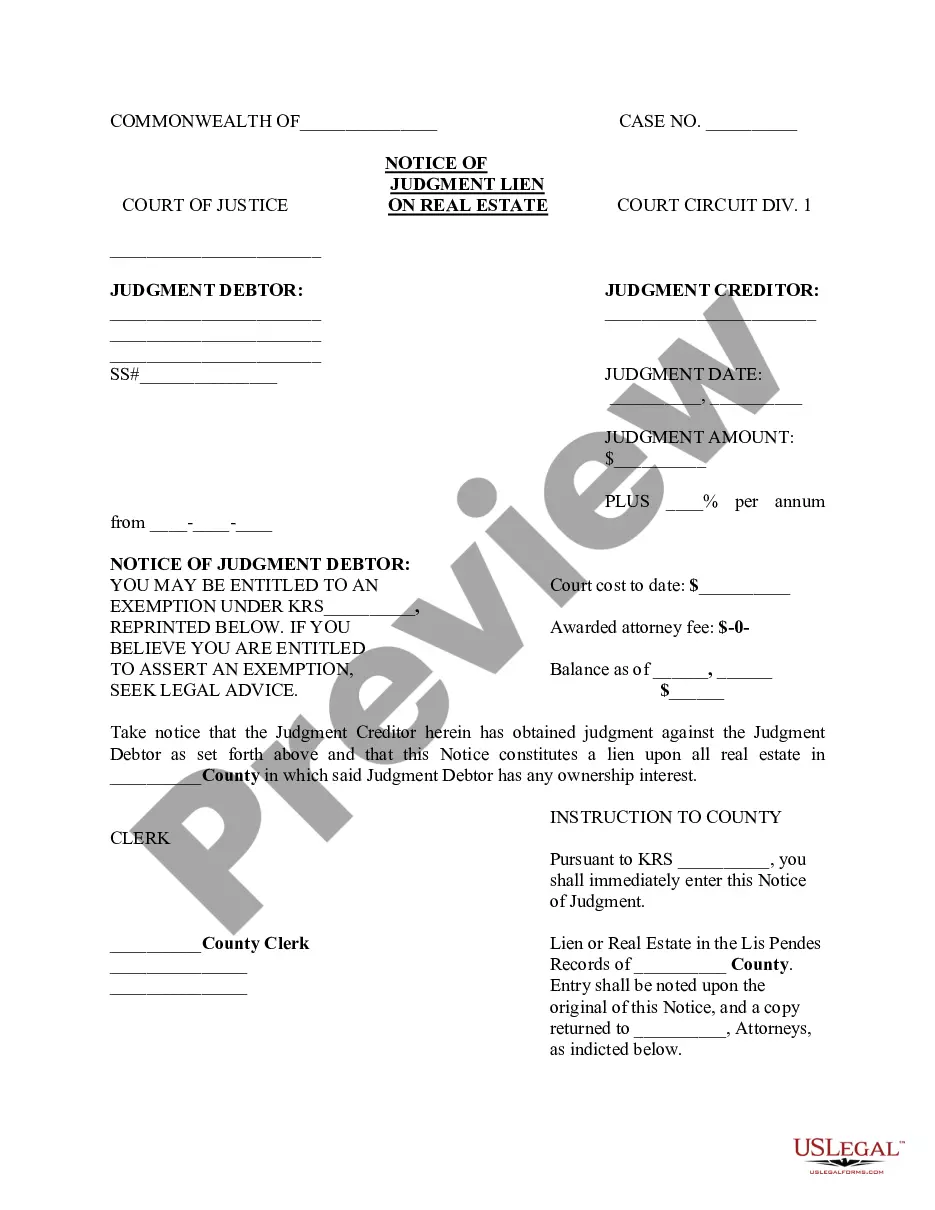

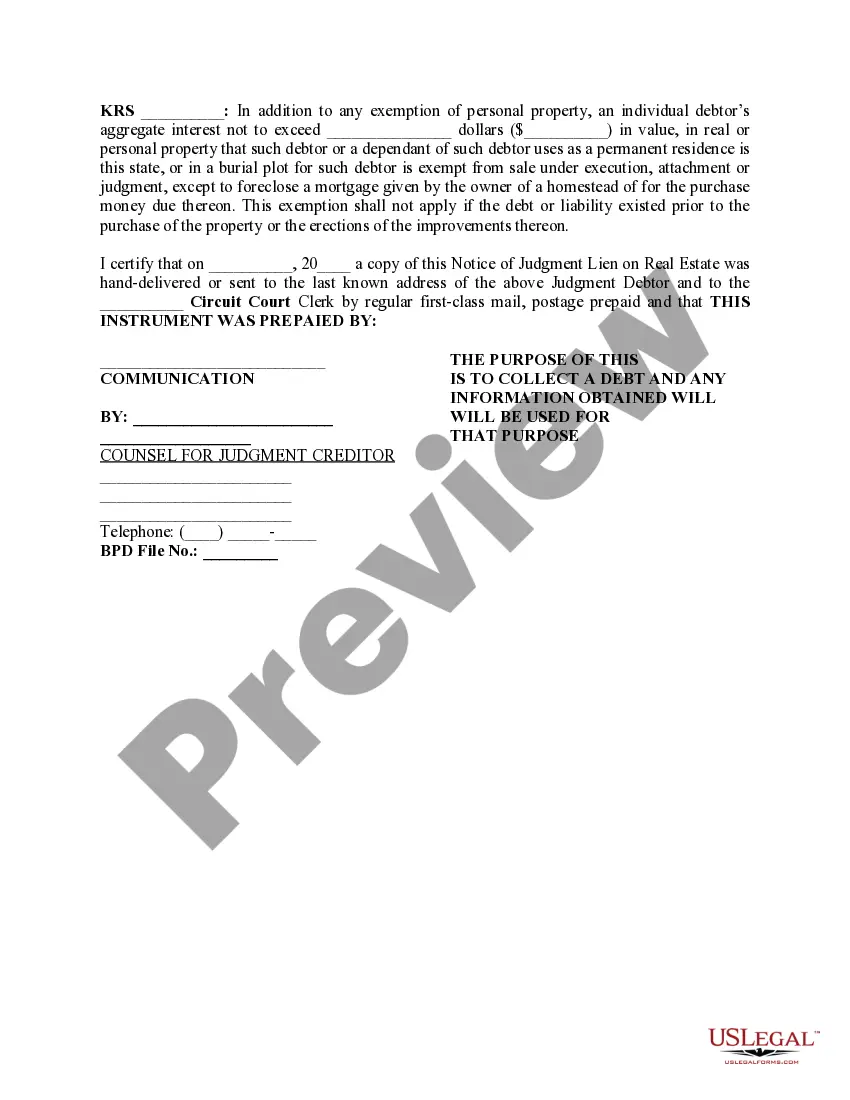

Louisville Kentucky Notice of Judgment Lien on Real Estate is a legal document filed to publicly notify individuals of a recorded judgment lien on a specific property in the Louisville, Kentucky area. This lien serves as a claim against the property, indicating that the property owner has an outstanding debt or judgment that needs to be satisfied. A Notice of Judgment Lien on Real Estate is typically filed by a creditor who has obtained a court judgment against the property owner for unpaid debts, judgments, or tax liens. By recording this notice, the creditor seeks to establish their priority right to recover the amount owed from the proceeds of the property, should it be sold or refinanced. In Louisville, Kentucky, there are different types of Notice of Judgment Liens on Real Estate, including: 1. General Judgment Lien: This is the most common type of judgment lien filed against real estate in Louisville, Kentucky. It is typically filed in the county where the property is located and serves as a public record, alerting potential buyers, lenders, and other interested parties of the creditor's claim on the property. 2. Tax Lien: In cases where property owners owe unpaid taxes, the government may file a Notice of Judgment Lien on Real Estate. This specific type of lien allows the government to recover the outstanding tax debt by seizing and selling the property if necessary. 3. Mechanic's Lien: Contractors, subcontractors, or suppliers who have provided labor, services, or materials to improve a property may file a Notice of Judgment Lien. This lien ensures they have a legal claim on the property to satisfy the unpaid amount. 4. HOA Lien: Homeowners' associations (Has) may file a Notice of Judgment Lien on Real Estate when property owners fail to pay their dues or assessments. This allows the HOA to recover the outstanding fees by placing a lien on the property. It's important to note that a Notice of Judgment Lien on Real Estate can negatively impact the property owner's ability to sell or refinance the property. It hinders the transfer of clear title, and potential buyers or lenders may be reluctant to get involved due to the financial obligations tied to the property. If a property owner wishes to remove or satisfy the Notice of Judgment Lien on Real Estate, they must pay the debt owed to the creditor, negotiate a settlement, or seek legal recourse to challenge the validity of the lien in court. Once the judgment is satisfied or resolved, the creditor should file a release or satisfaction of the lien with the appropriate county office to remove the cloud on the property's title. Understanding the implications and types of Notice of Judgment Liens on Real Estate in Louisville, Kentucky is crucial for property owners, buyers, lenders, and anyone involved in real estate transactions. Seeking legal advice and conducting thorough title searches can help ensure transparency and mitigate potential issues associated with these liens.

Louisville Kentucky Notice of Judgment Lien on Real Estate

Description

How to fill out Louisville Kentucky Notice Of Judgment Lien On Real Estate?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone with no law education to draft such papers from scratch, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you want the Louisville Kentucky Notice of Judgment Lien on Real Estate or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Louisville Kentucky Notice of Judgment Lien on Real Estate in minutes employing our trusted service. If you are already a subscriber, you can go ahead and log in to your account to download the appropriate form.

However, if you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Louisville Kentucky Notice of Judgment Lien on Real Estate:

- Be sure the template you have chosen is good for your location because the regulations of one state or area do not work for another state or area.

- Review the form and go through a short description (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your requirements, you can start again and look for the needed document.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or create one from scratch.

- Pick the payment method and proceed to download the Louisville Kentucky Notice of Judgment Lien on Real Estate once the payment is through.

You’re all set! Now you can go ahead and print the form or fill it out online. Should you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.