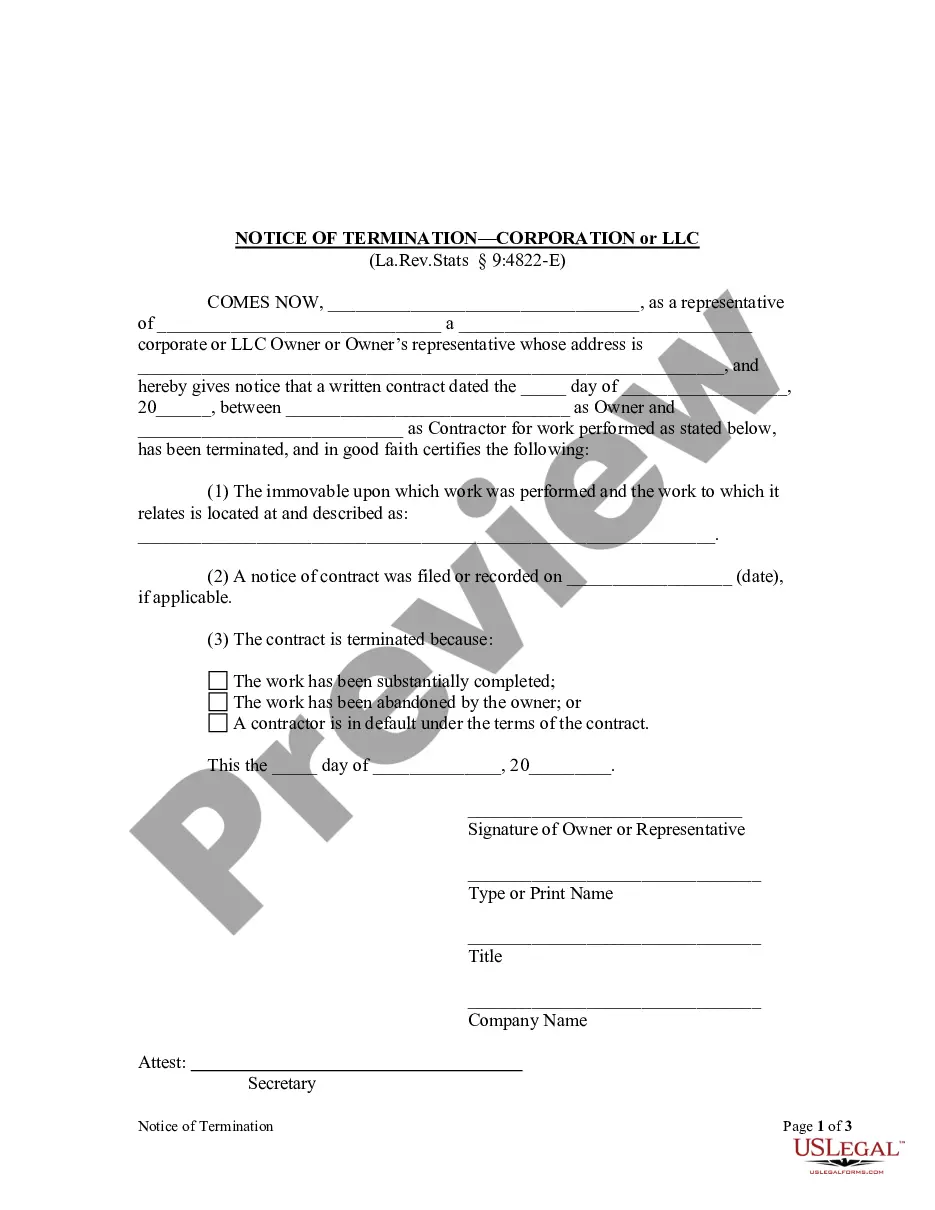

This Notice of Termination form is for use by a corporate or LLC owner or owner's representative to provide notice that a written contract between an owner and a contractor for work performed, has been terminated. The notice is used to certify the immovable upon which work was performed and the work to which it relates, the date the notice of contract was filed or recorded, if applicable, and the reason for termination.

Title: Understanding Shreveport Louisiana Notice of Termination — Corporation or LLC Description: In Shreveport, Louisiana, terminating a Corporation or Limited Liability Company (LLC) requires following the proper legal procedures. A Notice of Termination must be filed to officially dissolve the entity and conclude its operations. This article will provide a detailed description of what the Shreveport Louisiana Notice of Termination — Corporation or LLC entails, highlighting the essential steps and relevant keywords. Keywords: Shreveport Louisiana, Notice of Termination, Corporation, LLC, dissolution, legal procedures, entity, operations, filing, official, conclude. 1. Types of Shreveport Louisiana Notice of Termination for Corporations: a) Voluntary Dissolution: When the corporation's shareholders willingly agree to dissolve the entity, they must file a Notice of Termination with the Secretary of State's office in Louisiana. b) Involuntary Dissolution: In certain circumstances, the Louisiana Secretary of State or other authorized parties may initiate the dissolution of a corporation due to non-compliance with legal requirements, failure to file annual reports, or other specific reasons. 2. Types of Shreveport Louisiana Notice of Termination for LCS: a) Voluntary Dissolution: An LLC can be voluntarily dissolved by its members or managers. To initiate the process, they must file a Notice of Termination with the Louisiana Secretary of State. b) Judicial Dissolution: Under specific circumstances, a court may order the dissolution of an LLC. Such circumstances may include fraud, wrongful actions, or the inability to operate the business effectively. Key steps involved in the Shreveport Louisiana Notice of Termination — Corporation or LLC: 1. Prepare the Notice: The Notice of Termination must include the legal name of the corporation or LLC, the effective date of dissolution, and the reason for termination. It should also mention the shareholders or members who approved the dissolution. 2. File with the Secretary of State: The completed Notice of Termination form must be filed with the Louisiana Secretary of State's office. The filing fee should be paid along with the submission. 3. Notify Creditors and Other Interested Parties: After filing, it is crucial to notify creditors, suppliers, employees, and other stakeholders about the dissolution of the entity. Provide them with the necessary information and contact details. 4. Settle Debts and Obligations: Prior to termination, all outstanding debts, taxes, and other obligations should be settled. This includes filing final tax returns, informing government agencies about the business closure, and fulfilling any contractual obligations. 5. Maintain Documentation: It is advisable to retain copies of the filed Notice of Termination, correspondence with relevant parties, and any other documentation related to the dissolution, as these may be required for legal or accounting purposes. Conclusion: Understanding the Shreveport Louisiana Notice of Termination — Corporation or LLC is essential when seeking to dissolve a business entity in Shreveport, Louisiana. By following the proper legal procedures and employing the relevant keywords mentioned above, individuals can navigate the dissolution process smoothly and bring their Corporation or LLC to an official close.Title: Understanding Shreveport Louisiana Notice of Termination — Corporation or LLC Description: In Shreveport, Louisiana, terminating a Corporation or Limited Liability Company (LLC) requires following the proper legal procedures. A Notice of Termination must be filed to officially dissolve the entity and conclude its operations. This article will provide a detailed description of what the Shreveport Louisiana Notice of Termination — Corporation or LLC entails, highlighting the essential steps and relevant keywords. Keywords: Shreveport Louisiana, Notice of Termination, Corporation, LLC, dissolution, legal procedures, entity, operations, filing, official, conclude. 1. Types of Shreveport Louisiana Notice of Termination for Corporations: a) Voluntary Dissolution: When the corporation's shareholders willingly agree to dissolve the entity, they must file a Notice of Termination with the Secretary of State's office in Louisiana. b) Involuntary Dissolution: In certain circumstances, the Louisiana Secretary of State or other authorized parties may initiate the dissolution of a corporation due to non-compliance with legal requirements, failure to file annual reports, or other specific reasons. 2. Types of Shreveport Louisiana Notice of Termination for LCS: a) Voluntary Dissolution: An LLC can be voluntarily dissolved by its members or managers. To initiate the process, they must file a Notice of Termination with the Louisiana Secretary of State. b) Judicial Dissolution: Under specific circumstances, a court may order the dissolution of an LLC. Such circumstances may include fraud, wrongful actions, or the inability to operate the business effectively. Key steps involved in the Shreveport Louisiana Notice of Termination — Corporation or LLC: 1. Prepare the Notice: The Notice of Termination must include the legal name of the corporation or LLC, the effective date of dissolution, and the reason for termination. It should also mention the shareholders or members who approved the dissolution. 2. File with the Secretary of State: The completed Notice of Termination form must be filed with the Louisiana Secretary of State's office. The filing fee should be paid along with the submission. 3. Notify Creditors and Other Interested Parties: After filing, it is crucial to notify creditors, suppliers, employees, and other stakeholders about the dissolution of the entity. Provide them with the necessary information and contact details. 4. Settle Debts and Obligations: Prior to termination, all outstanding debts, taxes, and other obligations should be settled. This includes filing final tax returns, informing government agencies about the business closure, and fulfilling any contractual obligations. 5. Maintain Documentation: It is advisable to retain copies of the filed Notice of Termination, correspondence with relevant parties, and any other documentation related to the dissolution, as these may be required for legal or accounting purposes. Conclusion: Understanding the Shreveport Louisiana Notice of Termination — Corporation or LLC is essential when seeking to dissolve a business entity in Shreveport, Louisiana. By following the proper legal procedures and employing the relevant keywords mentioned above, individuals can navigate the dissolution process smoothly and bring their Corporation or LLC to an official close.