Title: Understanding Wichita Kansas Satisfaction, Release, and Cancellation of Mortgage by Individual Introduction: In Wichita, Kansas, the Satisfaction, Release, or Cancellation of Mortgage by Individual refers to the legal process in which a property owner or mortgage holder satisfies, releases, or cancels a mortgage loan. This detailed description serves to provide insight into the various types of satisfaction, release, or cancellation processes related to mortgages in Wichita, Kansas. Types of Satisfaction, Release, or Cancellation of Mortgage by Individual in Wichita, Kansas: 1. Voluntary Satisfaction: Voluntary satisfaction occurs when a borrower has successfully repaid the mortgage loan in full, thereby releasing them from any remaining obligations. This type of satisfaction requires the mortgage holder to file a Satisfaction of Mortgage form with the relevant county clerk's office to officially indicate the debt's satisfaction. 2. Release on Sale: If the property securing the mortgage is sold, a Release on Sale may be required. This type of release ensures that the mortgage lien is removed from the property's title and that the new homeowner is free from any mortgage obligations. The mortgage holder or lender will prepare and file a Release or Satisfaction of Mortgage document upon receiving the full payment for the outstanding loan. 3. Lien Release for Refinancing: When a property owner refinances their existing mortgage, the new lender paying off the old mortgage will request a Lien Release. This release indicates that the original mortgage is canceled and that the lien on the property has been transferred to the new lender. The original mortgage holder will file this release to ensure a clean title for the new lender. 4. Satisfaction due to Default: In some cases, a mortgage may be satisfied through a foreclosure or deed in lieu of foreclosure due to borrower default. When the property is sold in foreclosure or the borrower voluntarily transfers the property's deed to the lender, the mortgage is considered satisfied. The lender will then file a Satisfaction of Mortgage to release the lien on the property. 5. Satisfaction or Cancellation through Loan Modification: In certain situations, mortgage modifications are made to change the loan terms and facilitate affordable payments for struggling borrowers. If the terms of a loan are successfully modified, resulting in the borrower fulfilling their obligations under the new terms, the mortgage holder will file a Satisfaction or Cancellation of the previous mortgage and establish a new one reflecting the modified terms. Conclusion: Understanding the various forms of Satisfaction, Release, or Cancellation of Mortgage by Individual in Wichita, Kansas is crucial for both borrowers and mortgage holders. Whether its voluntary satisfaction, release on sale, lien release for refinancing, satisfaction due to default, or satisfaction through loan modification, each process ensures the legal release or cancellation of mortgage obligations, providing clarity and security to both parties involved.

Wichita Kansas Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Wichita Kansas Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Are you in search of a reliable and economical provider of legal forms to obtain the Wichita Kansas Satisfaction, Release or Cancellation of Mortgage by Individual? US Legal Forms is your ideal solution.

Whether you require a simple agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce process in court, we have everything you need. Our platform features over 85,000 current legal document templates for personal and corporate uses. All templates we provide are not generic, but tailored to meet the requirements of specific states and counties.

To download the document, you must Log In to your account, locate the required template, and click the Download button beside it. Please remember that you can access your previously purchased form templates at any time in the My documents section.

Are you a first-time visitor to our site? No need to worry. You can set up an account in just a few minutes, but first, ensure you do the following.

Once you are ready to create your account, select your subscription plan and proceed to payment. After the payment is processed, you can download the Wichita Kansas Satisfaction, Release or Cancellation of Mortgage by Individual in any available format. You can revisit the website anytime and redownload the document without any charges.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time on learning about legal paperwork online once and for all.

- Verify that the Wichita Kansas Satisfaction, Release or Cancellation of Mortgage by Individual meets the regulations of your state and locality.

- Review the form’s specifics (if available) to ascertain who and what the document is appropriate for.

- Restart your search if the template is not suitable for your particular situation.

Form popularity

FAQ

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

What is the distinction between a release and a discharge? With a release, your creditor confirms that all the sums due have been paid. The document certifies that the property is mortgage-free. The discharge releases only part of the property or only one of the individuals responsible for the mortgage payments.

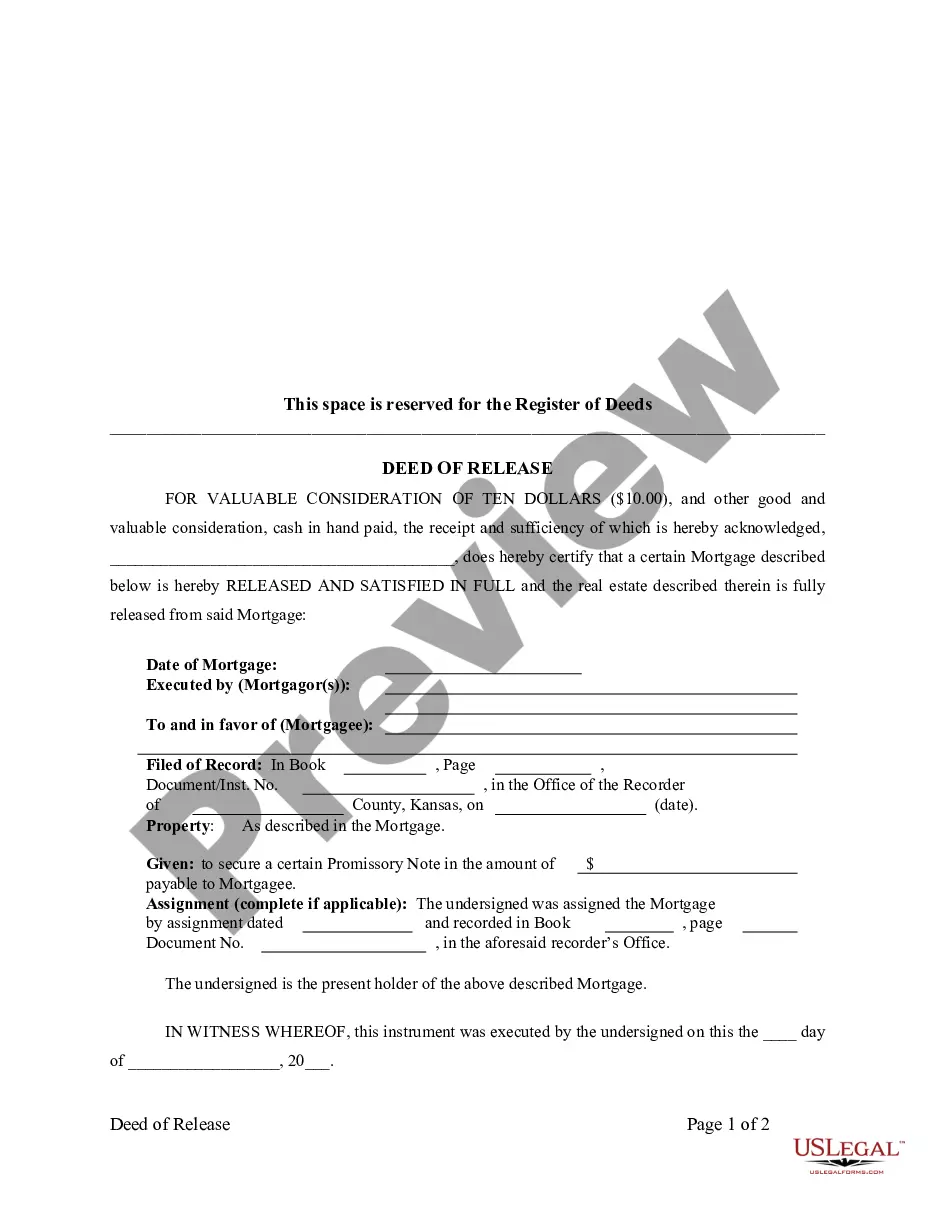

A deed of release refers to a legal document that eliminates a claim previously made on an asset. It helps with the documentation of release from a mandatory agreement. The deed may be included when a homeowner receives the title of a property from the lender upon satisfactory completion of mortgage payments.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

When your mortgage is paid off, a mortgage discharge should be recorded with the Registry of Deeds to clear your property's title. A discharge is a document (usually one page) issued by the lender, usually with a title such as ?Discharge of Mortgage? or ?Satisfaction of Mortgage.?

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

A mortgage discharge happens when you remove a home loan from the title of your property. Usually, when you have a home loan, the lender has the title - or ownership - of your home until the loan is repaid.

A release assignment or satisfaction of mortgage form is a document stating that the lender has released the homeowner from all liability regarding her mortgage. The release assignment must be recorded at the local land office in order to be valid.