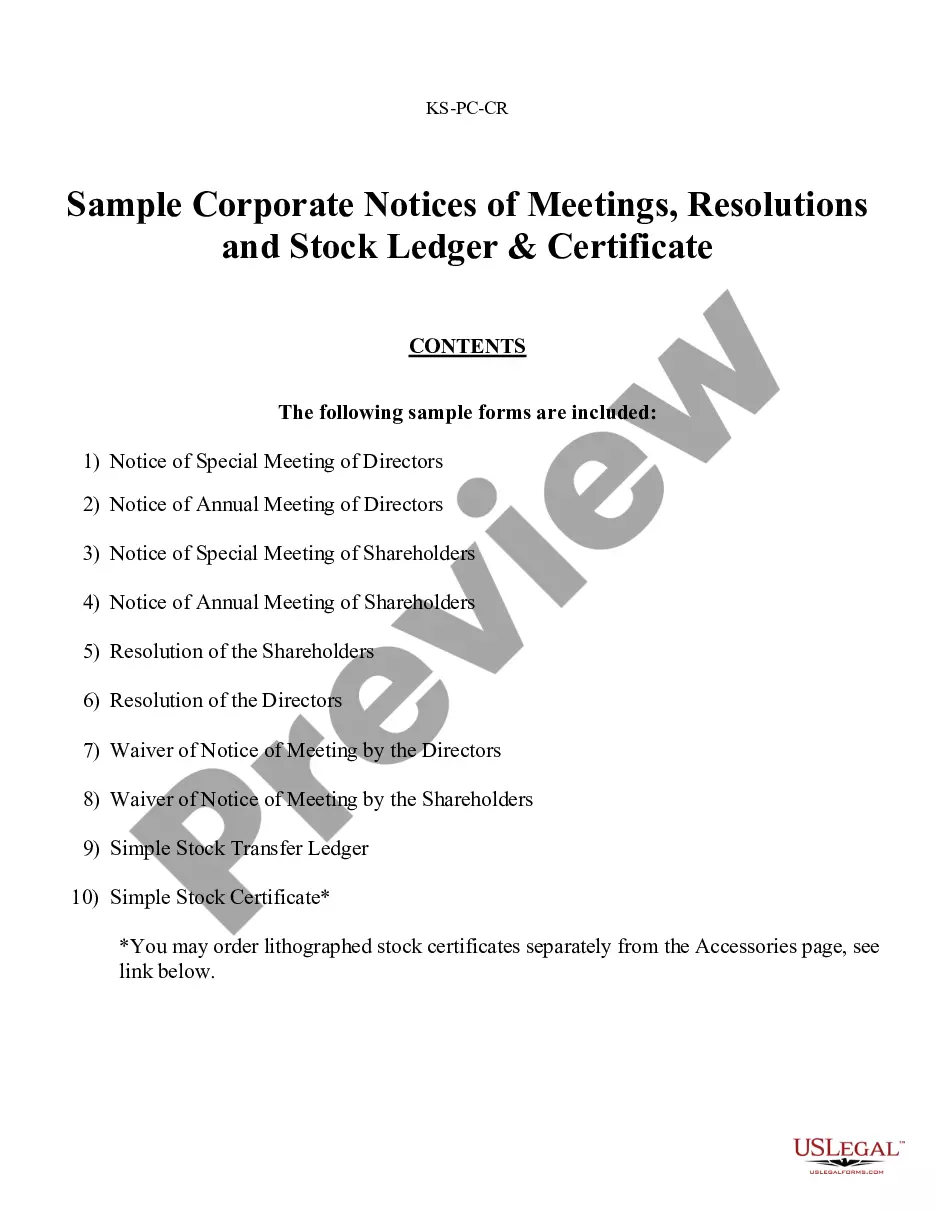

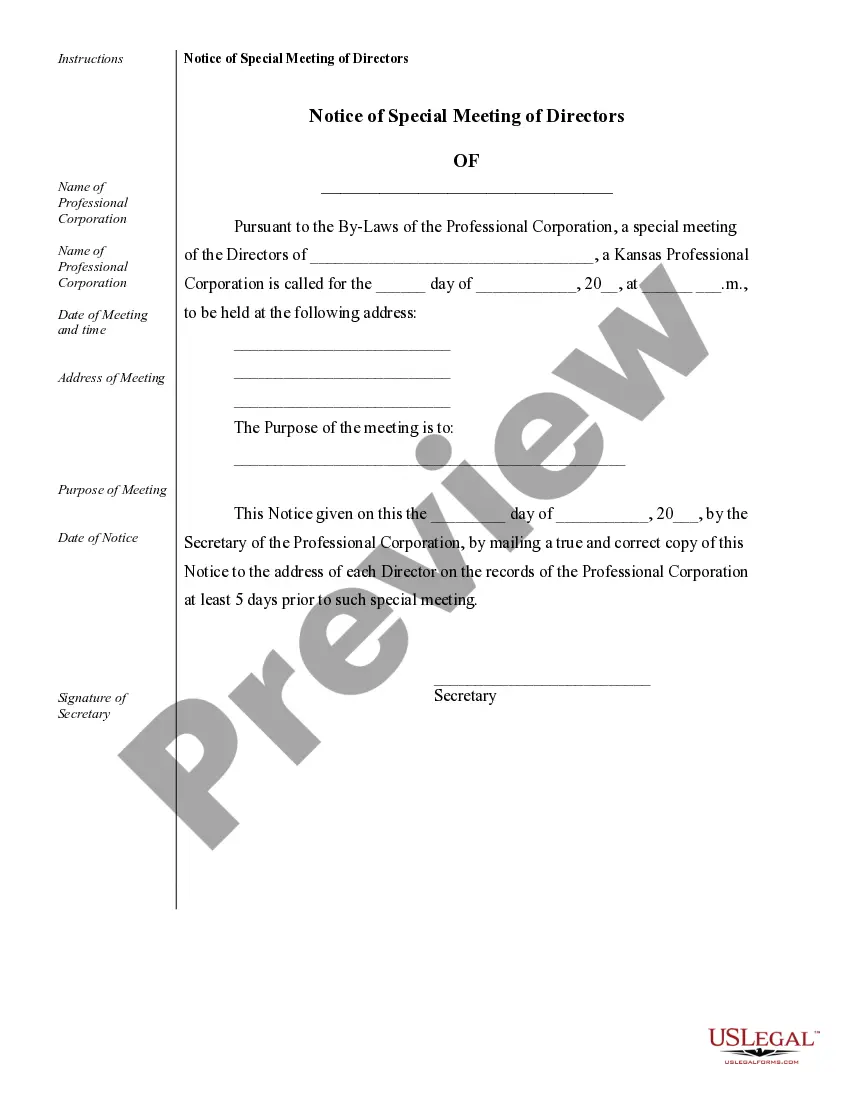

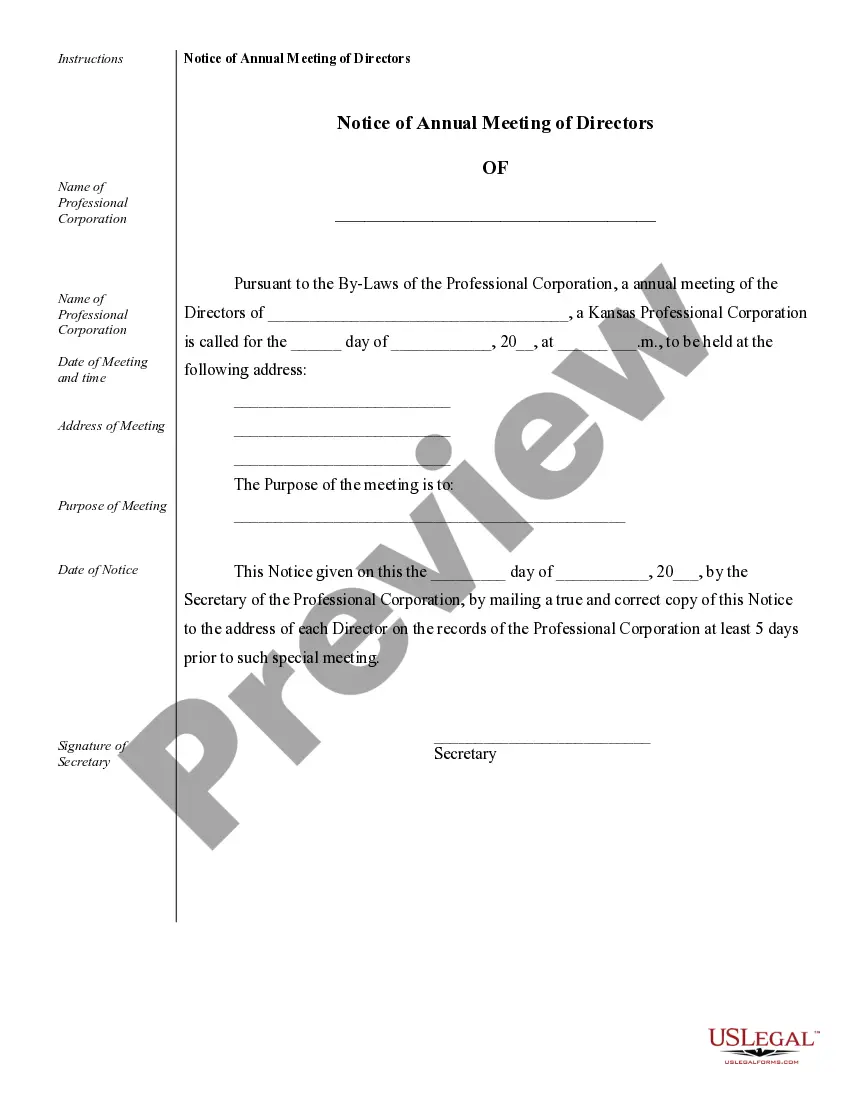

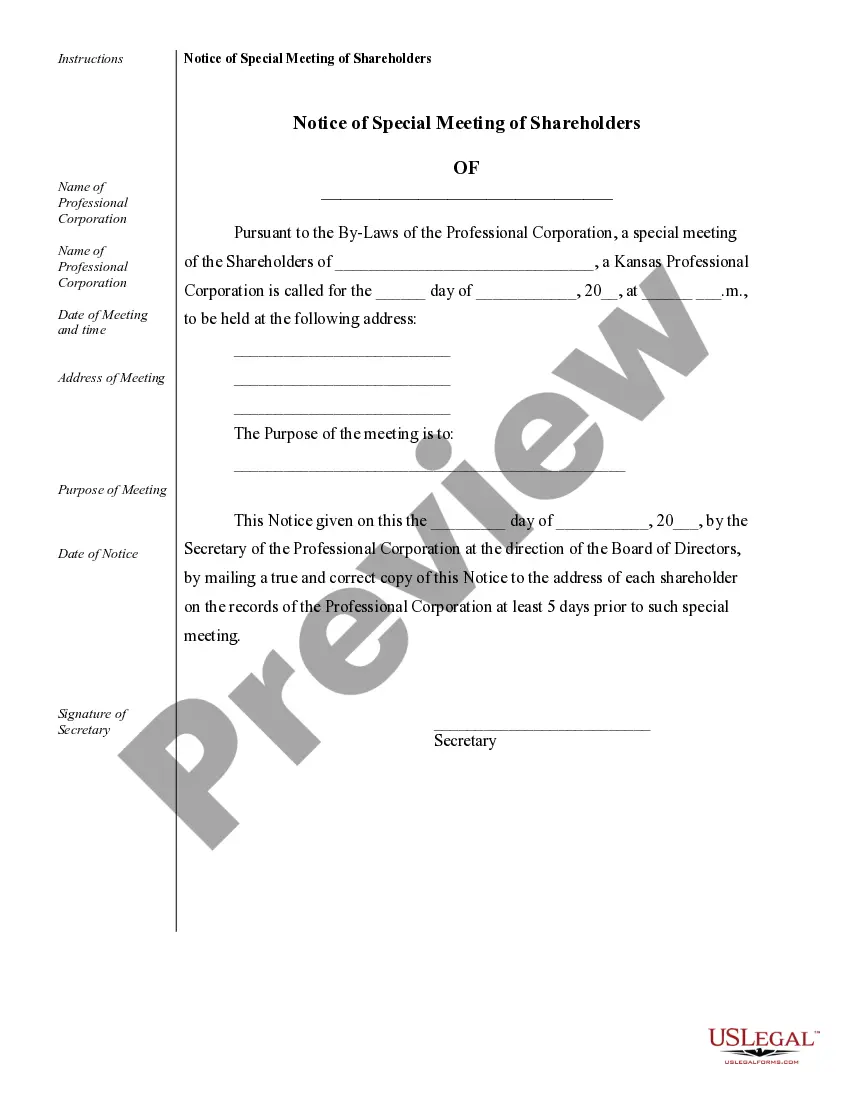

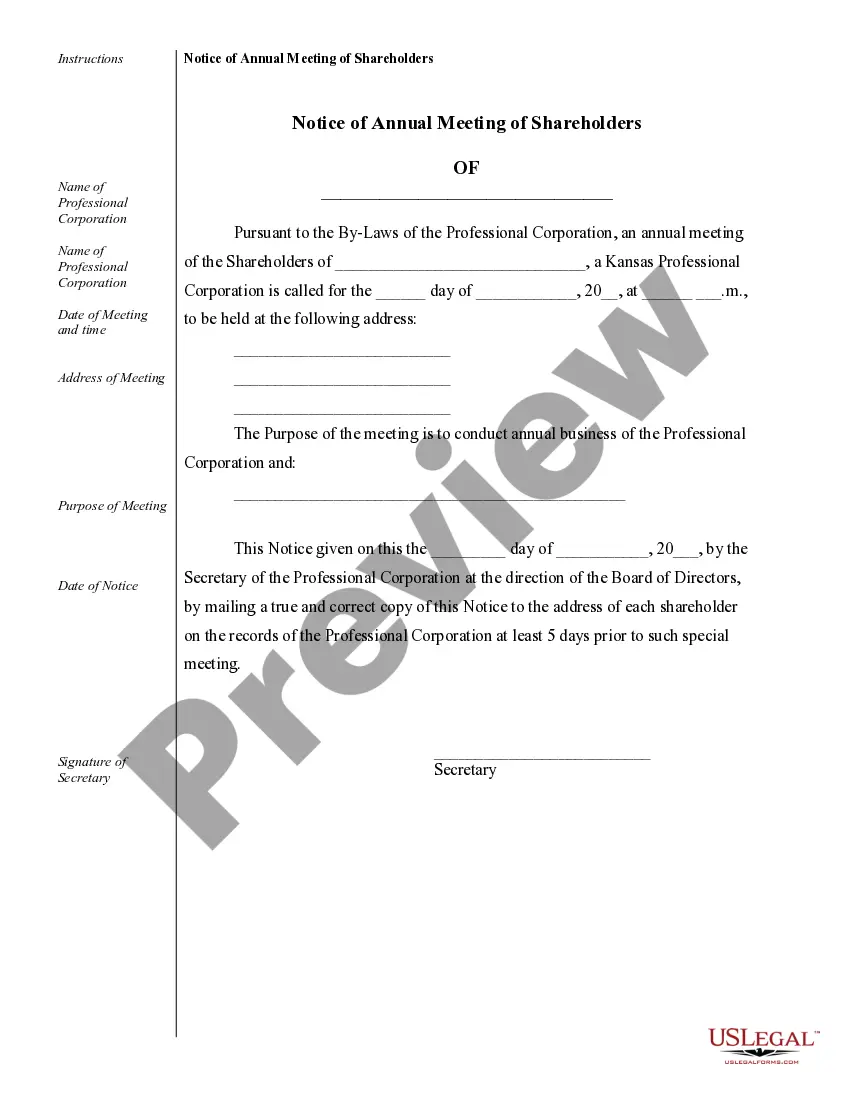

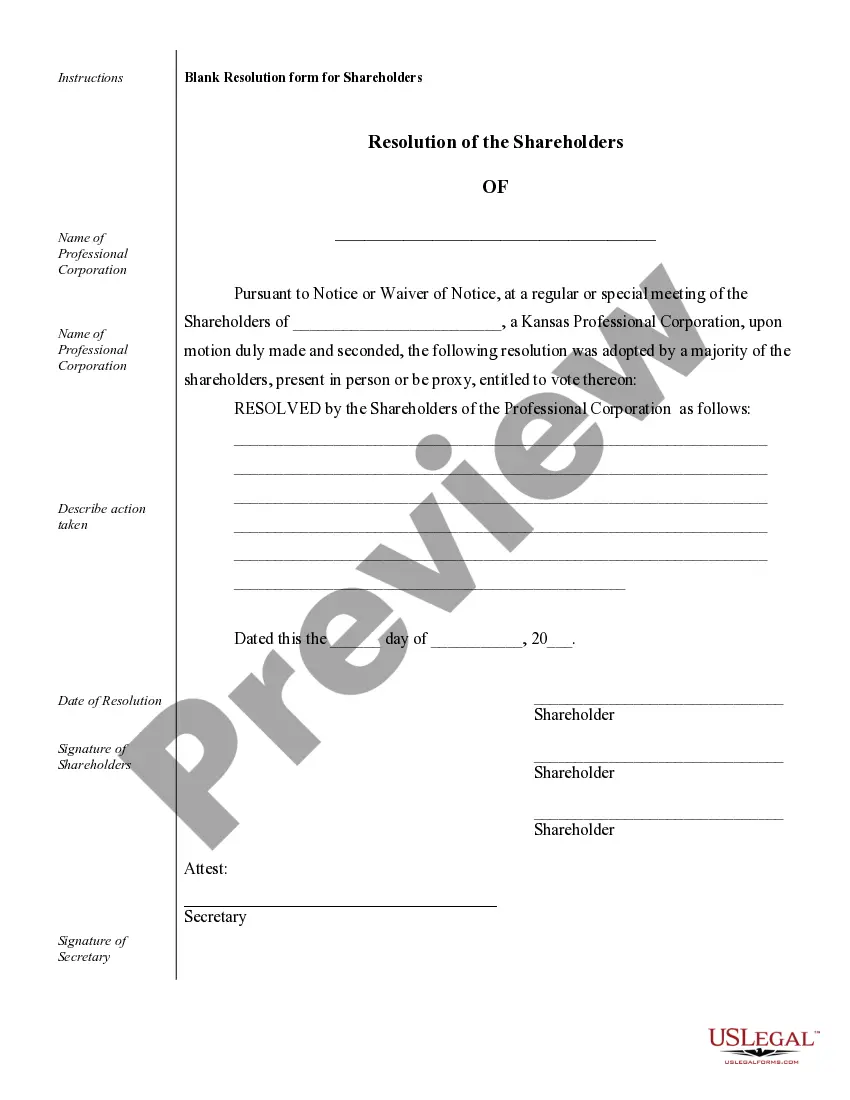

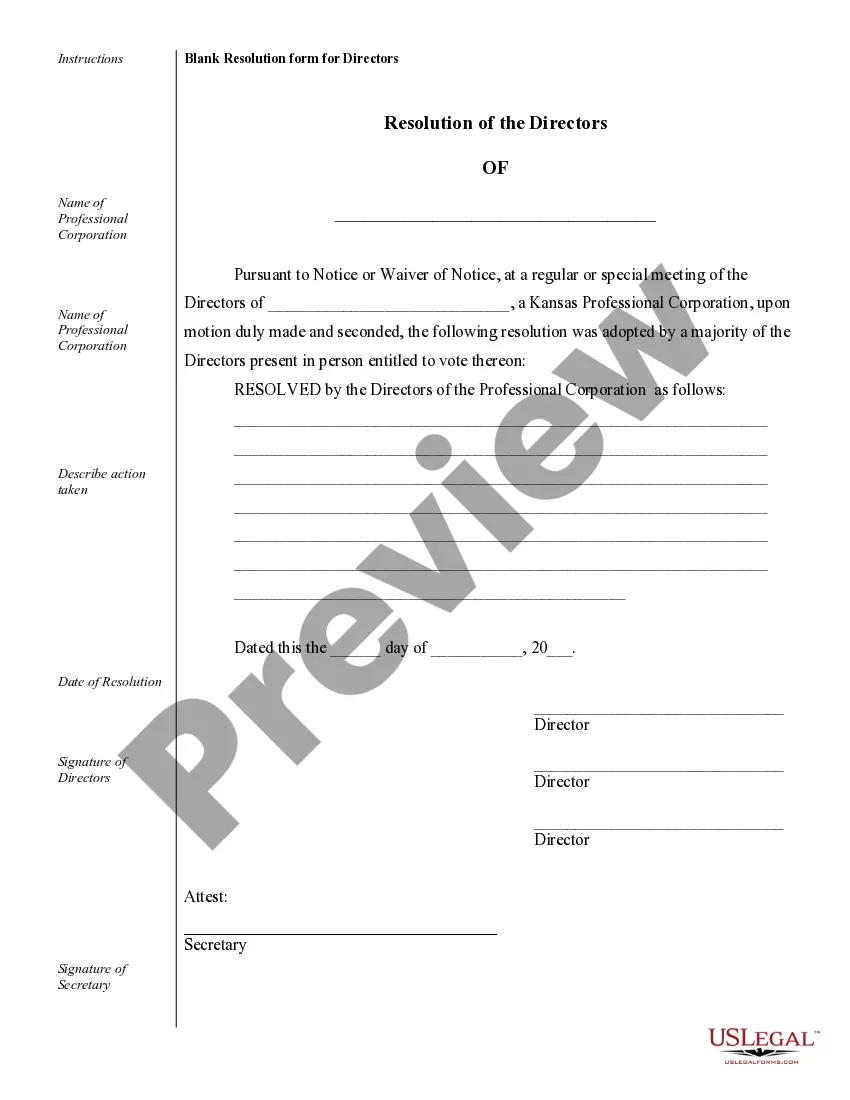

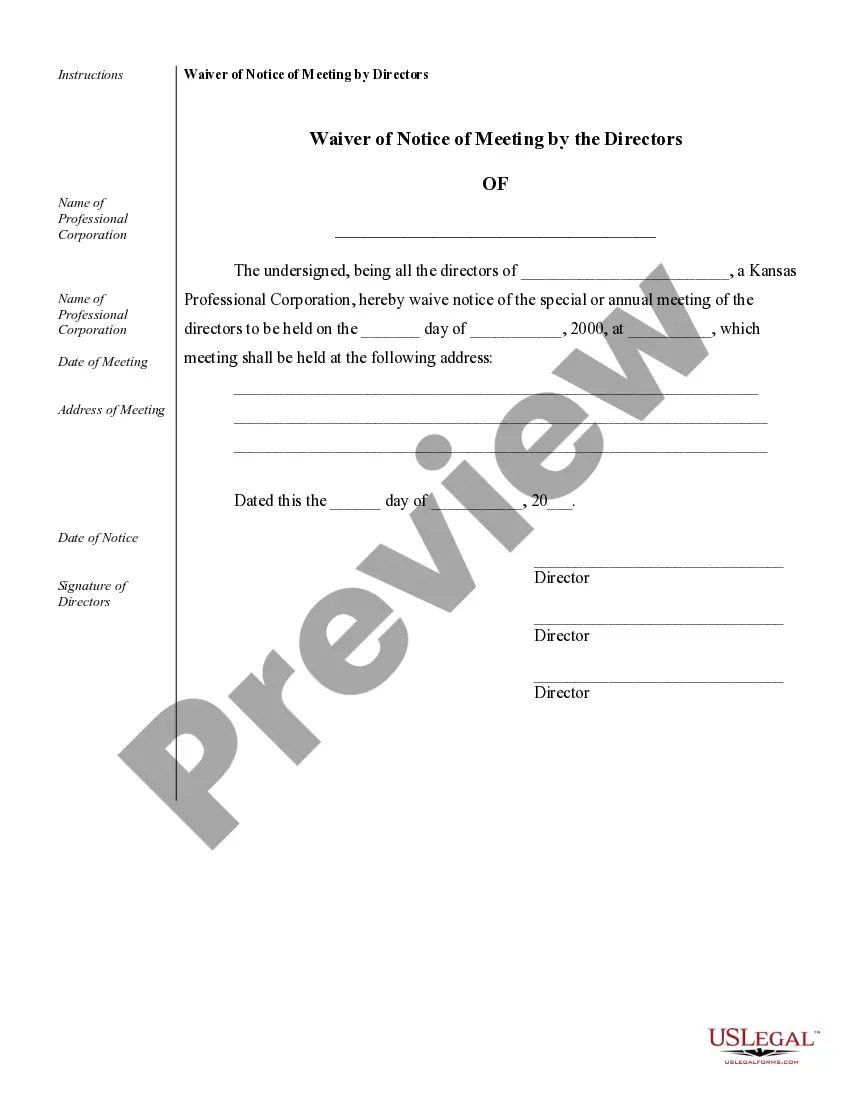

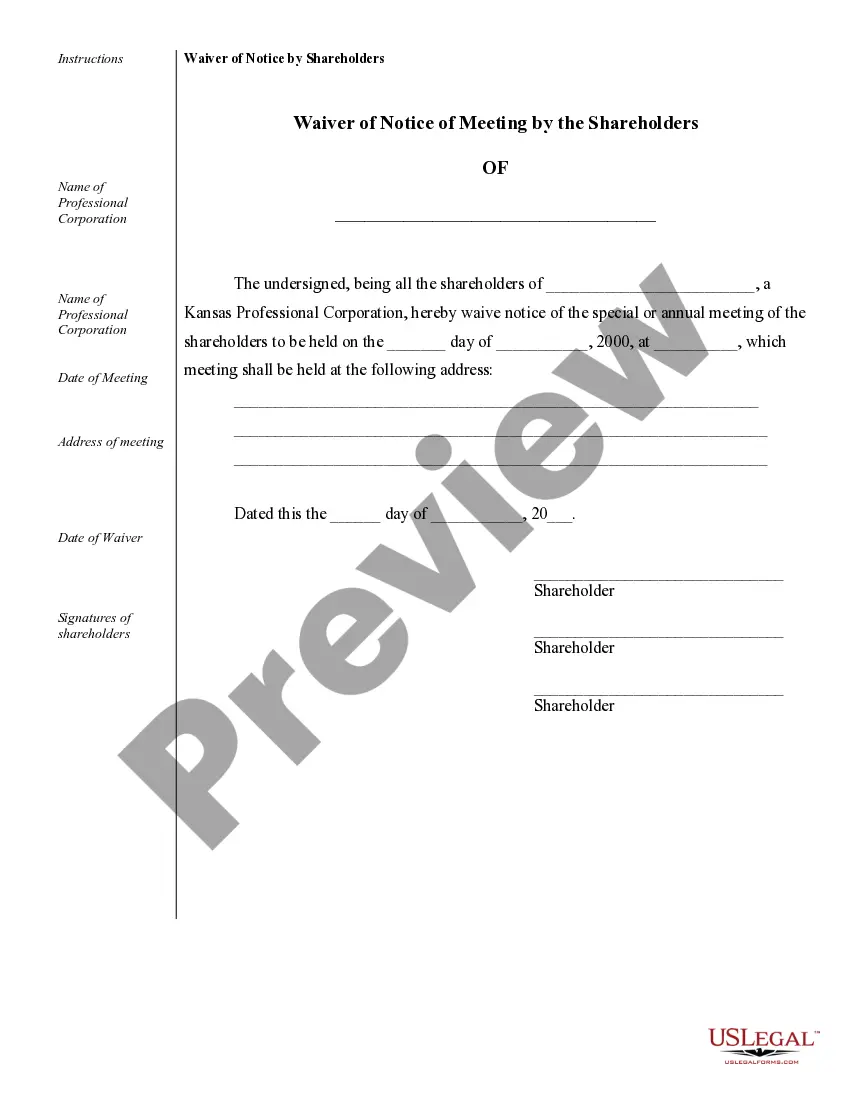

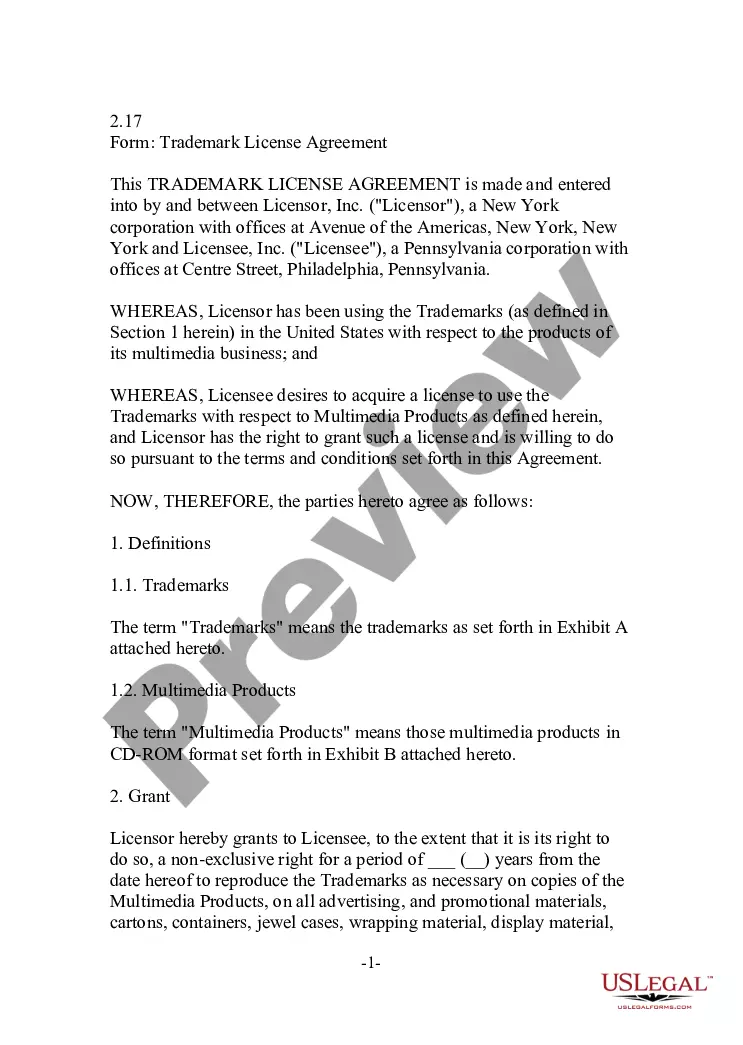

Overland Park Sample Corporate Records for a Kansas Professional Corporation are essential documents that provide a comprehensive overview of the business activities and legal obligations of the company. These records serve as a vital reference point for stakeholders, auditors, and potential investors to gain a better understanding of the corporation's operations and compliance with regulatory requirements in the state of Kansas. Some key types of Overland Park Sample Corporate Records for a Kansas Professional Corporation include: 1. Articles of Incorporation: This document outlines the formation, name, purpose, and structure of the professional corporation. It also includes information about the registered agent and initial directors. 2. Bylaws: These are the internal operating rules and regulations of the corporation, defining the roles and responsibilities of officers, directors, and shareholders. They also cover the procedures for holding meetings and voting on corporate matters. 3. Shareholder Agreements: These agreements outline the rights and obligations of the shareholders, including share ownership, voting rights, dividend distributions, and dispute resolution mechanisms. 4. Minutes of Meetings: These records detail the discussions, decisions, and resolutions made during shareholders' and directors' meetings. They serve as formal proof of corporate actions and are often required for legal compliance and audits. 5. Stock Certificates: These certificates represent ownership of shares within the corporation and provide evidence of the shareholder's equity interest. 6. Financial Statements: These records present the corporation's financial position, including income statements, balance sheets, and cash flow statements. They provide a comprehensive overview of the company's financial health and performance. 7. Regulatory Filings: These records include mandatory filings with state authorities, such as the annual report and business license renewal. They demonstrate compliance with various legal obligations and permit the corporation to operate within the state of Kansas. 8. Contracts and Agreements: These include copies of contracts, leases, vendor agreements, and other legally binding documents. They provide a comprehensive record of the corporation's obligations, rights, and legal relationships with external parties. 9. Tax Returns and Filings: These records include federal, state, and local tax filings, supporting documentation, and records of payments. They allow for accurate reporting and compliance with tax laws in Kansas. 10. Stock Ledger: This record maintains an accurate and up-to-date list of shareholder information, including names, addresses, and number of shares held. It is crucial for a Kansas Professional Corporation to maintain and manage meticulous corporate records to ensure legal compliance, corporate transparency, and effective governance. These records not only safeguard the corporation's interests but also contribute to establishing trust and credibility with shareholders, authorities, and potential business partners.

Overland Park Sample Corporate Records for a Kansas Professional Corporation

Description

How to fill out Overland Park Sample Corporate Records For A Kansas Professional Corporation?

Make use of the US Legal Forms and get instant access to any form template you require. Our helpful website with a large number of templates simplifies the way to find and obtain almost any document sample you need. You can export, fill, and certify the Overland Park Sample Corporate Records for a Kansas Professional Corporation in just a matter of minutes instead of browsing the web for several hours searching for a proper template.

Utilizing our catalog is a superb way to raise the safety of your document submissions. Our experienced legal professionals regularly review all the records to ensure that the forms are appropriate for a particular region and compliant with new acts and polices.

How can you get the Overland Park Sample Corporate Records for a Kansas Professional Corporation? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you view. In addition, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Find the form you need. Make sure that it is the template you were hoping to find: verify its title and description, and take take advantage of the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the saving process. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Pick the format to get the Overland Park Sample Corporate Records for a Kansas Professional Corporation and modify and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy document libraries on the internet. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Overland Park Sample Corporate Records for a Kansas Professional Corporation.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!