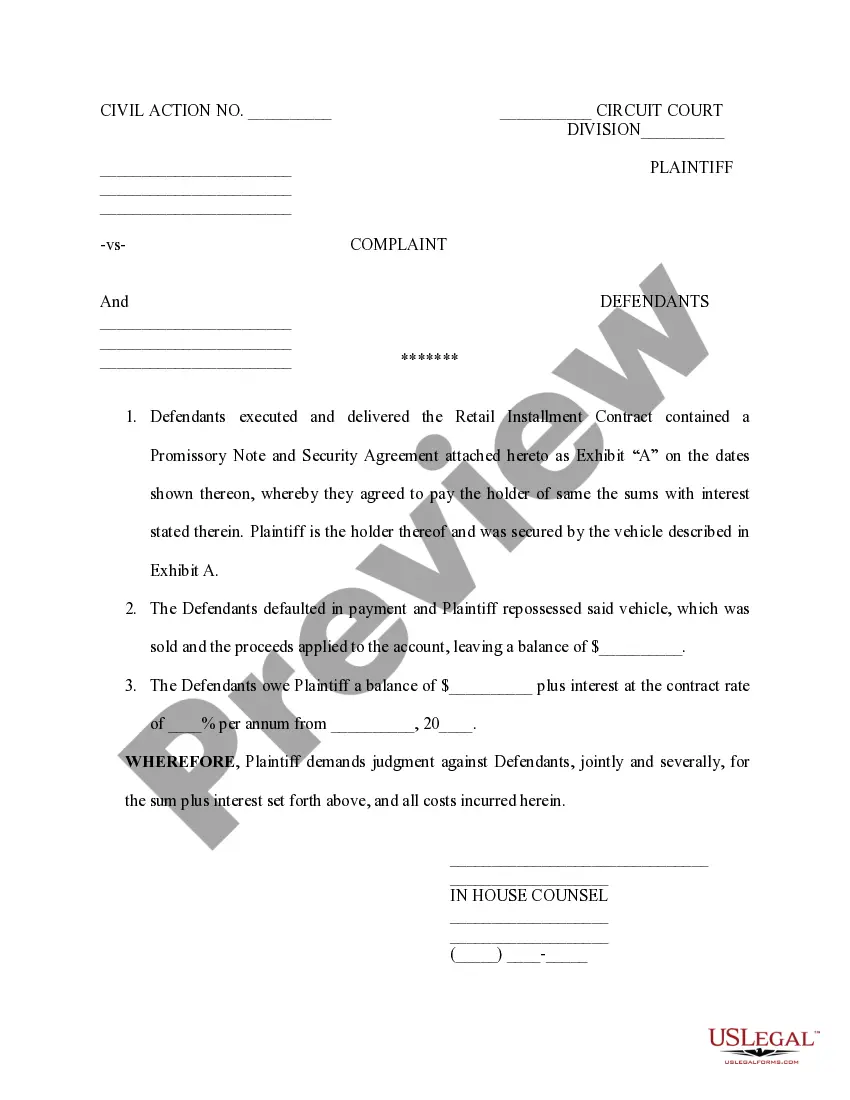

If you are interested in learning about Louisville Kentucky Complaint- Default Vehicle, you have come to the right place. In this detailed description, we will explore what this complaint entails, its general framework, and its potential variations. So let's dive into it! A Louisville Kentucky Complaint- Default Vehicle refers to a formal complaint made by a creditor against a debtor for defaulting on a vehicle loan or failing to meet the terms of the loan agreement. It is a legal process that allows the creditor to seek compensation or collateral repossession due to a breach of contract. This complaint aims to protect the rights of the creditor and resolve the financial dispute related to the vehicle. When it comes to the types of Louisville Kentucky Complaint- Default Vehicle, the variations could include: 1. Loan Default: This occurs when the debtor fails to make the agreed-upon loan payments on time or doesn't pay the stipulated amount. It can also refer to missing consecutive payments. 2. Repossession: If the debtor defaults on the loan, creditors may initiate vehicle repossession. This involves legally taking possession of the vehicle due to non-payment or other contractual violations. 3. Breach of Contract: In cases where the debtor does not adhere to the agreed terms and conditions outlined in the loan contract, such as excessive mileage, failure to maintain insurance or registration, or misuse of the vehicle, the creditor may file a complaint on the grounds of breach of contract. 4. Bankruptcy: In instances where the debtor files for bankruptcy, it can complicate the repayment process. Creditors can file a complaint to protect their rights and claims in the bankruptcy proceedings. 5. Collateral Damage: This refers to situations in which the collateral (the vehicle) sustains damage, diminishing its value or rendering it unusable while under the debtor's ownership. Creditors can file a complaint to address these issues and seek compensation for the damage. To sum it up, a Louisville Kentucky Complaint- Default Vehicle is a formal complaint filed by a creditor against a debtor for defaulting on a vehicle loan or violating the loan agreement. It serves as a means for the creditor to seek restitution, enforce the terms of the contract, or repossess the vehicle. Understanding the different types of default vehicle complaints can provide insights into the complexities surrounding the legal process and resolutions associated with such cases.

Louisville Kentucky Complaint- Default Vehicle

Description

How to fill out Louisville Kentucky Complaint- Default Vehicle?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Louisville Kentucky Complaint- Default Vehicle becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Louisville Kentucky Complaint- Default Vehicle takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Louisville Kentucky Complaint- Default Vehicle. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!