Olathe Kansas Financial Account Transfer to Living Trust: A Comprehensive Overview If you're considering safeguarding and managing your assets in Olathe, Kansas, transferring your financial accounts to a living trust can be a wise decision. A living trust offers numerous benefits, including avoiding probate, maintaining privacy, ensuring seamless asset distribution, and potentially reducing estate taxes. In this article, we'll explore Olathe Kansas Financial Account Transfer to Living Trust in detail, shedding light on its importance, legal aspects, notable types, and necessary steps to undertake. Olathe Kansas Financial Account Transfer to Living Trust: Why is it important? Transferring your financial accounts to a living trust provides you with enhanced control and confidence over your assets, even during your lifetime. Unlike a will, a living trust allows assets to bypass probate, granting the trustee immediate access to manage and distribute them according to your wishes. As a resident of Olathe, Kansas, organizing your financial affairs through living trust ensures a smooth transition of your assets to your chosen heirs or beneficiaries while minimizing legal complexities and delays. Legal aspects to consider: Before initiating an Olathe Kansas Financial Account Transfer to Living Trust, understanding the legal aspects involved is crucial. It is advisable to consult with a qualified estate planning attorney who specializes in living trusts and has knowledge of the Olathe, Kansas jurisdiction. They can guide you through the necessary documentation, legal requirements, and compliance with state laws. Types of Olathe Kansas Financial Account Transfer to Living Trust: 1. Revocable Living Trust: A revocable living trust allows you (the granter) to retain complete control over the trust and make changes or amendments as required during your lifetime. You can transfer various financial accounts such as bank accounts, investment portfolios, retirement accounts, and real estate to the trust, ensuring they are governed by its terms for seamless management and distribution. 2. Testamentary Living Trust: In contrast to a revocable living trust, a testamentary living trust is established through a will and comes into effect upon the granter's death. It enables the transfer of financial accounts to the trust after probate administration. Although it doesn't offer immediate probate avoidance, it provides a flexible estate planning solution for Olathe, Kansas residents. Process and Steps for Olathe Kansas Financial Account Transfer to Living Trust: 1. Consultation: Engage with an experienced estate planning attorney in Olathe, Kansas to discuss your financial goals, objectives, and assets. They will guide you on whether a living trust is the best solution for your specific needs. 2. Trust Creation: Based on your discussions, the attorney will create a revocable or testamentary living trust tailored to your requirements. This document will outline the provisions, beneficiaries, trustees, and terms of the trust. 3. Funding the Trust: To transfer your financial accounts into the trust, you must contact the relevant financial institutions, informing them of the trust's existence and providing the required documentation. This typically involves completing paperwork provided by the institution and obtaining a new account designation for the trust. 4. Updating Account Ownership: Once the financial accounts are transferred, it is crucial to update the account ownership records to reflect the trust as the new owner. This step ensures seamless management and distribution by the appointed trustee. 5. Periodic Review: Regularly reviewing and updating your living trust, especially if there are changes in your financial situation or personal circumstances, ensures that it remains aligned with your goals and objectives. In conclusion, an Olathe Kansas Financial Account Transfer to Living Trust delivers peace of mind by effectively protecting and managing your assets. Whether you choose a revocable or testamentary living trust depends on your specific needs and preferences. By working closely with a knowledgeable estate planning attorney, you can navigate the legal landscape and undertake the necessary steps to secure your financial future in Olathe, Kansas.

Olathe Kansas Financial Account Transfer to Living Trust

Description

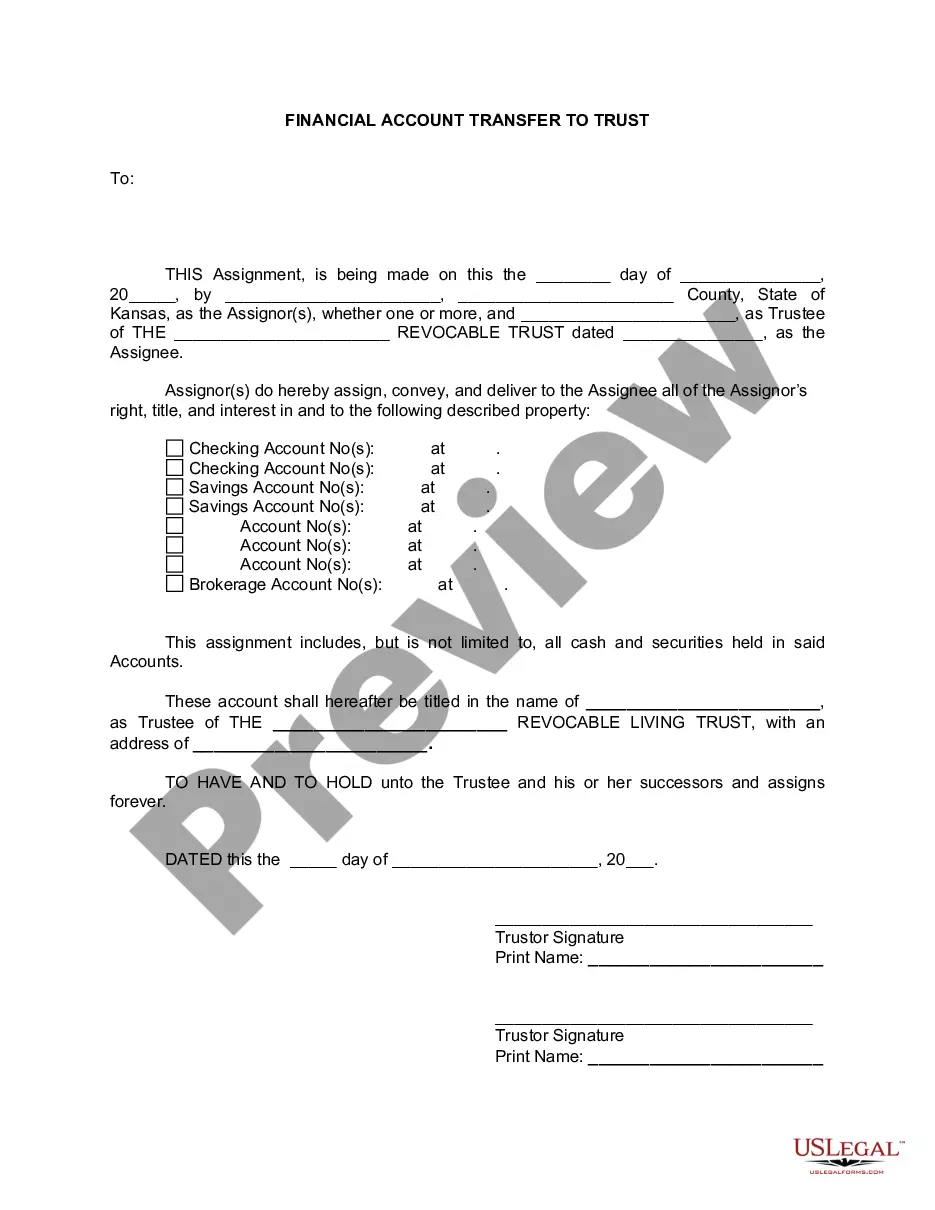

How to fill out Olathe Kansas Financial Account Transfer To Living Trust?

If you are looking for a pertinent form, it’s exceedingly challenging to select a superior platform than the US Legal Forms website – one of the most extensive collections on the internet.

Here you can find a myriad of form examples for business and personal uses categorized by type and region, or by keywords.

With our premium search feature, locating the latest Olathe Kansas Financial Account Transfer to Living Trust is as straightforward as 1-2-3.

Confirm your choice. Select the Buy now option, then choose your desired subscription plan and provide information to sign up for an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the relevance of every document is confirmed by a team of professional attorneys who routinely review the templates on our site and refresh them according to the latest state and county regulations.

- If you are already acquainted with our platform and possess an account, all you need to do to obtain the Olathe Kansas Financial Account Transfer to Living Trust is to Log In to your user profile and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have accessed the sample you need. Review its description and use the Preview option to examine its contents.

- If it does not fulfill your needs, utilize the Search feature at the top of the page to find the suitable document.

Form popularity

FAQ

To title a brokerage account in the name of your trust, you will typically need to provide the trust's name and tax identification number to your brokerage. Clearly state that the account belongs to your living trust, using the full name of the trust and the trustee's title. An Olathe Kansas Financial Account Transfer to Living Trust simplifies this process, as it ensures your brokerage account is properly titled and managed under your trust's directives. Always consult with a legal professional or your brokerage for specific requirements.

Putting your brokerage account in your living trust can be a wise decision. It allows your assets to bypass probate, which can save your heirs time and legal fees. Additionally, an Olathe Kansas Financial Account Transfer to Living Trust can provide greater control over how your assets are distributed after your passing. This strategic move can ensure your financial legacy aligns with your wishes.

Transferring a brokerage account to a living trust in Olathe, Kansas, requires contacting your brokerage firm. You will need to provide them with the trust’s legal documents, including the trust agreement. The firm may ask you to fill out a specific form to complete the Olathe Kansas Financial Account Transfer to Living Trust. Once approved, your assets will be held under the trust's name, ensuring they are managed according to your wishes.

Transferring a bank account to a living trust is a straightforward process. First, you need to create a trust document outlining the terms and stipulations of your living trust. Then, visit your bank and request a change of ownership form. Completing this form facilitates the Olathe Kansas Financial Account Transfer to Living Trust, making the process efficient and securing your assets for future distribution.

Yes, you can include a checking account in your trust. An Olathe Kansas Financial Account Transfer to Living Trust allows you to manage your assets effectively while retaining control over them. It ensures that the funds are distributed according to your wishes after your passing. By placing your checking account in a trust, you simplify financial management for your beneficiaries.

One disadvantage of a family trust is the potential for disputes among family members regarding the trust terms. If not clearly outlined, misunderstandings may arise, leading to conflict. By using specific resources for an Olathe Kansas Financial Account Transfer to Living Trust, families can minimize such disputes by ensuring transparency and clarity in their planning.

A significant disadvantage of having a trust is the complexity involved in setting it up. Many individuals find navigating trust laws and regulations challenging. Engaging services like uslegalforms can simplify your Olathe Kansas Financial Account Transfer to Living Trust, helping you create a plan that addresses all aspects of your estate effectively.

Yes, putting assets in a trust can be beneficial for your parents. It provides more control over how assets are distributed and can help avoid the probate process. By considering the Olathe Kansas Financial Account Transfer to Living Trust, your parents can ensure their wishes are respected and expedite the distribution process for their heirs.

Transferring your checking account to your living trust involves contacting your bank to inform them of your intent. You'll need to provide the trust's documentation and sometimes complete specific forms. This Olathe Kansas Financial Account Transfer to Living Trust process ensures that your funds are accessible as you intend, even after your passing.

To transfer your brokerage account to a living trust, you must contact your brokerage firm and provide them with the trust documents. This typically involves filling out a transfer form. This process is efficient and aligns with the Olathe Kansas Financial Account Transfer to Living Trust guidelines, ensuring your assets are properly managed according to your wishes.