Louisville Kentucky Affidavit and Statement of Valuation — Explained In Louisville, Kentucky, an Affidavit and Statement of Valuation is a legal document used in various situations to declare the estimated value of a particular property or asset. This affidavit is typically required during real estate transactions, estate settlements, tax assessments, and other legal proceedings. The Louisville Kentucky Affidavit and Statement of Valuation provide crucial information to interested parties, such as buyers, sellers, lenders, and government agencies, about the assessed value of a property or asset. This valuation estimation helps determine the property's worth, which, in turn, influences pricing, tax calculations, insurance coverage decisions, and other financial considerations. There are different types of Louisville Kentucky Affidavit and Statement of Valuation, tailored to specific contexts and requirements. Here are a few commonly encountered ones: 1. Real Estate Affidavit and Statement of Valuation: This type of affidavit is used during real estate transactions, such as buying or selling a home or commercial property in Louisville. It states the value of the property, including land, buildings, and any other structures or improvements on the land. 2. Personal Property Affidavit and Statement of Valuation: This affidavit focuses on individual assets, such as vehicles, furniture, jewelry, art, collectibles, and other tangible personal property. It is often required during estate settlements, divorce proceedings, or when determining personal property tax assessments. 3. Business Asset Affidavit and Statement of Valuation: In the case of business acquisitions, mergers, or dissolution in Louisville, this affidavit outlines the value of various business assets, including inventory, machinery, equipment, intellectual property, and goodwill. 4. Damage or Loss Affidavit and Statement of Valuation: When an insured property suffers damage or loss due to fire, natural disasters, accidents, or theft, this type of affidavit comes into play. It helps the insurance company assess the value of the damaged or lost items and determines the compensation payable to the policyholder. It is essential to provide accurate information in the Louisville Kentucky Affidavit and Statement of Valuation to ensure transparency and fairness. Professional appraisers, real estate agents, or attorneys often assist individuals in preparing these affidavits to ensure compliance with legal and marketplace standards. In conclusion, the Louisville Kentucky Affidavit and Statement of Valuation are vital legal documents used to declare the estimated value of properties and assets. They serve as a basis for determining prices, taxes, insurance coverage, and settling disputes. With different types available for varying purposes, accurate valuation is crucial in facilitating transparent transactions and legal processes.

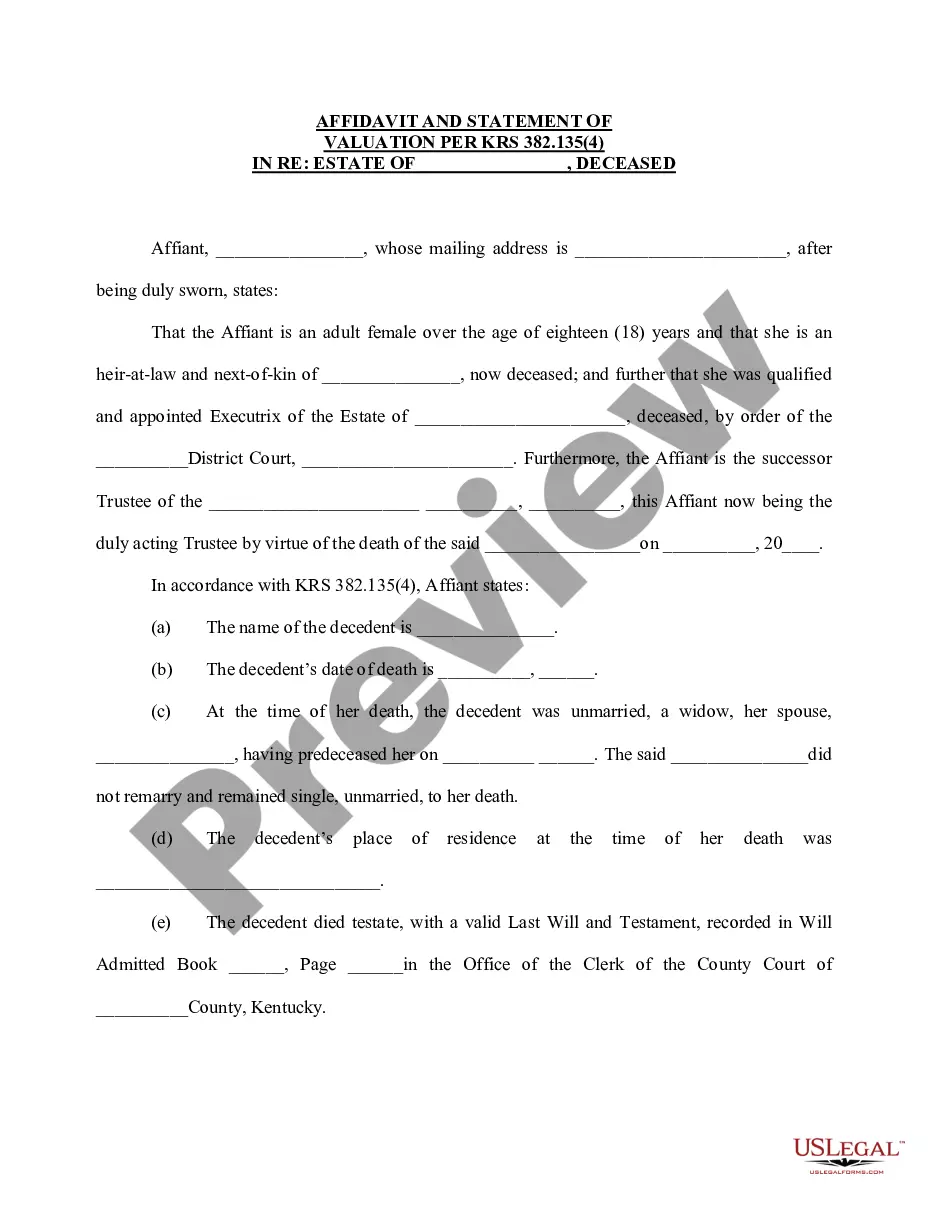

Louisville Kentucky Affidavit And Statement Of Valuation

Description

How to fill out Louisville Kentucky Affidavit And Statement Of Valuation?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Louisville Kentucky Affidavit And Statement Of Valuation gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Louisville Kentucky Affidavit And Statement Of Valuation takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Louisville Kentucky Affidavit And Statement Of Valuation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!