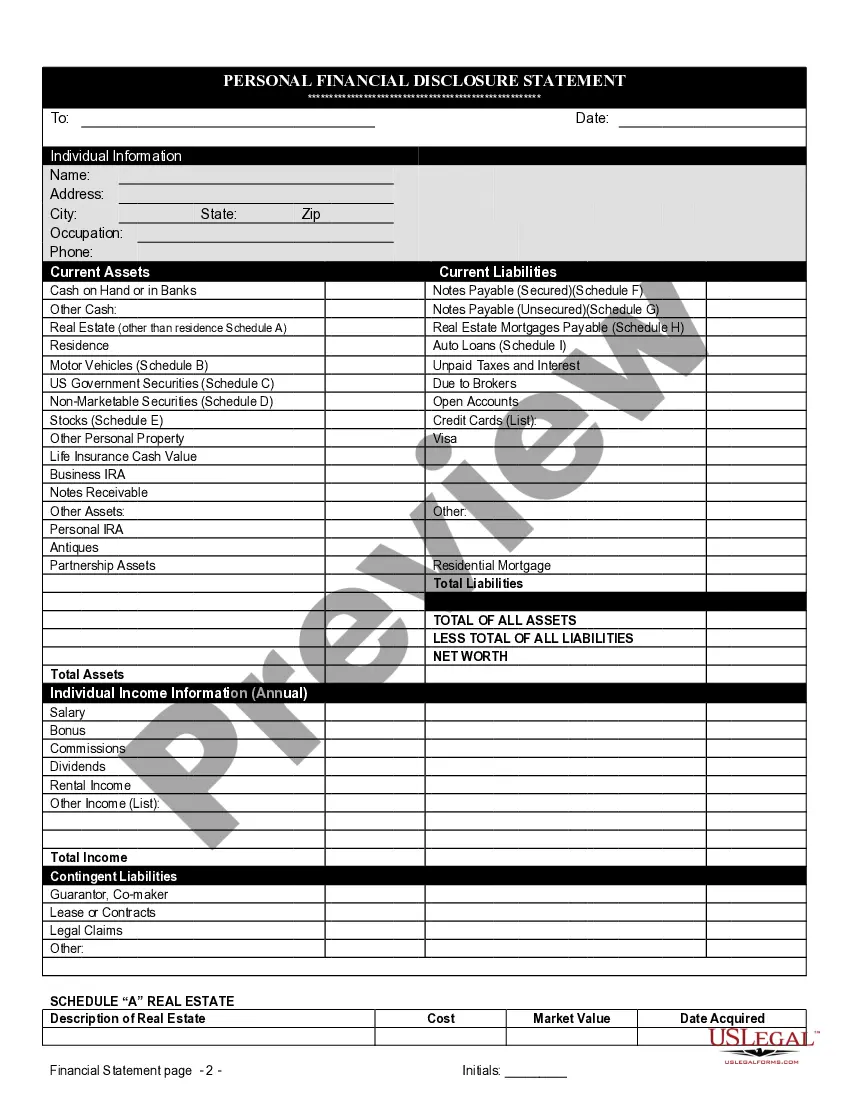

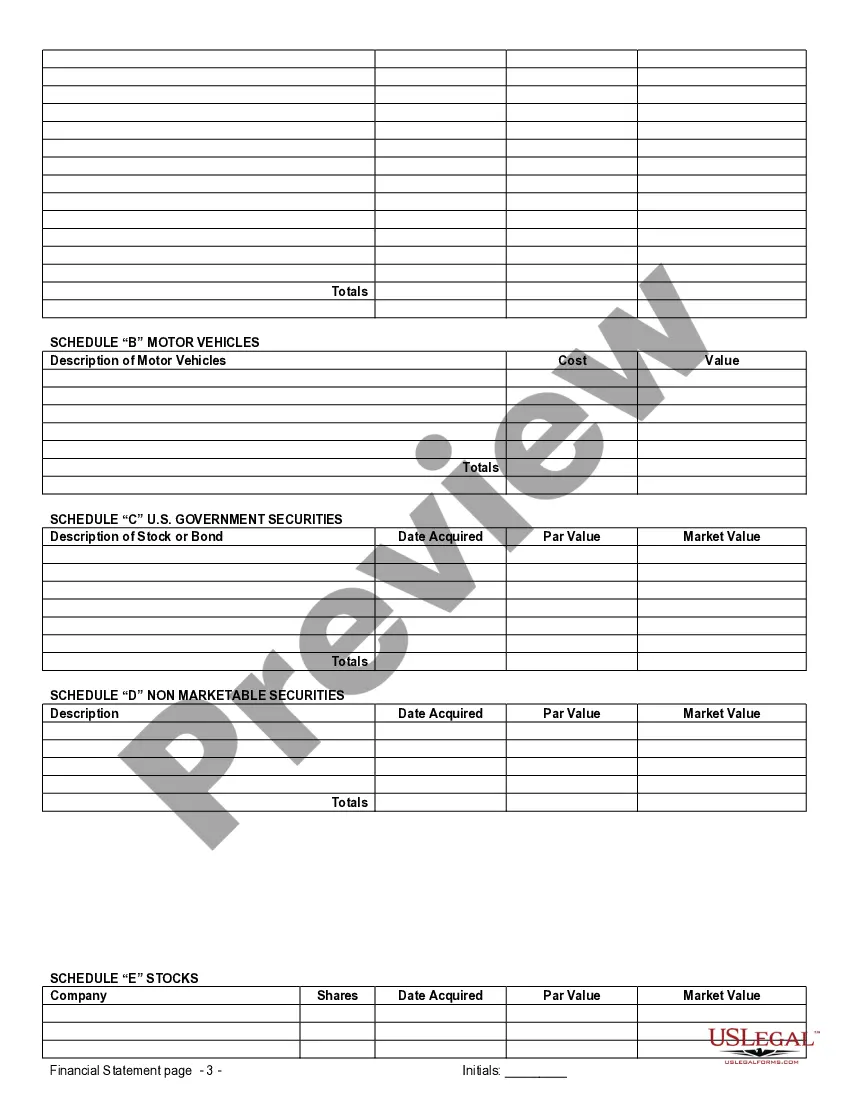

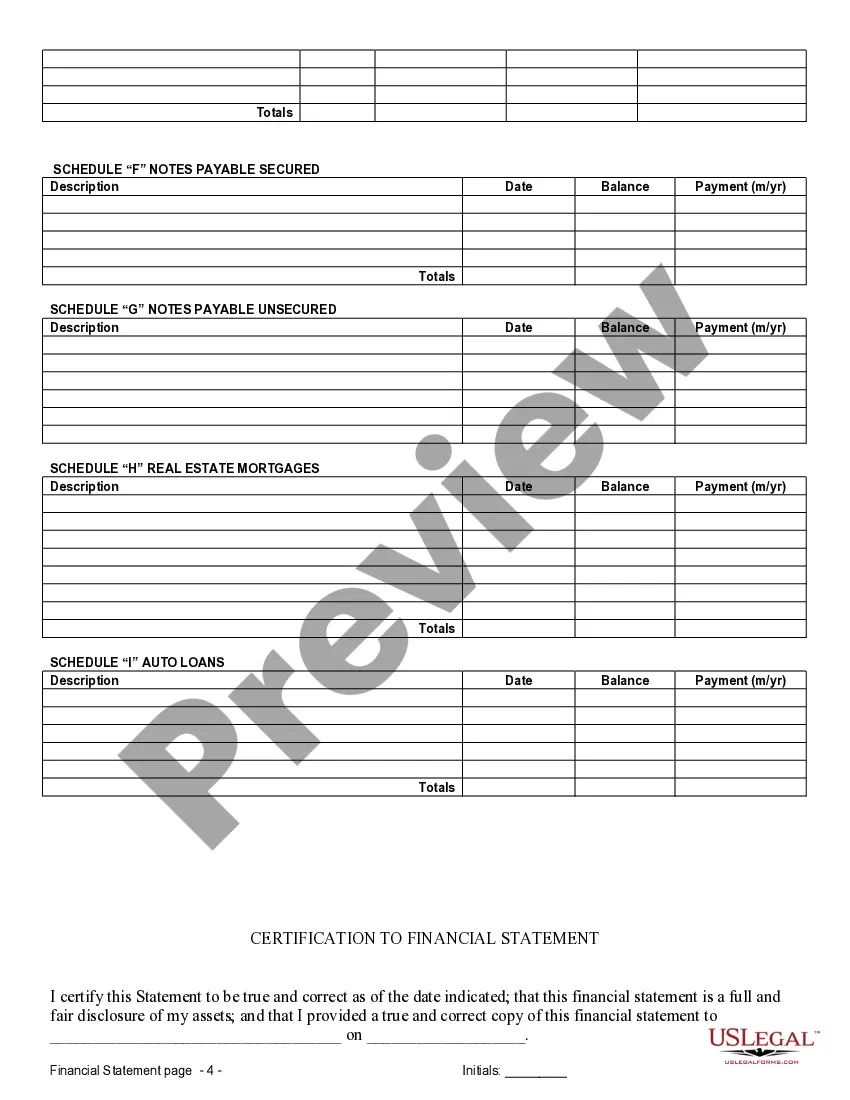

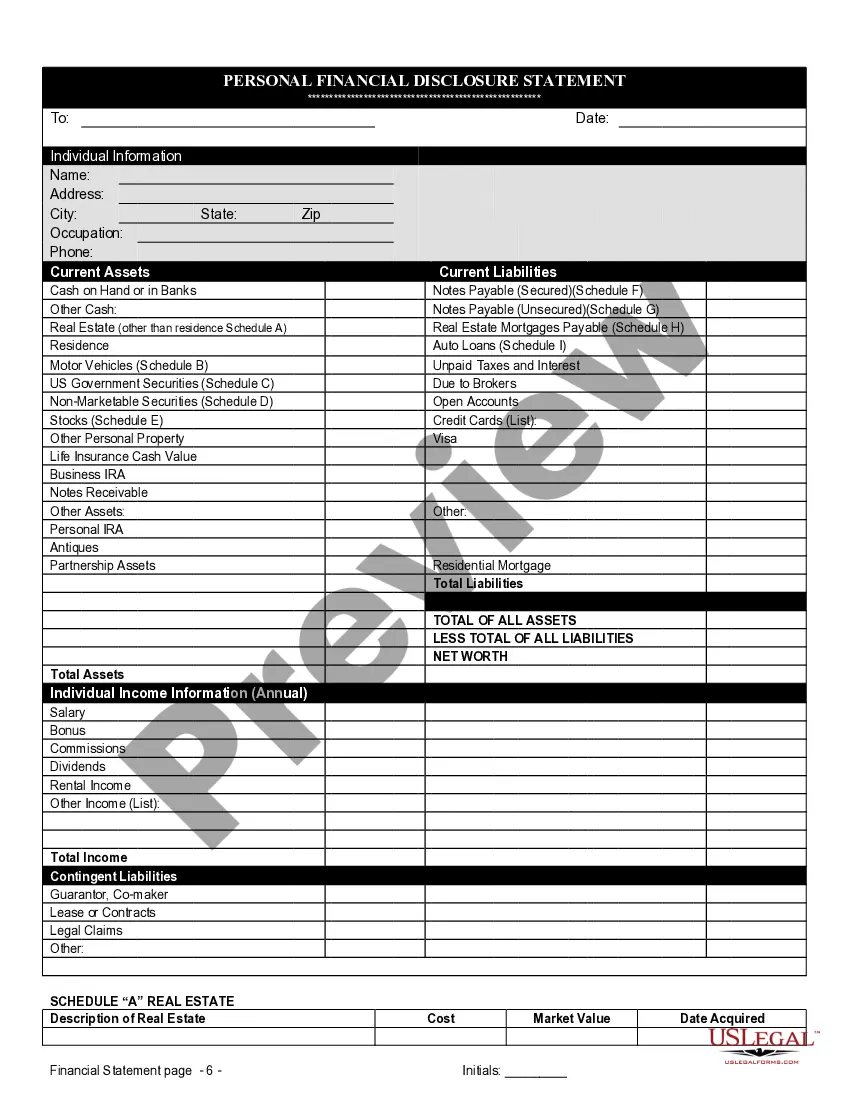

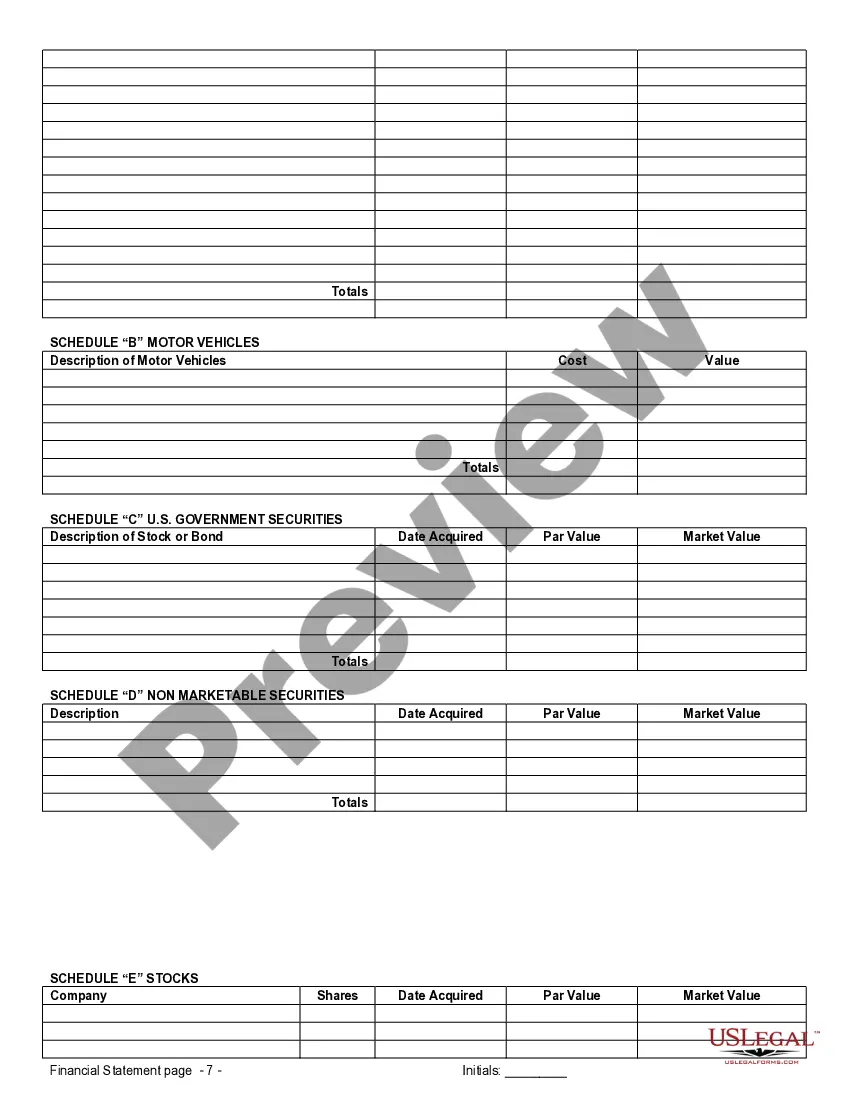

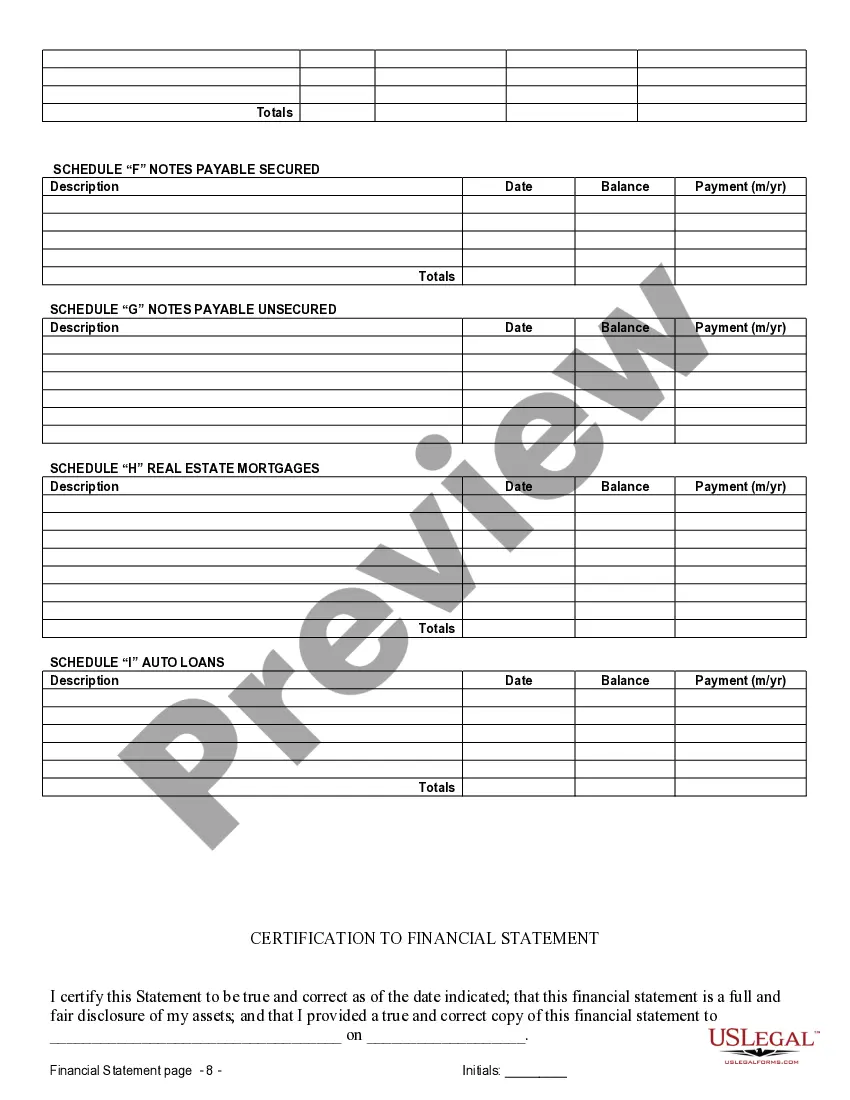

Baton Rouge Louisiana offers various types of financial statements solely intended for use in connection with prenuptial (also known as premarital) agreements. These statements help couples in Baton Rouge understand and disclose their financial positions accurately before entering into a marriage. 1. Prenuptial Financial Statements: Prenuptial financial statements outline the assets, debts, income, and expenses of each party intending to marry. These statements are usually prepared individually by each partner and are shared to achieve financial transparency and ensure full disclosure during the prenuptial agreement process. 2. Personal Balance Sheets: Personal balance sheets are crucial components of Baton Rouge prenuptial agreements. They provide an overview of each party's individual financial standing, including assets, liabilities, and net worth. By examining these statements, couples can understand their respective stakes and liabilities prior to marriage. 3. Income Statements: Baton Rouge prenuptial agreements may also require the inclusion of income statements, which detail each party's earnings and sources of income. This statement ensures transparency regarding ongoing salaries, bonuses, investments, and any other sources of financial gains. 4. Bank Statements: Bank statements play a critical role in prenuptial agreements in Baton Rouge. They provide concrete evidence of individuals' financial activities, showcasing their deposits, withdrawals, and account balances. By analyzing these statements, couples can gain a comprehensive view of each other's financial habits and liquidity. 5. Investment Portfolios Statements: Couples in Baton Rouge may choose to include investment portfolios statements within their prenuptial agreements. These statements disclose the details of various investments, including stocks, bonds, real estate, and other valuable assets. These documents help determine the current value and potential growth of individual investments. 6. Debt Statements: Debt statements within Baton Rouge prenuptial agreements outline the existing debts of each party. This includes mortgages, student loans, credit card debt, and other financial obligations. By disclosing these debts upfront, couples can clarify how they will address their shared and separate liabilities throughout the marriage. 7. Tax Returns: Tax return statements are crucial elements of prenuptial agreements in Baton Rouge. These documents provide a detailed record of each party's income, deductions, and tax liabilities. Analyzing tax returns allows couples to assess the potential impacts on their financial statuses due to taxation policies. It is important to note that these financial statements vary depending on the specific requirements of the couple and the complexity of their financial situations. Professional assistance from attorneys, accountants, or financial advisors in Baton Rouge is highly recommended ensuring accurate and legally sound financial disclosure within prenuptial agreements.

Baton Rouge Louisiana Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Baton Rouge Louisiana Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Make use of the US Legal Forms and get immediate access to any form template you need. Our useful website with a huge number of documents makes it simple to find and obtain virtually any document sample you require. You are able to export, complete, and certify the Baton Rouge Louisiana Financial Statements only in Connection with Prenuptial Premarital Agreement in a couple of minutes instead of browsing the web for several hours attempting to find the right template.

Utilizing our collection is a great way to raise the safety of your form submissions. Our experienced legal professionals on a regular basis review all the records to make sure that the templates are relevant for a particular region and compliant with new acts and polices.

How do you get the Baton Rouge Louisiana Financial Statements only in Connection with Prenuptial Premarital Agreement? If you have a subscription, just log in to the account. The Download option will be enabled on all the samples you look at. In addition, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, follow the instructions listed below:

- Find the form you need. Make sure that it is the form you were looking for: verify its name and description, and use the Preview option when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order with a credit card or PayPal.

- Download the file. Pick the format to get the Baton Rouge Louisiana Financial Statements only in Connection with Prenuptial Premarital Agreement and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy form libraries on the web. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Baton Rouge Louisiana Financial Statements only in Connection with Prenuptial Premarital Agreement.

Feel free to benefit from our service and make your document experience as straightforward as possible!