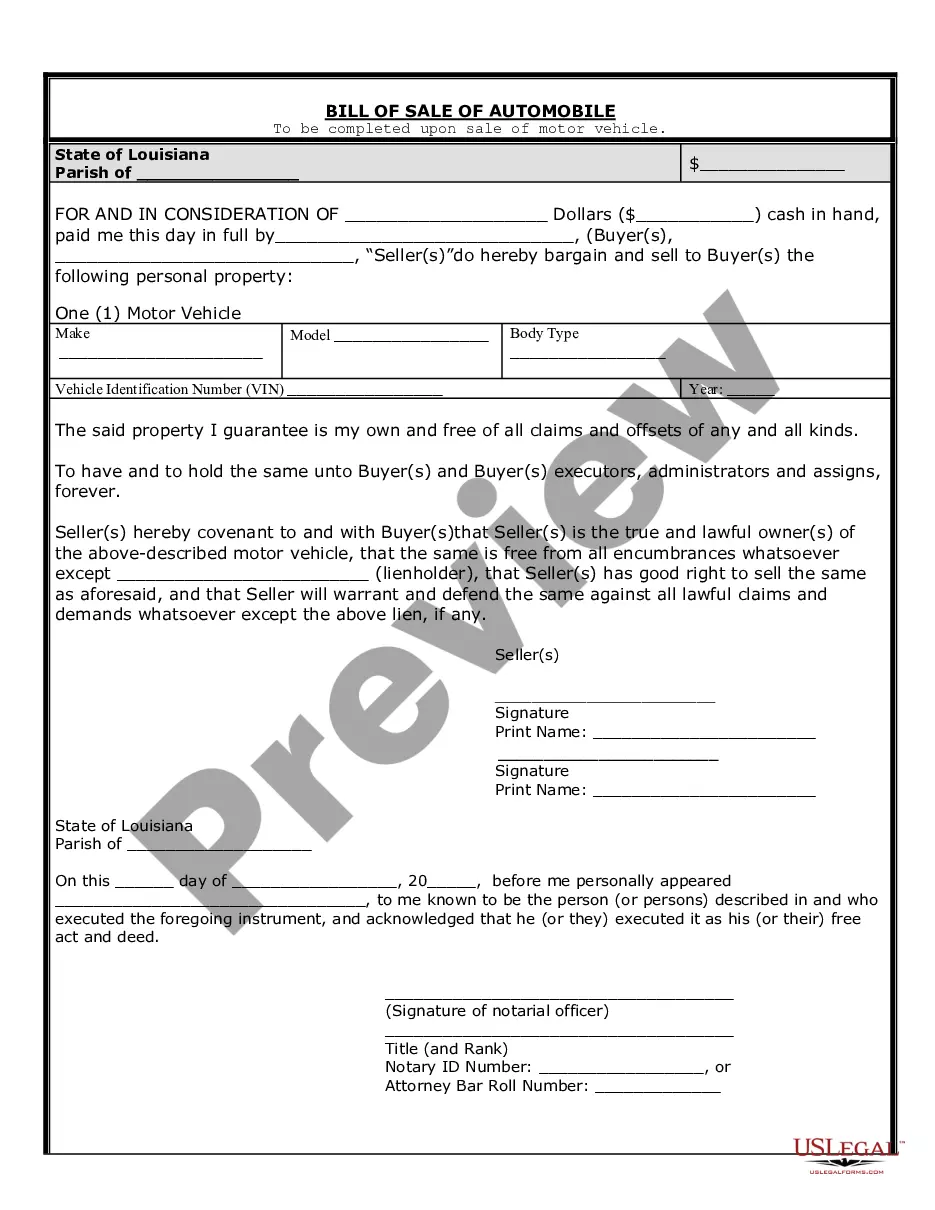

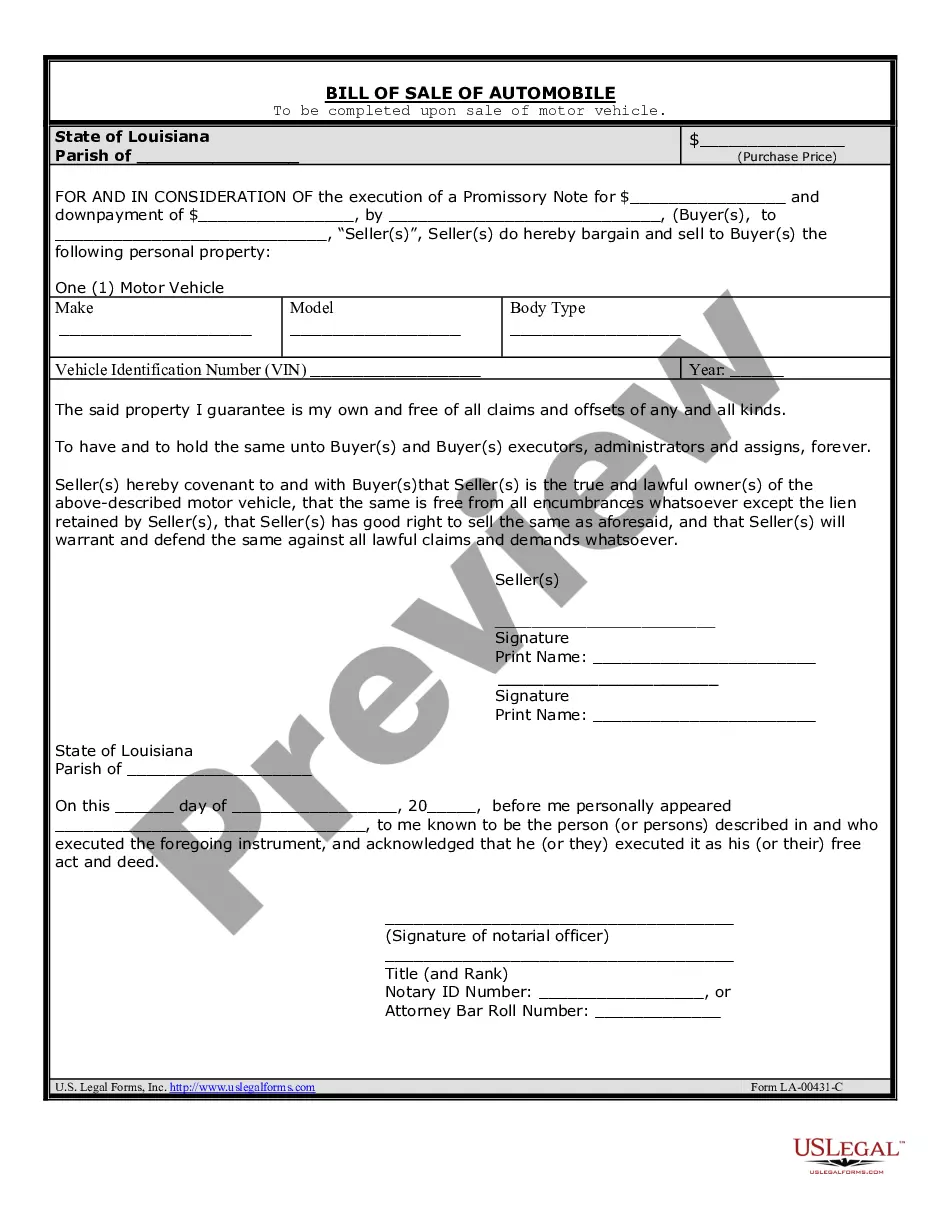

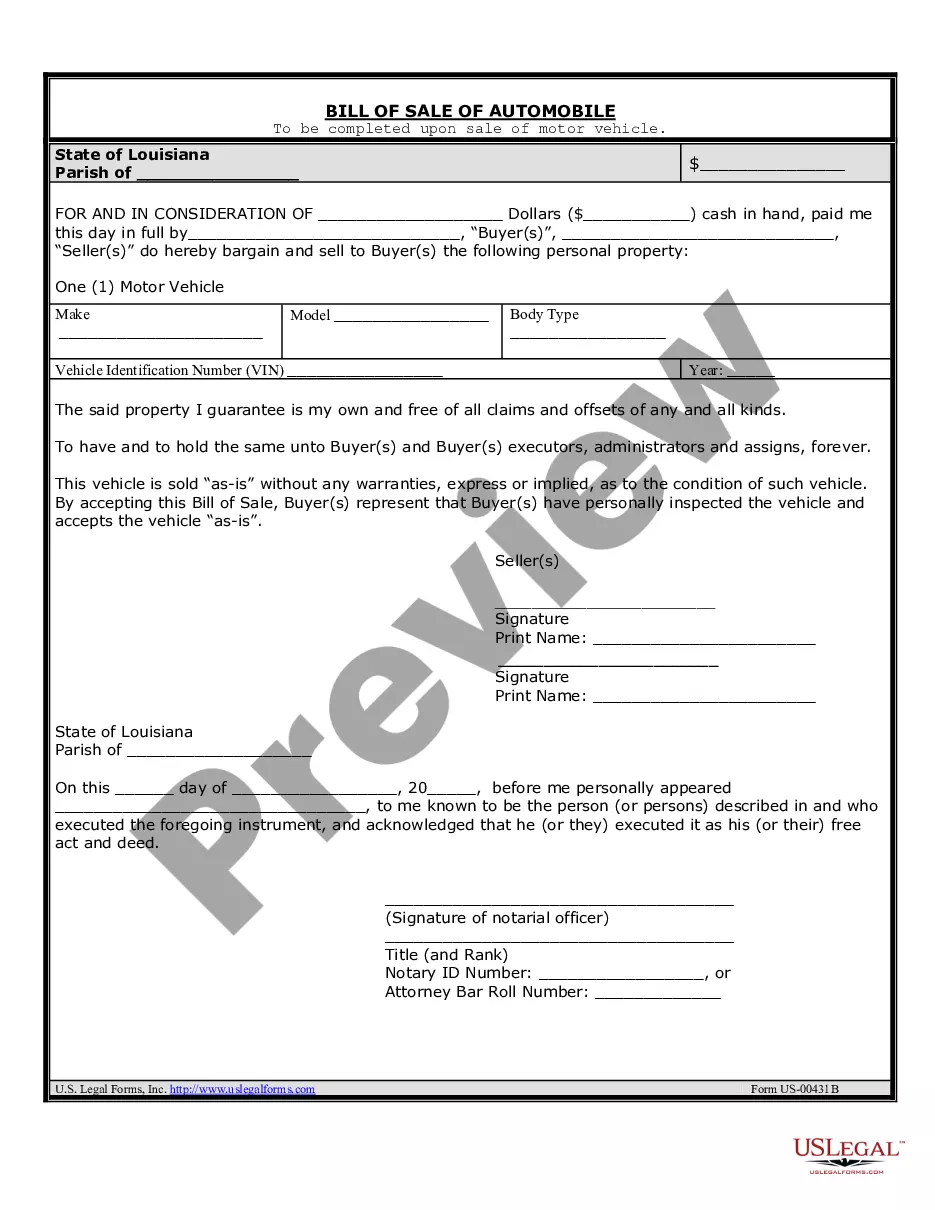

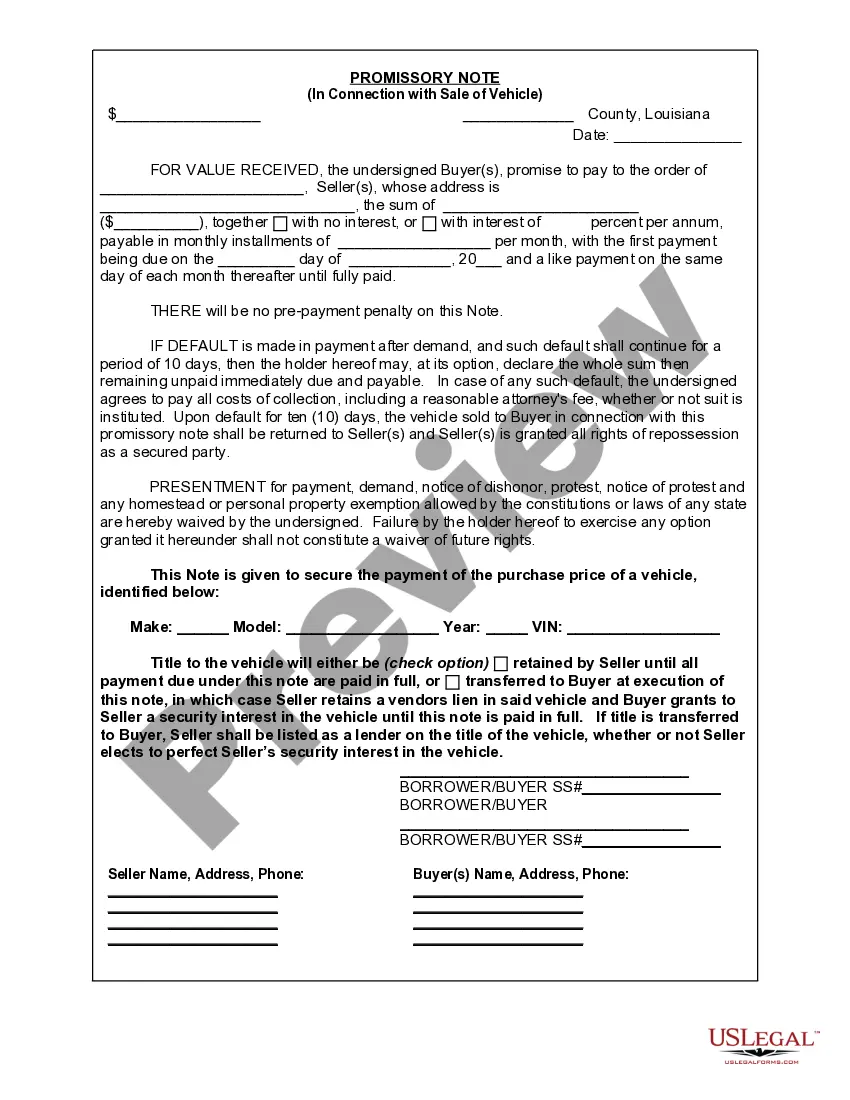

Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile: A Comprehensive Overview In Shreveport, Louisiana, a promissory note is a legal document that solidifies the agreement between a buyer and a seller in the sale of a vehicle or automobile. This note serves as a written promise by the buyer to pay a specific amount of money to the seller within a predetermined time frame. It outlines the terms and conditions of the transaction, establishes the rights of both parties, and provides legal protection to ensure the payment is made. 1. Types of Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile: There are three common types of promissory notes used in vehicle or automobile sales in Shreveport, Louisiana. a) Installment Promissory Note: This type of promissory note allows the buyer to pay the purchase price in installments. It sets out a schedule for repayment, including the amount and frequency of payments, interest rate (if applicable), and any penalties for late or missed payments. Throughout the repayment period, the seller typically retains ownership of the vehicle until the final payment is made. b) Lump-Sum Promissory Note: In contrast to the installment note, a lump-sum promissory note requires the buyer to make a single, upfront payment for the full purchase price of the vehicle. This note states the payment due date and any relevant details regarding penalties for late payment or defaulting on the agreement. c) Secured Promissory Note: A secured promissory note involves utilizing the vehicle itself as collateral for the loan. If the buyer defaults on payments, the seller can repossess the vehicle as per the terms outlined in the agreement. This provides an added layer of security for the seller in case of non-payment. Key considerations in a Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile: — Parties involved: The promissory note should clearly identify the buyer, seller, and their respective addresses. — Vehicle details: It should include comprehensive information about the vehicle being sold, such as make, model, year, vehicle identification number (VIN), and any existing liens on the vehicle. — Purchase price: The note should provide the exact amount agreed upon by both parties for the sale. — Payment terms: The note should establish the payment schedule, including the due date, amount, and frequency of payments. — Interest rates: If applicable, the note should indicate the interest rate charged on the outstanding balance. — Late payment penalties: The consequences for late or missed payments should be clearly outlined, including any additional fees or charges. — Default and repossession: Terms detailing the actions to be taken in the event of non-payment or breach of contract should be included to protect the rights of both parties. — Signatures: The promissory note must be signed by both the buyer and the seller to indicate agreement and consent to the terms and conditions. In conclusion, the Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile offers a legally binding contract for both buyers and sellers involved in the transaction. Whether using an installment note, a lump-sum note, or a secured note, it is essential to ensure that all relevant details, terms, and conditions are adequately stated within the document for a smooth and secure vehicle sale.

Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Shreveport Louisiana Promissory Note In Connection With Sale Of Vehicle Or Automobile?

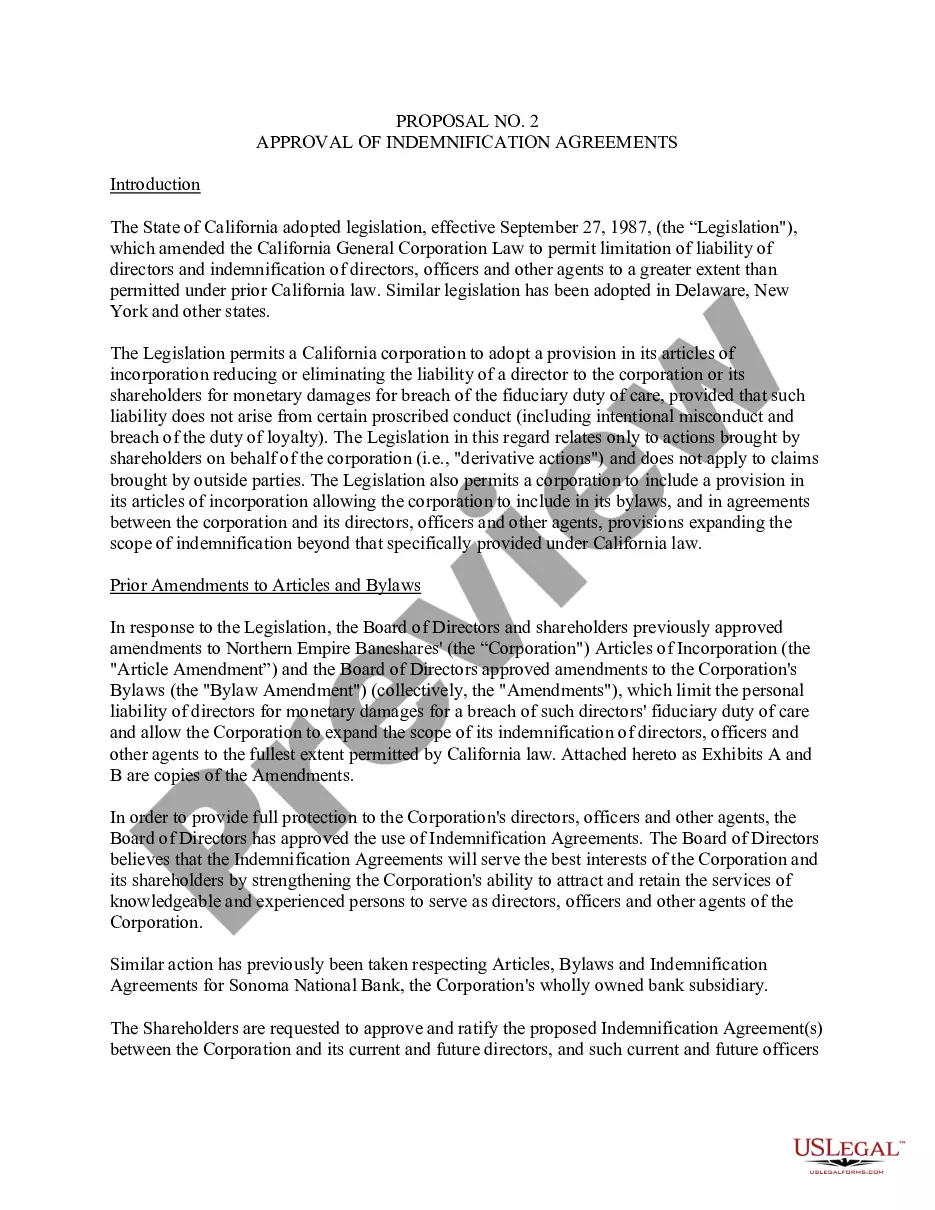

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no law education to draft this sort of papers from scratch, mostly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you want the Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile quickly using our trustworthy platform. If you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, in case you are unfamiliar with our library, ensure that you follow these steps before downloading the Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile:

- Be sure the form you have chosen is good for your location since the regulations of one state or area do not work for another state or area.

- Review the form and read a quick outline (if provided) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Shreveport Louisiana Promissory Note in Connection with Sale of Vehicle or Automobile once the payment is through.

You’re all set! Now you can go ahead and print the form or fill it out online. Should you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.