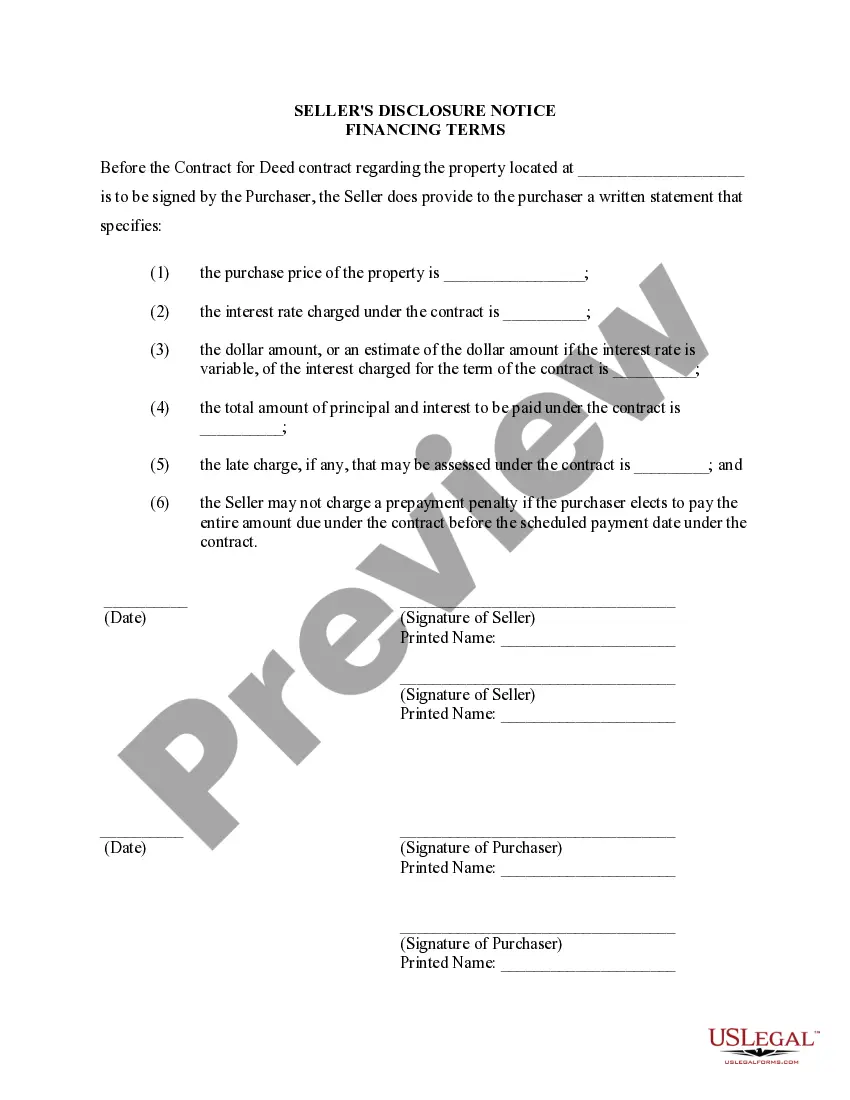

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Louisville Kentucky Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines the financing terms and conditions associated with the sale of a residential property. This disclosure is a crucial component of the contractual agreement between the seller and buyer, ensuring transparency and clarity regarding the financing arrangements. Keywords: Louisville Kentucky, Seller's Disclosure, Financing Terms, Residential Property, Contract or Agreement for Deed, Land Contract. Different types of Louisville Kentucky Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract may include: 1. Comprehensive Financing Disclosure: This type of disclosure covers all the essential aspects of the financing terms, such as the purchase price, down payment amount, interest rate, loan duration, and any additional costs or fees associated with the financing arrangement. It aims to provide a detailed overview of the financial obligations involved in the land contract. 2. Interest Rate and Payment Schedule Disclosure: This document specifically focuses on disclosing the interest rate applicable to the land contract and provides a clear payment schedule outlining installment amounts, due dates, and any penalties or charges for late payments. It aims to ensure that the buyer is fully aware of the financial obligations and repayment schedule. 3. Defects and Repairs Disclosure: This type of disclosure focuses on the condition of the property being sold and any known defects or repairs that may affect its value or habitability. It informs the buyer about any existing issues or necessary repairs that they should be aware of before entering into the land contract. 4. Insurance and Tax Disclosure: This disclosure highlights the insurance requirements and responsibilities for both the seller and buyer in relation to the property. It also outlines any tax obligations, such as property taxes, that the buyer will be responsible for during and after the land contract period. 5. Default and Foreclosure Disclosure: This type of disclosure provides information on the consequences and procedures in the event of default or foreclosure on the land contract. It outlines the rights and remedies available to both parties and ensures that the buyer is aware of the potential risks and implications involved in the financing agreement. It is important for both sellers and buyers to carefully review and understand the specific type of Louisville Kentucky Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract applicable in their situation. Consulting with a real estate professional or legal advisor can further clarify the disclosure requirements and ensure compliance with the relevant regulations and laws.Louisville Kentucky Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines the financing terms and conditions associated with the sale of a residential property. This disclosure is a crucial component of the contractual agreement between the seller and buyer, ensuring transparency and clarity regarding the financing arrangements. Keywords: Louisville Kentucky, Seller's Disclosure, Financing Terms, Residential Property, Contract or Agreement for Deed, Land Contract. Different types of Louisville Kentucky Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract may include: 1. Comprehensive Financing Disclosure: This type of disclosure covers all the essential aspects of the financing terms, such as the purchase price, down payment amount, interest rate, loan duration, and any additional costs or fees associated with the financing arrangement. It aims to provide a detailed overview of the financial obligations involved in the land contract. 2. Interest Rate and Payment Schedule Disclosure: This document specifically focuses on disclosing the interest rate applicable to the land contract and provides a clear payment schedule outlining installment amounts, due dates, and any penalties or charges for late payments. It aims to ensure that the buyer is fully aware of the financial obligations and repayment schedule. 3. Defects and Repairs Disclosure: This type of disclosure focuses on the condition of the property being sold and any known defects or repairs that may affect its value or habitability. It informs the buyer about any existing issues or necessary repairs that they should be aware of before entering into the land contract. 4. Insurance and Tax Disclosure: This disclosure highlights the insurance requirements and responsibilities for both the seller and buyer in relation to the property. It also outlines any tax obligations, such as property taxes, that the buyer will be responsible for during and after the land contract period. 5. Default and Foreclosure Disclosure: This type of disclosure provides information on the consequences and procedures in the event of default or foreclosure on the land contract. It outlines the rights and remedies available to both parties and ensures that the buyer is aware of the potential risks and implications involved in the financing agreement. It is important for both sellers and buyers to carefully review and understand the specific type of Louisville Kentucky Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract applicable in their situation. Consulting with a real estate professional or legal advisor can further clarify the disclosure requirements and ensure compliance with the relevant regulations and laws.