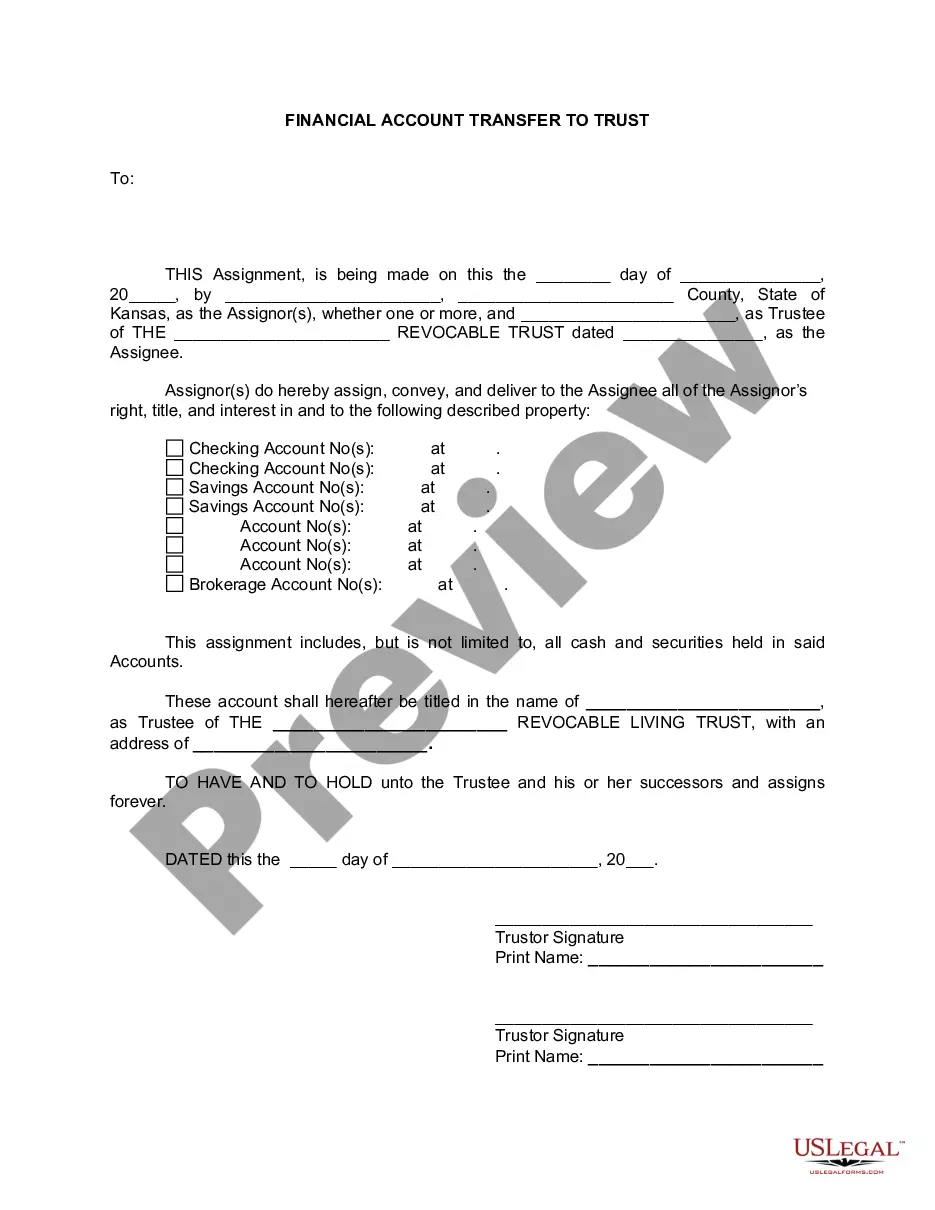

Wichita Kansas Financial Account Transfer to Living Trust: A Comprehensive Guide In Wichita, Kansas, transferring financial accounts to a living trust is a crucial step in estate planning. By executing this transfer, individuals can ensure the smooth and efficient distribution of their assets after their passing, while maintaining control over their finances during their lifetime. This detailed description will provide an overview of the process, its benefits, and the different types of transfers available in Wichita, Kansas. 1. Living Trust: A living trust, also known as an inter vivos trust, is a legal tool that allows individuals to place their assets and properties into a trust during their lifetime, with the purpose of managing and distributing them without the need for probate court intervention. In Wichita, Kansas, setting up a living trust offers several advantages, such as privacy, asset protection, and the ability to retain control over finances even if incapacity occurs. 2. Financial Account Transfer: Transferring financial accounts to a living trust involves the process of re-titling ownership of various accounts, such as bank accounts, investment accounts, retirement accounts, and brokerage accounts from an individual's name to the trust. This transfer ensures that these accounts will be governed by the terms and conditions set forth in the trust document. 3. Benefits of Financial Account Transfer to Living Trust in Wichita: — Probate Avoidance: By placing financial accounts into a living trust, individuals can bypass the probate process, saving time, costs, and potential complications for their loved ones. — Incapacity Planning: A living trust allows for a seamless transition of financial management if the granter becomes incapacitated, as the successor trustee designated in the trust document can take over without court involvement. — Privacy: Since living trusts do not go through probate, their terms and provisions remain private, unlike the public record of a will. — FlexibilityGrantersrs can modify or revoke the trust during their lifetime, making it a flexible tool that can adapt to changing circumstances. 4. Different Types of Financial Account Transfers to Living Trust in Wichita: — Bank Account Transfer: This involves re-titling personal and business checking accounts, savings accounts, certificates of deposit (CDs), and money market accounts into the name of the living trust. — Investment Account Transfer: Retirement accounts, individual brokerage accounts, and mutual fund accounts can be transferred to the living trust, ensuring their seamless integration into the estate plan. — Real Estate Transfer: While not strictly a financial account transfer, real estate properties can be transferred to the living trust, consolidating their management and distribution alongside other financial assets. In conclusion, executing a Wichita Kansas Financial Account Transfer to Living Trust is a key step in estate planning. By leveraging a living trust and transferring financial accounts, individuals can gain control, reduce costs, and ensure a smooth transition of their assets to their chosen beneficiaries. Whether it involves bank accounts, investment accounts, or real estate, each transfer type contributes to a comprehensive estate plan tailored to the unique needs of the granter in Wichita, Kansas.

Wichita Kansas Financial Account Transfer to Living Trust

Description

How to fill out Wichita Kansas Financial Account Transfer To Living Trust?

Regardless of your societal or occupational rank, filling out legal documents is an unfortunate obligation in the modern landscape.

Frequently, it’s nearly unfeasible for someone lacking any legal education to create this type of paperwork from scratch, primarily because of the intricate language and legal specifics involved.

This is where US Legal Forms comes to the aid.

Confirm that the template you have selected is appropriate for your locality, as the laws of one state or county do not apply to another.

Examine the form and review a brief overview (if available) outlining the situations for which the document can be utilized. If the chosen one does not align with your needs, you can restart the process and search for the required document.

- Our platform offers an extensive repository of over 85,000 readily-available state-specific forms applicable to nearly any legal matter.

- US Legal Forms is also a superb tool for associates or legal advisors seeking to conserve time with our DIY documents.

- Whether you require the Wichita Kansas Financial Account Transfer to Living Trust or any other documentation valid in your jurisdiction, US Legal Forms has everything you need.

- Here’s how you can obtain the Wichita Kansas Financial Account Transfer to Living Trust in just a few minutes using our reliable service.

- If you are already a registered user, simply Log In to access the suitable form.

- If you are new to our library, make sure to follow these steps before downloading the Wichita Kansas Financial Account Transfer to Living Trust.

Form popularity

FAQ

Retirement accounts definitely do not belong in your revocable trust ? for example your IRA, Roth IRA, 401K, 403b, 457 and the like. Placing any of these assets in your trust would mean that you are taking them out of your name to retitle them in the name of your trust. The tax ramifications can be disastrous.

Pertaining to the types of asset you put in a living trust: generally speaking, all of your assets should be transferred into your trust. However, there are some assets that you may not want or cannot be transferred into the trust. You cannot put a 401(k) in a living trust or other tax-deferred plans, for that matter.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Most living trusts are revocable, meaning they can be changed or deleted during the settlor's life. An irrevocable living trust becomes permanent once it is created. A living trust in Kansas may be created if the settlor lives in Kansas, the trustee lives or works in Kansas, or trust property is located in Kansas.

Retirement plans themselves cannot be transferred into a trust; those assets must be distributed from the plan first, which triggers income tax on the distribution. If you are older than 72 when you die, money generally must come out of your retirement plan according to the schedule that was required before your death.

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

Trusts can hold many different types of assets, including cash, stocks, bonds, mutual funds, real estate and other property. Once the account is opened, you can transfer assets into the trust.

Key Takeaways. Naming beneficiaries for qualified retirement plans means that probate, attorneys' fees, and other costs associated with settling estates are avoided. Naming a trust as a beneficiary is a good idea if beneficiaries are minors, have a disability, or can't be trusted with a large sum of money.