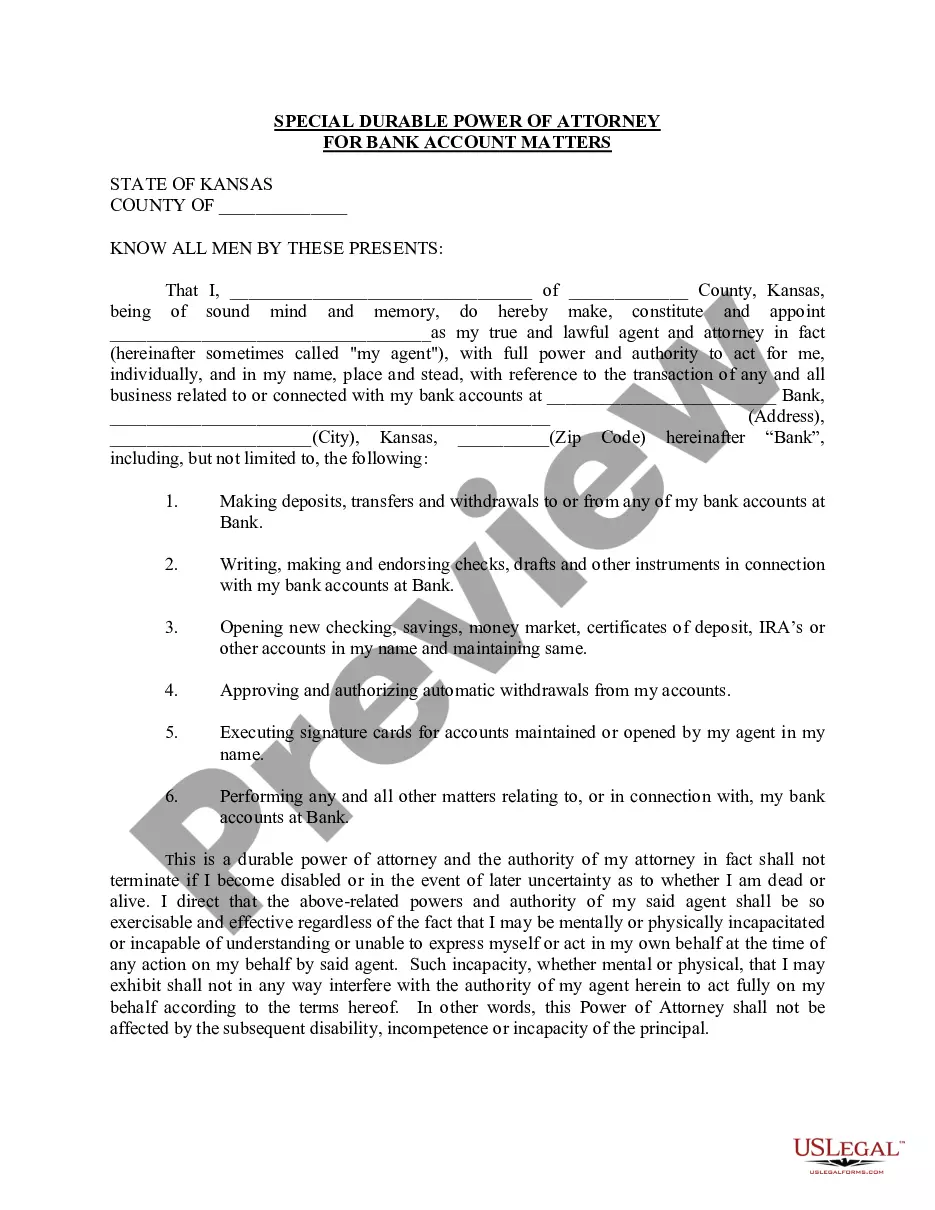

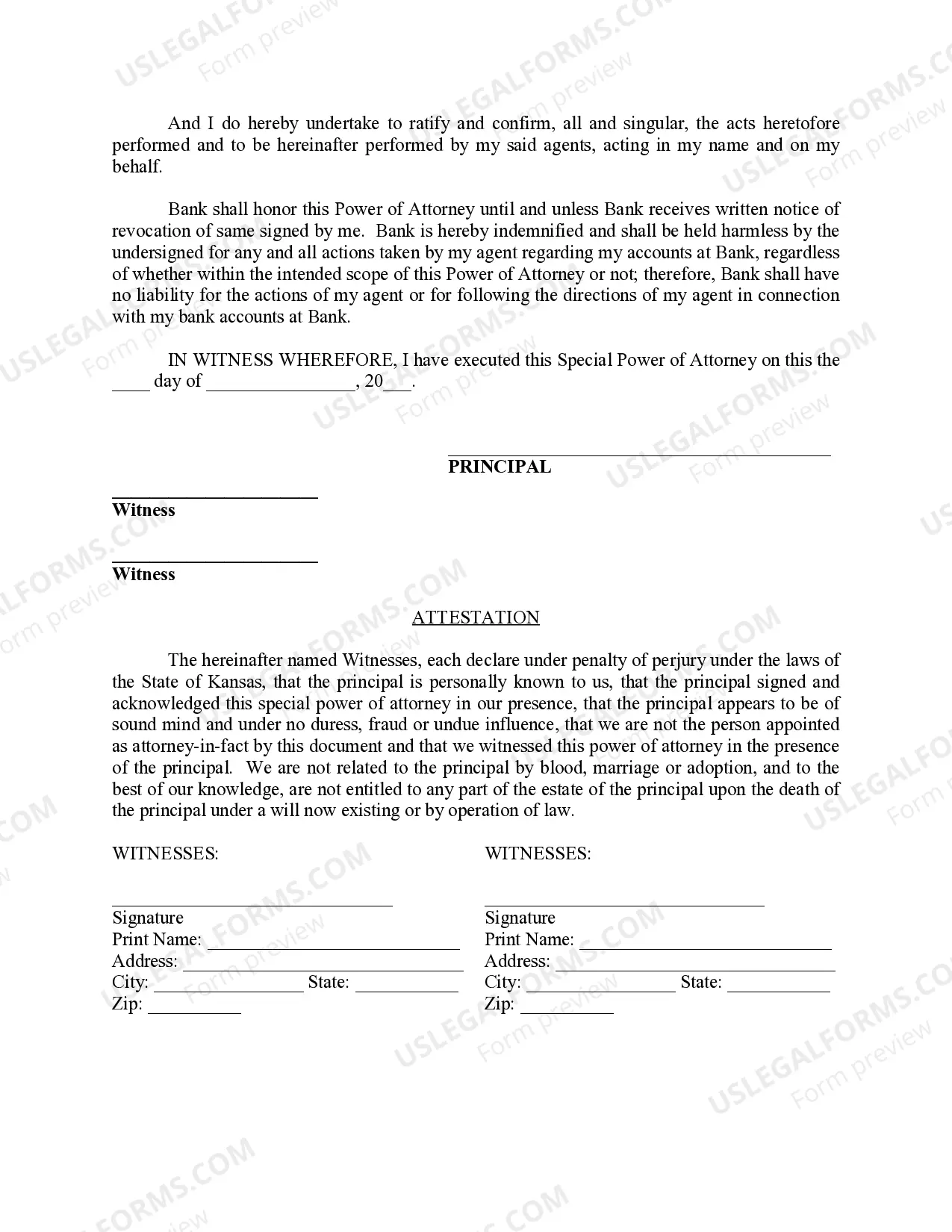

Olathe Kansas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants specific authority to an appointed agent to handle bank account-related affairs on behalf of the principal in the city of Olathe, Kansas. This power of attorney is established to ensure the smooth management and handling of various financial transactions pertaining to the principal's bank accounts. This type of power of attorney is intended to remain in effect even if the principal becomes incapacitated or mentally incompetent, making it "durable" in nature. By designating a trusted agent, the principal can rely on their expertise and responsibility to carry out important financial tasks with respect to their bank accounts. The Olathe Kansas Special Durable Power of Attorney for Bank Account Matters allows the agent to perform a wide range of actions involving the principal's bank accounts, including but not limited to: 1. Making deposits and withdrawals: The agent is authorized to deposit funds into the principal's bank accounts, as well as withdraw or transfer money from these accounts as deemed necessary to cover expenses, pay bills, or manage investments. 2. Managing bills and payments: The agent can handle the principal's financial obligations such as paying bills, mortgages, loans, and insurance premiums using the funds available in the specified bank accounts. 3. Conducting financial transactions: This power of attorney allows the agent to manage the principal's financial affairs, which may include opening or closing bank accounts, applying for loans or credit cards, and managing investments on behalf of the principal. 4. Accessing account information: The agent is given the authority to access the principal's account information, including balances, transaction history, and statements, allowing them to keep track of the principal's financial state. It is important to note that there may be different types or variations of the Olathe Kansas Special Durable Power of Attorney for Bank Account Matters. These variations could include limited powers of attorney, granting specific authority for a restricted period, or general powers of attorney, providing the agent with broader control over the principal's financial matters. Before executing the Olathe Kansas Special Durable Power of Attorney for Bank Account Matters, it is recommended to consult an attorney familiar with the laws and regulations in Kansas to ensure compliance with all legal requirements and for tailoring the document to suit the principal's specific needs and intentions.

Olathe Kansas Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Olathe Kansas Special Durable Power Of Attorney For Bank Account Matters?

Take advantage of the US Legal Forms and obtain instant access to any form sample you want. Our useful platform with thousands of document templates makes it easy to find and obtain virtually any document sample you require. It is possible to download, complete, and sign the Olathe Kansas Special Durable Power of Attorney for Bank Account Matters in a matter of minutes instead of surfing the Net for several hours seeking a proper template.

Using our library is a wonderful way to increase the safety of your document filing. Our experienced attorneys on a regular basis check all the records to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you get the Olathe Kansas Special Durable Power of Attorney for Bank Account Matters? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Furthermore, you can get all the earlier saved files in the My Forms menu.

If you don’t have an account yet, stick to the tips listed below:

- Find the template you require. Make sure that it is the template you were hoping to find: examine its name and description, and use the Preview option when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the document. Select the format to obtain the Olathe Kansas Special Durable Power of Attorney for Bank Account Matters and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy form libraries on the web. Our company is always happy to help you in any legal process, even if it is just downloading the Olathe Kansas Special Durable Power of Attorney for Bank Account Matters.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!