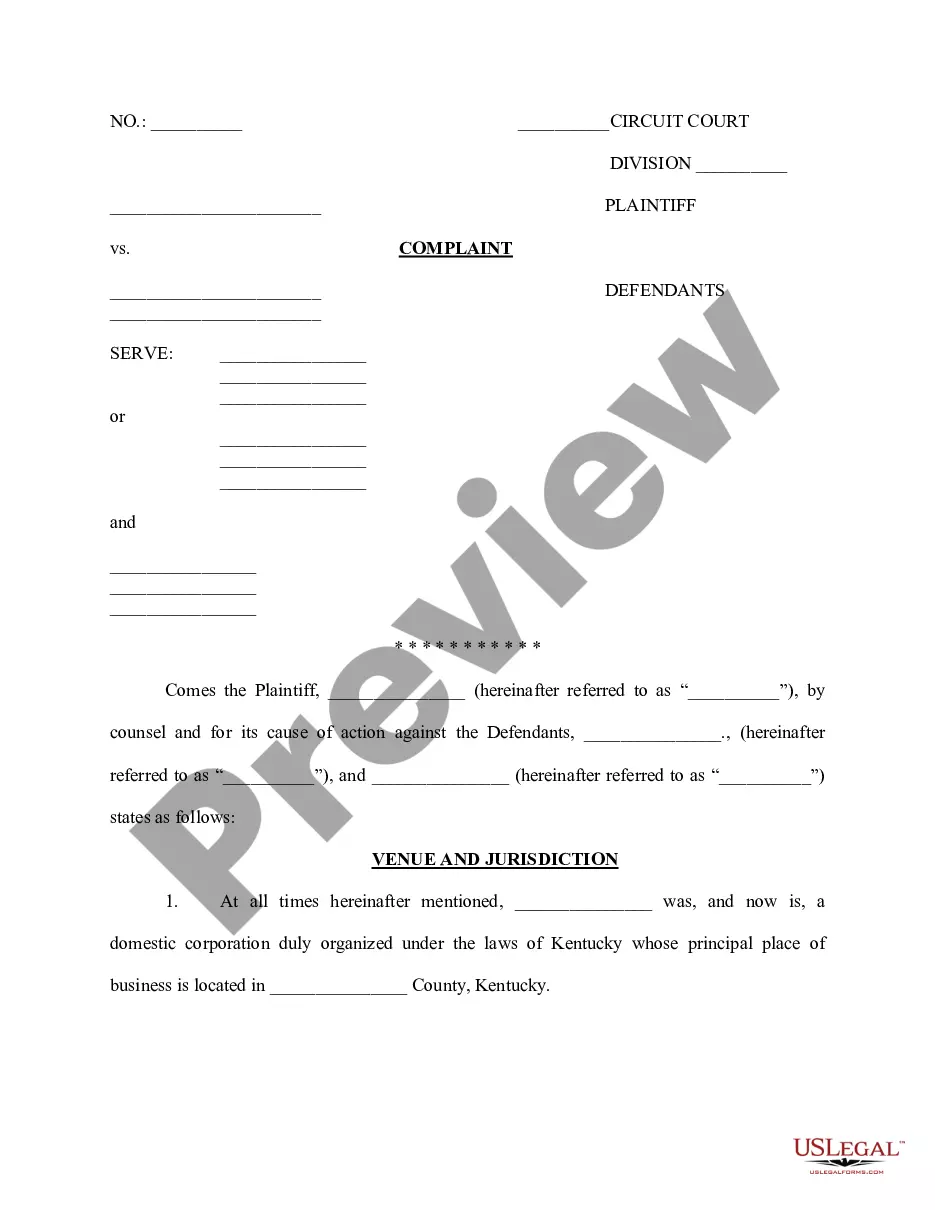

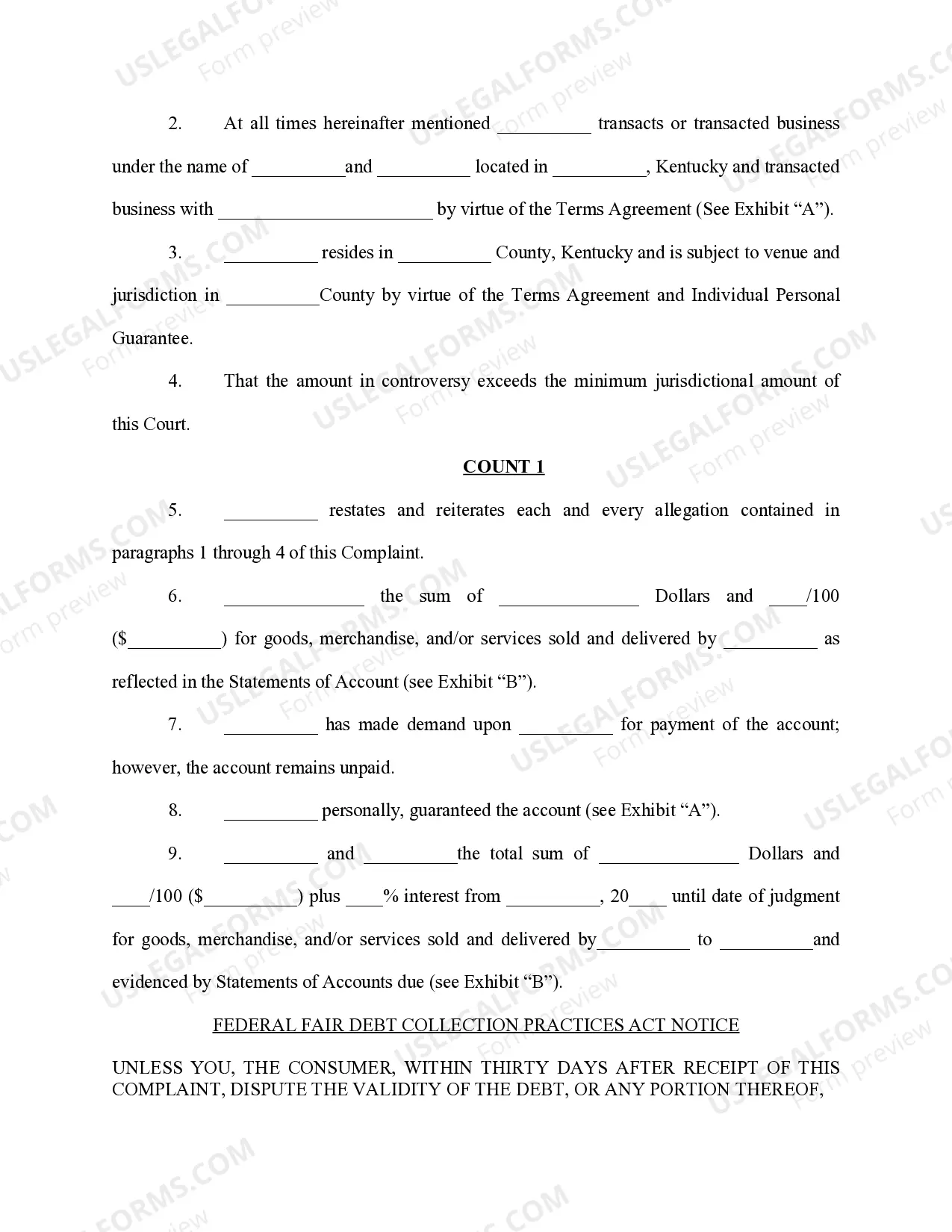

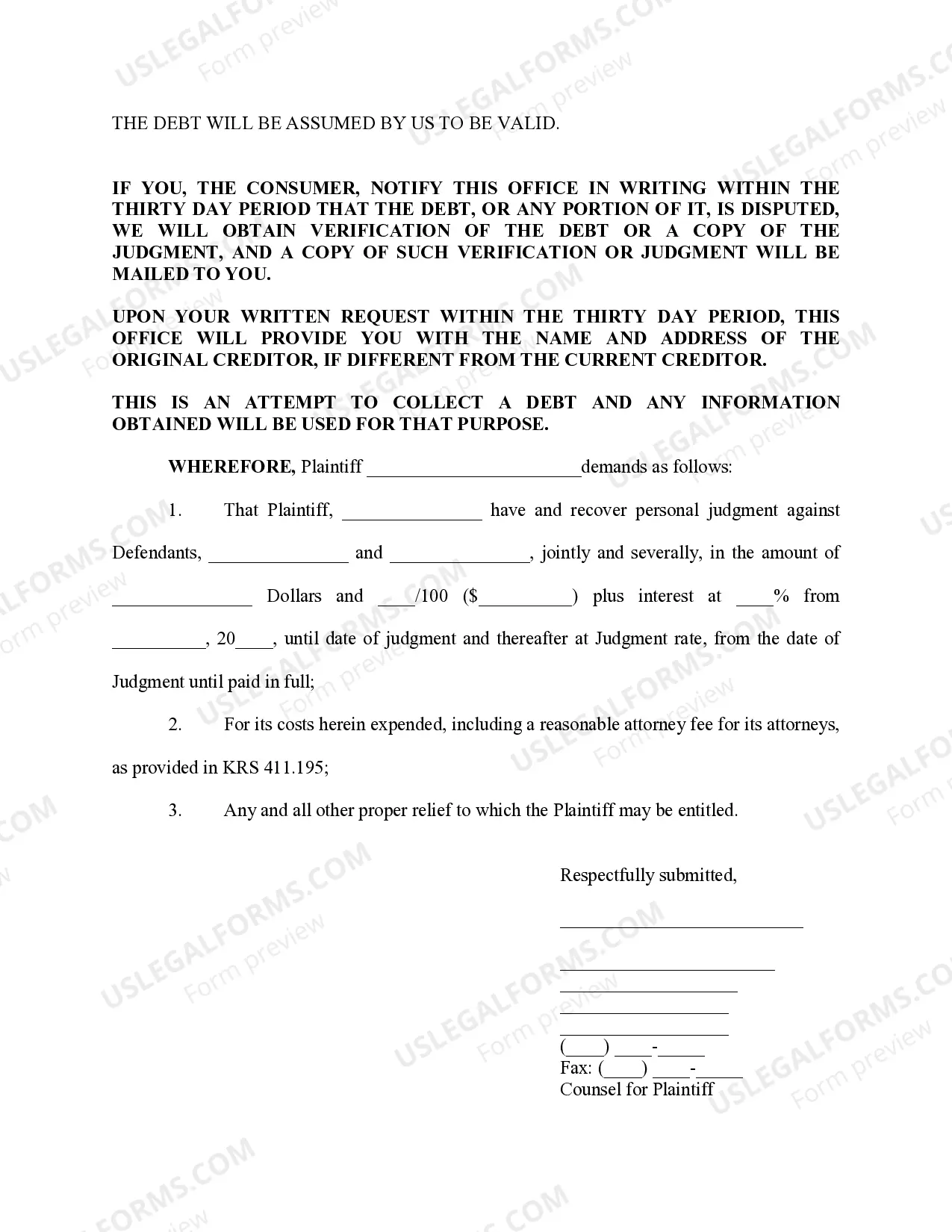

Louisville Kentucky Complaint- Debt refers to the collection of debt-related issues and complaints that arise within the Louisville, Kentucky area. It encompasses various types of debt complaints, including credit card debt, medical debt, student loan debt, mortgage debt, and personal loan debt. When faced with debt-related problems in Louisville, individuals may find themselves dealing with aggressive debt collectors, unfair lending practices, incorrect billing statements, debt collection harassment, or even illegal debt collection tactics. These issues can lead to financial distress, emotional turmoil, and a negative impact on one's credit score and overall financial well-being. Some specific types of Louisville Kentucky Complaint- Debt include the following: 1. Credit Card Debt Complaints: These involve issues such as high interest rates, hidden fees, identity theft, unauthorized charges, and poor customer service from credit card companies based in Louisville. 2. Medical Debt Complaints: These complaints may arise from excessive medical bills, incorrect billing, lack of insurance coverage, or difficulties in negotiating payment plans with healthcare providers or medical debt collection agencies in Louisville. 3. Student Loan Debt Complaints: These complaints encompass problems related to student loan services, such as difficulties in obtaining accurate loan information, improper loan servicing, inadequate repayment options, or issues arising from the mismanagement of federal student loan programs available to Louisville residents. 4. Mortgage Debt Complaints: These complaints focus on issues related to mortgage lenders, including unfair lending practices, foreclosure concerns, loan modification problems, predatory lending, or issues related to mortgage services and their handling of mortgage accounts. 5. Personal Loan Debt Complaints: These complaints pertain to issues involving personal loan lenders in Louisville, such as excessively high interest rates, misleading advertising, unfair loan terms, or problems with debt collection practices. Navigating the complexities of debt-related complaints in Louisville, Kentucky can be challenging. Seeking legal advice and assistance from consumer protection agencies, debt relief organizations, or attorneys specializing in debt-related matters can be instrumental in resolving these complaints and ensuring fair treatment under relevant state and federal laws.

Louisville Kentucky Complaint- Debt

Description

How to fill out Louisville Kentucky Complaint- Debt?

If you are looking for a valid form, it’s impossible to find a more convenient place than the US Legal Forms website – probably the most extensive libraries on the internet. Here you can get thousands of document samples for organization and personal purposes by types and regions, or key phrases. With the high-quality search option, getting the most recent Louisville Kentucky Complaint- Debt is as elementary as 1-2-3. In addition, the relevance of each file is proved by a group of skilled attorneys that on a regular basis review the templates on our website and update them based on the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to get the Louisville Kentucky Complaint- Debt is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you want. Look at its description and make use of the Preview option to see its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to discover the needed file.

- Confirm your decision. Select the Buy now option. Following that, choose the preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the template. Indicate the format and save it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Louisville Kentucky Complaint- Debt.

Each and every template you add to your user profile does not have an expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to get an additional copy for enhancing or creating a hard copy, you can return and save it again anytime.

Take advantage of the US Legal Forms extensive collection to gain access to the Louisville Kentucky Complaint- Debt you were looking for and thousands of other professional and state-specific samples on one platform!