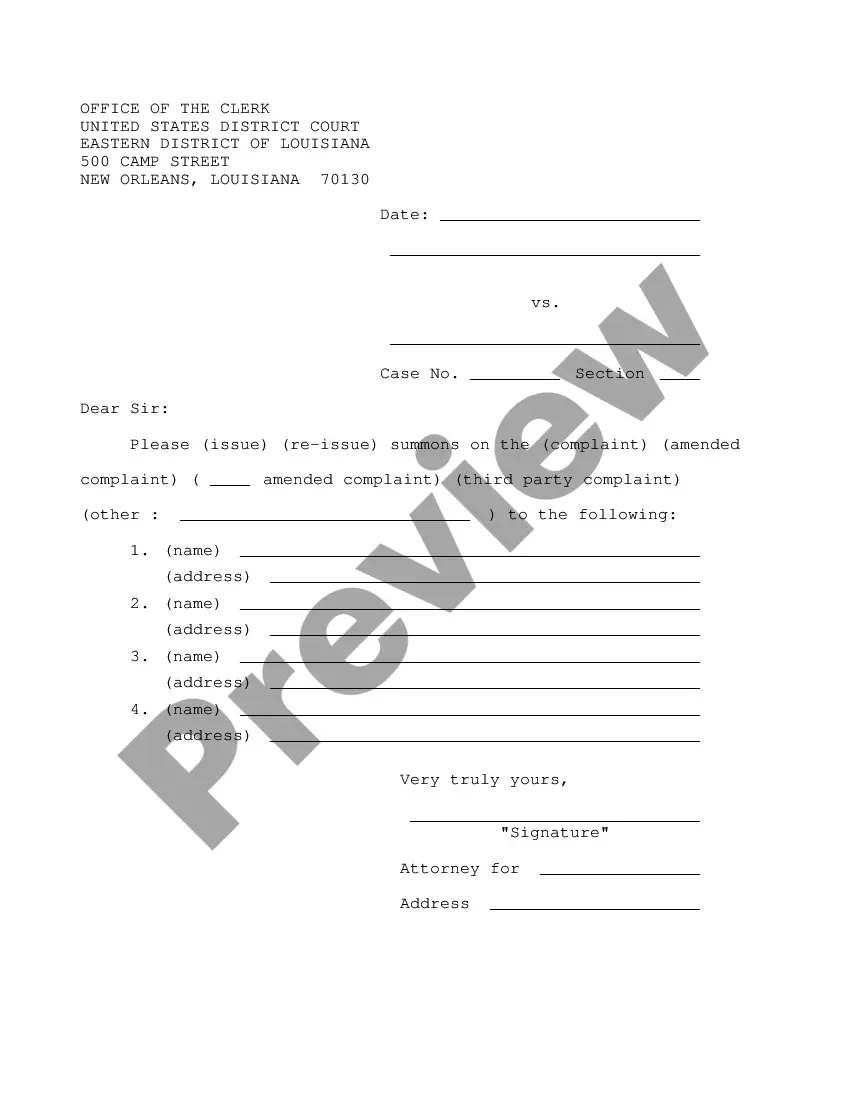

UCC1 - Financing Statement - Kentucky - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Louisville Kentucky UCC1 Financing Statement

Description

How to fill out Louisville Kentucky UCC1 Financing Statement?

We consistently aim to lessen or evade legal complications when addressing intricate legal or financial issues.

To achieve this, we enroll in legal services that are typically quite costly.

Nonetheless, not every legal concern is equally intricate. A majority of them can be handled by ourselves.

US Legal Forms is an online repository of current DIY legal documents spanning everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Just Log Into your account and click the Get button next to it. If you misplace the form, you can always redownload it from the My documents section. The process remains just as simple if you are new to the site! You can set up your account in a matter of minutes. Ensure that the Louisville Kentucky UCC1 Financing Statement complies with your state and area's laws and regulations. Additionally, it’s essential to review the form’s details (if available), and if you observe any inconsistencies with what you initially sought, look for a different form. Once you’ve confirmed that the Louisville Kentucky UCC1 Financing Statement suits your needs, you can select a subscription plan and move forward to payment. You can then download the form in any of the compatible formats. For over 24 years, we’ve assisted millions by providing customizable and up-to-date legal forms. Maximize the benefits of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your affairs independently without engaging a lawyer's services.

- We offer access to legal document templates that aren't always readily available to the public.

- Our templates are tailored to specific states and regions, greatly easing the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Louisville Kentucky UCC1 Financing Statement or any other document swiftly and securely.

Form popularity

FAQ

You should file a UCC-1 Financing Statement with the secretary of state's office in the state where the debtor is incorporated or located. If the collateral is real property, then you should also file a UCC-1 with the county recorder's office in the county where the debtor's real property is located.

When is a UCC-1 filed? UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower's assets. This motivates lenders to file a UCC-1 as soon as a loan is made.

In theory, anyone can file a UCC-1 against anyone else. To protect both secured creditors and debtors, Article 9 has strict requirements that must be met for a filed UCC-1 to be effective. One of those requirements is that the financing statement must be authorized by the debtor.

A rule of thumb when filing a UCC record is to file at the central filing office of the state where the debtor is located.

If you have not filed a UCC-1, then you are considered unsecured, and as such, you are placed in the ?back of the line,? behind the secured creditors. Secured creditors are taken care of first in the division of assets.

Additionally, a UCC filing does not natively impact your credit score. But a UCC filing does appear on your credit report, and it could affect whether you will qualify for other financing forms later down the road. For example, say that you receive funding from one lender who filed a UCC lien on some of your assets.

How Does a UCC Filing Affect My Credit? A UCC filing won't impact your business credit scores directly because it doesn't indicate anything about your ability to repay your debts. However, it can affect your ability to get credit again in the future.

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

What is the fee to file a UCC-1 financing statement? There is a $10.00 filing fee for UCC-1 financing statements consisting of no more than two pages. The filing fee for UCC-1 financing statements over two pages is $20.00.