Title: Understanding the Louisville Kentucky Complaint for Foreclosure — A Comprehensive Guide Introduction: In Louisville, Kentucky, a complaint for foreclosure refers to the legal process initiated by a mortgage lender or a lien holder to enforce their rights to seize and sell a property due to the homeowner's failure to make timely mortgage payments. This guide provides a detailed description of the Louisville Kentucky Complaint for Foreclosure, its process, and various types of complaints that can be filed. Keywords: Louisville Kentucky, complaint for foreclosure, legal process, mortgage lender, lien holder, seize, sell property, homeowner, mortgage payments. I. Overview of the Louisville Kentucky Complaint for Foreclosure: — The complaint for foreclosure is a legal action filed by a mortgage lender or lien holder against a homeowner who has defaulted on their mortgage loan payments. — The purpose of the complaint is to seek a court-ordered sale of the property to recover the outstanding debt. II. Process of Louisville Kentucky Complaint for Foreclosure: 1. Notice of Default: — The lendealienesoldererer sends a notice of default to the homeowner, informing them of their delinquent mortgage payments and the potential foreclosure action. — This notice provides an opportunity for the homeowner to resolve the issue voluntarily before the case progresses further. 2. Filing the Complaint: — If the homeowner fails to resolve the default, the lender or lien holder files a complaint for foreclosure with the appropriate Kentucky court. — The complaint outlines the details of the delinquency, the amount owed, and the legal basis for seeking foreclosure. 3. Service of Process: — After filing the complaint, the lender or their representative serves the homeowner with a summons and a copy of the complaint, notifying them of the foreclosure action. — Service of process ensures the homeowner is aware of the legal proceedings and has an opportunity to respond. 4. Homeowner's Response: — Upon receiving the complaint, the homeowner has a limited time, typically 20-30 days, to file an answer or other responsive pleadings. — The homeowner may choose to contest the foreclosure, citing grounds such as loan modification, lack of notice, or predatory lending practices. 5. Judicial Foreclosure: — In Kentucky, foreclosure is primarily a judicial process, meaning it requires court intervention. — The court carefully examines the case, considers the evidence, and renders a decision to either grant or deny foreclosure. 6. Foreclosure Sale: — If the court approves the foreclosure, an order of sale is issued, and the property will be sold at a public auction to the highest bidder. — The proceeds from the sale are used to pay off the outstanding debt, and any surplus is returned to the homeowner if applicable. Types of Louisville Kentucky Complaints for Foreclosure: 1. Residential Foreclosure Complaint: — This type of complaint is filed when a residential homeowner defaults on their mortgage payments, leading to foreclosure. 2. Commercial Foreclosure Complaint: — Commercial foreclosure complaints are filed when a commercial property owner fails to meet their financial obligations, resulting in foreclosure. 3. Tax Foreclosure Complaint: — In cases where the homeowner fails to pay property taxes, a tax foreclosure complaint may be filed to satisfy the unpaid tax obligation. Conclusion: Understanding the Louisville Kentucky Complaint for Foreclosure is crucial for homeowners facing financial difficulties in meeting their mortgage obligations. By familiarizing themselves with the process and potential types of foreclosure complaints, homeowners can better navigate the legal proceedings and seek appropriate solutions to address their mortgage delinquency.

Louisville Kentucky Complaint for Foreclosure

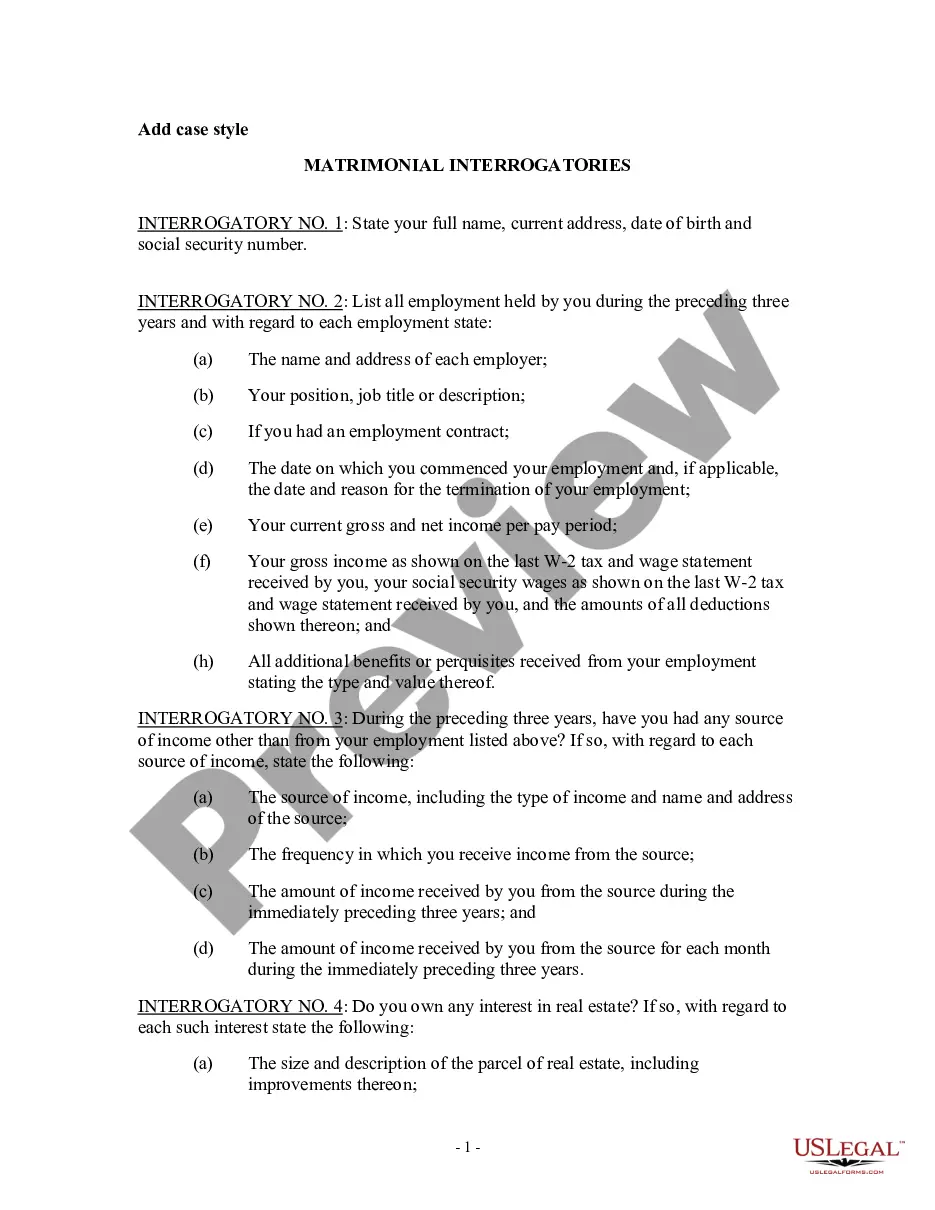

Description

How to fill out Louisville Kentucky Complaint For Foreclosure?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no legal education to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a huge catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you want the Louisville Kentucky Complaint for Foreclosure or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Louisville Kentucky Complaint for Foreclosure in minutes using our trustworthy service. In case you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, if you are new to our platform, make sure to follow these steps prior to downloading the Louisville Kentucky Complaint for Foreclosure:

- Ensure the template you have found is specific to your location since the regulations of one state or county do not work for another state or county.

- Review the document and read a brief outline (if provided) of scenarios the paper can be used for.

- In case the form you picked doesn’t suit your needs, you can start over and look for the suitable document.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Louisville Kentucky Complaint for Foreclosure once the payment is through.

You’re all set! Now you can go ahead and print out the document or fill it out online. If you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.