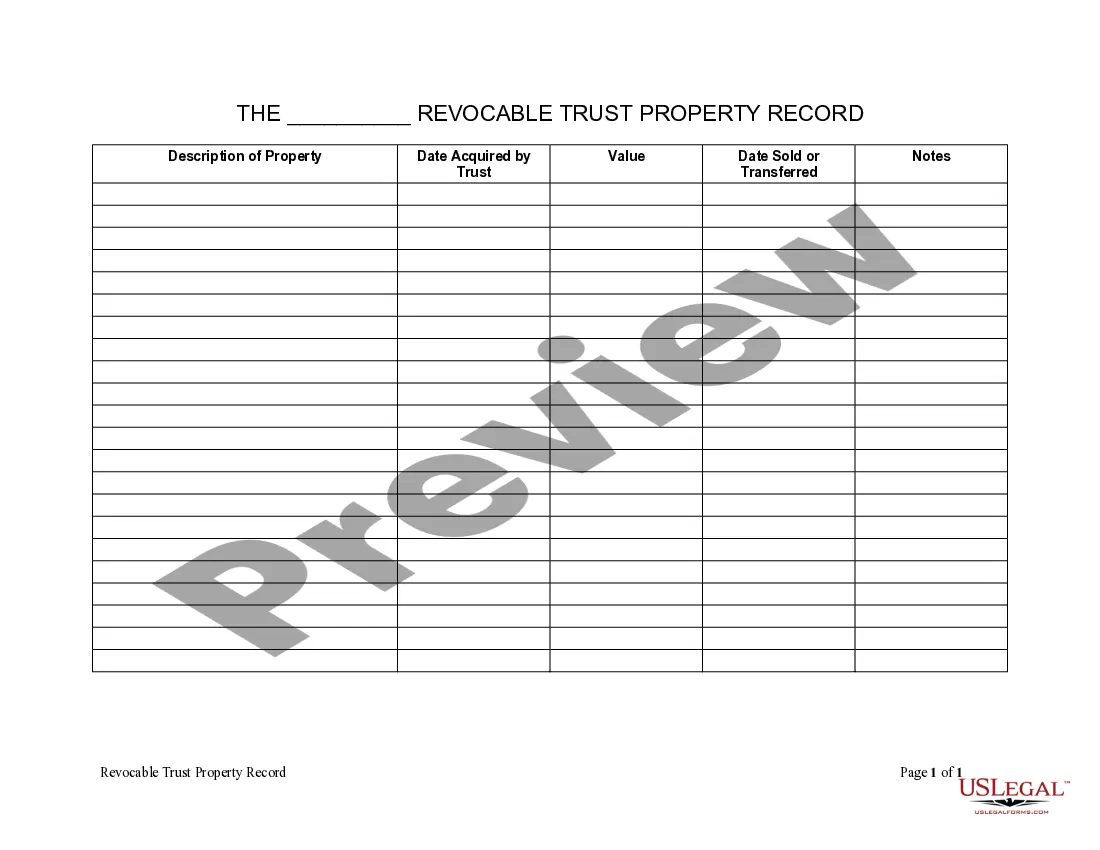

Wichita Kansas Living Trust Property Record serves as a comprehensive documentation of properties held within a living trust arranged by residents of Wichita, Kansas. A living trust is a legal entity created by individuals to hold assets during their lifetime, with the aim of avoiding probate court proceedings upon their death. By placing assets such as real estate, financial accounts, or personal belongings into a living trust, individuals maintain control over their properties and ensure easier transference to beneficiaries upon their death. The Wichita Kansas Living Trust Property Record includes vital information about the properties within the trust. It encompasses various details, such as the property's legal description, physical address, current market value, and record of transactions or transfers. This record serves as an essential tool for beneficiaries, trustees, and other interested parties to ascertain accurate ownership, evaluate the trust's assets, and oversee any changes or transactions involving the properties. Different types of Wichita Kansas Living Trust Property Records can be classified based on the specific property types included within the trust. Some common categories include: 1. Residential Property Record: This includes primary residences, secondary homes, or investment properties held within the living trust. It details the property's address, size, features, and any associated mortgages or liens. 2. Commercial Property Record: This category pertains to properties utilized for business purposes, such as office buildings, retail spaces, or industrial facilities. It records essential information such as the property's location, size, rent roll, lease agreements, and property management details. 3. Vacant Land Property Record: In instances where the living trust holds undeveloped land, this record provides information on the location, acreage, zoning restrictions, and any potential development plans or restrictions imposed by local authorities. 4. Financial Account Record: While not directly related to property, this category is crucial for living trusts containing liquid assets, such as bank accounts, investment portfolios, or retirement funds. It includes details about the financial institution, account numbers, balances, and account management instructions. 5. Personal Belongings Record: This record encompasses tangible personal property that may hold sentimental or monetary value, such as jewelry, artwork, collectibles, or vehicles. It outlines descriptions, appraisals, storage arrangements, and any specific instructions regarding distribution or sale. Maintaining a meticulously organized Wichita Kansas Living Trust Property Record ensures the efficient administration of the trust. It enables trustees, beneficiaries, and legal professionals to navigate property-related matters smoothly and safeguard the wishes of the trust's creator.

Wichita Kansas Living Trust Property Record

Description

How to fill out Wichita Kansas Living Trust Property Record?

If you are searching for a valid form template, it’s extremely hard to find a better place than the US Legal Forms site – probably the most comprehensive libraries on the internet. With this library, you can get a large number of templates for business and individual purposes by categories and regions, or key phrases. With our advanced search function, getting the most up-to-date Wichita Kansas Living Trust Property Record is as easy as 1-2-3. Additionally, the relevance of each record is verified by a team of expert lawyers that on a regular basis check the templates on our website and update them according to the latest state and county requirements.

If you already know about our system and have an account, all you should do to get the Wichita Kansas Living Trust Property Record is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the form you need. Read its information and make use of the Preview feature (if available) to see its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to discover the proper record.

- Affirm your selection. Select the Buy now option. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the file format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired Wichita Kansas Living Trust Property Record.

Every template you save in your profile does not have an expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an additional copy for modifying or creating a hard copy, you may come back and save it once more whenever you want.

Take advantage of the US Legal Forms extensive collection to gain access to the Wichita Kansas Living Trust Property Record you were looking for and a large number of other professional and state-specific samples on a single platform!