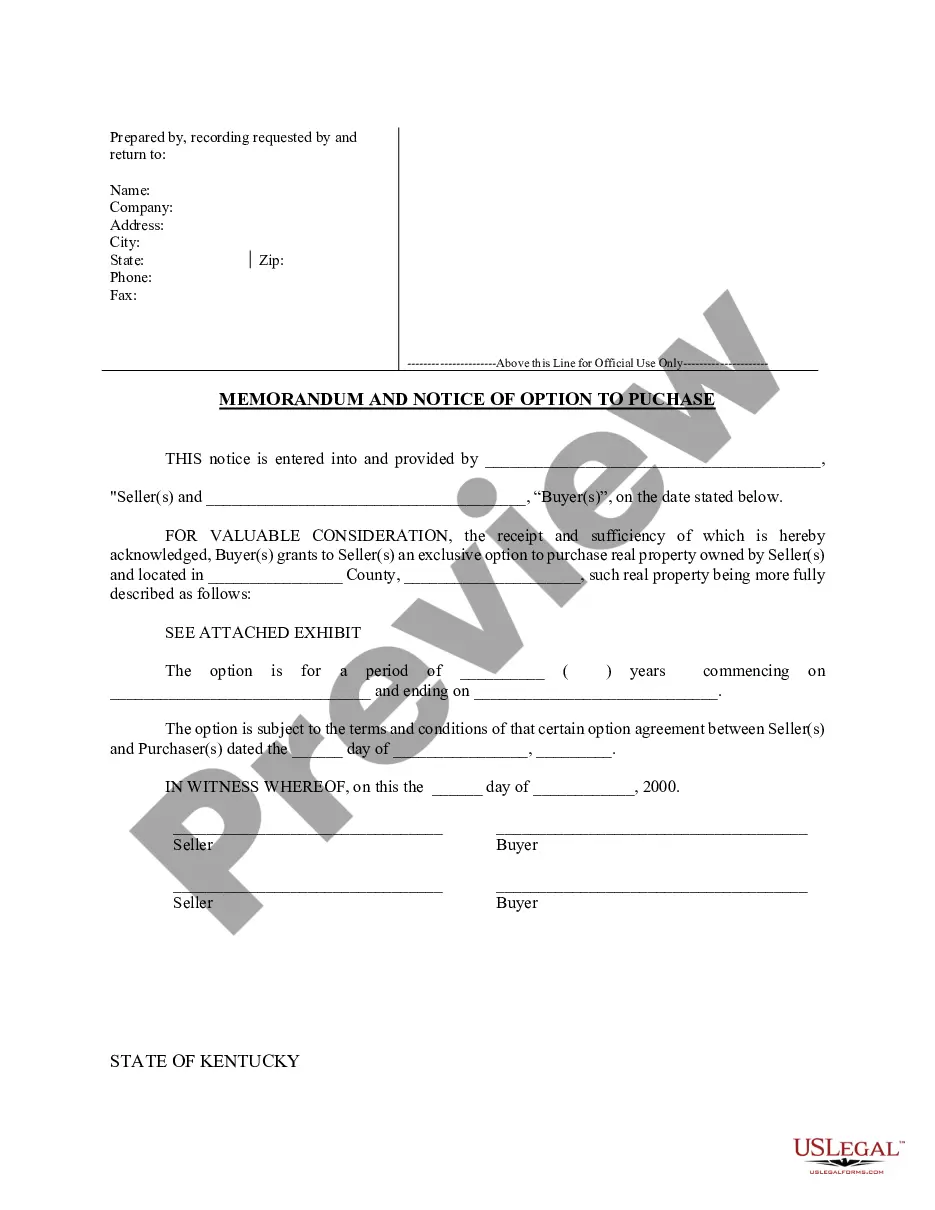

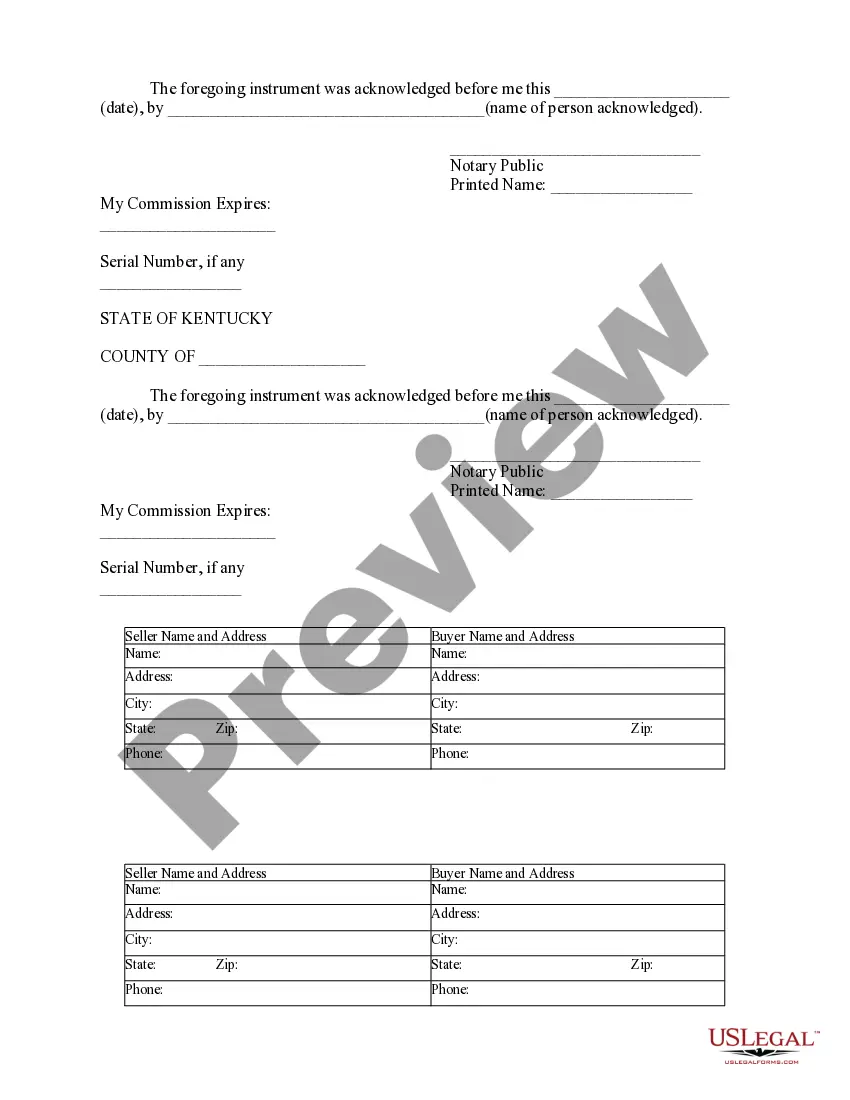

This Memorandum and Notice of Option Agreement is for recording in the official records in order to provide notice that an Option to Purchase exists on a certain parcel of real estate. It is used in lieu of recording the entire Option Agreement.

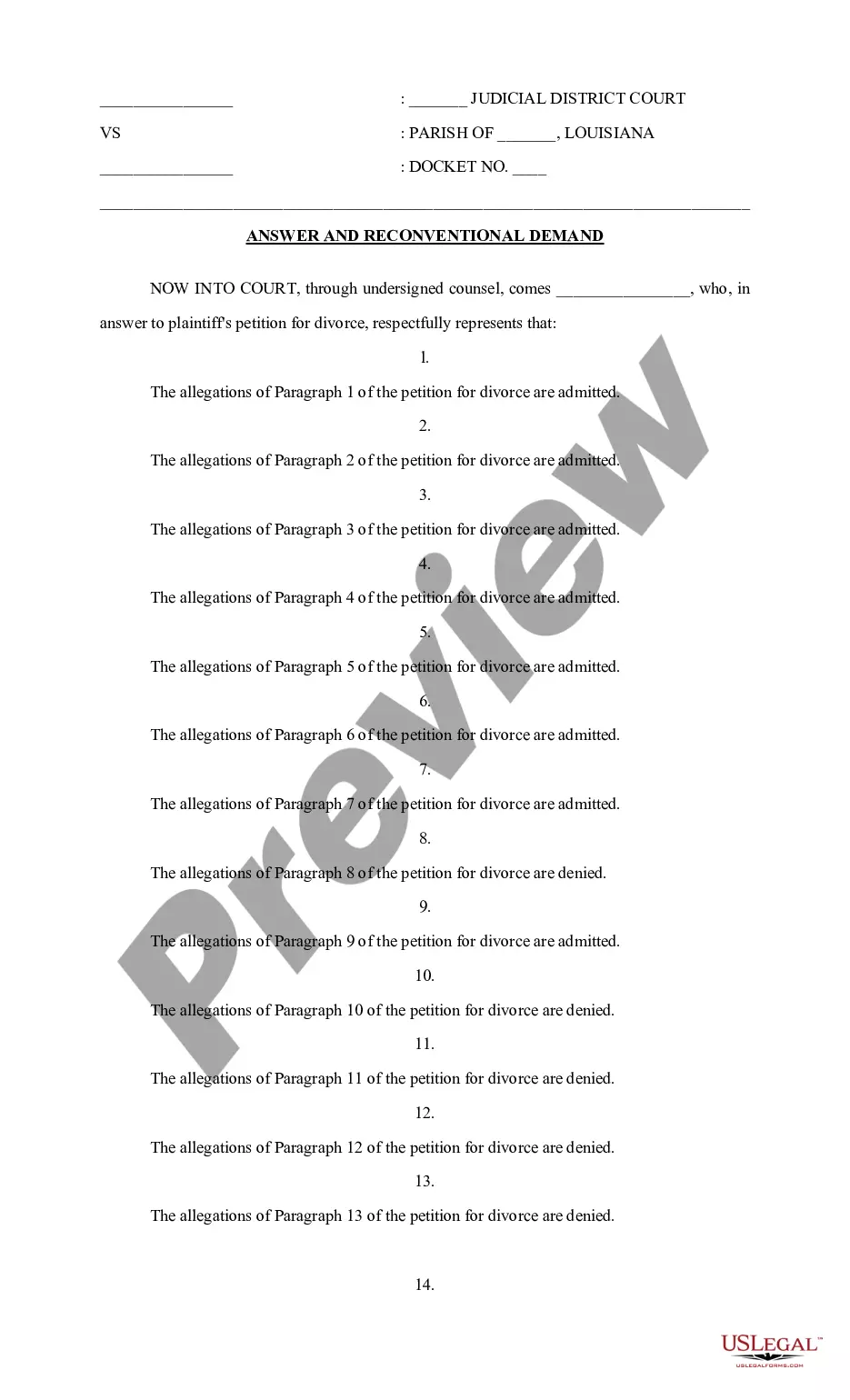

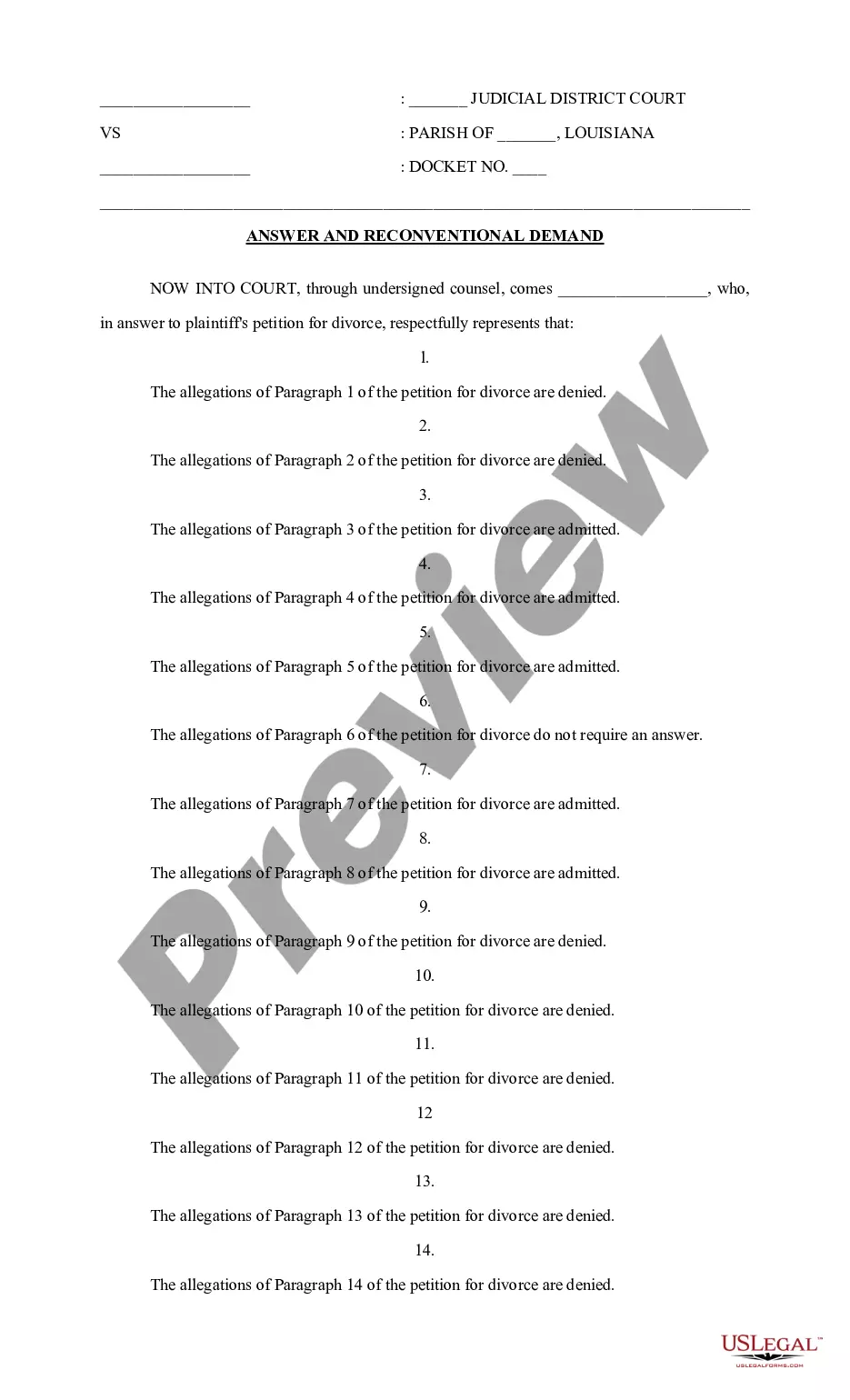

A Louisville Kentucky Notice of Option for Recording is a legal document that grants a person or entity the option to record a particular property or asset in Louisville, Kentucky. This notice signifies that the grantee has the right to secure their interest in the property or asset by officially recording it with the relevant authorities. The Louisville Kentucky Notice of Option for Recording serves as an essential tool for individuals or organizations who wish to protect their ownership rights, security interests, liens, or other claims on a property or asset within the jurisdiction of Louisville, Kentucky. By filing this notice, the grantee ensures that their interest in the property or asset is officially documented and recognized by law. There are several types of Louisville Kentucky Notice of Option for Recording that may exist based on the nature of the interest being recorded and the specific requirements of the situation. These types may include: 1. Notice of Option for Recording a Mortgage: This type of notice is relevant when a mortgage lender wants to record their lien on a property in Louisville, Kentucky. By filing this notice, the lender ensures that their mortgage interest is properly documented and will be given priority over potential future claims on the property. 2. Notice of Option for Recording a Deed: This type of notice is used when a property owner wants to record a deed to establish or transfer ownership rights to a property in Louisville, Kentucky. Recording a deed provides a legal record of the property transfer and protects the owner's interest in the property. 3. Notice of Option for Recording a Judgment Lien: In cases where a judgment has been obtained against a debtor in a court of law, this notice can be filed to secure the judgment lien on any real property owned by the debtor within Louisville, Kentucky. The notice ensures that the judgment creditor's claim is properly recorded, allowing the creditor to potentially recover their debt through the forced sale of the property. 4. Notice of Option for Recording a UCC Financing Statement: This type of notice is relevant for creditors who have provided financing secured by personal property located in Louisville, Kentucky. By filing this notice, the creditor establishes their security interest in the collateral, ensuring they have a legal claim on the property in case the debtor defaults on their obligations. Overall, the Louisville Kentucky Notice of Option for Recording is a crucial legal form that enables individuals, lenders, creditors, and property owners to protect their rights and interests in Louisville, Kentucky. By recording their claims or ownership, they ensure that their positions are properly documented, recognized, and enforceable under the law.