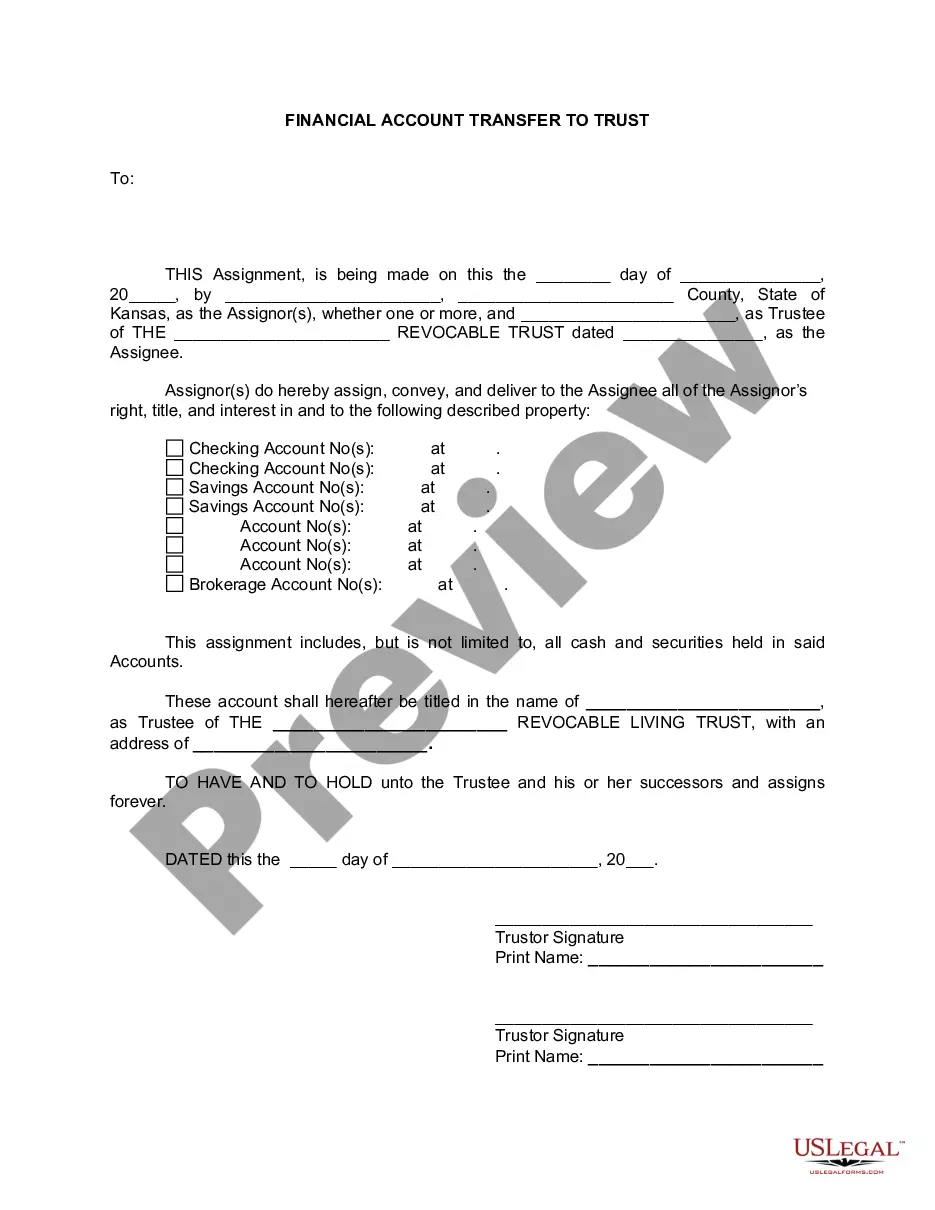

Topeka Kansas Financial Account Transfer to Living Trust: In Topeka, Kansas, a financial account transfer to a living trust is a legal process that allows individuals to transfer ownership of their financial accounts to a designated living trust. This ensures that their assets are properly managed and distributed in accordance with their wishes after their passing. This type of transfer provides numerous benefits, including potential tax advantages, avoiding probate, and ensuring privacy. There are various types of financial account transfers to living trusts available in Topeka, Kansas, tailored to meet different needs and preferences. Some of these types include: 1. Bank Account Transfer: This involves transferring checking, savings, or money market accounts into the living trust's name. By doing so, the assets held in these accounts become a part of the trust and are subject to its terms and conditions. 2. Investment Account Transfer: Individuals can transfer stocks, bonds, mutual funds, and other investment assets into their living trust. This type of transfer allows for the continued management and growth of these investments in accordance with the trust's provisions. 3. Retirement Account Transfer: Certain retirement accounts, such as IRAs or 401(k)s, can be transferred to a living trust. However, specific rules and regulations must be followed to avoid tax implications or penalties. Consulting with a financial advisor or estate planning attorney is essential for this type of transfer. 4. Real Estate Property Transfer: In addition to financial accounts, individuals can transfer real estate properties, such as homes or rental properties, to their living trust. This ensures the seamless transfer of ownership and management of the property and may help avoid the costly and time-consuming probate process. To proceed with a Topeka Kansas Financial Account Transfer to a Living Trust, it is recommended to seek professional guidance from a qualified estate planning attorney or financial advisor. These experts can provide personalized advice based on an individual's unique financial situation and estate planning goals. By utilizing a living trust and transferring financial accounts appropriately, residents of Topeka, Kansas, can ensure their assets are protected, managed, and distributed according to their wishes, thereby providing peace of mind for themselves and their loved ones.

Topeka Kansas Financial Account Transfer to Living Trust

Description

How to fill out Topeka Kansas Financial Account Transfer To Living Trust?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal services that, usually, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Topeka Kansas Financial Account Transfer to Living Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Topeka Kansas Financial Account Transfer to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Topeka Kansas Financial Account Transfer to Living Trust is suitable for you, you can select the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!