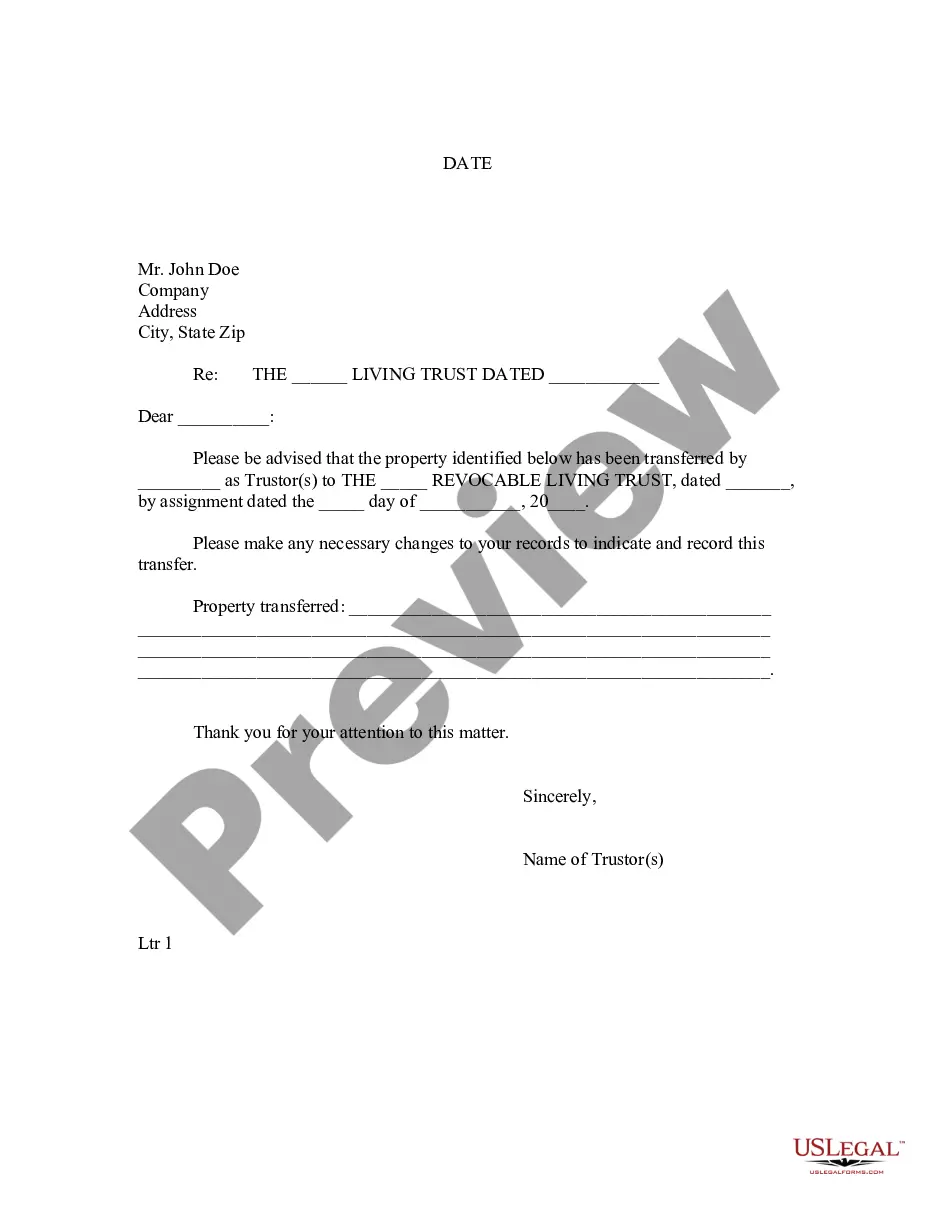

Topeka, Kansas: Letter to Lien holder to Notify of Trust A "Letter to Lien holder to Notify of Trust" is an important document that is used in Topeka, Kansas to inform a lien holder about the establishment of a trust. This letter is crucial in legally transferring the ownership or title of a property or asset into a trust, ensuring it is protected and managed according to the trust's terms. When creating a Topeka, Kansas Letter to Lien holder to Notify of Trust, there are several key elements that must be included: 1. Sender's Information: Begin the letter by providing your full name, contact information, including your address, phone number, and email address. It is essential to provide accurate and up-to-date information for smooth communication. 2. Date: Next, include the date of writing the letter. This helps in establishing a timeline for future reference. 3. Lien holder's Information: Provide the complete name and address of the lien holder. Ensure that the details are accurate and match the official documents. 4. Subject: Clearly state the purpose of the letter by mentioning "Notification of Trust Establishment" or a similar relevant subject line. 5. Introduction: Begin the letter with a formal greeting, addressing the lien holder by their proper title, such as "Dear [Lien holder's Name]." 6. Trust Information: In the body of the letter, provide all crucial information related to the trust, including its full name, date of creation, and relevant documentation, such as the trust agreement or certification. Be sure to mention that the property or asset in question is being transferred into the trust. 7. Enclosures: If applicable, mention any additional documents enclosed with the letter to ensure the lien holder has all necessary information regarding the trust. 8. Request for Action: Clearly state the desired action from the lien holder. For instance, if the lien holder needs to update their records to reflect the trust, provide instructions on how to proceed accordingly. 9. Contact Information: Include your contact information once again, after the signature, to encourage the lien holder to reach out if they have any questions or require further information. 10. Closing: End the letter with a professional closing, such as "Sincerely" or "Best regards." Sign the letter with your full name below the closing. Different types of Topeka, Kansas Letters to Lien holder to Notify of Trust may include variations based on the specific asset being transferred, such as: 1. Topeka, Kansas Letter to Lien holder to Notify of Real Estate Trust: Used to notify a lien holder about the transfer of a real estate property into a trust. 2. Topeka, Kansas Letter to Lien holder to Notify of Vehicle Trust: Used to inform a lien holder about the transfer of ownership of a vehicle title to a trust. 3. Topeka, Kansas Letter to Lien holder to Notify of Financial Asset Trust: Used to notify a lien holder about the transfer of financial assets, such as stocks, bonds, or bank accounts, into a trust. By using specific keywords like Topeka, Kansas, letter to lien holder, notify of trust, and various asset types, this content provides a detailed description of the purpose and components of a Topeka, Kansas Letter to Lien holder to Notify of Trust.

Topeka Kansas Letter to Lienholder to Notify of Trust

Description

How to fill out Topeka Kansas Letter To Lienholder To Notify Of Trust?

If you are in search of a legitimate document, it’s unfeasible to locate a more practical service than the US Legal Forms site – likely the most extensive collections available online.

With this repository, you can acquire a vast array of document samples for business and personal needs categorized by types and locations, or keywords.

With our enhanced search feature, locating the latest Topeka Kansas Letter to Lienholder to Notify of Trust is as straightforward as 1-2-3.

Finalize the transaction. Use your credit card or PayPal account to complete the registration process.

Obtain the template. Specify the format and download it to your device. Make amendments. Complete, modify, print, and sign the received Topeka Kansas Letter to Lienholder to Notify of Trust.

- Moreover, the applicability of each document is validated by a team of qualified lawyers who frequently assess the templates on our platform and update them according to the most recent state and county laws.

- If you are already familiar with our system and possess a registered account, all you have to do to obtain the Topeka Kansas Letter to Lienholder to Notify of Trust is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have selected the form you need. Review its description and utilize the Preview feature to examine its content. If it does not satisfy your needs, use the Search bar at the top of the page to find the appropriate document.

- Validate your selection. Choose the Buy now option. Then, select your desired subscription plan and provide the information to create an account.

Form popularity

FAQ

Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDORlienrelease@ks.gov .

If the lien has been paid off, use the assignment portion of the Lienholder Consent to Transfer Ownership, Form TR-128, attach the lien release in lieu of the lienholder's portion of the consent and go to your local county treasurer's motor vehicle office and make application for title.

Once the first lienholder has been paid off, they may submit their lien release electronically (if they are members of the KS E-Lien system), or by providing it to the owner who will then submit it to the local county treasurer's office or fax it to the Titles and Registrations Bureau at 785-296-2383.

A lien holder consent form may also be required. If the vehicle is given as a gift, an affidavit signed by the previous owner must be provided, or sales tax will be collected at the time of registration. The affidavit should state that the vehicle was given as a gift and not sold.

holding state is one where the lienholder (your lender) keeps the title until you've paid off the auto loan. You get the title sent to you once you've finished the loan in this case.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDORlienrelease@ks.gov .

Kansas is a ?lien holding? state. This means that the Kansas Department of Revenue holds the title on any vehicle that is bound by a lien. The lien is not available to the owner until payment is made in full on the purchase price or other loan in which the vehicle is a collateral.