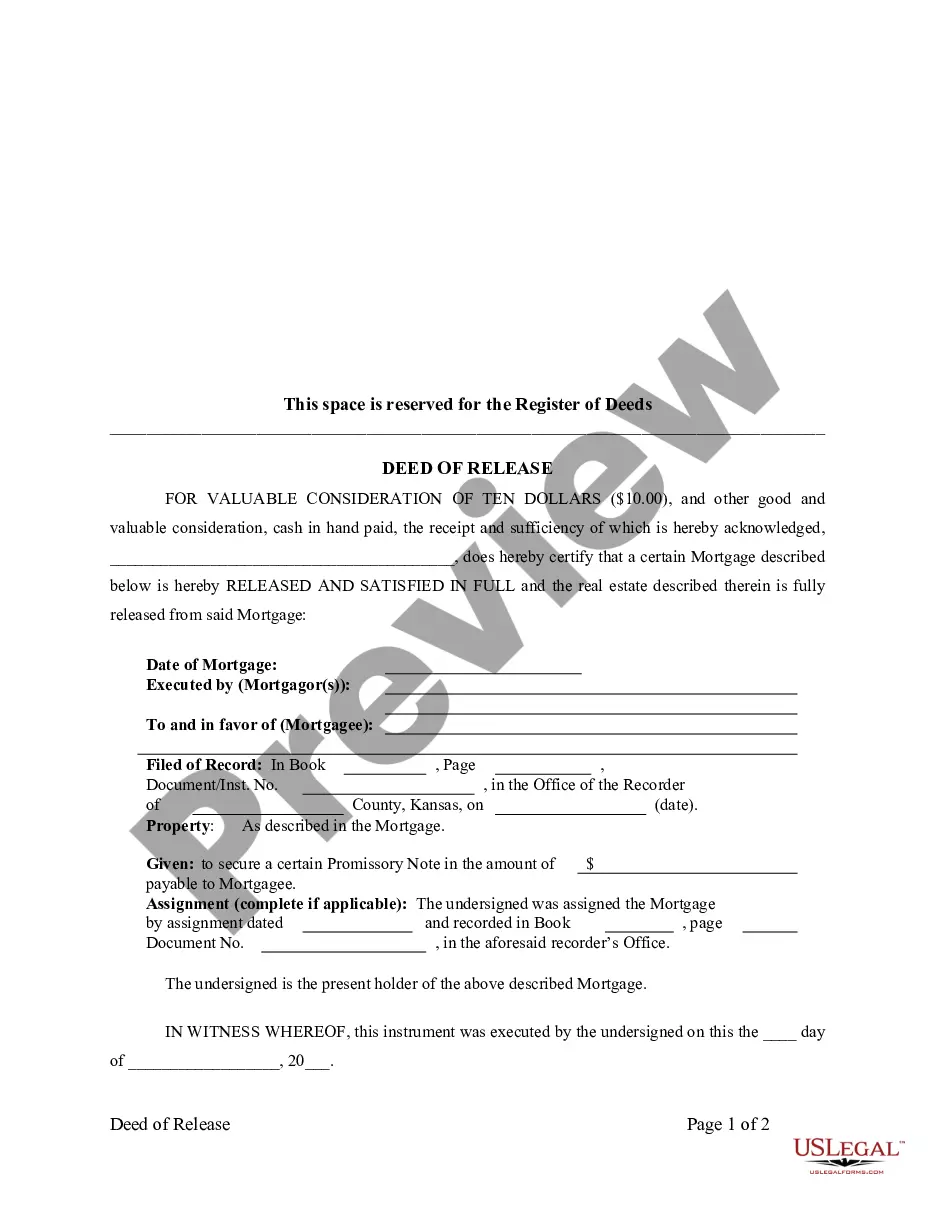

Olathe Kansas Satisfaction, Release or Cancellation of Mortgage by Individual: A Comprehensive Overview Olathe, Kansas, offers a detailed process for individuals to satisfy, release, or cancel a mortgage agreement. This procedure is crucial for homeowners who have successfully paid off their mortgage loans and wish to clear the lien from their property titles. Understanding the different types and requirements for satisfaction, release, or cancellation of mortgages in Olathe is essential. The following sections provide a comprehensive description of this process, including relevant keywords to ensure clarity. 1. Satisfaction of Mortgage by Individual: The satisfaction of mortgage by an individual in Olathe Kansas refers to the process of providing written evidence that a mortgage loan has been fully repaid. Once an individual successfully satisfies their mortgage, they can request the lender, typically a financial institution or a mortgage service, to issue a satisfaction of mortgage document. This document legally acknowledges the completion of all mortgage-related obligations and should be recorded with the appropriate county office for public record. Keywords: mortgage satisfaction process, repayment completion, written evidence, lender acknowledgement, satisfaction of mortgage document, public record. 2. Release of Mortgage by Individual: In some cases, Olathe homeowners may possess a mortgage that includes a release clause. This clause allows borrowers to obtain a release of mortgage from the lender once certain predetermined conditions are met. These conditions are usually outlined in the mortgage agreement itself and should be carefully reviewed. Homeowners seeking a release of mortgage should ensure they have satisfied the stipulated requirements before approaching their lender to initiate the release process. It is essential to note that not all mortgages include a release clause. Keywords: mortgage release clause, predetermined conditions, mortgage agreement review, borrower requirements, release of mortgage initiation. 3. Cancellation of Mortgage by Individual: The cancellation of mortgage by an individual in Olathe Kansas involves terminating or voiding a mortgage agreement before its intended completion. This cancellation may occur due to various reasons, such as errors in the mortgage documentation, fraud, breaches of contract, or mutual agreement between the borrower and lender. It is crucial to consult with legal professionals or mortgage experts to understand the specific circumstances in which cancellation is applicable. The cancellation process typically involves drafting a cancellation agreement, filing it with the appropriate local office, and updating public records accordingly. Keywords: mortgage cancellation, termination of agreement, mortgage documentation errors, fraud, breaches of contract, mutual agreement, cancellation agreement, public record update. By familiarizing yourself with the processes and keywords associated with Olathe Kansas Satisfaction, Release, or Cancellation of Mortgage by Individual, you can navigate this important aspect of homeownership confidently. Remember, it is always advisable to consult legal professionals or mortgage experts to ensure compliance with local regulations and to receive accurate guidance tailored to your specific circumstances.

Olathe Kansas Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Olathe Kansas Satisfaction, Release Or Cancellation Of Mortgage By Individual?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal services that, usually, are extremely expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Olathe Kansas Satisfaction, Release or Cancellation of Mortgage by Individual or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Olathe Kansas Satisfaction, Release or Cancellation of Mortgage by Individual adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Olathe Kansas Satisfaction, Release or Cancellation of Mortgage by Individual would work for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!