Louisville, Kentucky Bond is a type of municipal bond issued by the city of Louisville in the state of Kentucky. Municipal bonds, including the Louisville Kentucky Bonds, are debt securities issued by local governments to finance public infrastructure projects, such as schools, roads, hospitals, and other municipal projects. These bonds are typically tax-exempt at the federal level and may be exempt from state and local taxes as well, making them attractive investments for individuals seeking tax advantages. There are several types of Louisville Kentucky Bonds, each designed to meet different funding needs of the city. Some notable types of Louisville Kentucky Bonds include: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of the city and are typically secured by the city's taxing power. General Obligation Bonds are used to fund various public projects and are considered a safe investment. 2. Revenue Bonds: Louisville may issue revenue bonds to finance specific projects that generate revenue, such as toll roads, municipal utilities, or parking garages. These bonds are typically backed by the revenue generated from the project they finance. 3. Economic Development Bonds: These bonds are aimed at promoting economic growth within Louisville. They are used to funding projects that stimulate job creation, attract businesses, and revitalize certain areas of the city. 4. School Bonds: Louisville may issue school bonds to fund the construction or renovation of public schools within the city. These bonds are essential in ensuring the optimal learning environment for the students and the growth of the education sector. Investing in Louisville Kentucky Bonds can be attractive to investors looking for tax advantages and stable returns. The interest generated by these bonds is typically exempt from federal income tax, making them particularly appealing for high-net-worth individuals seeking tax-efficient investment options. However, potential investors should conduct thorough research and consult with financial advisors to ensure these investments align with their financial goals and risk tolerance. Overall, Louisville Kentucky Bonds provide an opportunity for investors to support the development and growth of Louisville while enjoying potential tax advantages and steady income.

Louisville Kentucky Bond

Category:

State:

Kentucky

City:

Louisville

Control #:

KY-057LRS

Format:

Word;

Rich Text

Instant download

Description

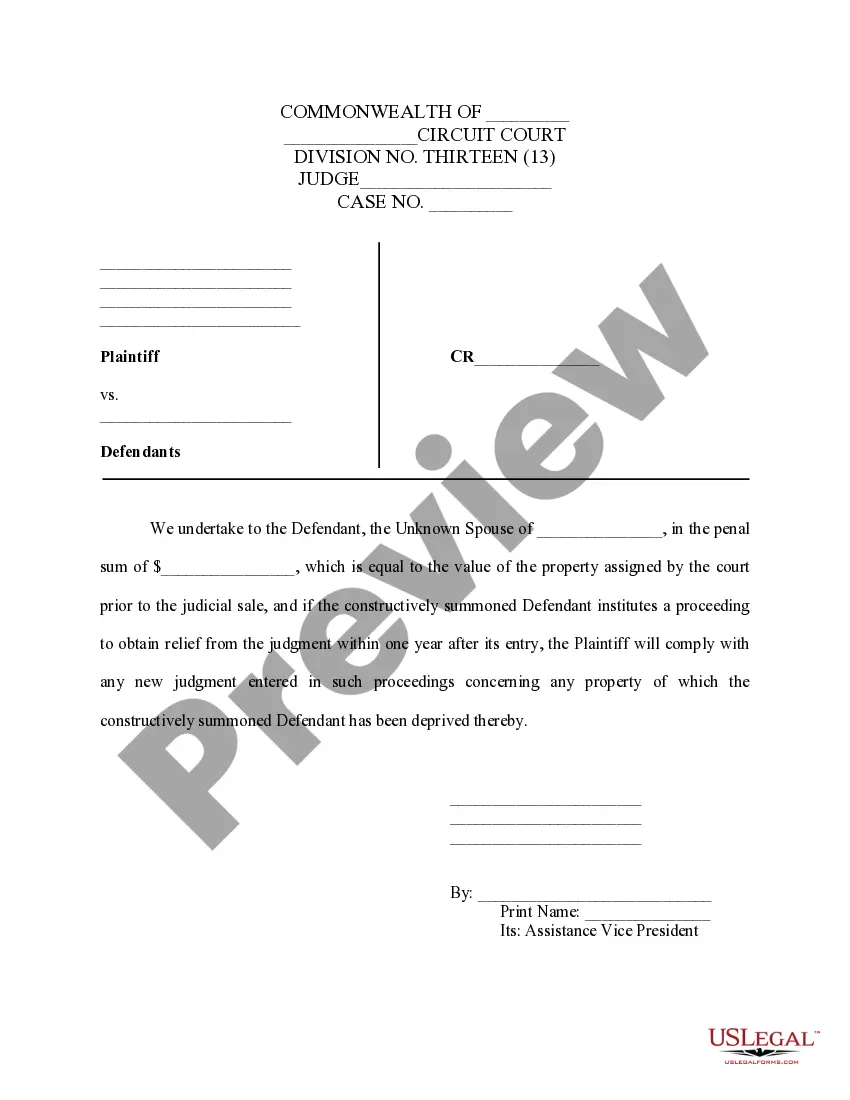

Property bond Surety agrees to pay bond that posts the value of tangible property, such as real estate, in order to obtain a pre-trial release from jail.

Louisville, Kentucky Bond is a type of municipal bond issued by the city of Louisville in the state of Kentucky. Municipal bonds, including the Louisville Kentucky Bonds, are debt securities issued by local governments to finance public infrastructure projects, such as schools, roads, hospitals, and other municipal projects. These bonds are typically tax-exempt at the federal level and may be exempt from state and local taxes as well, making them attractive investments for individuals seeking tax advantages. There are several types of Louisville Kentucky Bonds, each designed to meet different funding needs of the city. Some notable types of Louisville Kentucky Bonds include: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of the city and are typically secured by the city's taxing power. General Obligation Bonds are used to fund various public projects and are considered a safe investment. 2. Revenue Bonds: Louisville may issue revenue bonds to finance specific projects that generate revenue, such as toll roads, municipal utilities, or parking garages. These bonds are typically backed by the revenue generated from the project they finance. 3. Economic Development Bonds: These bonds are aimed at promoting economic growth within Louisville. They are used to funding projects that stimulate job creation, attract businesses, and revitalize certain areas of the city. 4. School Bonds: Louisville may issue school bonds to fund the construction or renovation of public schools within the city. These bonds are essential in ensuring the optimal learning environment for the students and the growth of the education sector. Investing in Louisville Kentucky Bonds can be attractive to investors looking for tax advantages and stable returns. The interest generated by these bonds is typically exempt from federal income tax, making them particularly appealing for high-net-worth individuals seeking tax-efficient investment options. However, potential investors should conduct thorough research and consult with financial advisors to ensure these investments align with their financial goals and risk tolerance. Overall, Louisville Kentucky Bonds provide an opportunity for investors to support the development and growth of Louisville while enjoying potential tax advantages and steady income.

How to fill out Louisville Kentucky Bond?

If you’ve already used our service before, log in to your account and download the Louisville Kentucky Bond on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Louisville Kentucky Bond. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!