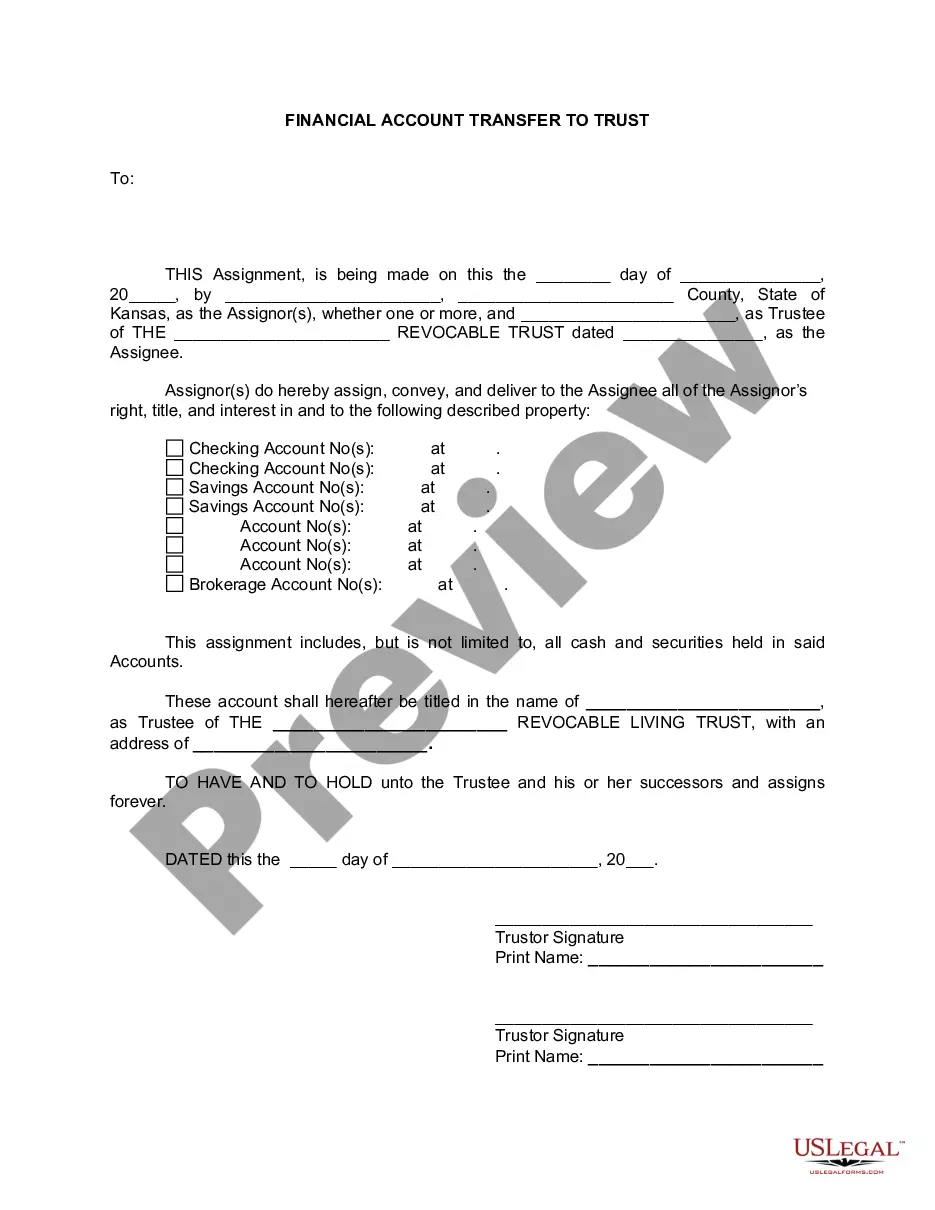

Overland Park Kansas Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Overland Park, Kansas, individuals have the option to transfer their financial accounts to a living trust, ensuring seamless management and distribution of their assets. This article will provide a detailed description of what an Overland Park Kansas Financial Account Transfer to Living Trust entails, exploring its benefits, process, and different types available. Benefits of Account Transfer to Living Trust: 1. Avoiding Probate: Transferring financial accounts to a living trust can help bypass the probate process, allowing beneficiaries to receive assets promptly without court intervention. 2. Privacy: Unlike wills, living trusts remain private documents, helping to preserve family confidentiality regarding financial matters. 3. Incapacity Planning: A well-structured living trust allows for the seamless management of assets in the event of the granter's incapacity, ensuring their financial affairs are handled according to their wishes. 4. Flexibility: Living trusts are highly customizable, enabling individuals to tailor their financial arrangements to their specific needs, such as designating special instructions for the distribution of assets. Types of Overland Park Kansas Financial Account Transfer to Living Trust: 1. Revocable Living Trust: The most common type, a revocable living trust allows the granter to retain control of assets during their lifetime, modify or revoke the trust, and designate beneficiaries who will receive the assets upon their death. 2. Irrevocable Living Trust: Once established, an irrevocable living trust cannot be modified or revoked by the granter without the consent of the beneficiaries. This type of trust offers potential tax advantages and may provide protection against creditors. 3. Testamentary Trust: Unlike revocable living trusts, testamentary trusts are created within a will and come into effect only upon the granter's death. These trusts are subject to probate. 4. Special Needs Trust: Designed to provide for individuals with disabilities without jeopardizing their eligibility for government benefits, special needs trusts allow for the management and distribution of assets while maintaining eligibility for programs like Medicaid or Supplemental Security Income (SSI). Process of Account Transfer to Living Trust: 1. Consultation with an Attorney: Seek guidance from a qualified estate planning attorney in Overland Park, Kansas, who will assess your specific financial situation, explain the legal implications, and propose appropriate steps. 2. Creating the Living Trust: The attorney will assist you in creating a living trust document, delineating your wishes for asset management and distribution. 3. Identifying and Transferring Financial Accounts: Compile a comprehensive list of your financial accounts, including bank accounts, investment portfolios, retirement funds, and insurance policies. With the guidance of your attorney, initiate account transfers, following the specific procedures of each financial institution. 4. Updating Beneficiary Designations: Ensure that all beneficiary designations reflect the terms of your living trust, making necessary adjustments to align them with your wishes. 5. Ongoing Financial Management: Once the accounts are successfully transferred to the living trust, diligently manage and monitor your assets, seeking professional advice whenever required. Conclusion: Overland Park Kansas Financial Account Transfer to Living Trust is an effective estate planning strategy that offers various benefits, including probate avoidance, enhanced privacy, and seamless asset management during incapacity. By understanding the different types of trusts available and following the proper process, individuals can safeguard their assets and ensure their distribution aligns with their desires. Consulting with an experienced attorney is crucial to navigate the complexities of account transfer to a living trust in Overland Park, Kansas, and tailor the approach to individual needs and circumstances.

Overland Park Kansas Financial Account Transfer to Living Trust

Description

How to fill out Overland Park Kansas Financial Account Transfer To Living Trust?

Benefit from the US Legal Forms and get immediate access to any form sample you require. Our helpful platform with a large number of document templates makes it easy to find and obtain almost any document sample you require. You are able to save, fill, and certify the Overland Park Kansas Financial Account Transfer to Living Trust in a few minutes instead of surfing the Net for hours attempting to find a proper template.

Utilizing our library is a superb strategy to improve the safety of your document submissions. Our professional attorneys on a regular basis review all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you get the Overland Park Kansas Financial Account Transfer to Living Trust? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Additionally, you can find all the previously saved records in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Open the page with the template you require. Make sure that it is the template you were hoping to find: check its name and description, and utilize the Preview option if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Indicate the format to obtain the Overland Park Kansas Financial Account Transfer to Living Trust and change and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable template libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the Overland Park Kansas Financial Account Transfer to Living Trust.

Feel free to take full advantage of our service and make your document experience as efficient as possible!