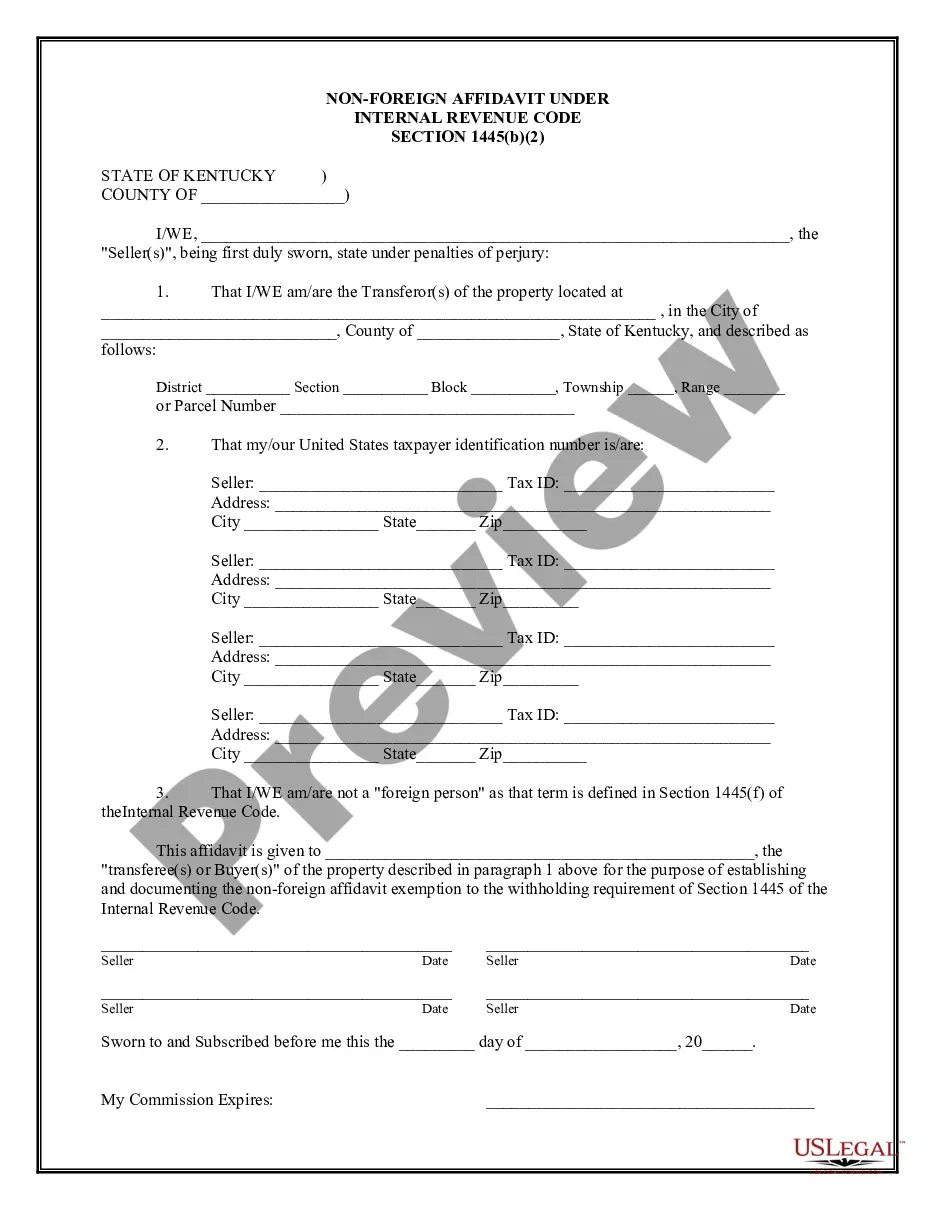

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Louisville Kentucky Non-Foreign Affidavit Under IRC 1445 is a legal document required in certain real estate transactions involving non-U.S. citizens. This affidavit serves as proof that the seller of a property in Louisville, Kentucky is not a foreign individual or entity subject to taxation under the Internal Revenue Code (IRC) Section 1445. The IRC 1445 is a provision that requires the withholding of a specific amount from the sale proceeds when a foreign person sells a U.S. real property interest. However, if the seller can provide a Non-Foreign Affidavit, they can be exempted from this requirement. This affidavit attests that the seller is not a foreign person under the IRC 1445 definition and thus is not subject to the withholding tax. There are two main types of Louisville Kentucky Non-Foreign Affidavits Under IRC 1445: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual, who is not a U.S. citizen or resident alien, is selling a property in Louisville, Kentucky. The individual will need to provide personal information, such as their name, address, and taxpayer identification number (TIN), in addition to confirming their non-foreign status. 2. Corporate Non-Foreign Affidavit: This type of affidavit is used when a corporation, partnership, or other legal entity (non-individual) is selling a property in Louisville, Kentucky. The entity will need to provide information about its organization, including its legal name, address, taxpayer identification number (TIN), and details about its shareholders or partners. The affidavit should confirm that the entity is not a foreign person as defined by the IRC 1445. By providing a duly completed Non-Foreign Affidavit Under IRC 1445, the seller can avoid the 10% withholding tax on the sales proceeds. This document plays a crucial role in protecting the buyer and ensuring compliance with relevant tax regulations, while facilitation a hassle-free real estate transaction in Louisville, Kentucky. It's important to consult with a qualified real estate attorney or tax professional to ensure accurate completion of the Louisville Kentucky Non-Foreign Affidavit Under IRC 1445 and to comply with all applicable laws and regulations.The Louisville Kentucky Non-Foreign Affidavit Under IRC 1445 is a legal document required in certain real estate transactions involving non-U.S. citizens. This affidavit serves as proof that the seller of a property in Louisville, Kentucky is not a foreign individual or entity subject to taxation under the Internal Revenue Code (IRC) Section 1445. The IRC 1445 is a provision that requires the withholding of a specific amount from the sale proceeds when a foreign person sells a U.S. real property interest. However, if the seller can provide a Non-Foreign Affidavit, they can be exempted from this requirement. This affidavit attests that the seller is not a foreign person under the IRC 1445 definition and thus is not subject to the withholding tax. There are two main types of Louisville Kentucky Non-Foreign Affidavits Under IRC 1445: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual, who is not a U.S. citizen or resident alien, is selling a property in Louisville, Kentucky. The individual will need to provide personal information, such as their name, address, and taxpayer identification number (TIN), in addition to confirming their non-foreign status. 2. Corporate Non-Foreign Affidavit: This type of affidavit is used when a corporation, partnership, or other legal entity (non-individual) is selling a property in Louisville, Kentucky. The entity will need to provide information about its organization, including its legal name, address, taxpayer identification number (TIN), and details about its shareholders or partners. The affidavit should confirm that the entity is not a foreign person as defined by the IRC 1445. By providing a duly completed Non-Foreign Affidavit Under IRC 1445, the seller can avoid the 10% withholding tax on the sales proceeds. This document plays a crucial role in protecting the buyer and ensuring compliance with relevant tax regulations, while facilitation a hassle-free real estate transaction in Louisville, Kentucky. It's important to consult with a qualified real estate attorney or tax professional to ensure accurate completion of the Louisville Kentucky Non-Foreign Affidavit Under IRC 1445 and to comply with all applicable laws and regulations.