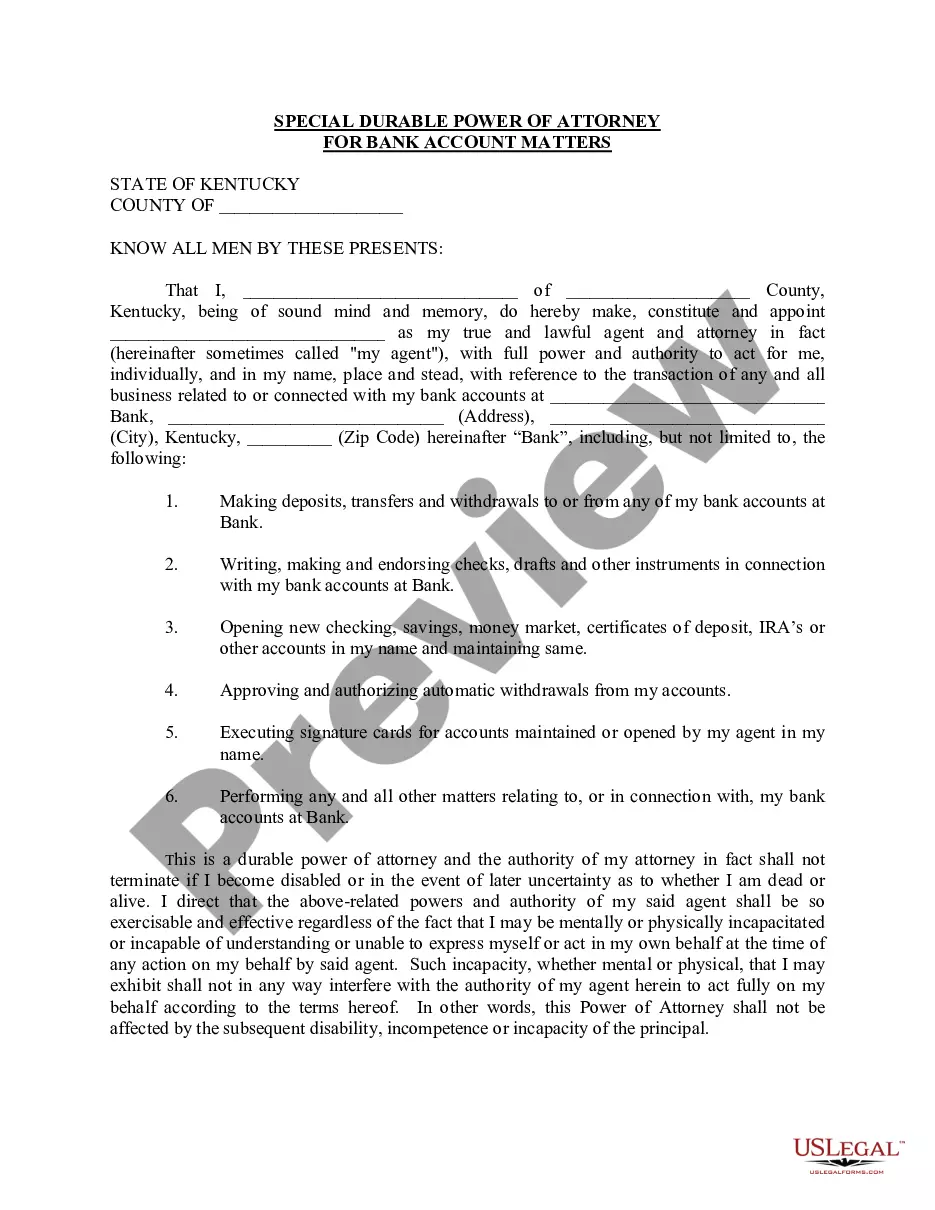

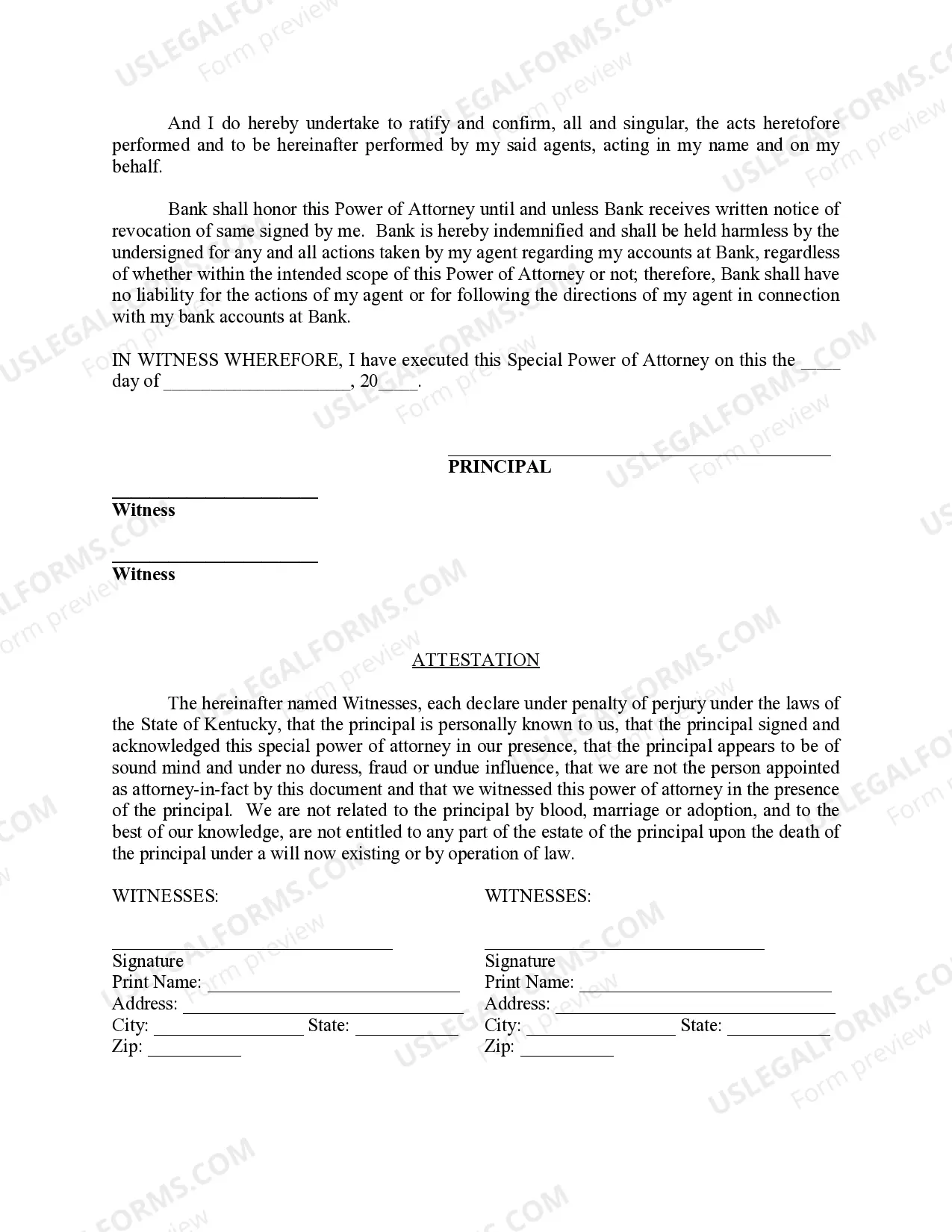

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

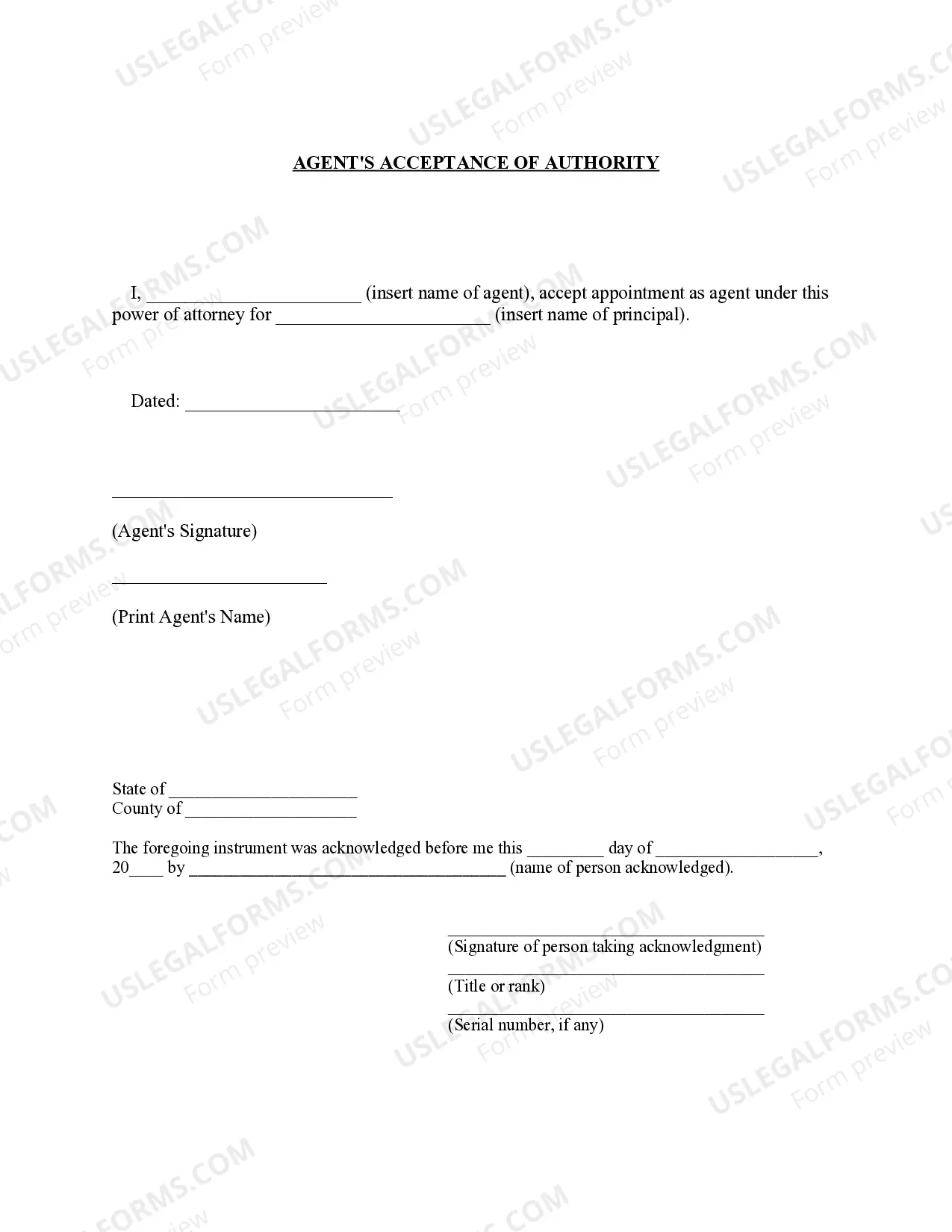

The Louisville Kentucky Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual the authority to handle specific banking matters on behalf of another person. This type of power of attorney is designed to remain effective even if the person granting the power becomes incapacitated or unable to make decisions for themselves. There are various types of Louisville Kentucky Special Durable Power of Attorney for Bank Account Matters, each serving a specific purpose: 1. General Special Durable Power of Attorney for Bank Account Matters: This grants broad authority to the appointed agent to handle all types of banking matters, including depositing and withdrawing funds, managing investments, paying bills, and managing any financial transactions related to the bank account. 2. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority to handle specific banking matters outlined in the document. For example, the individual may grant the agent authority to pay bills and make deposits, but not to withdraw funds or manage investments. 3. Health Care Special Durable Power of Attorney for Bank Account Matters: In addition to handling banking matters, this type of power of attorney also grants the agent authority to make decisions regarding healthcare and medical treatments on behalf of the person granting the power. This is particularly useful when the granter is unable to make medical decisions due to incapacitation or medical emergencies. 4. Financial Special Durable Power of Attorney for Bank Account Matters: This power of attorney specifically focuses on managing financial aspects of the individual's bank accounts. It grants the agent authority to handle banking transactions, investments, and financial decision-making, but does not extend to healthcare decisions. 5. Real Estate Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney is oriented towards managing real estate-related transactions involving bank accounts. The agent is authorized to handle real estate transactions, such as buying or selling property, paying property taxes, and managing rental income. 6. Business Special Durable Power of Attorney for Bank Account Matters: This power of attorney is specifically designed for business-related bank account matters. It grants the agent authority to manage business finances, handle financial transactions, sign checks, and make deposits and withdrawals on behalf of the business owner. In conclusion, the Louisville Kentucky Special Durable Power of Attorney for Bank Account Matters is a legal document that empowers an individual to handle specific banking matters on behalf of another person. There are different types of this power of attorney, each tailored to address specific needs and responsibilities associated with bank account management.The Louisville Kentucky Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual the authority to handle specific banking matters on behalf of another person. This type of power of attorney is designed to remain effective even if the person granting the power becomes incapacitated or unable to make decisions for themselves. There are various types of Louisville Kentucky Special Durable Power of Attorney for Bank Account Matters, each serving a specific purpose: 1. General Special Durable Power of Attorney for Bank Account Matters: This grants broad authority to the appointed agent to handle all types of banking matters, including depositing and withdrawing funds, managing investments, paying bills, and managing any financial transactions related to the bank account. 2. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority to handle specific banking matters outlined in the document. For example, the individual may grant the agent authority to pay bills and make deposits, but not to withdraw funds or manage investments. 3. Health Care Special Durable Power of Attorney for Bank Account Matters: In addition to handling banking matters, this type of power of attorney also grants the agent authority to make decisions regarding healthcare and medical treatments on behalf of the person granting the power. This is particularly useful when the granter is unable to make medical decisions due to incapacitation or medical emergencies. 4. Financial Special Durable Power of Attorney for Bank Account Matters: This power of attorney specifically focuses on managing financial aspects of the individual's bank accounts. It grants the agent authority to handle banking transactions, investments, and financial decision-making, but does not extend to healthcare decisions. 5. Real Estate Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney is oriented towards managing real estate-related transactions involving bank accounts. The agent is authorized to handle real estate transactions, such as buying or selling property, paying property taxes, and managing rental income. 6. Business Special Durable Power of Attorney for Bank Account Matters: This power of attorney is specifically designed for business-related bank account matters. It grants the agent authority to manage business finances, handle financial transactions, sign checks, and make deposits and withdrawals on behalf of the business owner. In conclusion, the Louisville Kentucky Special Durable Power of Attorney for Bank Account Matters is a legal document that empowers an individual to handle specific banking matters on behalf of another person. There are different types of this power of attorney, each tailored to address specific needs and responsibilities associated with bank account management.