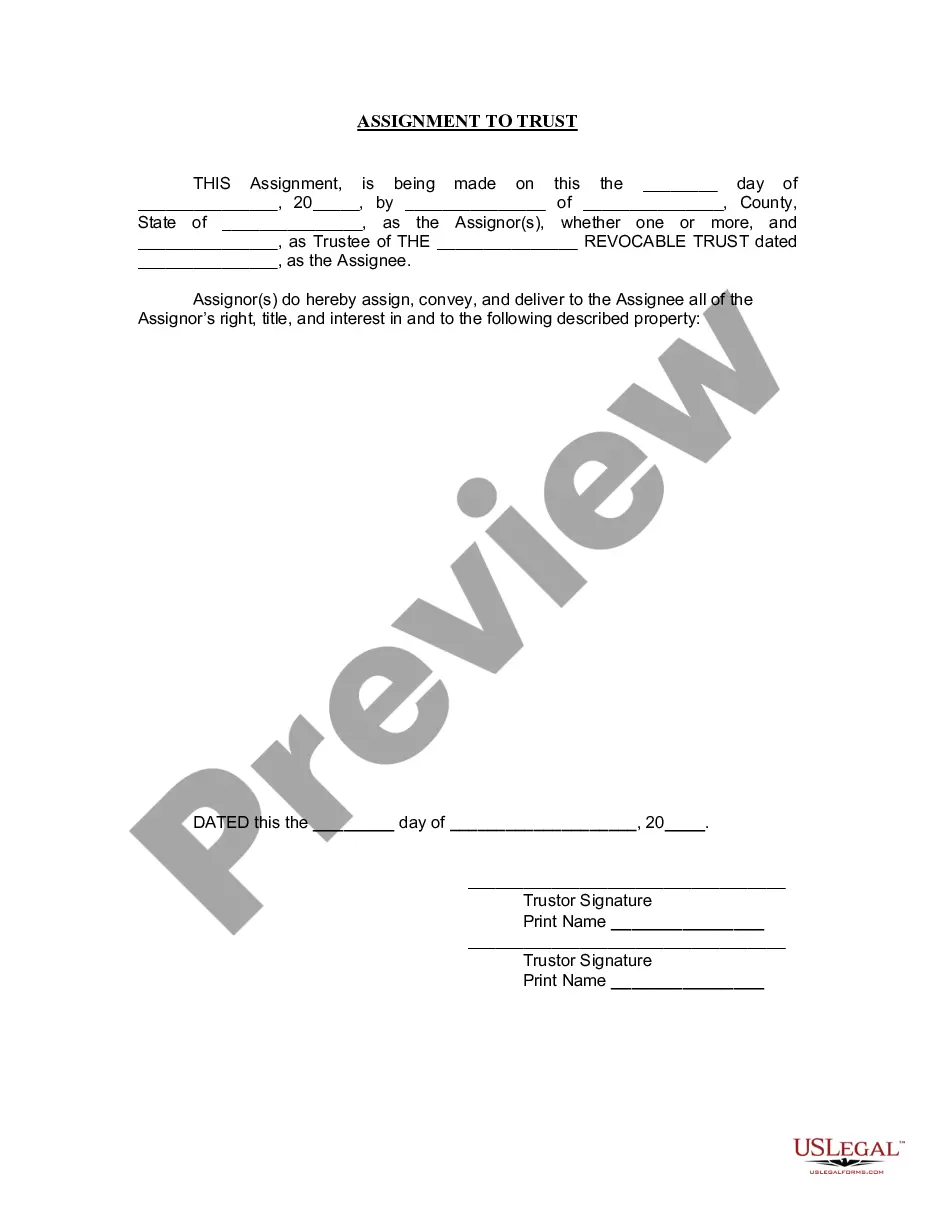

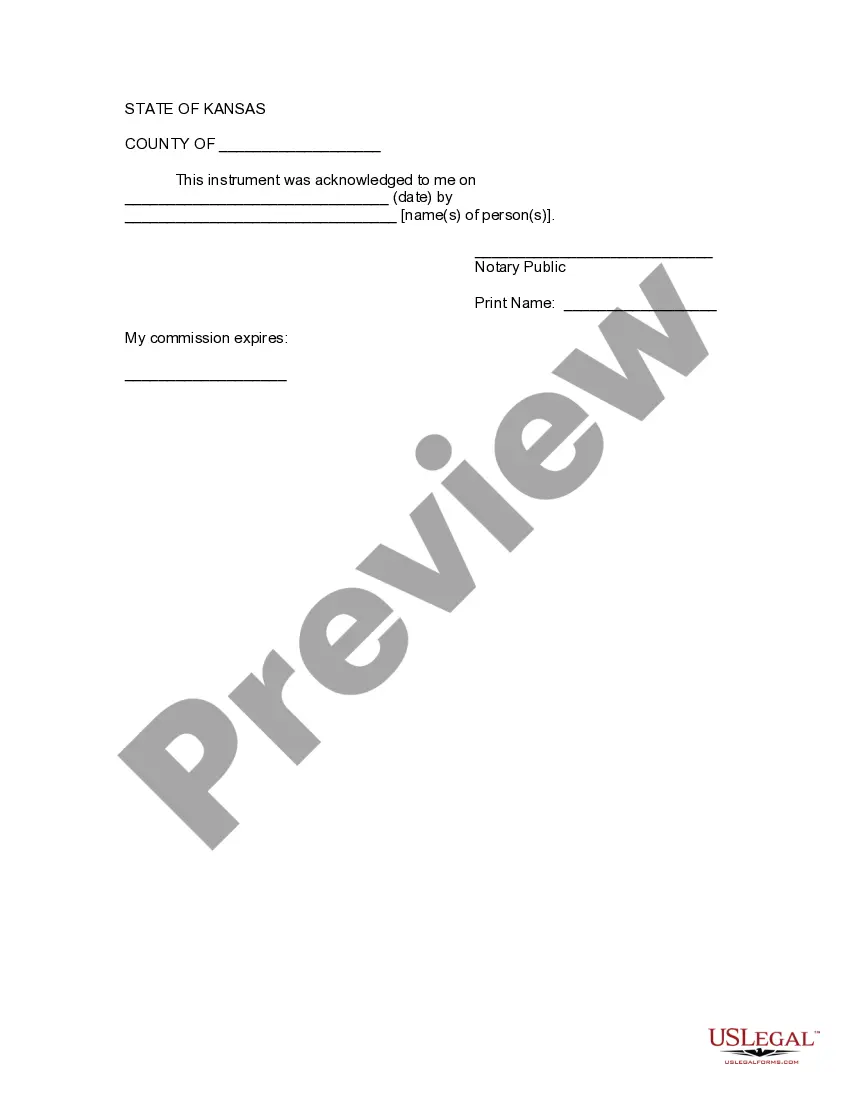

Topeka Kansas Assignment to Living Trust: A living trust is a legal document that allows individuals to transfer their estate assets into a trust for the benefit of themselves and their beneficiaries. In Topeka, Kansas, the assignment to a living trust follows specific regulations and procedures to ensure the proper transfer of assets and protection of the granter's interests. Here is a detailed description of the Topeka Kansas Assignment to Living Trust, covering various aspects and types: 1. Definition of Assignment to Living Trust: An Assignment to Living Trust in Topeka, Kansas, involves assigning or transferring assets to a revocable living trust created by an individual. This transfer of ownership from the individual to the trust allows for efficient management and distribution of assets, both during the granter's lifetime and after their demise, avoiding the probate process. 2. Parties Involved: The parties involved in a Topeka Kansas Assignment to Living Trust include the granter, who owns the assets and establishes the trust, and the trustee, who manages the trust and distributes the assets according to the granter's wishes. Beneficiaries are those individuals or entities designated to receive the assets from the trust. 3. Types of Living Trusts: a. Revocable Living Trust: This is the most common type of living trust in Topeka, Kansas. It allows the granter to retain control over the trust assets, make changes or revoke the trust during their lifetime. The assets in a revocable living trust are not protected from creditors but can be used for Medicaid planning and avoiding probate. b. Irrevocable Living Trust: An irrevocable living trust cannot be altered or revoked without the consent of the beneficiaries. Once assets are transferred to this trust, they are no longer considered part of the granter's estate, which can provide potential tax benefits and protection from creditors. 4. Benefits of Topeka Kansas Assignment to Living Trust: a. Avoidance of Probate: Assets transferred to a living trust do not go through the probate process, allowing for a quicker and private distribution of assets to beneficiaries while bypassing the court's involvement. b. Privacy: Unlike a will, a living trust is generally kept confidential, as it is not subject to public record. This confidentiality can provide privacy to the granter's financial affairs and the beneficiaries' inheritance details. c. Incapacity Planning: A living trust assists in managing assets during the granter's potential incapacitation or disability, allowing the appointed trustee to step in and manage the assets on their behalf to provide continuity and financial security. d. Flexibility: A revocable living trust enables the granter to maintain control over their assets and make changes as needed, providing flexibility in managing the trust throughout their lifetime. e. Estate Tax Planning: Living trusts can provide estate tax planning benefits, potentially minimizing estate taxes upon the granter's passing. In summary, the Topeka Kansas Assignment to Living Trust is a legal process of transferring assets into a trust, aiming to streamline asset management, avoid probate, protect the granter's interests, and provide for efficient distribution of assets to beneficiaries. Both revocable and irrevocable living trusts offer various benefits based on the granter's specific goals and circumstances. Seeking professional legal advice is essential when considering a living trust to ensure compliance with Topeka, Kansas, laws and regulations.

Topeka Kansas Assignment to Living Trust

Description

How to fill out Topeka Kansas Assignment To Living Trust?

Do you need a reliable and affordable legal forms provider to get the Topeka Kansas Assignment to Living Trust? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and county.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Topeka Kansas Assignment to Living Trust conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is good for.

- Restart the search if the form isn’t good for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is done, download the Topeka Kansas Assignment to Living Trust in any provided format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal papers online for good.