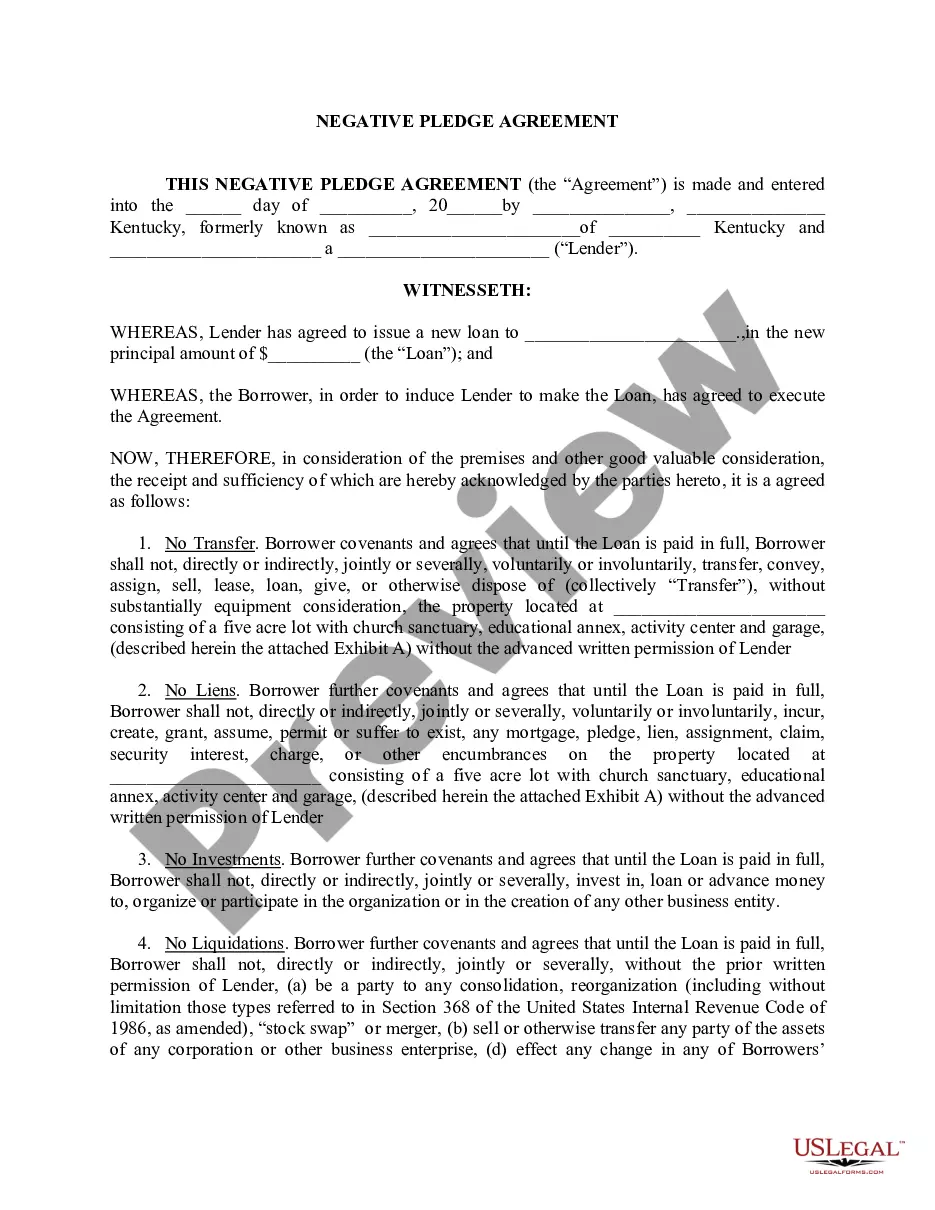

A Louisville Kentucky Negative Pledge Agreement is a legally binding contract commonly used in financial transactions, specifically in the context of loan agreements or bond issuance, where the borrower or issuer agrees not to encumber certain assets. This agreement restricts the pledging, mortgaging, or selling of specified assets without the prior consent of the lender or bondholders. In Louisville, Kentucky, the Negative Pledge Agreement is put in place to provide additional security to the lenders or bondholders by ensuring that the borrower or issuer will not engage in actions that could jeopardize their ability to repay the borrowed funds. By pledging specific assets as collateral, the lender or bondholders have a claim on those assets in case of default. Keywords: Louisville Kentucky, Negative Pledge Agreement, legally binding contract, financial transactions, loan agreements, bond issuance, borrower, issuer, encumber, assets, pledging, mortgaging, selling, consent, lenders, bondholders, security, borrowed funds, collateral, default. Different types of Negative Pledge Agreements in Louisville, Kentucky can include: 1. Real Estate Negative Pledge Agreement: This type of agreement applies specifically to immovable properties, such as land, buildings, or real estate projects. The borrower or issuer must obtain consent before encumbering or disposing of any real estate assets without jeopardizing the lender's security. 2. Equipment Negative Pledge Agreement: This agreement pertains to movable assets, including machinery, vehicles, or equipment. It ensures that the borrower or issuer cannot pledge, sell, or encumber these assets without the lender's prior approval. 3. Intellectual Property Negative Pledge Agreement: In cases where the borrower or issuer possesses valuable intellectual property assets, such as patents, trademarks, or copyrights, this agreement provides protection for the lender or bondholders by restricting the borrower's ability to transfer or pledge these assets without consent. 4. Receivables Negative Pledge Agreement: This type of agreement applies to a borrower's receivables or accounts receivable. It ensures that the borrower does not assign, sell, or pledge these receivables to other parties, thereby maintaining their value as collateral for the lender. Keywords: Real Estate Negative Pledge Agreement, immovable properties, land, buildings, real estate projects, encumbering, disposing, consent, equipment, machinery, vehicles, movable assets, intellectual property, patents, trademarks, copyrights, protection, transfer, pledge, receivables, accounts receivable, assign, sell, parties, collateral. These various forms of Negative Pledge Agreements play a crucial role in preserving the lender's security and protecting the interests of bondholders in Louisville, Kentucky, by limiting the borrower's ability to dispose of or encumber specific assets without obtaining prior consent.

Louisville Kentucky Negative Pledge Agreement

Category:

State:

Kentucky

City:

Louisville

Control #:

KY-128LRS

Format:

Word;

Rich Text

Instant download

Description

A pledge that the Lender will convey some right, title and interest in property to secure its obligations to the Lender.

A Louisville Kentucky Negative Pledge Agreement is a legally binding contract commonly used in financial transactions, specifically in the context of loan agreements or bond issuance, where the borrower or issuer agrees not to encumber certain assets. This agreement restricts the pledging, mortgaging, or selling of specified assets without the prior consent of the lender or bondholders. In Louisville, Kentucky, the Negative Pledge Agreement is put in place to provide additional security to the lenders or bondholders by ensuring that the borrower or issuer will not engage in actions that could jeopardize their ability to repay the borrowed funds. By pledging specific assets as collateral, the lender or bondholders have a claim on those assets in case of default. Keywords: Louisville Kentucky, Negative Pledge Agreement, legally binding contract, financial transactions, loan agreements, bond issuance, borrower, issuer, encumber, assets, pledging, mortgaging, selling, consent, lenders, bondholders, security, borrowed funds, collateral, default. Different types of Negative Pledge Agreements in Louisville, Kentucky can include: 1. Real Estate Negative Pledge Agreement: This type of agreement applies specifically to immovable properties, such as land, buildings, or real estate projects. The borrower or issuer must obtain consent before encumbering or disposing of any real estate assets without jeopardizing the lender's security. 2. Equipment Negative Pledge Agreement: This agreement pertains to movable assets, including machinery, vehicles, or equipment. It ensures that the borrower or issuer cannot pledge, sell, or encumber these assets without the lender's prior approval. 3. Intellectual Property Negative Pledge Agreement: In cases where the borrower or issuer possesses valuable intellectual property assets, such as patents, trademarks, or copyrights, this agreement provides protection for the lender or bondholders by restricting the borrower's ability to transfer or pledge these assets without consent. 4. Receivables Negative Pledge Agreement: This type of agreement applies to a borrower's receivables or accounts receivable. It ensures that the borrower does not assign, sell, or pledge these receivables to other parties, thereby maintaining their value as collateral for the lender. Keywords: Real Estate Negative Pledge Agreement, immovable properties, land, buildings, real estate projects, encumbering, disposing, consent, equipment, machinery, vehicles, movable assets, intellectual property, patents, trademarks, copyrights, protection, transfer, pledge, receivables, accounts receivable, assign, sell, parties, collateral. These various forms of Negative Pledge Agreements play a crucial role in preserving the lender's security and protecting the interests of bondholders in Louisville, Kentucky, by limiting the borrower's ability to dispose of or encumber specific assets without obtaining prior consent.

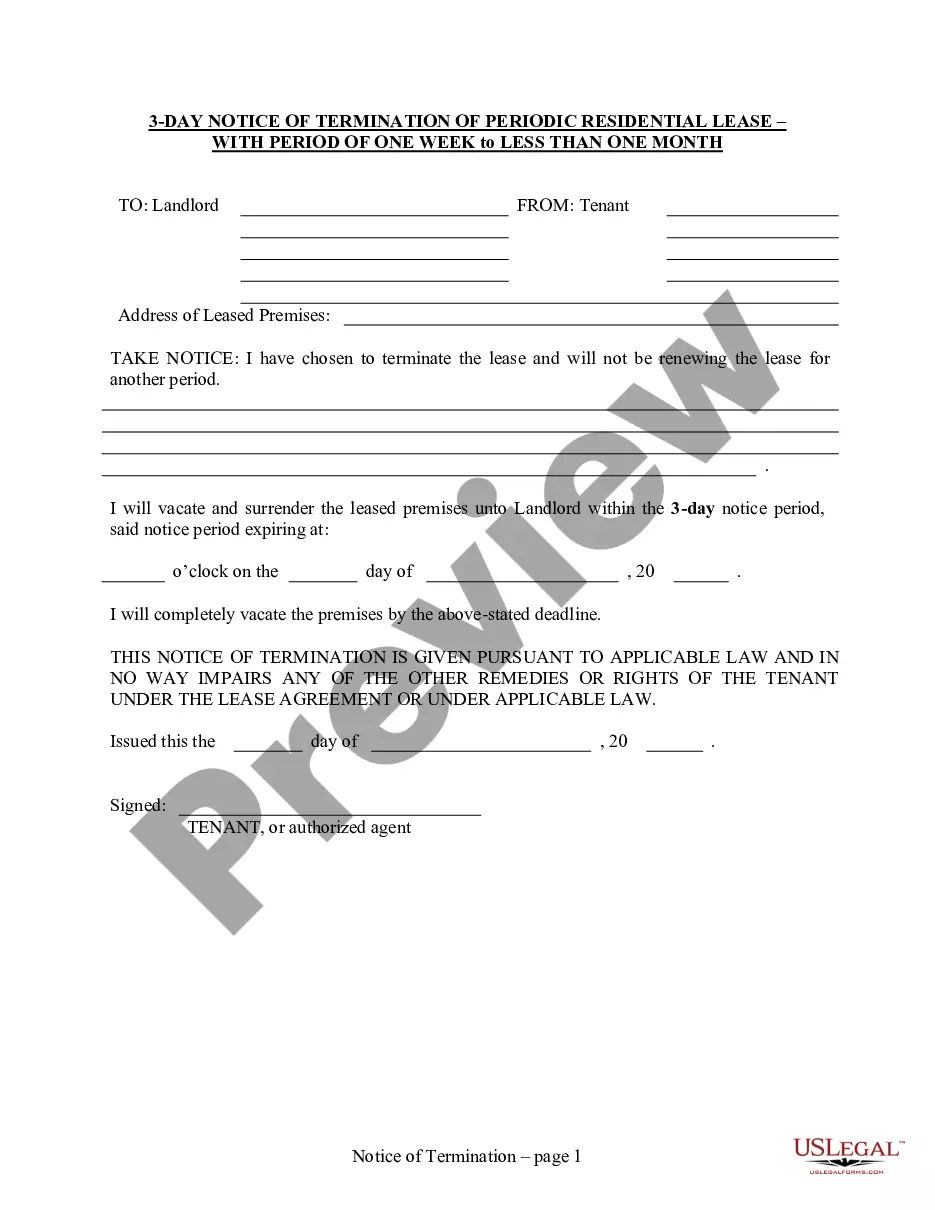

Free preview

How to fill out Louisville Kentucky Negative Pledge Agreement?

If you’ve already used our service before, log in to your account and download the Louisville Kentucky Negative Pledge Agreement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Louisville Kentucky Negative Pledge Agreement. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!