streamline the estate planning process. Utilizing uslegalforms offers resources to create the ideal joint trust.

The Olathe Kansas Living Trust for Husband and Wife with One Child is often the best option for many couples. This type of trust allows both spouses to manage their assets together while providing clarity for their child's inheritance. It can simplify the process of transferring assets and help avoid probate, ensuring that your wishes are honored efficiently. Exploring options through uslegalforms can guide you in setting up the right trust for your needs.

Even if you have only one child, establishing a living trust can be beneficial for your family. An Olathe Kansas Living Trust for Husband and Wife with One Child simplifies the transfer of assets upon your passing and can help avoid probate. This legal strategy also allows for greater control over how your assets are managed and distributed. Ultimately, it offers peace of mind knowing your child will inherit according to your wishes.

To write a living trust in Kansas, you should start by gathering important information about your assets and beneficiaries. Next, work with a qualified attorney or use an online platform like US Legal Forms, which offers templates specifically designed for an Olathe Kansas Living Trust for Husband and Wife with One Child. This helps you ensure that the trust complies with state laws. Finally, make sure to fund the trust by transferring ownership of your assets into it.

One potential downfall of having an Olathe Kansas Living Trust for Husband and Wife with One Child is the ongoing management required. Keeping records, filing taxes, and meeting legal requirements can be burdensome for some individuals. Additionally, trusts may not provide the same tax benefits as other estate planning options. It's important to weigh these factors against the benefits of smooth asset management and distribution.

If your parents are considering estate planning, establishing an Olathe Kansas Living Trust for Husband and Wife with One Child could be beneficial. A trust can help protect their assets from probate, ensuring a smoother transition for you as their child. In addition, a trust allows them to dictate how and when the assets are distributed. Seeking professional advice can help them evaluate whether a trust is the right choice.

Yes, a married couple can indeed create one living trust, such as an Olathe Kansas Living Trust for Husband and Wife with One Child, to manage their shared assets. This approach simplifies the estate planning process and ensures seamless asset distribution. By combining assets into a single trust, couples can reduce administrative efforts and potentially lower costs. It's advisable to consult with a legal expert to ensure proper structuring.

Parents often overlook the importance of proper funding when creating a trust fund like an Olathe Kansas Living Trust for Husband and Wife with One Child. It is essential to transfer assets into the trust to ensure that it functions effectively. Leaving assets outside the trust can lead to unintended consequences, including probate. Working with professionals can provide guidance in properly funding and managing the trust.

A family trust, such as an Olathe Kansas Living Trust for Husband and Wife with One Child, can sometimes lead to family conflicts. Diverging views regarding asset distribution among beneficiaries may cause tensions. Furthermore, if family members disagree on how the trust should be managed, it could create complications and stress. Clear communication and understanding among family members can help mitigate these issues.